Summary:

- Transocean has recently reported in-line earnings results.

- The company’s management issued a very positive outlook and confirmed their willingness to reactivate cold-stacked rigs.

- Transocean has plans to retire a big portion of its debt.

- The offshore driller’s financial position is sound.

- Everything will be fine unless there is a major recession.

Reg Lancaster

Transocean (NYSE:RIG), the largest offshore driller, has recently reported its quarterly earnings results. As always, they were quite in line with analysts’ expectations. The company’s management is optimistic, whilst the stock is relatively stable, given the recent oil price drop. Let me explain my thoughts regarding the current situation Transocean is in.

RIG earnings

My fellow Seeking Alpha contributor Henrik Alex published an interesting and thoughtful article on Transocean’s results. I would like to focus on some other details of Transocean’s earnings conference call and also disagree with some of the points made by Henrik.

Just a quick recap. During the past quarter, Transocean’s adjusted EBITDA totaled $217 million. The adjusted contract drilling revenues, meanwhile, were $667 million. In 1Q 2023 the management booked about $900 million in backlog additions. This number does not mean anything on its own. Instead, we should compare it to the past performance. This is more than double the backlog added for the same period a year ago and even more than seven (!) times what Transocean added in 1Q 2021. The average day rate was $364,000. Indeed, if you look at the company’s contracts, you will see that Transocean’s day rates mostly range from $350,000 to $450,000 per day. But Jeremy Thigpen aims to reach the $500,000 per day level. It’s not a number out of nowhere, indeed.

We all know Transocean operates different types of equipment, including floaters and ultra-deepwater environment ships. Obviously, the management can charge different day rates for different rigs. But the demand for offshore drilling also varies across the regions. Transocean’s management is particularly enthusiastic about Australia, the Mediterranean, Namibia, and Norway. But the best day rates seem to be in Brazil. During one of the tenders happening last year, 2 rigs were bid above the $500,000-a-day mark. A couple of weeks ago 9 rigs were also engaged for that day rate. So, Thigpen’s expectation seems to be realistic.

But I’d like to touch on the topic of cold-stacked rigs. Right now Transocean has 12 of them. It might look like bad news because the cost of reactivating them is significant. At the same time, within its peer group RIG has the most operational potential should the market rise, especially given the company’s fleet. In the entire industry, there are only 13 remaining sixth and seventh-generation cold-stacked drillships. Eight of them are in Transocean’s fleet. RIG can command higher day rates for these drillships, given the current market deficits. Obviously, it is much more rational to reactivate the already built equipment than to construct new rigs.

The management estimates the costs to construct new drillships are somewhere between $200 million and $250 million. Reactivating cold-stacked rigs would cost somewhere between $75 million to $125 million. My fellow Seeking Alpha contributor Henrik is skeptical about the low costs of reactivating drillships. “In combination, it’s hard to envision Transocean being able to reactivate a cold-stacked 7th generation drillship for significantly less than $100 million, and to be perfectly honest, I wouldn’t be surprised to see the company ultimately exceeding the upper end of the provided range.” Still, $100 million is less than $200 – $250 million necessary to build a new rig. The management also named the 12 to 18-month time frame to put cold-stacked drillships to work. RIG’s CEO expects an upcycle for offshore drillers to last for 3 years. So, it would make economic sense to reactivate almost all of them. The most important detail of this, in my view, is that Transocean’s customers should directly pay for these reactivations. So, the management is not doing that just in the hope there would be enough demand for these drillships.

Probably more important than anything else is the company’s financial position. It might seem like Transocean took a poor decision for the management to do a convertible debt issuance in September because the company had to take a $133 million non-cash charge in interest expense. But Transocean’s deleveraging seems to be successful. Very recently, the company’s management agreed with one of their largest holders of exchangeable bonds to convert their bonds to equity. This helped the management reduce corporate debt by $213 million. Very importantly, the management thinks it can further get rid of the $618 million debt tied in outstanding exchangeable bonds soon. The company’s net debt is currently standing at about $6.5 billion. So, such a debt reduction would matter.

Transocean’s outlook

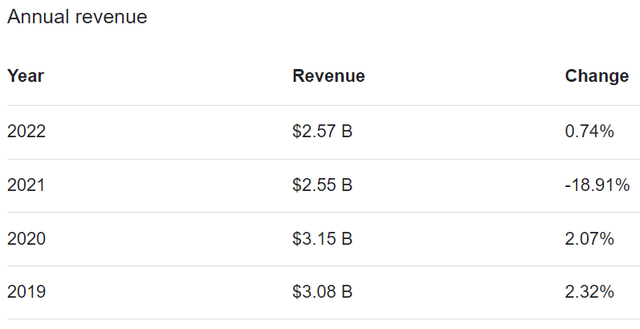

Transocean’s liquidity is expected to decline by the end of 2023. But this situation is not worth investors’ worries because the company has addressed all its major maturities by 2025. RIG’s free cash flow in the past quarter totaled minus $128 million. This was due to the contract preparations and $81 million in capital expenditures, related to the Deepwater Atlas and Deepwater Titan. RIG ended the first quarter with total cash of about $1.7 billion. According to the company’s guidance, liquidity in December 2023 is predicted to total between $1.2 billion and $1.3 billion. This might look discouraging but it is mostly due to the new builds. After all, the company can afford this. The revenue outlook is the following: for the full year 2023 the adjusted revenue would be between $2.9 billion and $3 billion. That is really good. Because in the years 2021 and 2022, the revenue was only $2.55 billion and $2.57 billion respectively.

Transocean’s management expects new contract awards for its ultra-deepwater environment rigs and even floaters.

In the next 18 months, the company expects to award 80 rig years. Rystad Energy also predicts the offshore sector will grow the highest in more than a decade. During the next two years, more than $200 billion will be invested in new projects. The most striking forecast is that 70% of all sanctioned conventional hydrocarbons in 2023 and 2024 will be due to offshore drillers. But it is plausible because this industry is the last one oil majors invest in when there is an upcycle. Yet, when everyone sees that high oil prices are here to stay, investments in offshore oil really pick up.

Risks

The biggest risk facing Transocean is its debt load. As the interest rates are rising, it is getting costlier for RIG to service its debt load. But the management is taking every effort to decrease the company’s liabilities and to raise its cash reserves. I have discussed this in some more detail above.

Almost in every article I write I stress the recessionary risks that are only getting higher as inflation readings are still high and the central bankers are not particularly dovish. Obviously, it could pose a substantial risk to the whole oil industry. But still, the oil supply might get very low, thus pushing the prices upwards for many reasons, most notably geopolitical ones. There were historical periods when this happened. The 1970s in the US and Europe was such a time period.

There is also a “soft landing” scenario that cannot be excluded. This means that the Fed will eventually stop tightening and the US economy will avoid recession. In this case, the future for the entire oil industry, including Transocean, looks bright.

Conclusion

In spite of my personal grim outlook for the world’s economy, I still remain a fan of Transocean’s shares. The company reported sound in-line results, has a relatively strong liquidity position, and plans to reactivate rigs. But I was personally even more impressed with its plans to retire hundreds of millions in debt, which is extremely important for RIG. So, I am bullish on Transocean stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.