Summary:

- Nvidia shares may be due for a big pullback.

- NVDA stock has once again become grossly overvalued.

- The current growth rates do not support the market’s optimism.

Justin Sullivan

This story was originally published on May 9 for subscribers of Reading The Markets, a Seeking Alpha Investing Group.

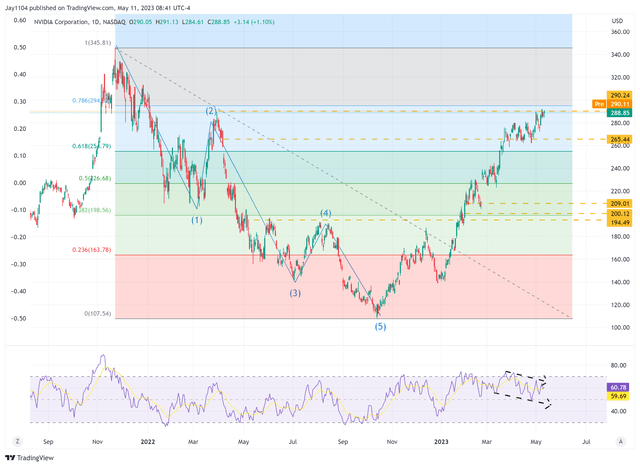

Nvidia’s (NASDAQ:NVDA) recent surge has seen the stock retrace almost 78.6% of its decline from its November 2021 highs, resulting in a 160% increase since October. However, an options trader has bet that the rally is due to end and a significant pullback is coming.

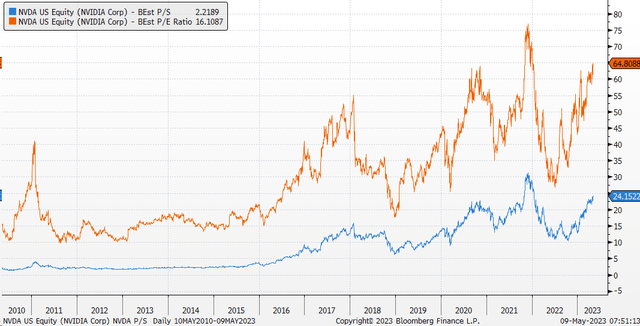

The company has benefited from the recent rise in cryptocurrencies such as Bitcoin and the promise of a future dominated by artificial intelligence. This has led to a surge in Nvidia’s valuation, reaching levels close to historical highs, comparable only to the peak of the COVID-19 bubble.

Nvidia Stock’s Valuation And Price Do Not Justify The Fundamentals

Currently, the stock is trading at 64.8 times its fiscal 2024 earnings estimates and 24.1 times its sales estimates, both near the upper limits of their trading range. This suggests that investors are seeking significant earnings and sales growth in the future.

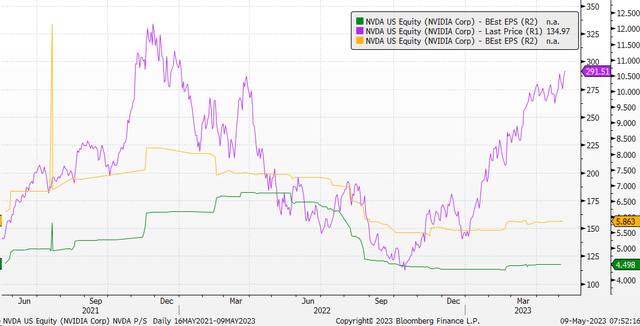

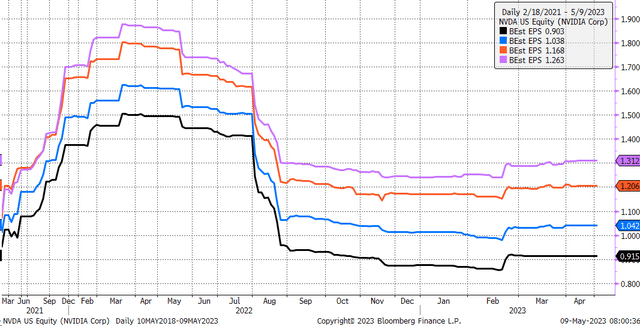

Now, at least at this point, analysts do not seem as optimistic about the future despite the significant stock gains and have done little to lift the company’s earnings estimates for fiscal 2024 and 2025. Earnings estimates have dropped significantly from their peaks. While the stock has rallied sharply, earnings estimates have not, a clear sign that analysts do not see the same opportunities for the business as investors.

Nvidia is scheduled to release its earnings on May 24. Analysts predict that its adjusted earnings per share for the first fiscal quarter will decrease by 32.7% year-over-year to $0.91, with revenue dropping 21.5% to $6.5 billion.

However, the guidance provided by the company will be more crucial as Nvidia will be facing an easy comparison with its weak second quarter of 2022. Therefore, analysts anticipate a 104.25% increase in second-quarter 2023 earnings to $1.04 per share, with revenue growing by only 6% to $7.1 billion. Nevertheless, these earnings expectations are still significantly lower than analysts initially estimated many quarters ago.

Given that the surge in Nvidia’s stock price thus far has been primarily driven by multiple expansion and optimism for a promising future, there is little margin for error when the company reports its results. This is because the prospects of strong growth from these benefits in the next one to two years seem unlikely.

A Massive Wager

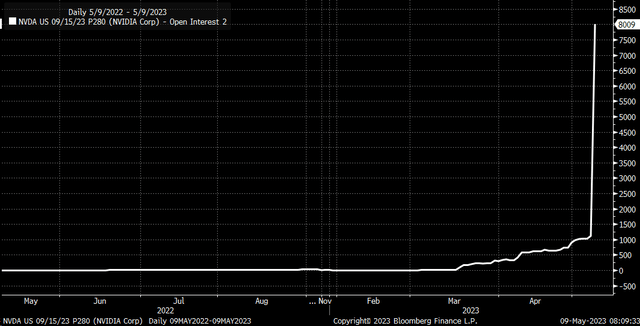

An options trader is betting that the market returns to its sense on Nvidia over the next few months. On May 9, there was a notable increase in open interest for Nvidia’s September 15 $280 puts, with around 6,900 contracts bought on the ask for approximately $26.50 to $26.60 per contract. This implies that the trader would require the stock to drop to roughly $253.50 to earn a profit if holding the put contracts until expiration, a decline of approximately 13.0%. This is a substantial bet, with the trader paying a roughly $18 million premium.

Bearish Divergence

According to the technical chart, Nvidia’s shares are facing resistance at $292, which was the high in March 2022. Moreover, a bearish divergence is visible on the RSI, with a sequence of lower highs and lower lows compared to the stock price, which has made a higher high. The critical support level for Nvidia has been at around $265. If this level is breached, it could lead to a significant decline for Nvidia, possibly down to about $209, where a gap exists from mid-February.

However, if the stock pushes above $292, it could rise to around $312 in the near term.

Nvidia’s stock has become significantly overvalued once again. Despite the company’s improving earnings and indications of growth, they are still far from the levels they were once expected to achieve. This raises concerns about why the stock is trading at its current levels.

For Nvidia’s shares to continue rising, the company must deliver better-than-expected results and provide significant upside surprises in its guidance. Otherwise, it may be difficult for the stock to maintain its current levels or continue its upward trend.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, and looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.