Summary:

- Exxon Mobil reported solid profitability in the first quarter.

- However, the petroleum and gas producer has seen a significant sequential decline in profits and free cash flow in Q1’23. Earnings likely peaked in FY 2022.

- EPS estimates may get adjusted downward which would add new pressure on Exxon Mobil’s valuation.

Joe Raedle

Petroleum prices have skidded lately, threatening the profitability of large producer companies like Exxon Mobil (NYSE:XOM). With WTI falling towards $73 a barrel, I believe Exxon Mobil faces continual earnings and free cash flow pressure in the foreseeable future which should then also likely translate to a lower valuation multiplier. Because of a sharp decline in Exxon Mobil’s average prices for petroleum and natural gas products in the first-quarter, I don’t see a reason to upgrade my rating on the company and continue to believe that Exxon Mobil is headed for more pain in the short term!

Exxon Mobil’s profits continued to fall in the first-quarter

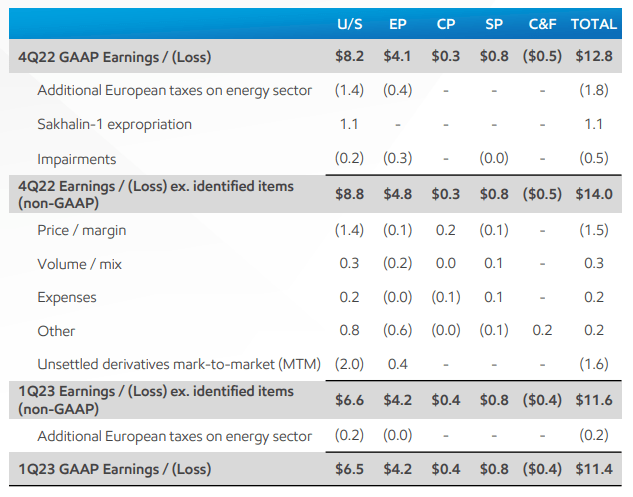

Exxon Mobil suffers from declining profitability as the war in Ukraine and European sanctions on Russian natural gas no longer have a boosting effect on market prices for energy products. Nonetheless, Exxon Mobil is still very much profitable and reported Q1’23 adjusted profits of $11.6B compared to $14.0B in the previous quarter. Profits in the production segment declined strongly in the first-quarter, however, dropping 25% quarter over quarter, chiefly due to lower average market prices.

Source: ExxonMobil

Turning to free cash flow.

Exxon Mobil generated $11.4B in free cash flow in the first-quarter which is a considerable sum to earn in FCF in any quarter. However, it was the second straight decline in free cash flow since Exxon Mobil reached record free cash flow of $22.0B in the third quarter of FY 2022. Since reaching this peak, Exxon Mobil’s free cash flow has dropped off almost 50% and I expect continual pricing weakness as the risk of a recession is growing and inflation still remains a considerable challenge for consumers. WTI crude prices have dropped significantly in the last year as fears over energy supplies faded away and investors priced in the risk of lower petroleum demand in a potential recession situation.

|

Exxon Mobil |

FY2023 |

FY2022 |

|||

|

$B |

Quarter 4 |

Quarter 4 |

Quarter 3 |

Quarter 2 |

Quarter 1 |

|

Cash Flow from Operating Activities |

$16.3 |

$17.6 |

$24.4 |

$20.0 |

$14.8 |

|

Proceeds from Asset Sales |

$0.9 |

$1.4 |

$2.7 |

$0.9 |

$0.3 |

|

Cash Flow from Operations and Asset Sales |

$17.2 |

$19.0 |

$27.1 |

$20.9 |

$15.1 |

|

PP&E Adds / Investments & Advances |

($5.8) |

($6.7) |

($5.1) |

($4.0) |

($4.3) |

|

Free Cash Flow |

$11.4 |

$12.3 |

$22.0 |

$16.9 |

$10.8 |

(Source: Author)

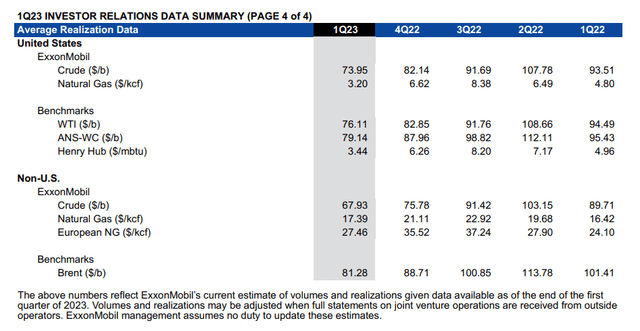

The drop in Exxon Mobil’s profitability is due chiefly to a decline in average prices. Exxon Mobil’s average petroleum price in the U.S. in Q1’23 was $73.95 a barrel compared to $91.69 a barrel in Q3’22, showing a decline of 19%. At the same time, Exxon Mobil’s average natural gas price has seen an even sharper decline of 62% to $3.20 per kcf in the first-quarter.

Exxon Mobil’s valuation

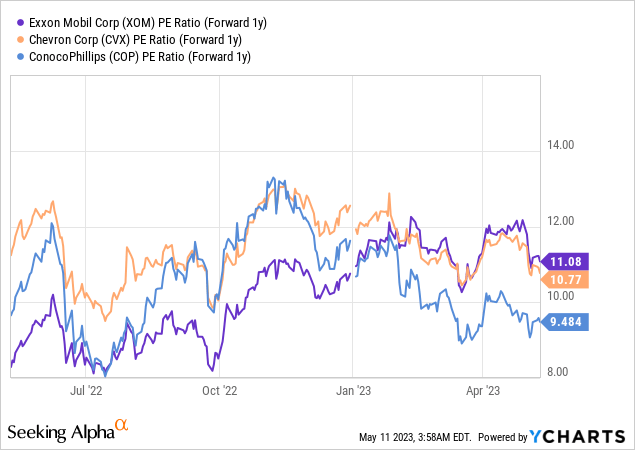

Exxon Mobil is valued at a P/E ratio of 11.1X, but EPS estimates have started to fall in a lower-price world and estimates may continue to drop off if investors get convinced that economic growth in the U.S. is slowing. A drop in EPS estimates would result in a higher price-to-earnings ratio for the petroleum producer going forward and would pose a challenge to Exxon Mobil’s current valuation. Chevron (CVX) and ConocoPhillips (COP) are both cheaper than Exxon Mobil, but both companies face the same cyclical EPS risks as their larger cousin.

Exxon Mobil’s EPS estimate trend is also negative as predictions have dropped broadly recently. In the last 90 days, there were 17 downward revisions and only 6 upward revisions for Exxon Mobil’s FY 2023 EPS… indicating that the market expects a normalization of the price picture in petroleum markets and lower earnings and free cash flows for Exxon Mobil.

Risks with Exxon Mobil

By far the biggest risk for Exxon Mobil is that prices for petroleum and natural gas products continue to decline as the market and the economy get ready to deal with a recession. Lower average prices for petroleum and natural gas would be by far the biggest headwind for Exxon Mobil’s earnings and free cash flow in the short term. If the U.S. economy doesn’t have to deal with a recession in the near term, however, then Exxon Mobil’s earnings and free cash flow picture could improve.

Final thoughts

Exxon Mobil’s first-quarter has shown that the company still has strong underlying profitability and free cash flow, but the petroleum producer clearly has seen a decline in its profitability. The first-quarter of FY 2023 was the second straight quarter in which the petroleum producer saw its earnings/free cash flow fall sequentially and Q1’23 FCF was about half the level it was in Q3’22, at its peak. I continue to see significant EPS risks for Exxon Mobil and other petroleum producers as prices have fallen to about $73 a barrel. For those reasons, I continue to believe that Exxon Mobil’s Q1’23 results confirm my suspicion that petroleum profits have indeed peaked in Q3’22. With valuation and EPS risks rising in a weakening economy, I must reiterate my sell rating on Exxon Mobil!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.