Summary:

- AT&T Inc. stock experienced a selloff in recent weeks and currently trades close to its 6-month low.

- Despite reporting decent results for Q1, the market didn’t like the fact that AT&T generated minimal free cash flow during the quarter.

- The good news, though, is that there are reasons to believe that AT&T should be able to exceed expectations in the following quarters.

- If that’s the case, then there’s a possibility that AT&T stock would recover and create additional shareholder value in the foreseeable future.

Ronald Martinez

Despite reporting decent earnings results for Q1 and beating the street estimates a couple of weeks ago, AT&T Inc. (NYSE:T) stock nevertheless experienced a selloff and trades close to its 6-month low to this day. While the market didn’t like the fact that the company generated minimum free cash flow (“FCF”) during the March quarter, there are nevertheless reasons for optimism, as AT&T has all the chances to improve its overall performance in the next few quarters. This would likely lead to the creation of additional shareholder value in the foreseeable future.

Market Fears Are Overblown

The Q1 earnings results that AT&T revealed in late April showed that the company generated $30.14 billion in revenues, up 1.4% Y/Y, while its non-GAAP EPS was $0.60. At the same time, the postpaid average revenue per user increased by nearly 2% to $55.05, while the postpaid and prepaid churn rates were 0.81% and 2.73%, respectively. Such results indicate that AT&T still has the ability to grow and retain subscribers even in the current environment despite all the chatter about how its business is dying. There’s even an indication that the company would be able to continue to exceed top line expectations in the following months.

However, despite those results, AT&T’s stock has experienced a major selloff in recent weeks and currently trades close to its 6-month lows. This is due to the fact that AT&T generated only $1 billion in FCF during the quarter, below the expectations of nearly $3 billion. While at first this might seem like a big deal, I would argue that the recent depreciation of the company’s shares is unjustified.

While the FCF came in below the initial target, AT&T nevertheless is on track to reach $6 billion in cost savings, as it’s in the middle of optimizing its business in the post-Warner Media era. At the same time, the $6.4 billion in capital expenditures in Q1 for fiber and 5G projects have the potential to help the company revive the growth story and yield greater returns in the following years. In addition to that, AT&T’s management still expects to generate $16 billion or more in FCF in FY23 due to the forecasted better returns in the next few quarters.

Considering that in FY22 we faced a similar situation where FCF was weak in the first half of the year but later improved by year-end and helped the management reach its target, there’s a high possibility that the same scenario will unfold in FY23. If that’s the case, then the recent selloff is unjustified.

In addition to this, AT&T was also able to strengthen its balance sheet as the long-term debt decreased from $132.9 billion in Q4’22 to $123.4 billion in Q1’23. On top of that, by having an interest coverage ratio of nearly 4x while 95% of its debt is at a fixed rate of 4.1%, the company will likely be able to continue to service its debt without any problems despite the rising rate environment. Add to this the fact that AT&T continues to generate positive FCF at a time when it substantially decreases its debt and pays ~$2 billion per quarter in dividends and it becomes obvious that the company is able to continue to create additional shareholder value in the foreseeable future.

That’s why I think that the latest selloff is unjustified. The good news, though, is that at the current market price, AT&T’s stock now offers a good entry point for new investors, as its dividend yield at the current levels is over 6% while the downside is relatively limited.

What’s Next For AT&T Stock?

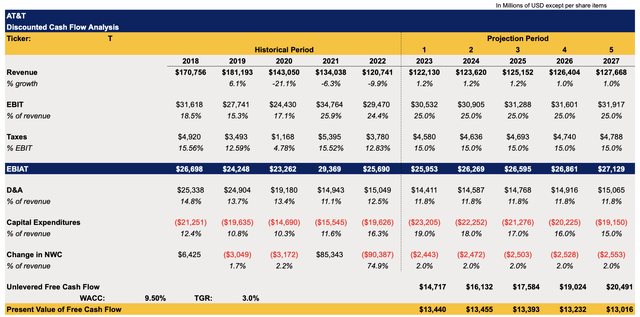

In addition to various growth opportunities, there’s also an indication that AT&T’s stock is undervalued solely based on the fundamentals and could create additional shareholder value in the following months. To figure up how much of an upside the company offers at the current levels, I’ve updated my discounted cash flow, or DCF, model. It may be seen in the table below.

The assumptions for the revenue and earnings in the model for the next couple of years are mostly in line with the Street and management’s outlook. The assumptions for other metrics are also similar to my previous model, which was published in late March before the release of Q1 results. The WACC rate in the model stands at 9.50%, while the terminal growth rate is 3%.

AT&T’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

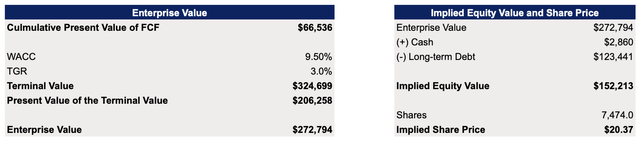

The updated model shows that AT&T’s enterprise value is $272.8 billion while its fair value is $20.37 per share, which represents an upside of ~20% from the current market price.

AT&T’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

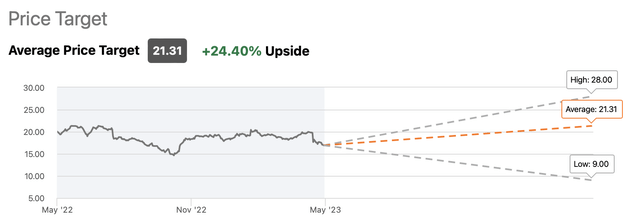

In addition to my valuation, the Street also believes that the latest selloff is unjustified as the company is likely to improve its overall performance in the coming quarters. As such, it gives AT&T’s shares a consensus price target of $21.31 per share, which indicates that the upside could be even greater than my calculations suggest.

AT&T’s Consensus Price Target (Seeking Alpha)

Risks To Consider

Despite all the upside, there are nevertheless a couple of risks that investors need to consider. First of all, the potential recession could bring the AT&T Inc. share price even lower despite all the growth catalysts and strong fundamentals.

At the same time, while the debt situation is currently manageable, if the Fed overdoes the tightening and crushes the economy then there’s a risk that AT&T could fail to meet its performance targets and could even generate a negative FCF. While it’s unlikely that that’s going to be the case, there’s nevertheless a risk that under such a scenario the questions would be raised about the potential elimination of dividends to continue to service the debt and improve the balance sheet. Even though I don’t think that’s going to happen in the distant future, a hard landing or a black swan event could nevertheless lead to such a scenario. Investors need to be aware of it before deciding whether to hold AT&T’s shares in the portfolio.

The Bottom Line

While the decline of FCF in Q1 disappointed the market, there are nevertheless reasons to be optimistic about AT&T’s performance in the foreseeable future. Thanks to various growth catalysts, AT&T Inc. has everything going for it to generate better returns and exceed its expectations in the next few quarters and reach its FCF target for the year. Add to this the fact that AT&T Inc. shares are undervalued after the recent selloff and it becomes obvious that the business’s stock has all the chances to create additional shareholder value in the following months despite all the risks that are unlikely to materialize in the following months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!