Summary:

- Unity reported strong earnings on Wednesday and the stock is flying.

- Q1 results support the operating leverage we thought was coming from ironSource.

- The chart supports higher prices and margins should continue to expand this year and beyond.

alvarez/E+ via Getty Images

The bear market that began in tech stocks towards the end of 2021 took a massive toll on countless smaller tech names that were priced in a frothy, unsustainable way. However, I believe we’re already in the next bull market for tech and growth stocks, and indeed, we’ve seen significant rallies in the names that were the most beaten down by the 2022 bear.

Given this, I’ve been shopping for those names that I think have some upside, one of which is Unity Software (NYSE:U), which also reported earnings last night for its fiscal first quarter. The stock is flying pre-market, and while Unity isn’t out of the woods yet, given that I think growth and tech stocks have meaningful upside this year and that Unity’s Q1 report is being cheered by investors, I like this one from the long side.

The last time I covered Unity was several months ago, and I incorrectly stated at the time Unity was on its way to its next rally. The possibility of being wrong is why I preach the use of stops to my subscribers, and use them myself. It’s okay to be wrong if you use stops and losses are manageable; it is not okay to be a bag-holder. So, is this time different for Unity? Time will tell, but I like what I’m seeing both fundamentally and technically.

Let’s start with the technical picture, and I’ll note that I’ve placed a blue arrow inside an oval to mark where the stock is trading post-earnings, which is not reflected on the chart.

There are a few reasons why I think the path of least resistance for Unity is higher at the moment. First, the double-digit gain from the earnings report is a great sign that there’s significant buying demand for some good news. During 2022, it didn’t seem to matter what growth companies reported; it was challenging to get a good reaction off of an earnings report. We’ve seen the opposite in this Q1 earnings season, with Unity being the latest example.

Second, the stock put in double bottom at ~$24, which was also higher than the ultimate low the stock made back in November. Higher lows are one way to define a bullish market for a security, and Unity is well on its way.

In addition to that, the momentum indicators suggest the most recent trip to $24 was more likely to be sustainable. The PPO put in a positive divergence between the March and May lows, which means that while price tests support or makes a lower low, the PPO is moving higher. This is one of my favorite ways to find trend changes, and we certainly have one here. That doesn’t guarantee the stock cannot go lower, of course, but it puts the odds in the bulls’ favor.

Finally, Unity has underperformed its peers this year, as evidenced by the second-to-last panel. However, software stocks are flying relative to the broader market, and that greases the wheels from a bullish perspective for all software stocks. This is the rising-tide-raising-all-ships idea, and the point is that it’s been clear for some time money is flowing into the sector, which makes it more likely Unity will benefit directly.

To sum this up, the first test of resistance overhead is $33, which is the high from early April, but I see Unity as a long unless it fails the rising 20-day exponential moving average, which should make a bullish crossover of the 50-day simple moving average in the coming days, barring a massive selloff.

Q1 shows continued progress

Unity is still in the fairly early stages of its growth, so investors looking for value or a forward P/E ratio of 8 should look elsewhere. Unity is a bet on a very long (and potentially very profitable) path to more and more revenue growth, which begets expense leverage, and profits. This is not a stock for the weak-hearted, and it’s volatile. However, I think Q1 results show the promise of the company’s platform, its willingness to continually innovate, and its ability to meet the wants and needs of customers. So long as these things continue, the stock looks pretty attractive to me.

I’ve covered Unity’s model in previous articles but basically, it offers a unique content creation platform that affords users of all sizes to make games, design products or buildings, use in filmmaking, or anything else where 3D content can enhance the user experience. Unity is known for its ties to the gaming industry, but there are countless industrial applications for its products, which is why I think the runway is long if the company can execute.

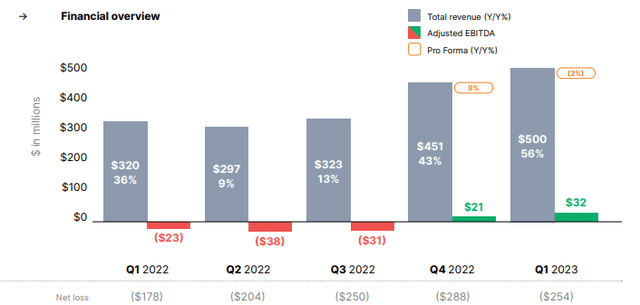

Q1 results showed 56% revenue growth year-over-year, but of course, that was due to the November 2022 ironSource acquisition. Pro forma revenue was -2% year-over-year, so a much less optimistic picture.

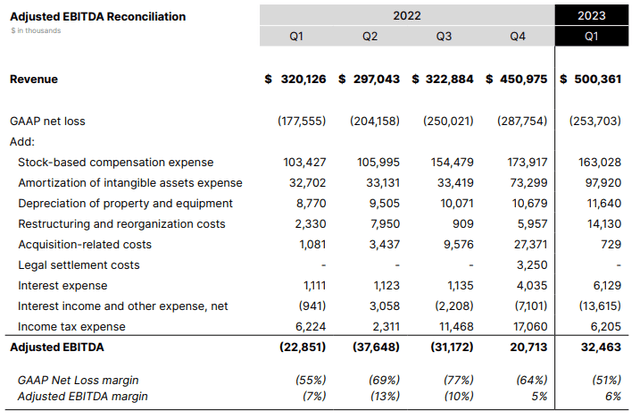

However, there are positives to be had. The goal of the ironSource was to not only gain access to the company’s intellectual property, but provide some expense leverage as well. Expense leverage is absolutely critical for growing software businesses, and we can see from the Adjusted EBITDA values above that it is working. Adjusted EBITDA was negative prior to the fourth quarter of last year, and grew once again in Q1. Adjusted EBITDA is not a perfect measure of profitability, but in terms of measuring operating leverage, it’s pretty good, and the story here is a positive one. The story should also only get better as revenue ramps more and more in the years to come.

As part of this, the company has undergone multiple rounds of layoffs in the past year, which has helped reduce a cost structure that had clearly become bloated. Layoffs are very unpleasant and there are human beings on the receiving end, which is very sad. While I don’t celebrate layoffs, I know they are necessary sometimes, and it was clear they were necessary for Unity. This should free up margin growth in the coming quarters, and that’s exactly what I want to see.

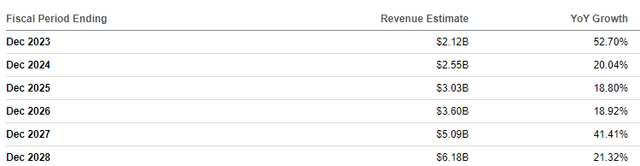

Now, expense leverage relies heavily upon top line growth, so let’s take a look at analyst expectations on that front.

Revenue growth will be huge this year from ironSource, but even after that, we’re looking at ~20% annual growth. So long as Unity can execute on this, we should see margins move a lot higher in the years to come, not only from the higher top line, but the operating leverage that affords. One thing to keep an eye on is headcount growth, as the company was clearly overstaffed heading into 2023, but surely the management team has learned this lesson.

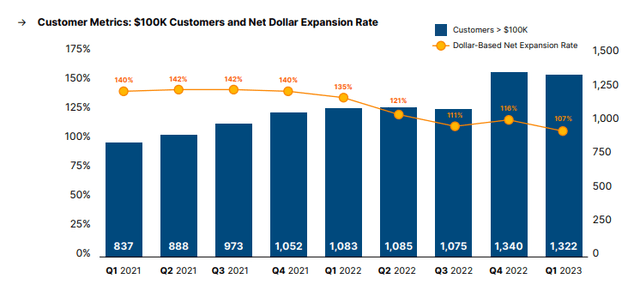

The company now has over 1,300 customers that generate at least $100k in annual revenue, and net dollar expansion is still over 100%. It’s off from 140%+ in 2021, but as the customer base matures, that’s to be expected. I would love to see this creep higher again, but I don’t see cause for alarm just yet; it’s just something to keep an eye on.

Let’s finally take a look at the income statement from Q1 to illustrate the power of operating leverage. The Adjusted EBITDA margin number at the end of the table shows what can happen when revenue grows quickly. Unity was at -10% Adjusted EBITDA margin in Q3, but was +5% in Q4 – when ironSource closed – and was even better in Q1. I expect further improvement as job cuts are digested and eventually lapped, as well as the ever-rising total of revenue.

Let’s value this thing

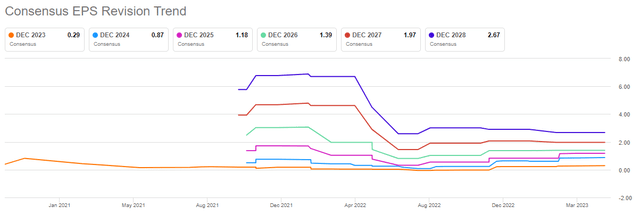

We’ll value Unity based upon forward revenue estimates given it is still early in its life cycle, but I wanted to call attention to EPS estimates. These were very clearly too high during 2021/2022, and have been reset much lower. However, we’re starting to see higher estimates creep in, which suggests the worst is over on this front.

Unity is expected to produce a small EPS gain this year, with further gains ahead. The days of being able to value Unity on earnings are rapidly approaching, and that’s a good thing for the value of the stock long-term.

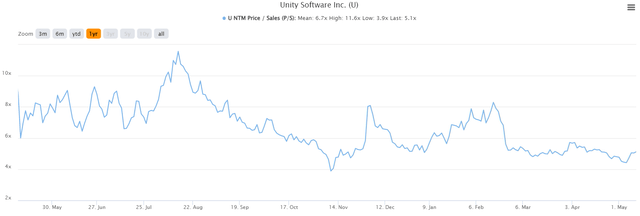

Now, if we look at the forward price-to-sales ratio for the past year, we can see Unity is cheap. In fact, it’s about as cheap as it’s ever been on this measure. It would take roughly 30% expansion to get back to its average for the past year, and would be 100%+ to get back to its high. Given the positive reaction to a good Q1 report, it is my belief investors will be willing to pay more for Unity’s growth stream as it becomes clearer the path to profitability is underway.

With all of this in mind, I think Q1 results were a stamp of approval on Unity’s strategic direction and execution. The company is growing revenue rapidly and taking necessary steps to improve margins. The stock is fairly cheap based on forward P/S, and the chart supports the odds of the next big move being higher, rather than lower. I’m sticking with my bullish stance on Unity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in U over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.