Summary:

- The narrowing operating losses in the DTC segment mask two risks that are looming on the horizon.

- As a Disney shareholder, I do not feel comfortable adding to my position today because of a few reasons.

- Disney still can offer tremendous value in the long run as a diversified entertainment giant that has stood the test of time but investors are in for a rough patch.

Razvan

The Walt Disney Company (NYSE:DIS) reported fiscal second-quarter earnings that disappointed investors yesterday. Although the company only marginally missed earnings estimates, Disney stock is down close to 5% in pre-market trading today, which confirms that Mr. Market was unimpressed with the entertainment giant’s earnings print. At Beat Billions, we follow earnings events closely as our investment strategy is centered around earnings catalysts, and we prefer to invest in companies that consistently top Wall Street earnings estimates. From this perspective, there’s nothing to write home about as Disney failed to meet expectations for Q2 earnings and behind the scenes, earnings revisions are not moving in the right direction either. A closer evaluation of Disney’s prospects suggests that Wall Street might have some catching up to do with fiscal 2024 EPS estimates (year ending September 2024), which is a good thing as we believe positive earnings revisions of a certain magnitude will move the stock price. That being said, there are still many uncertainties surrounding the sustainability of Disney’s earnings, and several warning signs should not be ignored.

Curb Your Enthusiasm About Narrowing Losses

Fellow SA contributor Jonathan Weber has already highlighted the key takeaways from Disney’s Q2 earnings print, so I will not dig deep into earnings in this analysis. I will discuss some of the most important observations from Q2 earnings in this analysis to support my stance on Disney stock.

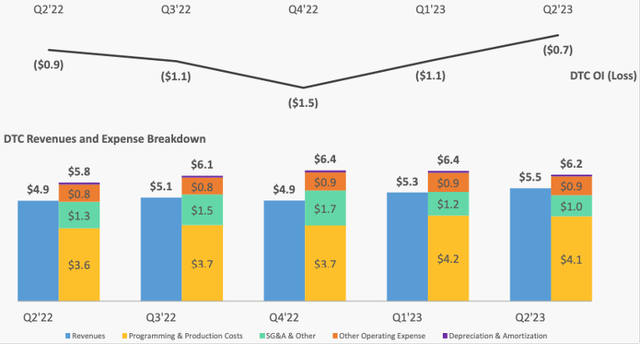

The most important observation that deserves scrutiny is the increasing ARPUs and decreasing operating losses in the direct-to-consumer business. As illustrated below, the DTC segment’s operating losses improved by around $400 million in Q2 compared to the previous quarter, which certainly seems like an encouraging sign at first.

Exhibit 1: DTC quarterly operating loss, revenues, and breakdown of expenses

Earnings presentation

Disney+, which is arguably the most closely followed business unit in the DTC segment, added a modest 600,000 core subscribers in Q2 but the Disney+Hotstar segment suffered a loss of 4.6 million subscribers compared to the fiscal first quarter. Although the company did report better profitability metrics from the DTC business, I am wary of Disney+Hotstar losing millions of customers.

All else equal, subscriber losses in India should reflect well on ARPUs as a higher concentration on the Western world will benefit average revenue per user. In a few online forums, I have already seen some Disney shareholders welcoming this development. As a Disney shareholder myself, I believe investors should be wary of Disney+Hotstar losing steam in India. Reed Hastings, former Netflix, Inc. (NFLX) CEO, said in 2018 that India is the most important streaming market globally because of the massive size of this market and the long runway for growth available in India at a time when the country is emerging as a regional economic superpower. The rising middle-class society in India, multi-billion-dollar IT infrastructure development projects, and the ever-increasing Internet penetration rate suggest Reed Hastings was spot on about the massive growth potential of India’s streaming market. India is a highly competitive market, and it took Netflix many years to figure out what works for this market. Disney, on the other hand, had a dominant market share in India through Hotstar well before the launch of Disney+ in 2019, but the recent subscriber losses in India are now opening doors for competitors to gain market share at Disney’s expense. In the long run, losing the dominant position in the Indian market could prove very costly.

Not to forget, Disney lost the broadcasting rights to the Indian Premier League last year to Viacom18 from 2023 to 2027. The IPL, a cricket league that brings in the best players around the world, is bigger and more important than many investors realize. To give some context, the cost of broadcasting an IPL match (there are more than 70 matches per season) eclipsed that of the English Premier League, Major League Baseball, and the NBA League last year.

Exhibit 2: Broadcasting rights fee per match

Statista

The IPL attracts millions of cricket fans every season – including yours truly – and the cricketing event runs almost two months every year. With Disney losing broadcasting rights to IPL, I believe a further erosion of Disney+Hotstar subscribers is on the cards.

In the U.S., Disney+ benefited from recent price hikes. These price increases played a major role in improving the operating results of the DTC segment. The below excerpt from the 10-Q summarizes domestic ARPU trends in Q2 compared to the second quarter of fiscal 2022.

Domestic Disney+ average monthly revenue per paid subscriber increased from $6.32 to $7.14 due to an increase in average retail pricing, partially offset by a higher mix of subscribers to multi-product offerings.

There is nothing wrong with increasing subscription prices to drive profitability higher. In fact, Netflix has used this strategy effectively over the last five years. However, I believe Disney+ does not have a deep, differentiated content library to achieve the same success Netflix did with price hikes. Many of my colleagues who are avid fans of Marvel and Disney characters have developed the habit of subscribing to Disney+ for a couple of months at a stretch to binge-watch their favorite content and then cancel the subscription until a new title worth subscribing to appears on Disney+. This is a risk faced by Netflix as well, but Netflix differs from Disney+ because of its deep content library which makes it possible for users to find something that matches their taste throughout the year. I believe Disney’s ability to hike prices to drive profitability is very limited compared to Netflix, and for this reason, I am not impressed by the higher ARPUs reported by Disney+ in the U.S. in Q2 compared to the corresponding quarter the previous year.

Overall, I believe the narrowing operating losses mask Disney’s struggles in India and the unsustainability of continued price hikes.

The Path Forward Will Be Bumpy

I still believe Disney has a lot to offer as an entertainment giant that has stood the test of time, which is exactly why I am continuing to be invested. However, I believe Disney investors are in for a tough few quarters. Disney is trying to get its act together by trying different strategies to gain traction. The fact that Disney is now focused on creating more generalized content is a step in the right direction as it would be difficult to compete with the likes of Netflix without a deep, diversified content library. Fine-tuning the content strategy is easier said than done, especially for a company like Disney which is used to producing a few blockbusters every year. To be successful as a DTC brand, Disney will have to figure out a way to consistently produce eye-catching content while keeping costs and debt at a manageable level. Until the company makes progress from this front, I believe Mr. Market will not reward any improvements in the parks segment.

The Missing Earnings Catalyst

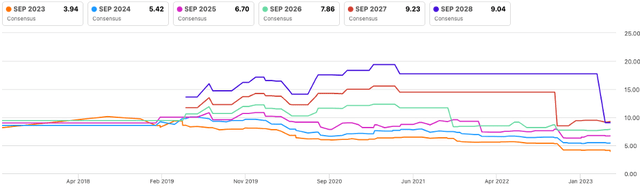

In the last eight quarters, Disney has beaten Wall Street estimates for earnings in four quarters and missed in four quarters as well, which is a choppy track record. At Beat Billions, we look for earnings momentum, which Disney is certainly lacking. We also look for momentum in earnings revisions as a quantifiable relationship can be found between long-term stock prices and earnings revisions. Unfortunately, Disney does not show momentum on this front either.

Exhibit 3: EPS estimate revisions

Seeking Alpha

With fiscal 2024 earnings estimates continuing to trend in the wrong direction, I believe DIS stock will not show any strength in the foreseeable future.

Takeaway

Investors cheered when Disney+ got off to a strong start in 2019 and 2020 aided by pandemic tailwinds, and today, investors are punishing the company because of cracks that have appeared in the growth story. Disney still has a lot to offer as a diversified entertainment behemoth, but the short term does not look promising. With no earnings catalysts in sight, I will not add to my long position at these prices.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long NFLX.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!