Summary:

- Microsoft Corporation is a rare case about which both Wall Street and Main Street are very bullish.

- Indeed there are plenty of reasons for optimism ranging from its collaboration with ChatGPT to the AI future.

- However, I am concerned that the current bullish sentiment on Microsoft is premature and overdone.

- Microsoft’s valuation is at a level hard to justify even by the most aggressive assumptions – those that Warren Buffett reserves for PERPETUAL compounders.

lcva2

Thesis

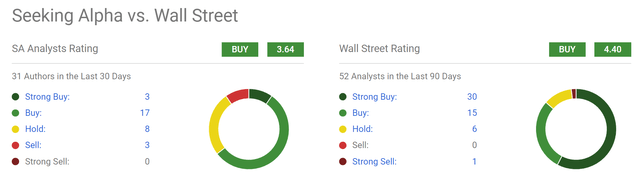

Microsoft Corporation (NASDAQ:MSFT) is a rare case where Wall Street and Main Street opinions overlap remarkably, as shown in the chart below. According to the statistics provided by Seeking Alpha, MSFT has been discussed by a total of 31 SA Authors in the past month. No one rated it as Strong Sell, and a total of 20 rated it as a “Buy” or “Strong Buy.” The picture is very similar on the Wall Street side, even more bullish. Out of the 52 Wall Street analyses published on the stock, 30 recommended “Strong Buy” and another 15 recommended “Buy.”

It is common knowledge that Warren Buffett never owned MSFT because of his lack of ability to understand tech stocks (plus other reasons, such as his relationship with Bill Gates, which are more or less speculative to me). And this article will elaborate in this direction and argue that the current Microsoft bullish sentiment is premature and overblown. Many of the catalysts the market is betting on (such as AI and ChatGPT) are poorly understood, not only for Warren Buffett but for everyone. Yet, the stock valuation has already been driven up to the level as if the profitability and growth to be fueled by these catalysts were a “sure” thing, as elaborated immediately next.

No sure thing and risk-free rates

There is no sure thing in investing. The closest you get is the risk-free rates. And Buffett is famous for his use of risk-free rates as the discount rate for valuing stocks with compounding power. To me, what is even more insightful are his comments about the way most of us chose the discount rates, which he called “mathematical gibberish” in his annual meeting (see the quotes below and highlights added by me):

… But we believe in using a government bond-type interest rate. We believe in trying to stick with businesses where we think we can see the future reasonably well — you never see it perfectly, obviously — but where we think we have a reasonable handle on it.

If you say I’m going to stick an extra 6 percent in on the interest rate to allow for the fact — I tend to think that’s kind of nonsense. I mean, it may look mathematical. But it’s mathematical gibberish in my view.

You better just stick with businesses that you can understand, and use the government bond rate. And when you can buy them — something you understand well — at a significant discount, then, you should start getting excited.

So here, rather than cherry-picking a discount rate (which can then be used to justify any valuation you want), I will make a bold assumption that MSFT will be a PERPETUAL compounder and deserves the royal treatment of risk-free rates as its discount rates.

And next, I will illustrate the excessive optimism pumped into MSFT even under this bold assumption.

CAPM and risk-free rates

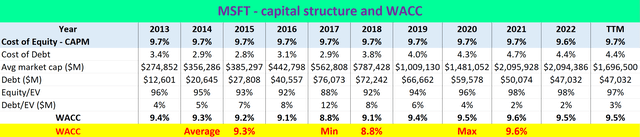

To further elaborate on how aggressive the assumption is, the following shows the discount rates for MSFT estimated by the capital asset pricing model (“CAPM”). In case you are new to the CAPM model, it is a widely accepted model and the inputs involved in the model are those listed in the table below, including the capital structure, debt rates, tax rates, beta, and also the 10-year treasury rates. As seen, WACC (weighted average cost of capital) for MSFT has been in the range of 8.8% to 9.6% in the long term. And its current hovers towards the higher end at 9.6%.

Source: author based on Seeking Alpha data

Valuation and expected return

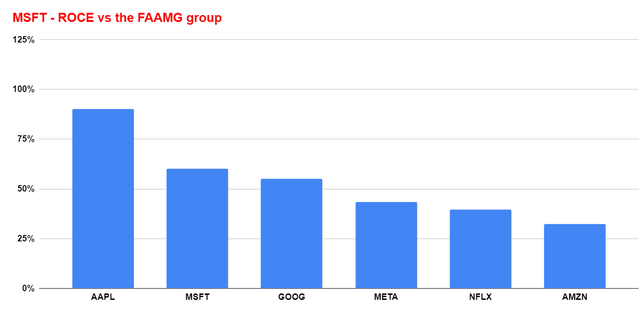

With the above background, here I will just plug in the average 10-year treasury rates (about 4.5% on average) into the discounted dividend model. Given MSFT’s long and stable dividend history, I think it is a well-justified assumption that its dividends accurately approximate its owners’ earnings. Also, I am using its TTM dividend payouts of $2.66 per share. The terminal dividend growth rate was estimated by multiplying MSFT’s average return on capital employed (ROCE, more on this later) of 67% by its reinvestment rate (taken to be 5% based on its long-term historical average). And since we assumed it to be a perpetual compounder, we are essentially assuming it can sustain this level of ROCE and reinvestment rate indefinitely. Under these assumptions, the terminal growth rate turned out to be 3.4% (67% ROCE x 5% reinvestment rate = 3.38% perpetual growth rate).

And the bottom line is that MSFT’s fair valuation would be about $238 based on these parameters ($2.66/(4.5% – 3.38%)). Its market price was $310 at the time of this writing. Thus, even under all the aggressive assumptions built into the analysis, the stock is at a sizable premium of about 30%.

Other risks and final thoughts

To reiterate, there is no doubt that Microsoft Corporation has a good business model and an incredibly stable moat- a point thoroughly analyzed in many other Seeking Alpha articles (including some of my own). Microsoft would still be a good business even if the AI initiatives do not work out. However, my concern is that the current bullish sentiment surrounding Microsoft Corporation stock is premature and overblown.

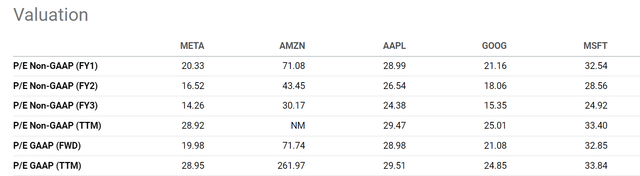

The following two charts further illustrate the risks. As seen, with a TTM P/E around 34x, MSFT is the most expensively valued stock among the FAAMG group if Amazon.com, Inc. (AMZN) is excluded. Accounting P/E simply does not apply to AMZN as detailed in my earlier article. In terms of ROCE, MSFT admittedly ranks high even among this group of overachievers. But its ROCE is below that of Apple (AAPL) by a good margin, and not that higher than the rest of the pack. And fundamentally, at this early stage of AI development and commercialization, I view all the FAAMG stocks as viable contenders.

As such, my conclusion is that Microsoft Corporation’s valuation has been driven to a level that is hard to justify even by the most aggressive assumptions. Potential investors at this price level face more downside risks than upside risks.

Source: Seeking Alpha data Source: Author based on Seeking Alpha data

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.