Summary:

- Q1 earnings showed both good operational and financial results; it appears PayPal’s strategy is working and growth is sustainable.

- We believe Q2 results will be slightly better than its guidance.

- Margin expansion is developing better than expected due to marketing and G&A expenses cut. AI will also bring its contribution in further profitability growth.

- PayPal is currently record-breaking cheap: despite growth opportunities, valuation is now comparable to cyclical stocks, and its buyback yield is higher than the dividend yield of many value stocks.

- We’re maintaining strong buy status on PayPal: growing financials with such valuation creates enormously attractive opportunities.

Justin Sullivan

Investment thesis

Despite quite good earnings, PayPal (NASDAQ:PYPL) shares have slipped after unfavorable Q2 guidance. We believe that PayPal is now one of the best opportunities in the market: its business is growing, financials are getting better and yields are already enormously high for the sector. Strong BUY at current prices.

Q1 earnings summary: Conservative guidance despite good operational data

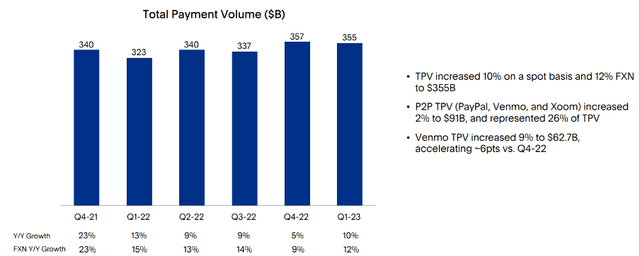

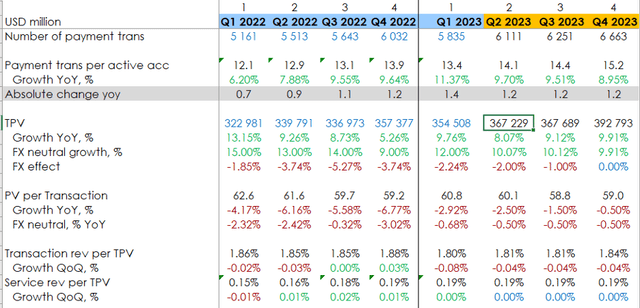

The 1Q 2023 report was in line with our expectations, as PYPL’s business continues to grow at a decent pace: TPV grew 12% on FX neutral basis, supported by strong unbranded checkouts growth.

In Q1, the company launched PayPal and Venmo at McDonald’s (MCD) restaurants, and signed a deal with Microsoft (MSFT) that brings the Buy-now-pay-later option and Venmo Wallet to the Xbox Store. PayPal continues to actively cooperate with major representatives of various industries (Booking, Adobe, Live Nation, ApplePay), which allows the company to actively increase TPV even in the face of competition and slowing demand.

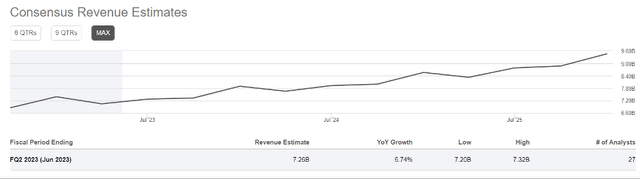

Despite quite good earnings, the stock has fallen on unfavorable Q2 guidance – management expects 6.5% to 7% revenue growth, which shows a slowdown compared to Q1 results.

We think that the market reaction on earnings was overwhelming and now the market is underestimating further PayPal results, despite prospects being good enough.

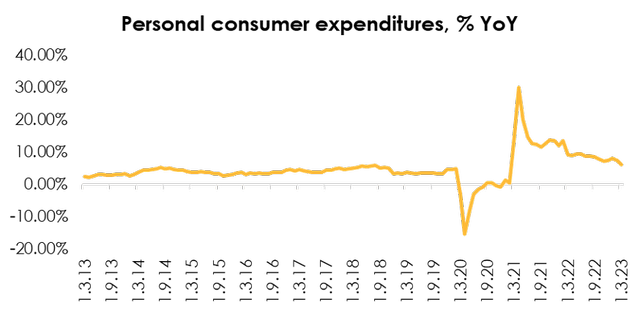

Since 2017 PYPL’s TPV has grown at a CAGR of 24%, and trailing 12 months TPV has increased 8.20% despite macroeconomic uncertainty and an observed consumer spending slowdown.

U.S. Bureau of Economic Activity

We believe that PayPal’s collaboration and expansive growth policy will sustain TPV growth even despite remaining competition and high digital payments penetration. We’re expecting TPV to grow to $1,482,219 mln (+9.22% y/y) in 2023 and then accelerate to $1,658,219 mln (+11.90%) in 2024 due to a consumer recovery and more deals to be signed.

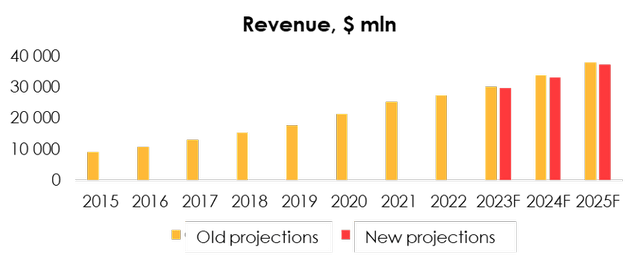

Anyway, we see that outpacing growth rates at unbranded checkout negatively affects total monetization rates which is conforming to the laws of nature after aggressive expansion, so we’re decreasing expected monetization rate in 2023-2025 from 1.87% to 1.81%. Anyway, we don’t expect decrease in monetization rate to significantly fall, because when PayPal switches from expansion to monetization in Venmo, Braintree and unbranded checkouts will also increase.

We’re lowering revenue forecasts from $30,073 mln (+9.3% y/y) to $29,693 mln (+7.9% y/y) in 2023 and from $33,855 mln (+12.6% y/y) to $33,227 mln (+11.9% г/г) in 2024.

Despite a revenue forecast decrease, we believe that PYPL will beat its guidance and consensus estimates in Q2 even with lower monetization rates:

We see a sustainable trend in consumer involvement growth, as number of transactions per active account is rising at a decent pace. And even with lower monetization levels, we believe that in Q2, PayPal’s revenue will total at least $7,334 mln (+7.8% y/y).

Margins continue to get better and further expansion potential remains

In terms of operating costs, the company’s development is going slightly better than we expected. The company managed to reduce marketing expenses to $436 mn (-26.6% yoy) and administrative expenses to $507 mn (-16.5% yoy). And though a huge part of the OPEX decrease was caused by falling costs in marketing (CPC, ARPU’s etc.), the previously announced cost cut plan also brings its contribution.

The company’s management announced the introduction of artificial intelligence into PayPal’s activities, and it will be used in almost all divisions (front and back offices, legal department, marketing), which will significantly reduce costs and improve profitability.

Given the new input data, as well as more positive cost dynamics in 1Q, we lowered our 2023 marketing budget forecast from $2,461m (+9.0% yoy) to $2,011m (-11% yoy) and in 2024 – from $2,771 million (+13% yoy) to $2,560 million (+27.3% yoy). For administrative expenses, the forecast was lowered from $2,519 million (+20% yoy) to $2,121 million (+1% yoy) in 2023 and from $2,836 million (+13% yoy) to $2,367 million (+12% YoY) in 2024.

However, we included restructuring costs related to the implementation of the new strategy in our cost projections and estimated them at $464 million in 2023 and $200 million per year in 2024-2025.

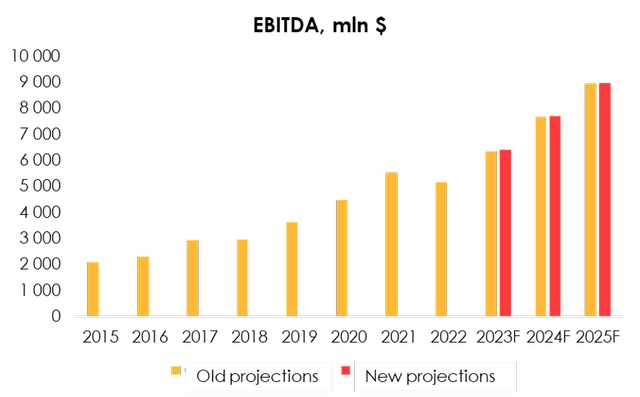

Since the effect of a lower operating costs forecast is stronger than the effect of lower revenue forecast, we raise our EBITDA forecast in 2023 from $6,347m (+23.2% yoy) to $6,396m (+24.1% yoy) and in 2024 year – from $7,679 million (+21.0% yoy) to $7,696 million (+20.3% yoy).

After the post-earnings sell-off, PayPal’s valuation sets new lows; and the yields – new highs

When we get to the valuation side, a huge question arises why PayPal stock is currently valued at such a low price. With a historical adjusted EV/EBITDA multiple of 22.73x, company is now trading at 10.8x FWD EV/EBITDA multiple (or 11.3x FY23 and 9.4x FY24).

At the same time, PayPal peers are much more expensive: Visa (V) is trading at 21x FWD EV/EBITDA and Mastercard (MA) at 24x. Other peers like AFRM or FUTU remain unprofitable.

PayPal’s buyback program for FY23 is $4 bn, which gives a buyback yield of 5.51% at its current market capitalization, which is almost twice that of Coca-Cola’s (KO) FWD dividend yield (2.9%) and even higher than Philip Morris’ (PM) FWD dividend yield of 5.35%.

The numbers speak for themselves – PayPal is currently too cheap and the market doesn’t seem to understand how much of a bargain it is now.

Valuation

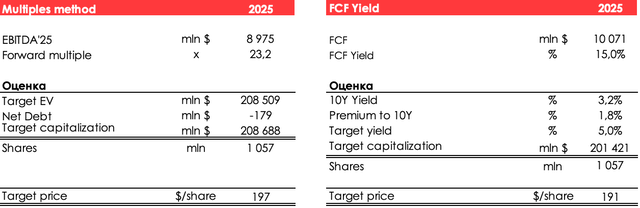

We’re evaluating PYPL prices based on 2025 EV/EBITDA multiples and FCF Yield. The fair value price for the shares is $157, which is the average price between EV/EBITDA multiples and FCF Yield and discounted by 13% per annum. Figures depicted below are not discounted. Rating is BUY.

Conclusion

PayPal remains as a well-positioned business with an appropriate strategy and solid prospects. Despite growing results and further potential, the stock is now valued as a cyclical one, or as a business reaching its ceiling. We’re maintaining Strong BUY status for PayPal.

To manage the position, we recommend keeping an eye on the financial statements of PayPal and its competitors (Visa, Mastercard, Affirm, Square), as well as industry research (McKinsey, Capgemini, Worldpayglobal)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.