Summary:

- Apple delivered results last week, and the stock rallied.

- The strength in iPhone sales and the potential in emerging markets were especially compelling.

- However, given the over-stretched valuation and technicals, I am forced to sell.

mevans

Thesis Summary

Apple, Inc (NASDAQ:AAPL) recently released its second-quarter results. Investors were pleased with the company, and the stock has continued to rally.

There’s a lot to like from Apple and the recent results, including the strength in iPhone sales and the forward guidance given.

However, as the stock valuation becomes more rich, is now still a good time to buy?

Q2 Earnings

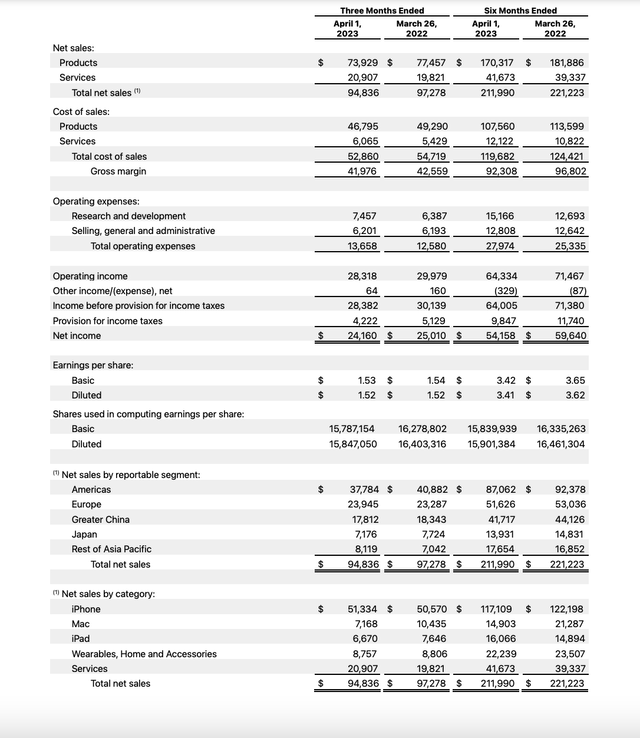

Looking at Apple’s quarterly revenues, they are not that impressive when compared to last year.

Total sales are actually down 5% YoY, though EPS has remained flat YoY thanks to marginally lower costs of sales and tax provisions. The company actually increased gross margins vis-a-vis the last quarter by 130 basis points to 44.3%.

If we break down revenues, we can see that the services segment is continuing to grow at a slow pace, while product sales have been declining in the last six months compared to the previous year.

The silver lining to the products segment is the iPhone, where sales have grown sequentially by around $800 million.

The other positive note in terms of revenue is the growth we have seen in the “rest of Asia pacific” geography.

On the surface, there’s nothing too impressive with these results, though the company has maintained steady EPS at a time when most companies have struggled. This resilience might be why the stock has been rallying.

But with the stock now trading at 29 P/E, is there still a reason to buy, or should investors be making their way to the exit?

I like the stock, but I’m taking profits.

There’s a lot to like from Apple.

The strength in iPhone sales has not gone unnoticed. Even at a time when the economy was not doing so well, Apple’s start product continues to deliver.

Let’s start with iPhone, which set a new March quarter record with revenue of $51.3 billion. The iPhone 14 and 14 Plus continue to delight users with their long-lasting battery and advanced camera. And our pro users continue to rave about the most powerful camera system ever in an iPhone.

Source: Earnings call

But this was perhaps the second most encouraging thing about this quarter. What I found even more compelling was the strong growth we saw in emerging markets, and specifically in India.

Yes, sure. Looking at the business in India, we did set a quarterly record, grew very strong, double digits year-over-year. So, it was quite a good quarter for us, taking a step back, India is an incredibly exciting market. It’s a major focus for us…

There are a lot of people coming into the middle class, and I really feel that India is at a tipping point, and it’s great to be there. On other emerging markets, we had a stellar quarter in emerging markets overall, as I had mentioned, with records set in a number of different places, including Indonesia and Mexico, the Philippines, Saudi Arabia, Turkey, UAE, and then quarterly records in Brazil, India, and Malaysia.

Source: Earnings call

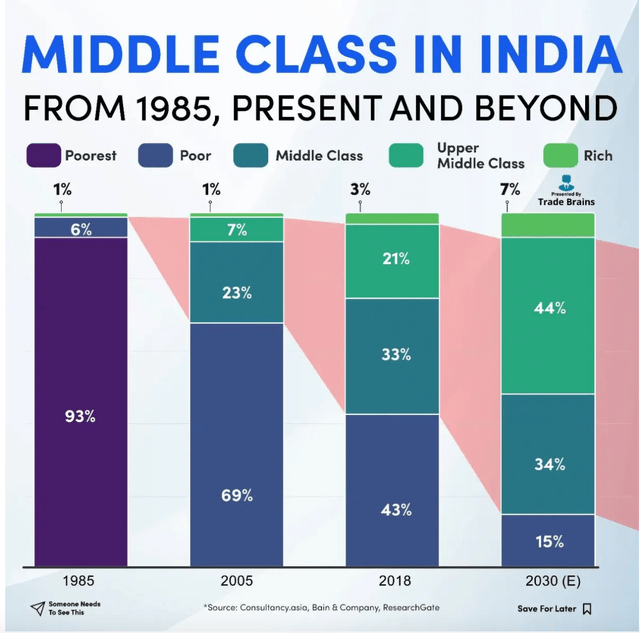

Tim Cook is not wrong; the Indian middle class is forecast to represent 34% of the Indian population, according to an analysis from Bain & Company.

India Middle Class Forecast (Nain & Company)

Add to this 44% of the upper middle class, and 7% of rich people, and you have 85% of the population that are now potential customers of Apple. That’s 85% of an estimated 1.515 billion.

The growth potential is huge, and Apple has established itself as a clearly differentiated and very highly valued brand.

This leads me to the third thing I like about Apple, which is the fact that it is a global company. I am of the belief that the US economy could struggle moving forward, and so could the US currency. Gaining some exposure to international markets is a good idea, and Apple is a relatively safe way of doing this.

However, with the stock near all-time highs, I have no choice but to take some profits.

Valuation

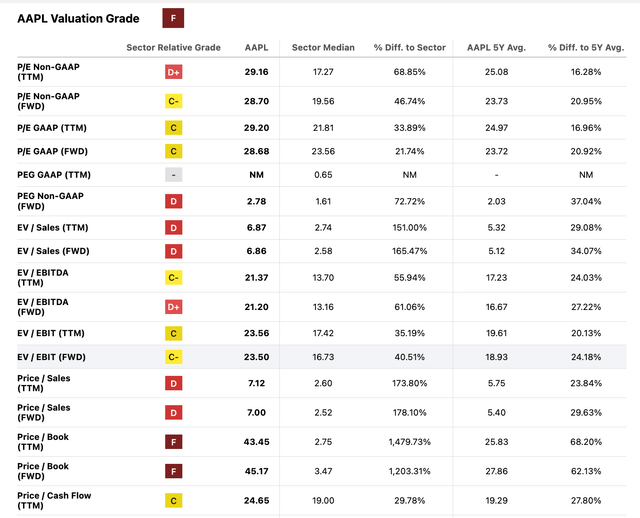

Apple is performing well, sure, but not well enough to justify this valuation:

By any traditional metric, Apple is grossly overvalued. Not only is Apple overvalued compared to the sector median, which would be justified given that this is Apple. Apple is overvalued compared to its own historical valuation.

With a P/E of nearly 30 and a P/cash flow of almost 25, it’s hard to justify this valuation. It is true that P/S has been higher in the past, but at this point, even with the India catalysts, Apple’s growth shouldn’t justify this premium.

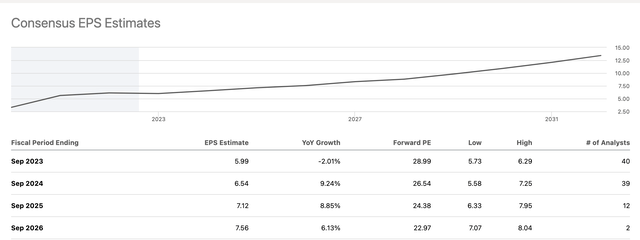

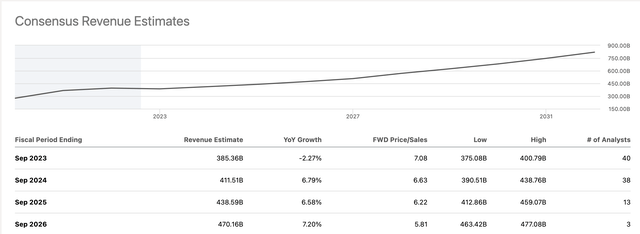

This is reflected in the earnings and revenues estimates:

EPS Estimates (SA) Revenue estimates (SA)

We have EPS projected to grow to $7.12 by 2025, which implies a forward P/E of 24,38. Meanwhile, the forward P/S for 2025 is 6.22.

A high multiple could be justified if we were looking at double-digit growth, but this is not the case. Apple has some significant catalysts ahead that will ensure steady long-term growth, but nothing explosive.

Most importantly, though, we have to understand that Apple’s high valuation is being driven, in great part, by the broader fear and bearish sentiment that is currently prevalent in the market.

Apple is seen as a safe bet, which it is, but as the Fed eases, which is already in motion, given that we probably had the last rate hike, I believe many market participants will be looking to rotate out of the big tech safety and into more “speculative” bets.

This is a dynamic we have seen time and time again, and this time should be no different. It’s not that Apple is a bad stock to own; it’s that as the market changes, the opportunity cost of holding Apple will become greater.

This is what ultimately should drive down Apple’s valuation.

Technical Analysis

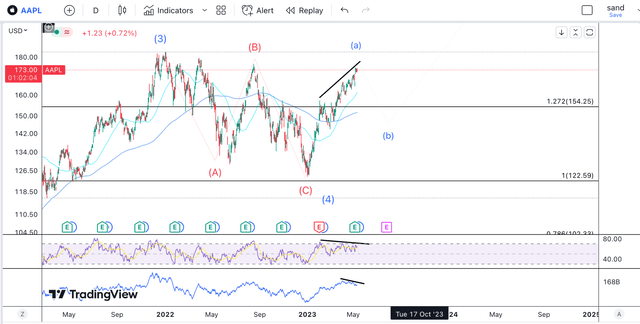

Now, if we look at the technical chart, there are also reasons to sell. Apple stock has rallied non-stop, and it is showing signs of exhaustion:

Looking at the Daily chart, we can see that the RSI topped back in February, and the stock has continued higher. This is a bearish divergence. The same can be found when we look at On Balance Volume, which has been trending down.

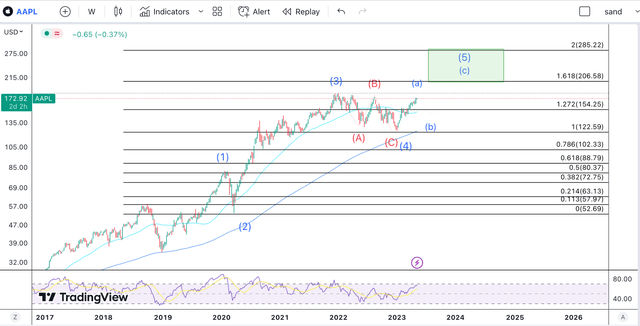

Looking at the weekly chart, I do see a correction coming, but this is part of a larger move which should take us north of $200 eventually. A retest of the 50-week MA, at least, would be healthy at this point.

Takeaway

In conclusion, there are a lot of reasons to be bullish long-term for Apple. I wouldn’t recommend selling if you are simply holding for the long term. However, given the stretch in the technicals, and the valuation, I see a 10% sell-off much more likely than a 10% rally at this point. For this reason, I am taking profits and looking to re-buy aggressively lower. I will also be taking profits and investing in other areas of the market I feel could outperform going forward, such as small-caps and even financial stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is just one of many exciting and fairly priced tech stocks you can buy right now!

Join The Pragmatic Investor to stay ahead of the latest news and trends in the tech space and you will receive:

– Access to our Portfolio, which features “value tech stocks”.

– Deep dive reports on tech stocks.

– Regular news updates

Technology is changing the future, don’t just watch it, be a part of it!