Summary:

- We maintain our buy rating on The Walt Disney Company after the fiscal Q2, 2023 earnings report in spite of subscriber loss.

- We expect the price increase coupled with reduced expenses are CEO Robert Iger walking the talk when it comes to the company’s shift to profitability for its streaming businesses.

- Disney reported an operating loss of $659M in its streaming business, compared to 887M a year ago; we believe the turnaround plan is in action.

- The Disney stock price may be volatile in the near term due to macro headwinds pressuring consumer spending, but we expect Disney to be positioned to outperform in the mid-to-long run.

- We recommend investors begin exploring entry points into The Walt Disney Company stock on pullbacks.

tvierimaa/iStock Editorial via Getty Images

We continue to be buy-rated on The Walt Disney Company (NYSE:DIS) post fiscal Q2, 2023 earning results. Shares fell more than 5% in extending trading after the company reported a miss in Disney+ subscriptions and in-line revenue of $21.82B, up 13.4% Y/Y. We’re not too concerned about the subscriber miss this quarter, as we believe Disney is doing well on its plan to shift focus to profitability amid market uncertainty. We prefer long-term profitability over near-term subscriber growth amid macro headwinds that are visibly weighing on discretionary spending.

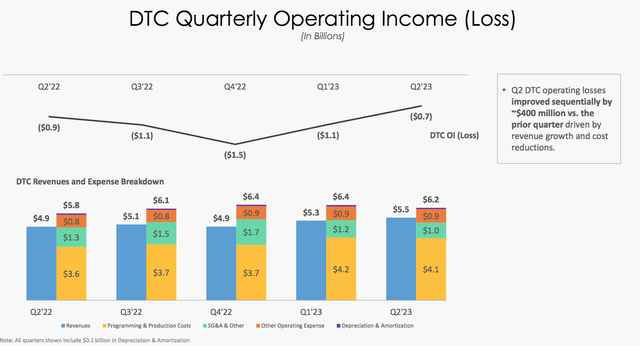

Our takeaway from the fiscal Q2 2023 earning report was Disney shrinking operating loss in its Direct-to-Consumer segment; the company reported a loss of $659M this quarter, compared to a consensus of $841M and a loss of $887M a year ago. Just last quarter, 1Q23, Disney reported an operating loss in its Direct-to-Consumer segment of $1,053M; the company has narrowed the operating loss by roughly $400M sequentially. Consistent with our March note, we believe Disney is using its pricing power in streaming businesses and restructuring costs to improve profitability. We don’t expect profitability to be attained before the end of 2H23, but expect the company’s strategy of price increases and reduced expenses to make it well-positioned to achieve profitability in the mid-to-long run.

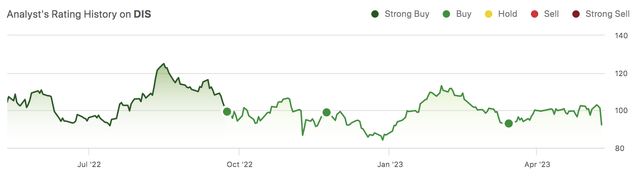

The Disney stock price will likely remain volatile over the next couple of quarters. We recommend investors take advantage of the market’s overreaction to the fiscal Q2 2023 earning results and begin exploring favorable entry points into the stock on pullbacks, as we expect Iger’s Disney is slowly making a comeback. The following chart outlines our rating history on the stock.

Narrowing operating loss for long-term profitability

Our bullish sentiment is driven by our belief that Disney is shifting much-needed focus on profitability, and 2Q23 is proof that the company is on the right path, but investors will have to brace for some subscriber shed. We believe management is figuring out how to navigate the streaming businesses to achieve profitability and simultaneously expand market share as competition with Netflix, Inc. (NFLX) and others intensify, and macro headwinds persist.

This quarter Disney+ total subscribers came in at 157.8M, compared to 161.8M a quarter earlier, and suffered a 2% decline in membership. The company shed around 4M subscribers this quarter, the bulk of which came from an 8% drop in India’s Disney+ Hotstar subscriber base. Still, Disney’s average monthly revenue per paid subscriber (ARPU) is up significantly this quarter. Disney+’s domestic ARPU grew to $7.14 from $5.95 as the company increased its average retail pricing. On the international level, ARPU increased slightly less to $5.93 from $5.62. ESPN+’s ARPU also increased slightly to $5.64 from $5.53, while Disney+ Hotstar’s dropped to $0.59 from $0.74 due to “lower per-subscriber advertising revenue.” Disney’s operating loss in its Direct-to-Consumer segment declined year-over-year due to a combination of increased pricing and reduced expenses; management reported revenues increased by 12% Y/Y this quarter.

The following graph outlines Disney’s Direct-to-Consumer quarterly operating loss up to 2Q23.

Disney 2Q23 earnings presentation

We believe Disney’s operating loss hit its low in 4Q22 and is slowly recovering; hence, we recommend investors buy at current levels rather than wait until operating loss shrinks further. The company is also working to reduce content from its streaming platforms to manage expenses. We expect the operating loss to narrow further sequentially toward 1H24, and recommend investors begin exploring entry points into the stock at current levels to get ahead of the curve.

Risks to our bull thesis

We still believe weaker ad spending due to inflationary pressures and higher interest rates will pressure the company through 2H23, making it more challenging to lower operating loss in international markets and achieve overall profitability. But, we believe the slower ad spending issue is pressuring the media and entertainment industry as a whole, including Netflix and Paramount Global (PARA). We expect Disney’s well-positioned to maneuver the macro headwinds while pumping revenue toward the end of the year and in 2024.

It’s also important to note that streaming isn’t Disney’s only revenue source. While all eyes are on Disney’s Media and Entertainment segment, Disney’s Parks, Experiences, and Products segment also stands to be a profit driver for the company in the post-pandemic environment, growing 20% Y/Y this quarter with Domestic parks and experiences revenue growing to $5.6B from $4.5B a year ago. We see some short-term pain as the company maneuvers macro headwinds but believe Disney is well-positioned to outperform in 2024.

Valuation

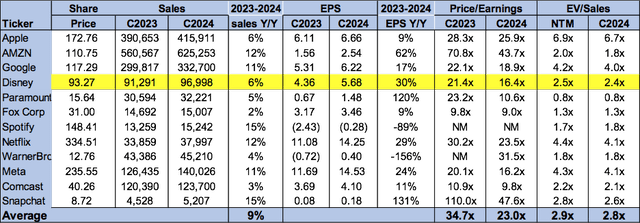

Disney’s stock is relatively cheap, trading at 16.4x C2024 EPS $5.68 on a P/E basis compared to the peer group average of 23.0x. The stock is trading at 2.4x EV/C2024 Sales, versus the peer group average of 2.8x. We see favorable entry points at current levels, as we believe the stock is reasonably valued and expect the stock to re-rate higher as the company shifts more focus on profitability.

The following chart outlines Disney’s valuation relative to the peer group.

Word on Wall Street

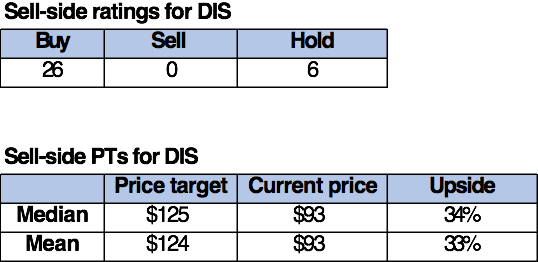

Wall Street shares our bullish sentiment on Disney stock. Of the 32 analysts covering the stock, 26 are buy-rated, and the remaining are sell-rated. The stock is currently priced at $93 per share. The median sell-side price target is $125, while the mean is $124, with a potential upside of 33-34%.

The following charts outline Disney’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We’re bullish on The Walt Disney Company stock; we expect some near-term pain in the streaming businesses due to the worsening macro condition, but we believe the company is en route to achieving long-term profitability. We’re constructive on Iger’s second earnings report since returning to the company; the fiscal 2Q23 earning report shows higher ARPU and reduced expenses, including 7,000 job cuts. We expect Disney’s restructuring plan is in action and believe investors buying the stock at current levels will be well-reward in the mid-to-long run.

Disney’s stock is trading at $93 per share, roughly 10% higher than its 52-week-low of $84.7. We see favorable entry points at current levels and recommend investors buy into The Walt Disney Company’s future profitability.

Our Investing Group, Tech Contrarians, will be launching on June 1st with a significant discount on the annual subscription for the life of the service. We cover everything software/hardware and semiconductors as engineers turned top analysts. Keep reading our work to see more of what’s ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.