Summary:

- The Walt Disney Company disappointed investors with some of its results for the second quarter of its 2023 fiscal year.

- While the firm could have done better, it did report some rather stellar developments such as debt reduction, cost-cutting, strong cash flows, and growing sales.

- In all, this is a bump in the road for a truly great American business that should continue to grow moving forward.

Julio Aguilar

As sad as it is to admit, not even the happiest place on earth can always be happy. Right now, shareholders of entertainment giant The Walt Disney Company (NYSE:DIS) are likely feeling less happy and more agitated after the company announced financial results covering the second quarter of the company’s 2023 fiscal year. A decline in the number of subscribers to its Disney+ streaming platform, combined with a slight earnings miss, has sent the stock down in after-hours trading on May 10th. While this is definitely painful in the near term, when you dig deeper, the picture for the company continues to look impressive. For those focused on the long haul, this might actually be a good time to consider picking up additional units of the business. Because when you weigh out all of the positive and negative that management reported, the positive still definitely wins out.

A look at the headline news

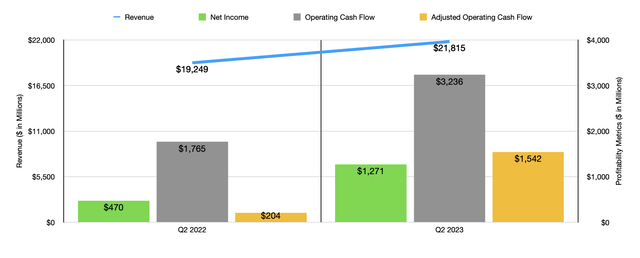

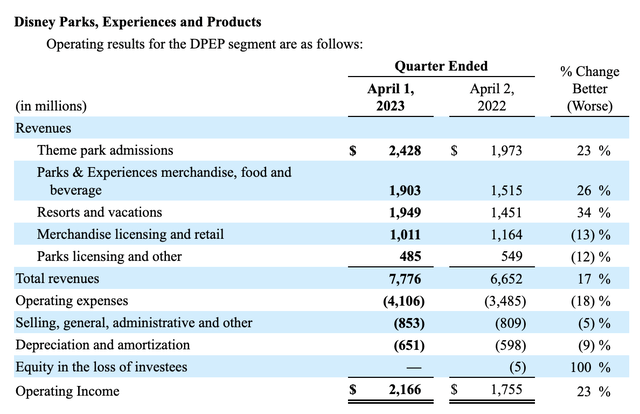

To start with, we should touch on how the company performed on both its top and bottom lines. During the quarter, the company generated revenue of $21.82 billion. This represents an increase of 13.3% over the $19.25 billion the company reported one year earlier. In addition to this, it also translated to an extra $16.2 million over what analysts had forecasted. The lion’s share of the growth for the company during this time came from its Disney Parks, Experiences and Products segment, with revenue spiking 17% from $6.65 billion to $7.78 billion. Digging deeper, you find that much of this increase was driven by some of the core operations of the company. Theme park admissions revenue, for instance, shot up 23%. Parks and experiences merchandise, food, and beverage revenue grew 26%. And resorts and vacations revenue skyrocketed 34%.

This increase in sales was driven by a couple of different factors. For instance, at the company’s parks, domestic attendance was up 7% year over year, while per capita guest spending grew 2%. Its hotels reported an occupancy rate of 89% compared to the 84% seen one year earlier. Internationally, attendance more than doubled because of the lag last year in certain economies reopening because of the COVID-19 pandemic. Per capita guest spending internationally, meanwhile, jumped about 20%, while occupancy rates grew from 46% to 72%.

Leading up to the earnings release for the company, I wrote a preview article wherein I discussed some of the expectations that investors should have. In the first quarter of the 2023 fiscal year, this portion of the company had performed incredibly well compared to what it had one year earlier. And when you consider that international operations experienced a lag in recovery because of extended COVID-19 protocols, I felt as though we would definitely see continued strength on this front in the second quarter. Outside of revenue, I believed that this recovery would be apparent through the occupancy rates and per capita guest spending that the company reports data on. And sure enough, management did not disappoint.

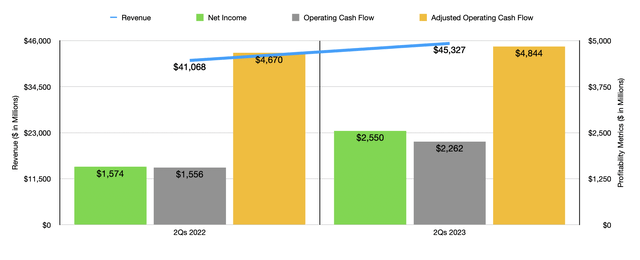

On the bottom line, the company reported profits of $0.69 per share. That’s significantly higher than the $0.26 per share reported one year earlier. On the other hand, it did end up coming in $0.02 per share lower than what analysts thought it would be. On an adjusted basis, meanwhile, earnings fell from $1.08 per share last year to $0.93 this year. Analysts, meanwhile, were expecting $0.97 per share on an adjusted basis. The earnings per share reported by the company translated to net profits of $1.27 billion. Had the company matched expectations, this would have been just under $1.30 billion. Even so, it did mark a significant improvement over the $470 million reported one year earlier. Cash flow data also came in remarkably strong. Operating cash flow spiked from $1.77 billion to $3.24 billion. If we adjust for changes in working capital, we would have seen it rise from $204 million to $1.54 billion.

Streaming isn’t so bad

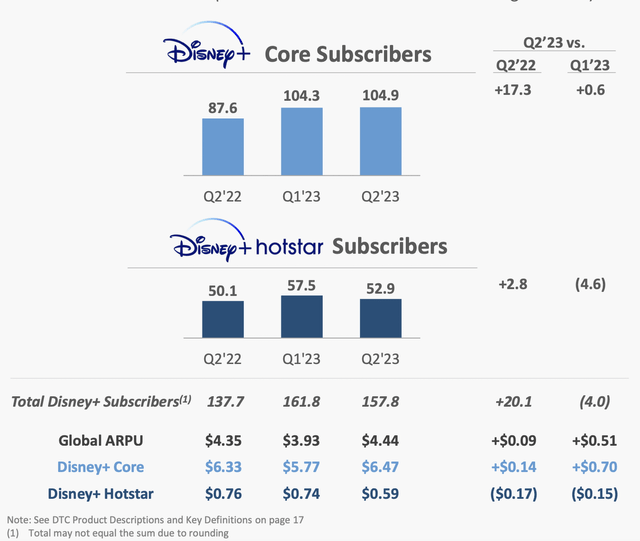

In addition to the company’s missing expectations on the bottom line, another driver behind the share price decline was likely the drop that the company experienced in subscriber numbers associated with its Disney+ platform. By the end of the quarter, the company had 157.8 million paid subscribers. That was down from the 161.8 million reported in the first quarter. At first glance, this looks awful. However, the overwhelming majority of this decline came from the lowest value international operations that the business has. Core Disney+ subscribers actually grew from 104.3 million to 104.9 million. In addition to this, the company enjoyed a rise in its monthly ARPU from $3.93 to $4.44. This may not seem like much of an improvement. But when applied to the total subscribers that the company has, it translates to about $965.7 million of additional revenue per year compared to a scenario where pricing would remain unchanged.

Although disappointing, the decline in subscriber count for Disney+ was not that surprising. The first weakness the company had on that front occurred in the first quarter of the 2023 fiscal year, as I pointed out in my earnings preview of the business. However, I was a bit surprised at just how large the decline was. The good news is that, as I already highlighted, the core subscriber base for the company continued to expand. Had that contracted, my concern would have grown. I also did state in my earnings preview article that investors should be paying attention to the ARPU for the company, especially because of a price increase that was initiated late last year. As we have now seen, that did not disappoint.

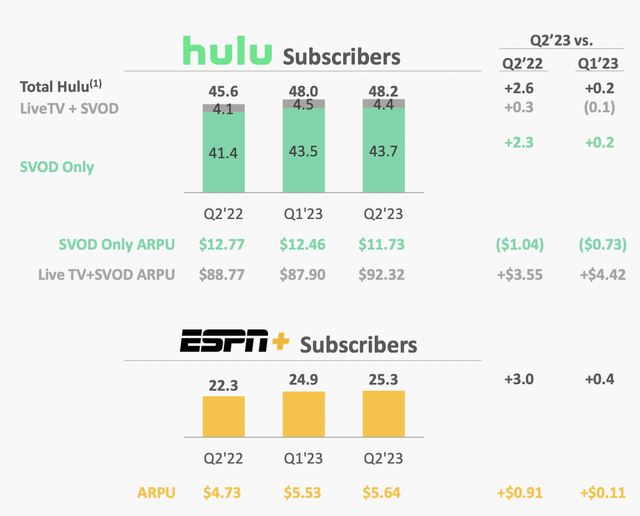

The other streaming services that the company has performed better by comparison. ESPN+, for instance, went from 24.9 million subscribers to 25.3 million. At the same time, monthly ARPU grew from $5.53 to $5.64. Meanwhile, the company’s Hulu subscriber base inched up from 48 million to 48.2 million. On the other hand, monthly ARPU on that platform dropped from $19.53 to $19.06. While this may seem distressing to some, Hulu does have a history of volatility when it comes to pricing. And this change is well within that historical range. Combined, the changes in streaming subscriber count and in pricing has pushed the annualized revenue associated with its subscriptions up from $20.53 billion in the first quarter of this year to $21.14 billion today. This ignores the potential advertising revenue that the company is targeting. Over the past year, the company claims to have added over 1,000 advertisers to its overall advertising portfolio. That brings them up to roughly 5,000 advertisers across its streaming platforms. This does seem to counter the narrative that the company would suffer from political positions that some deem to be unpopular.

Other important developments

Although many investors right now seem to be focused on the headline news and the streaming results, it is worth pointing out that there were other developments that the company reported that were incredibly important. At top of mind is the fact that, compared to only one quarter earlier, the company managed to reduce its net debt from $39.91 billion to $38.12 billion. That’s a decline of roughly $1.79 billion in a span of only three months. This was made possible by the strong cash flows that the company generated. And the improvement in cash flow has been driven not only by higher revenue, but also by cost cutting initiatives implemented by management. As I mentioned in a prior article, the company is trying to reduce costs by $5.5 billion. In the direct-to-consumer operations, the company already achieved a $400 million improvement on the bottom line in the course of only one quarter. And management did say that the company is on track to meet or exceed their total cost cutting plans.

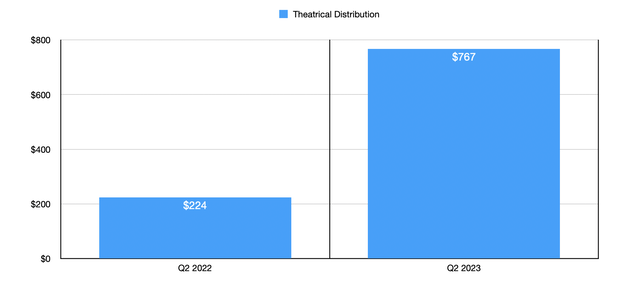

Another area that I pointed out to that investors should pay attention to involves the theatrical distribution side of the company. Although much smaller than other parts of the enterprise, I view the theatrical distribution aspect of the company as the start of the feeder structure that makes the company’s ecosystem thrive. After all, with the exception of ESPN+, Hulu, and some miscellaneous assets like ABC, nearly all of the revenue that the company generates has its roots in the movies and TV shows of the business. During the COVID-19 pandemic, this side of the company was crushed because of social distancing requirements. Fortunately, with some rather successful theatrical releases, this side of the company is coming back rather nicely. During the quarter, theatrical distribution activities brought in $767 million of revenue. That’s more than triple the $224 million generated one year earlier.

This was one area in which I had a great deal of optimism in my earnings preview. I had mentioned that the theatrical distribution portion of the company had shown tremendous upside in the first quarter of the 2023 fiscal year relative to the same time one year earlier. And that included only a couple of weeks worth of the second installment of the Avatar franchise. With more exposure to that film, combined with a continued recovering in the movie theater business in general following the end of the COVID-19 pandemic, it would be shocking not to see strength persist into the most recent quarter.

On the streaming side, management does plan to take advantage of the aforementioned improvement in the advertising picture to launch its ad-tier Disney+ service in Europe by the end of 2023. As a very mature and developed market, this should prove beneficial for the company. In addition to this, the company also is making other changes aimed at bolstering its sales. A Frozen inspired land at Disneyland Paris is in development and follows the one-year anniversary of the success of the Avengers Campus that the company opened there. A Zootopia-inspired expansion is opening later this year at Shanghai Disney Resort, while Arendelle, the World of Frozen expansion, at Hong Kong Disneyland debuts in the second half of this year. Other initiatives are taking place at Tokyo Disney Resort as well.

Takeaway

I understand that investors might be a bit frustrated at this time. It’s never great to see a company’s share price drop when you own shares of that business. Having said that, I see this as a bump in the road. Absent something unexpected coming out of the woodwork, I fully anticipate 2023 being the year that the company achieves the highest revenue in its history. Continued revenue growth associated with streaming, even in light of the loss of low value subscribers, as well as strength across its theme parks and theatrical operations, should all prove very bullish for shareholders. Add on top of this the continued cost cutting initiatives implemented by management, and I have no reason to rate the company anything other than a ‘strong buy’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!