Summary:

- Rivian upheld its 50,000 delivery goal for 2023.

- There is still high demand for the vehicle.

- Though losses are concerning, I believe the company has a bright future.

Kevin Dietsch

Rivian Automotive (NASDAQ:RIVN) recently reported their results for the first quarter that saw better than expected earnings. The main story was that the EV company reaffirmed its 50,000 production goal for the year. The earnings reports received mixed reactions as the stock went up 10% during market hours, and down 15% by the end of the week.

I said previously that I thought Rivian could beat delivery numbers this year, so I for one was slightly disappointed by the earnings report. Even now, there are mixed opinions on the stock. I disagree with what the bears are saying, and I will maintain my buy rating even though there are some visible road bumps ahead.

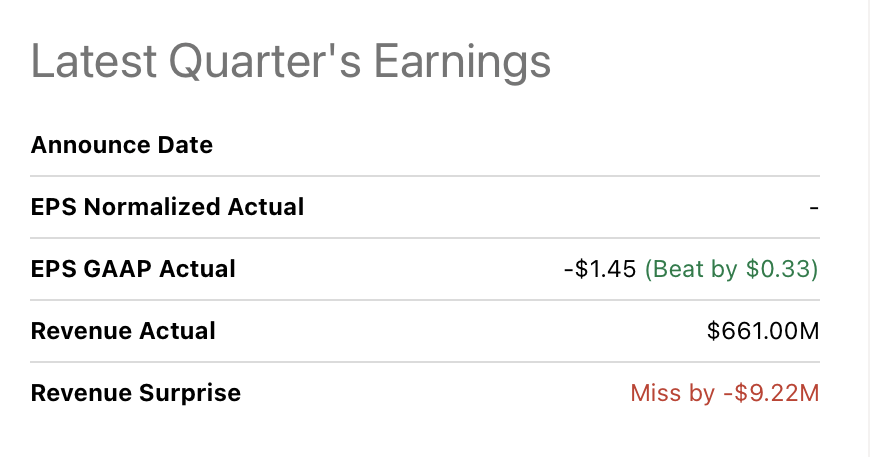

Earnings

In Q1, Rivian missed revenue expectations by 1.4% but beat earnings estimates by 20%. Their net loss was $1,349 million, compared to $1,593 million the same quarter last year.

Seeking Alpha

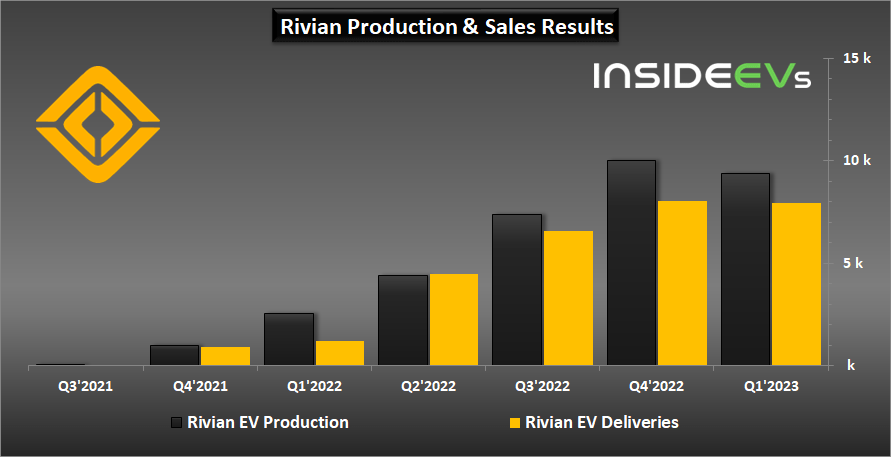

As for guidance, Rivian maintained its 50,000 goal, which in hindsight is plausible considering similar EV companies such as Lucid (LCID) lowered their production target. However, this is nothing to brag about, last year, Rivian maintained their 25,000 vehicle goal for the first 3 quarters, only to fall short in the last quarter. In Q1, Rivian produced 9,395 vehicles and delivered 7,946 vehicles. This is a slight decrease from Q4 of last year, this was due to slowdown of commercial van production in order to implement new hardware into the production line. Overall, it was a solid quarter.

Production and deliveries slightly decreased last quarter (Inside EVs)

Still Really High Demand

A large part of the bears’ worry is a lack of demand while EV market share drops. At the same time, Rivian’s competitors, notably Tesla (TSLA) and Ford (F), are dropping prices. The Ford Lightning, comparable to Rivian’s R1T model, MSRP starting at $60,000. The R1T’s MSRP start at $73,000.

Despite this, Rivian is sticking to its prices, unworried about demand.

Given the data that we have on customer behavior, the aggregate result we see is a continued upward shift in ASPs (Average Selling Price)

-CEO RJ Scaringe

I agree with Rivian’s statements. In their last public update in November of last year, Rivian reported over 114,000 pre-orders. The company only reported 71,000 pre-orders in the same period a year ago (late 2021). There is clearly way more demand than what the company can supply, and I do not foresee a demand issue in the near-term because the company has got more than enough orders on their hands at the current moment.

In the worst case scenario, given a massive decrease in demand because alternative options are more appealing for example, Rivian should be kept busy for at least another 6 quarters before competitive pressure causes them to change pricing. In short, I think it is too early to worry about Rivian being unable to sell their vehicles, and the market will clearly change when that happens.

The R2

As for the long term, I would like to introduce the R2 series. The release date for the R2 is set to 2026. The R2 series is expected to be an affordable version of the R1 series, much like Tesla’s model 3 and model Y. This will be Rivian’s make-it-or-break-it vehicle. Currently, it’s too early to decide whether or not Rivian will “become the next Tesla”. I think some bears are too quick to conclude that Rivian cannot find similar success to Tesla.

Tesla’s model 3 was released in 2017; in 2016, Tesla only delivered 76,230 vehicles, not terribly far from 50,000 Rivian expects this year. Since the release of the model 3, Tesla found massive success, quickly being added to the S&P 500 by 2020, and now has become S&P’s top 10 companies by weight.

Model 3 (Tesla)

The R2 will be Rivian’s shot at becoming Tesla, and should definitely be considered in the future prospects of the company. That said, the 2 companies operate in different niches, and have different financial strategies toward net profit.

Financials

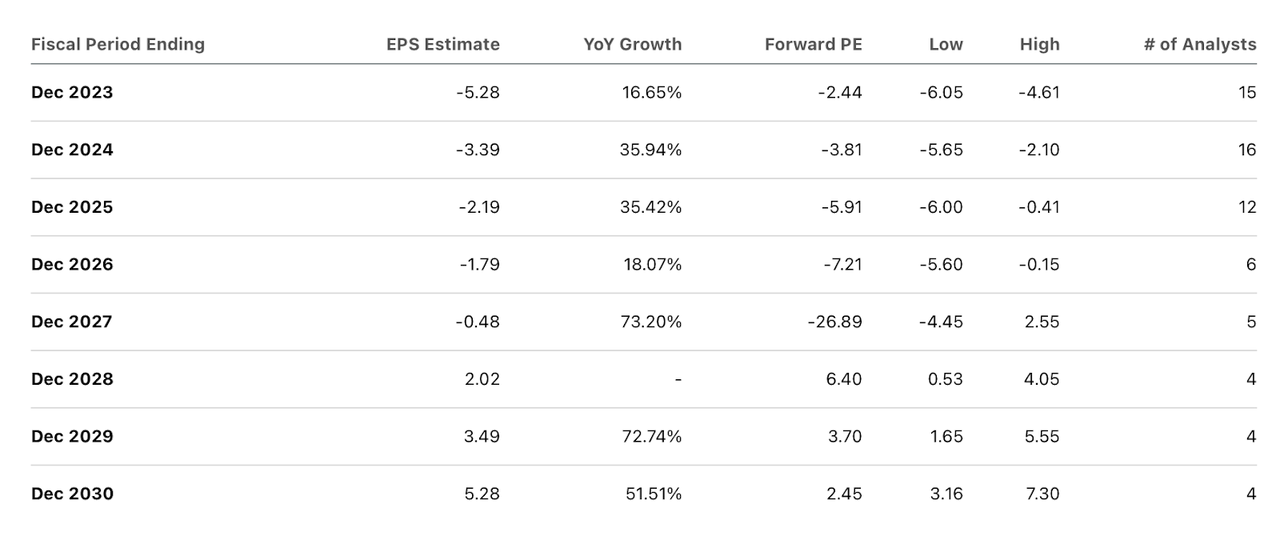

With $12 billion of cash, cash equivalents, and restricted cash, Rivian’s financials seem good in the near term. Their net loss this quarter was $1.3 billion, which means the company should be good for about 9 quarters at their current rate. In addition, Rivian expects to see positive gross profit by 2024. This means, by then, the company will avoid LCNRV charges and losses on firm purchase commitments, further helping their margins.

However, the money may get tight by 2025, as analysts expect net losses to continue until 2027-2028. This means raising capital through either debt or stock, and hurting investor confidence. Told you, this ride is not for the faint of heart.

earnings estimates (Seeking Alpha)

Valuation

Rivian currently trades at 5.34x P/S, which is under to Tesla’s 6.14x. It is important to note that Rivian’s revenue is forecasted to grow quickly, with a forward p/s of under 3x, compared to Tesla’s 5.31x. For more comparisons, a newer EV company like Lucid trades at 17.3x P/S.

It is difficult to set an appropriate PT for the company, analysts at Yahoo Finance set price targets ranging from $11 to $40, with an average of $23.8. The stock is still very reactant to news and reports, and I would only recommend investing if one finds the deep value within Rivian.

Risks

A major reason Rivian stock has fallen so significantly since its earnings report is investor’s worries the EV company will experience demand issues. As discussed, I don’t think the company will see any issue with demands for the next few quarters. In fact, I’d rather Rivian keep its vehicle costs in order as the company is very unprofitable. In my opinion, the two major issues for the company are ramping up production and balance sheet.

For the production side, there’s two major components the company absolutely has to get right- quantity and quality. Currently, many EV companies are facing supply issues. In 2022, Rivian was unable to meet their vehicle production forecast, saying that they “encountered multiple days of lost production due to supplier shortages.” This will be one of the major hurdles to bringing production up to Rivian’s expectations. Even though Rivian didn’t lower their vehicle production forecast, they may encounter similar problems they did last year.

The other vital part of a successful ramp up is vehicle quality. While higher production output means lower cost per vehicle, the margin of error may become greater. In one of Out of Spec Detailing’s videos, host Coleton compared the qualities of 2 R1Ts, one with VIN #4000 and the other #13200. He found out that the newer Rivian had a lower build quality. While this may be sheer coincidence, 7 out of the 15 complaints on NHTSA for the R1T were filed in 2023. This makes me somewhat worried about if production ramp up is coming at the cost of quality.

As for their balance sheet, as discussed, Rivian most likely needs to raise capital one more time before positive becoming a net-positive company. In March, when Rivian announced their plans to sell bonds worth $1.3 billion, stock fell 7% in aftermarket trading.

Both of these issues could seriously hurt Rivian stock, and investors should be prepared to take on these risks.

Overall, I believe Rivian will offer competitive products for years to come. For those reasons, I think it is still investable. Yes there are some issues the company needs to deal with, but there are a lot of upside if they can get those right. Plus, the stock is pretty cheap! Though I understand some think the risks are too great for the current price, I still maintain that it’s a buying opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.