Summary:

- Apple reported its Q2-23 results, demonstrating better-than-expected iPhone demand, immense resiliency of its sticky services business, and continued margin expansion despite macro headwinds.

- Total revenues declined by 2.5%, as 5.5% growth in Services was offset by a 4.5% decline in Products. However, FX-neutral revenues actually grew by 2.5%, and emerging markets grew by 15.3%.

- The ecosystem strategy is unstoppable, as Apple is set to surpass 1B subscribers in the upcoming quarter, after gaining an additional 40M in Q2, despite headwinds in gaming and ads.

- The company’s emerging markets focus is a clear success, with March quarter all-time highs in India, Australia, Spain, Canada, Switzerland, UAE, Indonesia, Brazil, Malaysia, and Turkey.

- As Q2 results add certainty regarding the huge potential of Apple’s near-term strategy, I reiterate a Buy rating and raise my price target to $192 per share.

AleksandarNakic

Apple Inc. (NASDAQ:AAPL) reported Q2-23 results that beat expectations. Revenues totaled $94.9B, compared to an expected $92.8B, and EPS came at $1.52, compared to the expected $1.43, as gross margins reached an all-time high of 44.3%. Specifically, it was iPhone sales that crushed expectations, coming in at $51.3B compared to the $48.9B expectations.

As Apple approaches the 1 billion paid subscribers threshold and its focus on emerging markets bears fruit, I reiterate a Buy rating and raise my price target to $192 per share.

Background

About a month ago, I published Apple: The Ecosystem And The Largest Subscription Company In The World and began my coverage of the company with a Buy rating. I urge you to read that article, in which I explained my investment thesis thoroughly, as well as described Apple’s ecosystem strategy, operations, revenue streams, business model, and the company’s major risks, main growth prospects, and long shots.

Moreover, I explained the importance of differentiating between relevant and irrelevant information when it comes to investing in Apple, as the company seems to never leave the headlines, thanks to its unparalleled popularity. Just as an example, at that time, Apple’s stock was in a downtrend due to another misleading headline that was based on third-party data. Well, the stock is up 7% since, compared to the S&P 500’s 0%.

Now, let’s begin by revisiting the investment thesis and assess how the drivers of Apple’s ecosystem (active devices & paid subscribers) fared in the last quarter. Then, we’ll discuss the two major pillars for growth, and update our financial model and projections accordingly.

Spoiler alert: the ecosystem is stronger than ever, and a surprising growth prospect, which is emerging markets, is becoming more and more important.

Revising The Investment Thesis – The Ecosystem Business Model

In my previous article, I wrote the following about Apple’s ecosystem business model:

Apple’s ecosystem business model is quite simple. Usually, a customer first engages with Apple through an iPhone. Then, as every other piece of hardware the company offers is seamlessly integrated with the iPhone, the customer will most likely elect an Apple product rather than a competitor’s substitute offering, despite Apple’s products being typically more expensive. The customer will elect to do so not only because of the individual quality of the product by itself but also due to the value of integration between all of the customer’s Apple products.

In addition to the hardware, the customer will most likely choose to use Apple’s services, as they are the most convenient option and sometimes the only option when using Apple’s hardware.

Approaching 1 Billion Subscribers, Another All-Time High In Active Devices

Within Apple’s ecosystem, I listed two major metrics to look at in order to assess the strength of the company’s ecosystem. The first, Active Devices Installed Base, reached an all-time high in Q2, but we didn’t get a number update from management (they typically provide a number in the first quarter of Apple’s fiscal year).

During the quarter, our installed base of active devices continued to grow at a nice pace thanks to extremely high levels of customer satisfaction and loyalty, and reached an all-time high for all major product categories and geographic segments.

— Luca Maestri, Senior Vice President & CFO, Q2-23 Call

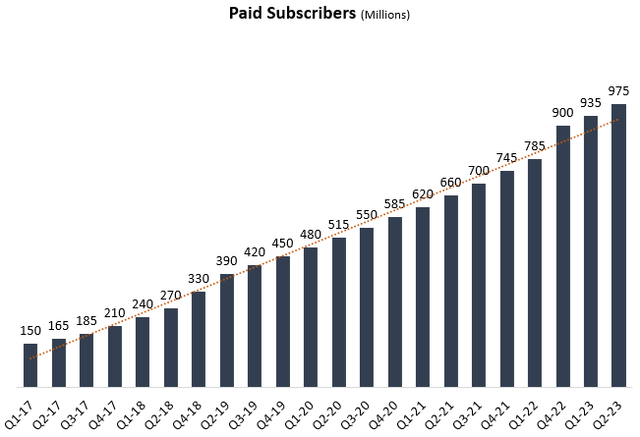

The second metric, Paid Subscribers, gained an additional 40 million in the quarter, and ended at 975 million, reflecting 24.2% growth from the prior year period.

Created by the author based on management remarks in Apple’s earning calls 2016-2023

As we can see, Paid Subscriber growth is accelerating, defeating the law of large numbers. In Q1-23, we saw 19.1% growth, and in 2022 we saw 20.8% growth. What does that tell us? well, first of all, it’s clear that Apple’s services business isn’t slowing down, despite what some market participants suggested prior to the Q2 announcement. Secondly, it appears that new launches like Apple Music Classical, Apple Pay Later, and Apple Card Savings, are very well accepted by customers.

We achieved all time revenue records across App Store, Apple Music, iCloud and payment services. And now, with more than 975 million paid subscriptions, we’re reaching even more people with our lineup of services.

— Tim Cook – Chief Executive Officer, Q2-23 Call

Overall, it seems our investment thesis remains solid. Looking at the above two metrics alone, I think even the most stubborn bears will have to acknowledge Q2-23 was extremely impressive.

No More Growth? I Beg To Differ

One of the easiest claims against investing in Apple is that the company’s growth is limited as its total addressable market (TAM) is already saturated. After two consecutive quarters of negative revenue growth, and with 2 billion active devices compared to the world’s population of 8 billion, it’s hard to refute such a claim. However, let’s give it a try.

As we noted earlier, in the two negative growth quarters, constant currency was a major headwind, and without it, we would have seen 2.5% growth in each of the quarters. This is significantly higher than the overall consumer electronics market. Even if we take out Services revenues, Apple was still able to outgrow peers like HP (HPQ), Microsoft’s devices (MSFT), and Samsung’s SDC (OTCPK:SSNLF), which saw their comparable segments decline by 19%, 30%, and 17%, respectively.

That being said, we have to face the truth, some of Apple’s markets are, in fact, saturated. For example, in the U.S., the company’s share of the smartphone market is estimated at 57.0% and, 87% of U.S. teens already own an iPhone. As I wrote in my previous article, the life cycle of an iPhone is longer than a year for most consumers, and while we can rely on most of the customers to come back, bi-annual or longer upgrades aren’t a significant enough driver for future growth. With the exception of an extremely unique iPhone edition that comes to market once in a few years and delivers growth acceleration even in saturated markets, we will have to look somewhere else for growth.

That somewhere else, in my view, is the combination of emerging markets and services.

Emerging Markets Focus

Most of us are familiar with Apple’s intentions to diversify its supply and production chains to lower its exposure to China, with India being a leading candidate for that. Somewhat under the radar, is Apple’s focus on diversifying its customer markets, and increasing its market share in what the company defines as emerging markets.

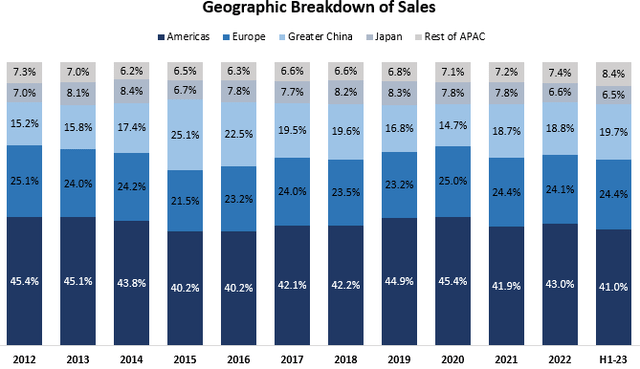

Created and calculated by the author using data from Apple’s financial reports

Back in 2012, approximately 60% of Apple’s revenues came from Europe and the Americas. In the first half of FY23, we can see that only 55.4% of revenues were attributable to those geographies, as China and the Rest of Asia Pacific took 5.6 percentage points.

While China’s share of revenues is below its peak, the Rest of APAC is now in a hyper-growth phase. Since 2018, the Rest of APAC cohort outperformed other geographies by a significant margin, which reached a tipping point during the last quarter, as the Rest of APAC grew by 15.3%, while Apple’s total revenues decreased by 2.5%.

Fueled by the two retail locations that opened in India during the quarter, Apple saw record sales in India, as well as other developed and emerging markets in Indonesia, Turkey, Mexico, the Philippines, Saudi Arabia, Turkey, Brazil, Malaysia, and the UAE.

It’s clear that Apple is shifting focus towards emerging markets, where its presence is still extremely low. Just a few days ago, the company announced its first online store in Vietnam.

Although it’s still a small cohort compared to the overall business and with a relatively lower price level, I find the potential in emerging markets significant. First, there are a whole lot of potential new customers in India, with the country’s economy projected to become the third-largest in the world by 2027. Secondly, we already know that Apple’s business from its customers doesn’t end with a single product purchase. On the contrary, it’s after the first transaction that the customer gets into the ecosystem, and then, usually, he becomes a lifetime customer.

Services

So if the first growth driver is a little under the radar, Apple’s services are probably on the opposite end of the scale. The company’s services seem to be making a lot of headlines these days, specifically due to the launches of many financial offerings like Apple Savings during the regional banking crisis.

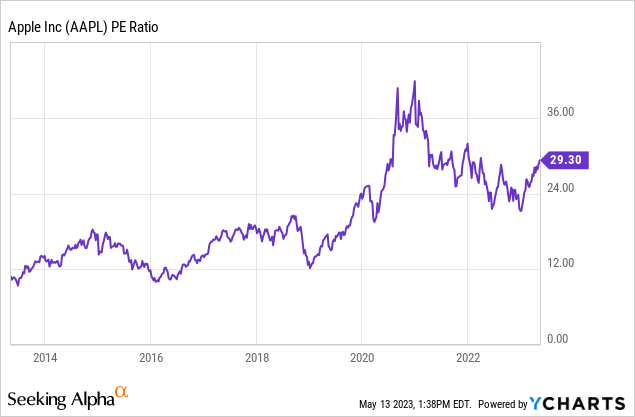

Looking at Apple’s PE ratio, we can clearly see the company has been trading at much higher multiples since 2019:

Some people would argue this is a testament to its overvaluation, but in my view, Apple’s services becoming almost 20% of the company has a lot to do with the multiple expansion.

Under services, Apple includes advertising (app store and traffic acquisition costs), cloud, digital content (books, music, video, games, podcasts, tv, news, and fitness), AppleCare (technical support, and repair & replacement services), and Apple’s payment services (Apple Pay, Apple Card, Apple Pay Later). Those combine for approximately 20.0% of Apple’s revenues, and a little over 32% of the company’s gross profits.

Unlike the market saturation on the product front, it seems Apple’s services are still in their early days. We saw growth acceleration in paid subscribers, with a 24.2% increase YoY, and services revenues grew by 5.5%, despite a 5.0% FX headwind.

Growth in services was even more impressive considering the slowdown in mobile gaming, which is mainly a result of pulled-forward demand during the pandemic. Additionally, Apple, like most advertisers, is experiencing headwinds due to the macroeconomic environment. Despite that, the company achieved a March quarter record in advertising.

Apple Financial Services

It has become obvious that Apple is one of the largest financial services companies in the world, with its Apple Pay, Apple Card Savings, and Apple Pay Later, among others.

Apple Pay is constantly expanding its offerings and has now become the preferred way to pay for many:

And tap-to-pay continues to be a powerful driver of engagement. Globally, 74% of all face-to-face transactions outside the U.S. are now taps. In the U.S., we’re at 34%, up 7x from three years ago and up more than 10 percentage points from last year.

— Ryan McInerney, Visa’s CEO, Visa Q2-23 Earnings Call.

Moreover, Apple made waves in the banking system with its 4.15% APY savings account. The question that arises following these industry-leading APY is whether Apple uses its financial services as a way to strengthen the ecosystem, or is it a standalone business opportunity, and to that, Tim Cook answered the following:

Q: You launched so many services around Apple Pay most recently, you mentioned Buy Now Pay Later high yield savings account. Where do you see the expansion and the payments ecosystem over time? And do you look at the payments ecosystem as a standalone revenue opportunity? Or is it more about making the devices even more inseparable from us?

— Wamsi Mohan, Bank of America

A: What we’re trying to do with our payments work is that sort of like we’ve done on the watch, where we’re focused on helping people live a healthier day on our financial products. We’re helping people have a better financial health and so things like the Apple Card and the fact that it has no fees, like the savings account, which has, as you mentioned, it’s very attractive yield. So we’re trying to help our users, but these things have to stand on their own, obviously. But we’re very user focused, and so we’re listening to them at what things provide them pinch points and orchestrate our roadmaps around that. Buy Now Pay Later is another one that we’ve just gotten out of the shoot. But on the savings account specifically, we are very pleased with the initial response on it. It’s been incredible.

— Tim Cook – Chief Executive Officer, Q2-23 Call

In my view, Tim Cook’s answer shows not only the fact that Apple’s financial services are profitable on their own, but it also represents Apple’s overall vision and strategy. Each and every service and product provide added value to the other, but each and every service and product can stand on its own, just as well.

Traffic Acquisition Costs – The Most Important “Service”

Another important topic to discuss under services is traffic acquisition costs (TAC). For some reason, I saw that some market participants project TAC to decrease. Now, I’m not sure whether that was aimed at making headlines, or that was an actual projection, but I have to say I have the utmost certainty TAC is only going to increase, specifically due to the reignition of the search wars between Alphabet’s Google (GOOG) and Microsoft.

According to most estimates, Google pays Apple around $17.5B per year for the right to be the default search engine on Apple’s devices. The most quoted analysis was made by Goldman Sachs, which estimated the number at $9.5B in 2018, a year that Google’s total TAC amounted to $26.7B. So, 35.5% of Google’s TAC, which amounted to $48.9B in 2022, means $17.4B that Apple received from the search giant for that year. With more than 1 billion active iPhones, this “real estate” is one of the most expensive properties in the world. As we’re already hearing about Microsoft eyeing a Firefox search deal, it would be a shocker if Apple wouldn’t exploit this situation to its advantage.

With so much going in its favor, and because FX, gaming, and ads are all temporary headwinds that should start to ease already in the second half of the fiscal year, I project Apple’s service revenues will see growth accelerate in the very near term.

Updated Valuation

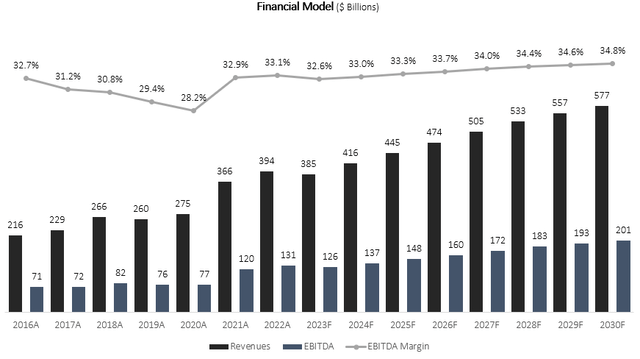

I used a discounted cash flow methodology to evaluate Apple’s fair value. I forecast Apple will grow revenues at a 5.9% CAGR between 2023-2030, based on steady growth in the company’s core operations, and accelerated growth in emerging markets and services. My projection is in line with the consensus but significantly below Apple’s past 7-year CAGR of 10.6%.

I project EBITDA margins will increase incrementally up to 34.8% in 2030, as the services portion of total revenues continues to grow. I find this projection conservative, as the company achieved a 33.1% EBITDA margin in 2022, a year in which it had a 43.3% gross margin, which is 1.2% below management’s guidance for 2023. Thus, I believe the company is already capable of a margin that is around 34.3%.

Overall, my assumptions result in EBITDA growth slightly above revenue growth, reflecting operational leverage and a better mix.

Created and calculated by the author based on data from Apple’s financial reports and the author’s projections

Taking a WACC of 7.2%, I estimate Apple’s fair value at $192 per share, which represents an 11.1% upside compared to the market price at the time of writing. This valuation reflects an arguably high forward P/E multiple of 24.9 based on my EPS projection for 2024. However, today’s Apple isn’t the old Apple. Its historical average P/E ratio reflects a product company, whereas the services side of the business is becoming increasingly important. Additionally, I expect 2024 will be a remarkable year for the company, as it will have easier comparisons and temporary headwinds should evaporate.

Conclusion

Apple’s unstoppable ecosystem continued to gain strength in Q2-23, with over 2 billion active devices, above 1 billion active iPhones, and 975 million paid subscribers. Time and time again, Apple bears find their claims defeated by the world’s largest company. As Apple constantly expands its offerings, the company is staying true to its strategy. Each and every product and service should add value to the other, and each and every product and service should be accretive to the company’s profits. For these reasons, I reiterate a Buy rating and raise my price target to $192 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.