Summary:

- Management’s new initiatives are paying off, especially their investments in digital enhancements.

- Mcdonald’s is relatively inflation-proof, but management has noticed some consumer changes, mainly reductions in units per order.

- MCD stock is too expensive trading at 28 times earnings.

- If the price falls to $220, that would signify a return to its normal P/E and would be an investment worth reevaluating then.

Richard Stephen

Nothing quite captures American soul more than Freedom Fries and a Coca-Cola. America without McDonald’s (NYSE:MCD) is not America. And I would not want to live here.

Unfortunately, McDonald’s stock price reflects the value it brings to our nation as it currently trades at a 28 P/E. This breaks my heart because as an American citizen, it is my duty to own this stock, but it is simply too expensive at the moment. In fact, when I became an American citizen a few years ago, I had to swear on a McDonald’s menu that I would dine there at least once a week.

Company Background

McDonald’s is a fast-food restaurant chain which operates in over 100 countries with over 40,000 locations, 95% of which are franchised.

The company is currently focused on its “Accelerating the Arches” plan which is a general outline of the areas McDonald’s wants to develop. If I had to summarize the goal of the plan, it would be this:

McDonald’s is investing in technology that reduce customer friction points making make each transaction quicker and more seamless.

The company has already seen changes in the way consumers engage with ordering as in 2022, 35% of sales in the top six markets came from digital channels (mobile app, delivery, kiosk). Covid-19 changed the way consumers pick up their food, with an emphasis being placed on less human-to-human contact. Ordering digitally enables the consumer to skip the line and pick up their order “quicker and more seamlessly.” In fact, McDonald’s is testing out a new initiative called, “The Order Ahead Lane,” which allows customers to pick their already placed orders via a conveyer belt… in a separate drive-thru lane.

Q1 2023

The company experienced consistent double-digit growth across its channels, while total revenue grew 8% and operating income grew 10% (in constant currency). The primary driver of this growth was menu price increases, but traffic increased as well. McDonald’s strategy continues to pay off as digital sales grew to be 40% of systemwide sales in the top six markets.

Recession and Inflation

The management team was asked about how a recession and inflation will affect the business. CEO, Chris Kempczinci, stated:

And then the other thing is we continue to monitor very closely the acceptance of our pricing. I’m really proud of how our system has executed pricing in light of the double-digit inflation that we have been experiencing. But we are seeing, in some places, resistance to pricing, more resistance than we saw at the outset.

Will Inflation Reduce Sales?

Demand for McDonald’s is somewhat inelastic meaning it is not overly sensitive to moderate price changes. Even if this wasn’t the case, for every customer being priced out of the McDonald’s market due to rising prices, one would likely be priced back in due to rising prices. In other words, higher prices leave some customers behind, but it works both ways, bringing in additional customers who became priced out of other options which became too expensive. The company sees some softness in order units per transaction, but overall McDonald’s is a company that does well in both good times and bad.

McDonald’s expects operating margins for the FY23 to be 45%, which would be the best margins in the last twenty years, as far as my data goes back. Furthermore, there is an interesting possibility that margins expand if inflation cools off in the second half of the year. McDonald’s would retain the same pricing levels, but a reduction in inflation would give the company leverage over its operating costs, thereby producing fatter margins. This is one catalyst that could drive the stock price higher, so let’s get into valuation…

FastGraphs

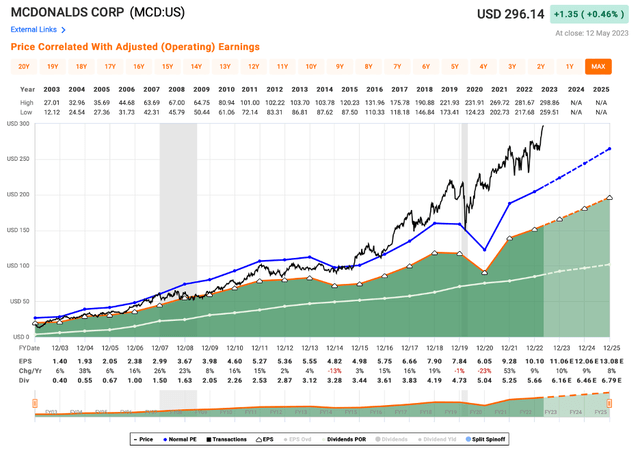

FastGraphs is my favorite financial software as it lays out valuation in an organized, easy to understand view. The overarching (pun intended) theme for McDonald’s is that it is overvalued.

McDonald’s Earnings History

The first thing readers will notice is the company’s phenomenal earnings growth over the years. In fact, the only meaningful reduction in earnings was during Covid where earnings fell by 23%. However, growth immediately resumed like normal the following year as if it never missed a beat. This is a clear demonstration of McDonald’s resistance to external threats.

Given McDonald’s is a legacy brand and one of the best stocks in American history, it always trades at premium to what is generally considered a fair value P/E of 15 times earnings. McDonald’s normal P/E ratio (blue line), has historically has been 20 times earnings. Currently, the company’s stock price (black line) is well above its normal P/E as it is trading at 28 times earnings.

Even though McDonald’s is a great company, it is not worth 28 times its earnings. If we apply McDonald’s normal P/E of 20, then the stock is priced as if McDonald’s is going to earn $14.80 per share this year – analysts forecast EPS to be $11.06. The stock is basically priced 34% higher than normal.

Looking forward, if the stock returns to around $220 this year, it would represent an opportunity to open a position at the historical normal P/E of 20 times earnings. While expensive even at that level, McDonald’s rarely ever trades under a 15 P/E. Looking at the above graph, only twice in the last twenty years has this happened; once in 2003 and once in 2009.

At $220 per share, investors would also be chomping on a 2.75% dividend yield as opposed to a 2.06% yield today. The current dividend payout ratio is 56%, which is the lowest it has been in the past ten years (aside from 2018). Furthermore, the gap between earnings and the dividend payout ratio is widening, which leaves potential to increase the dividend at a faster rate. Therefore, the future yield could be well in the 3% range if the stock price falls to $220 per share.

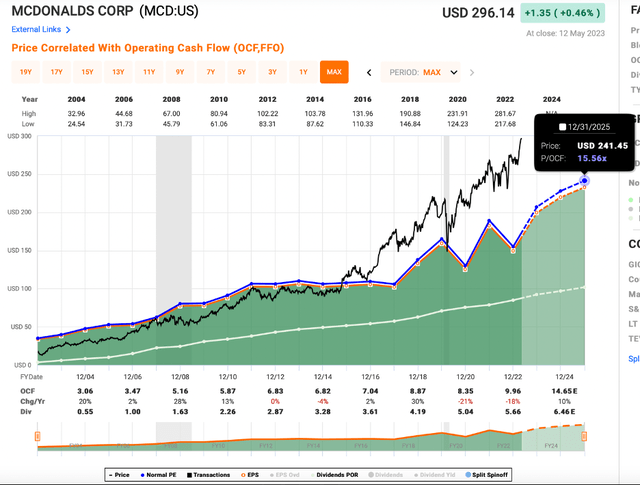

McDonald’s Cash Flow from Operations

When we examine CFFO, it becomes apparent around 2015, McDonald’s stock chartered into overvalued territory. In recent years, this divulgence has been further amplified, peaking at present day. Looking forward, if McDonald’s stock retreats to its normal P/CFFO, its price range would be between $207 – $241 based on expected earnings, with a midpoint at $224 per share. This corroborates our valuation estimate based on earnings from the section above at around $220 per share.

Risks

There are numerous risks involved in buying McDonald’s:

- McDonald’s is a global chain which subjects the company to political risk and recessionary pressures overseas.

- Negative impact from exchange rates would reduce earnings.

- Inflation continues to increase causing operating expenses to increase and margins to diminish.

- If McDonald’s raises prices more, they might lose customers as the price of a meal goes into “healthier fast casual” territory, around $12-18 per meal (Chipotle, CAVA, Sweetgreen, etc.).

- American preferences might change towards healthier fast food and McDonald’s may not be able to adapt to the increased in demand for quality ingredients. I know, the concept of “healthy” fast food is funny.

- The stock’s overvaluation steeply corrects leaving investors who overpaid with a loss.

- For the company’s set of risks, please click here.

Takeaway

McDonald’s is not an undervalued asset and therefore, despite it being one of the best American companies, it is not a buy. If the stock price falls to around $220, it would be trading near its historical normal P/E, which would be the time to re-evaluate this stock as a potential investment. If the circumstances which warranted the price decline are not structural, McDonald’s would make an excellent long-term investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Neither this article nor any comment, message, video, or interaction associated with it is to be taken as financial advice. Investors should always do their own research before executing any financial transaction. Raul Shah is not liable for any financial outcome which might occur. Investors assume full responsibility for their actions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.