Summary:

- Medtronic has faced hurdles of its own making over the last three years.

- The company’s pipeline, however, has recently delivered some wins.

- We believe that MDT stock is likely to re-rate as the new products continue to come online.

JHVEPhoto

Background

Medtronic (NYSE:MDT), the worldwide medical device company founded in 1949, has had a downtrodden couple of years. Dogged by a pipeline that investors saw as stale, leveraged with more debt than its largest peer, and trouble with the FDA, investors found little reason to be excited about the stock. The market has reflected this sentiment over the past three years.

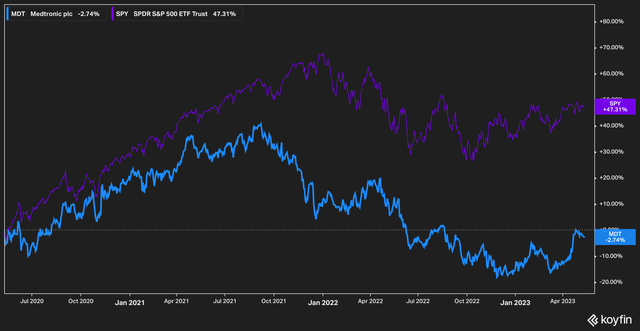

On a total return basis, Medtronic’s stock has delivered negative 2% to investors against the S&P 500’s (SPY) return of 47%. Excluding dividends adjusts the return over the same time frame to roughly negative 10%.

In this article we’ll explore why we believe Medtronic’s fortunes are likely to change in the near term and why today’s levels are an attractive option for investors. Let’s dive in.

Clearing Skies

In 2021, investors received an unpleasant surprise: the FDA had issued a warning letter against Medtronic. The issue was in regards to the company’s MiniMed insulin pumps, and the tidal wave of complaints that had been registered over the years regarding pump malfunctions. The FDA alleged that Medtronic was slow and inefficient in its response to investigate and resolve the pump complaints. Given the large scale liability the company could potentially face, investors were understandably nervous. This also came on the heels of other bad news, like the September 2021 recall of the company’s Pipeline Flex Embolization Devices.

Over the last few months, however, Medtronic appears to be turning a corner. In late April the company announced that it had resolved the warning letter. Investors undoubtedly found this news to be exciting, especially since it came only four days after even bigger news–the FDA had approved the company’s MiniMed 780G insulin pump for use in America (the device has been available outside the U.S. for a few years), which represents a major technological leap for the company in that this new model monitors blood sugar levels and administers adjustments in real time to patients.

The approval of the 780G pump is, to put it lightly, a big deal for Medtronic. In recent years investors have worried that the company was losing ground in the diabetes care space to companies like Tandem Diabetes (TNDM) and DexCom (DXCM). Approval of the 780G will allow Medtronic to be more competitive in the space.

The opportunity ahead for Medtronic is hard to overstate as sales from diabetes care currently make up less than 10% of Medtronic’s overall sales. In the last quarter, only $570 million of its $7.7 billion in sales came from diabetic care–an annual run rate of $2.2 billion. Considering that the estimated TAM for global diabetes care is just south of $30 billion, it doesn’t take an enormous leap of logic to see that an innovative product could meaningfully move the needle for Medtronic. Additionally, given that the pump has already been in use outside the U.S. and has seen steady growth, access to the Medtronic’s largest geographic market is likely to provide a solid boost to the division’s top line.

Diabetes, however, isn’t the only area where Medtronic is set to take additional market share. The company recently announced positive IDE trial results for its atrial fibrillation [AFIB] product, PulseSelect. While the addressable market for AFIB is much smaller than diabetes, the product–if approved–should allow Medtronic to take meaningful market share from competitors.

The company is also upbeat on its prospects for Hugo, the robotic surgical platform that is a direct competitor to market-leader Intuitive Surgical’s (ISRG) Da Vinci device. On the latest conference call, executives states that physician feedback on Hugo was very positive. CEO Geoff Martha, commenting on Hugo specifically, stated:

we are getting feedback from physicians that are converting from the competition or have both and they are high-volume users and they have a high bar for robotic surgery and that feedback has been really, really strong. And that is, I think is very encouraging. And that word is spreading, as I talk to U.S. physicians that don’t have access to it yet because they are not part of the trial and they have a pretty detailed understanding of the robot and its features and its capabilities. And so, we are getting – and so that’s just driving really strong adoption.

Valuation

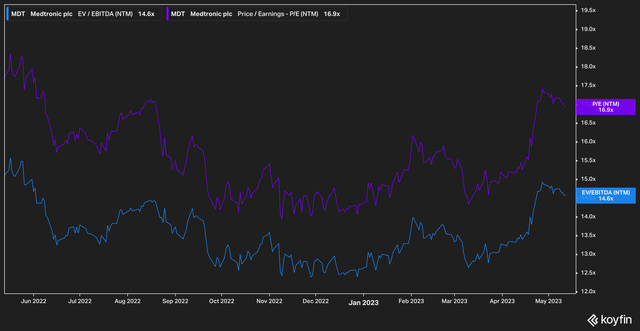

Given the issues Medtronic has faced over the past few years concerning its pipeline development coupled with its underperformance, it’s no surprise that on most metrics Medtronic looks cheap.

On a forward basis, the stock currently trades at a 14.6x EV/EBITDA multiple, and 16.9x earnings. While these are not necessarily a departure from historical levels (multiples at Medtronic have been depressed for several years), we believe that as new products come online, a re-rating is likely to occur.

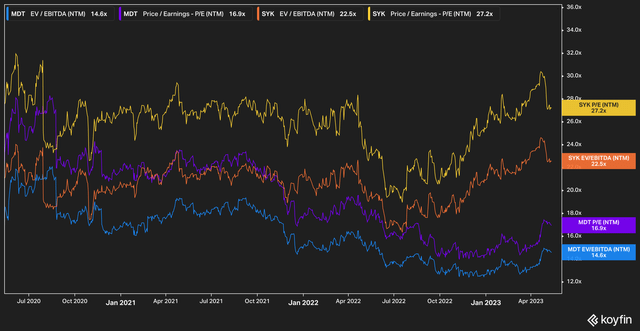

Take, for example, Medtronic’s valuation compared against competitor Stryker (SYK).

Stryker–with revenues of $4.7 billion versus Medtronic’s $7.7 billion–commands a large premium over Medtronic, with a forward price to earnings of 27.2x and EV/EBITDA of 22.5x.

Stryker has, in our view, earned this multiple. The company is well-run and its product mix is stellar. We believe, however, that the forward multiple the market has assigned Medtronic is unjustifiably low in comparison.

Looking ahead, we expect that multiples are likely to re-rate for Medtronic if the pipeline develops as expected. We believe that a 21x forward price to earnings multiple is not unrealistic. With $5.22 per share being the average analyst consensus view, $110 is our current price target for Medtronic.

The Bottom Line

Medtronic has faced a number of headwinds over the last few years, but these appear to be dissipating. The company trades at a discount to competitors that–we believe–is likely to close if management can deliver. Risks to our thesis include approval delays or negative trial results. However, we think that the recent performance of Medtronic is a good sign that management has things back on track.

Earnings for the company are set to be reported on May 25 (Q4 and full year), with consensus estimates for top line annual revenue currently at $30.9 billion. While we will be paying attention to that number, we will especially be interested to hear management’s guidance about the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.