Summary:

- 2U’s major transformation into a platform business through the acquisition of edX will offer interesting value-creation potential.

- The ongoing transformation carries big risks, and is temporarily putting pressure on growth. Shares are down 43% YTD.

- In my view, 2U presents an attractive speculative opportunity.

pidjoe/E+ via Getty Images

2U (NASDAQ:TWOU) is one of the leading players in the online higher education space. Launched 15 years ago and went public in 2014, the company has garnered a strong reputation as a provider of a technology platform that enables universities to offer online degree and non-degree learning programs.

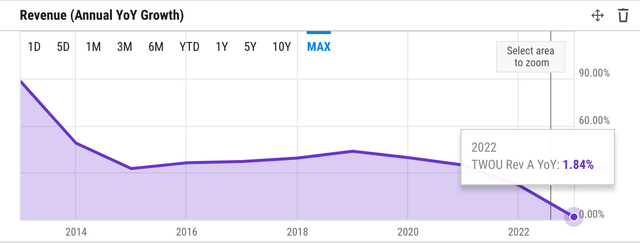

Revenue growth used to be quite steady at +35% annually for the past few years until 2021, when 2U made a major acquisition of edX, a well-known massive open online course/MOOC platform, for $800 million. Fueled by the acquisition of edX, 2U launched a significant transformation plan to become a platform business. This seems like a very attractive move considering the value creation potential from the vertical integration between 2U and edX.

Nonetheless, the move also comes with a high risk. The transformation strategy, which includes a massive cutback on marketing spend to emphasize profitability, has also depressed the near-term growth outlook. 2U expects a merely 3% growth for FY 2023, just a tad higher than the previous ~1.8% growth in FY 2022. Since last year, the stock has seen significant selling pressure, with shares down +43% YTD and +62% YoY.

At +$3 per share today, I consider 2U a speculative opportunity and assign a buy rating for the stock in this coverage.

Financials

Since going public in 2014, 2U’s growth had slowed from ~90% YoY to a +35% level in the following years. Since 2021, we see a drastic decline due to two key few factors – the macro downturn and strong labor market that increases the opportunity cost for degree education as well as the marketing spend cutback due to the strategic shift.

The overall decline was mostly driven by the Degree Program business. 2U has two revenue streams – The degree Program and the Alternative Credentials segments. In the Degree Program segment, 2U partners with universities to deliver online degree programs, ranging from undergraduate to postgraduate degrees. With +$570 million of revenue last year, the business represents a significant portion of 2U’s revenue. But it is also the most impacted area from the macro slowdown. In FY 2022, enrollments decreased by 1.5%, resulting in a 3.5% decline in Degree Program revenue. In Q1 2023, the impact was a bit more severe. Q1 revenue declined by -9% YoY as the company also initiated further cuts on marketing.

The Alternative Credentials segment, on the other hand, refers to shorter-term, non-degree programs offered by 2U in partnership with universities. These programs include short courses, boot camps, professional development courses, and continuing education programs. Overall, the segment has been a bit more resilient, since it still grew by 10% YoY in FY 2022 and experienced a softer decline in Q1, where it generated $98 million of quarterly revenue, a -1% YoY decline.

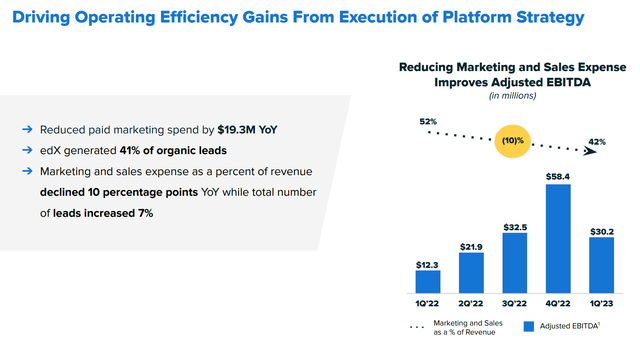

Profitability improvement, specifically at the adjusted EBITDA level, has been the key focus of the company since FY 2022. Overall, the improvement here has been quite pronounced, especially with the company cutting a lot of marketing spend, which traditionally is the largest operating cost item.

The decline of 10% pps in marketing and sales expense in just over a year is a significant improvement. It is also a reflection of the value that the edX asset brings to 2U. edX has a very strong brand reputation in the online higher education market with a solid online presence that produces a lot of organic traffic.

I believe that the cutback on marketing was more or less a crucial move to preserve capital, considering that 2U has been having a few things going on at the same time in the last few years that have been affecting its financials. The company is still working on capturing the value from the edX acquisition in 2021 (the 2022 reorganization plan) while also working towards restructuring its debt. 2U today has +$900 million of debt in its balance sheet and spends over $50 million to $60 million annually on interest expense alone. As such, the adjusted EBITDA may not reflect the actual profitability outlook of 2U.

Catalyst

At a full extent, edX + 2U combination would on paper make a great online education platform that has a competitive advantage due to the access to more efficient distribution/user acquisition (organic) and quality courses that may attract enterprise clients – two major competitors, Coursera (COUR) and Udemy (UDMY) already generate a lot of business from the enterprise market, and I think that edX + 2U combination can produce a competitive enterprise offering that drives revenue growth and enables better diversification.

I would also highlight edX’s strong brand reputation. It is a renowned online learning platform founded by Harvard and MIT. edX is recognized for its extensive catalog of courses and collaborations with prestigious institutions worldwide. While it is arguable that the takeover value of $800 million is a bit on the high side, the acquisition allows 2U to gain access to a broader student base and tap into edX’s strong network of university partners at a significantly lower annual acquisition cost. As discussed previously, the 41% organic leads brought by edX in Q1 was a relatively good figure. 2U can certainly improve on the organic tactics, even more, to further pressure marketing spend and drive more quality conversion.

Moreover, the fact that edX is a well-known online platform that attracts +240 million visits a year also offers a huge advantage for 2U in its core business, since it presents a very strong organic distribution channel for courses. For instance, 2U can have the upper hand in any future revenue-share contract negotiations with potential university partners to develop new degree or non-degree programs.

Risk

There are a lot of risk factors on 2U today, and it is the reason why it remains a speculative opportunity to me. The ambitious transformation into a platform-focused organization, particularly through the integration of edX, requires a significant investment of time, resources, and effort. While the potential for value creation exists, realizing the full benefits may take longer than anticipated. I would suggest that investors exercise patience and understand that the speculative opportunity associated with this transformation carries inherent risks, including execution challenges, delays, and potential initial underperformance.

Having really focused on driving bottom-line improvement at present, I continue to anticipate how 2U will navigate the transition back into the growth mode once it has the edX integration done to a full extent. As 2U shifts its focus towards becoming a platform, maintaining the desired flywheel effect could prove unexpectedly expensive. Building and scaling the platform, attracting and retaining top-tier university partners, and driving student enrollment growth requires substantial investments.

Apart from that, 2U’s Online Program Manager / OPM business model, which involves partnering with universities to offer online degree programs, has been subject to regulatory scrutiny. Regulatory agencies may impose new regulations or modify existing ones, potentially increasing compliance costs and operational complexities for 2U. Extreme changes in regulations could impact the company’s ability to operate efficiently and expand its partnerships with universities, posing a risk to its revenue and growth prospects.

In recent times, 2U has faced regulatory scrutiny from the U.S. Department of Education regarding its OPM business model. The department expressed concerns about potential conflicts of interest, transparency, and control over academic functions. Accordingly, 2U has responded by suing the department. While the company played down the potential impact during the Q1 earnings call, the outcome of these discussions and any resulting actions by the Department of Education remain unclear.

Valuation/Pricing

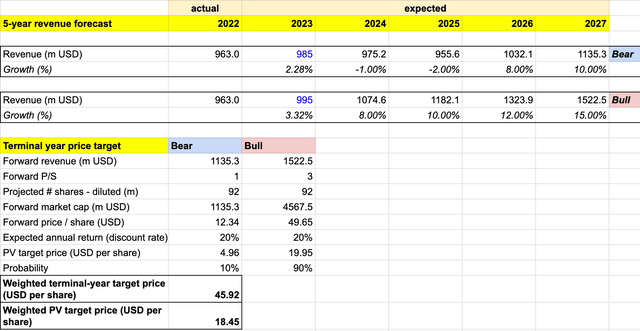

In estimating the price target for 2U, I consider the following probability-weighted bull vs bear scenario-based 5-year revenue forecast:

- Bull scenario (90% probability) – labor market situation to improve to favor 2U in the FY 2024, and 2U revenue growth to reaccelerate to 8% in that year. 2U then makes good progress towards some of the attributes from its target model, such as EBITDA margin expansion to +20% level and single-digit unlevered FCF margin, driven by the well-executed organic / paid marketing tactics. Growth also gradually reaccelerates from 8% to between 10% – 15% in FY 2025 – FY 2027, as the company makes inroads into the enterprise business.

- Bear scenario (10% probability) – labor market situation to sustain into FY 2024. 2U to see a negative regulatory effect affecting its future partnership model and ultimately its growth. I expect -1% to -2% revenue growth in the next two FYs, followed by an improving outlook as the company makes inroads into the enterprise business in FY 2026 and 2027. We see the company being positioned a bit further from its intended target model than it does in the bull scenario in FY 2027, especially on profitability, as it needs to be laser-focused on the enterprise segment, a business that’s less affected by the regulatory situation.

I am also assigning a P/S of 3 for the bull scenario, considering that the success in realizing the value from the edX integration that drives both growth and profitability, as well as in the enterprise business, should warrant a higher premium. Nonetheless, I’d be conservative and note that the industry players in the online higher education market overall do not benefit from a high valuation premium. I believe that a P/S of 3, which is a comparable level to Coursera, which already serves the enterprise clients, is a fair figure. For the bear scenario, I am assigning a P/S of 1, which means that 2U is basically valued according to its annual revenue.

author’s own analysis – target price

Consolidating all the information above into my model, I arrived at an FY 2027 weighted target price of $46 per share in FY 2027. Discounting that target price with a 20% discount rate, I arrived at a Present Value/PV weighted target price of ~$18 per share. The 20% discount rate represents the expected annual return.

The ~$18 per share is the highest price point at which investors can purchase the stock to realize a projected 20% annual return if 2U shares reach the FY 2027 target price of +$46. As 2U currently trades at ~$3.5 per share, the model indicates that the stock is undervalued, creating a buying opportunity today.

Conclusion

Driven by the acquisition of edX, 2U has embarked on a major transformation initiative to become a platform business. I expect the combination of the two businesses to offer promising value-creation potential through vertical integration and economies of scale. However, this bold move is not without risks. The transformation strategy, which includes reduced marketing expenditure to prioritize profitability, has impacted the company’s short-term growth prospects.

The situation has also been made worse by the unfavorable macro and regulatory environment. With a projected growth of only 3% for FY 2023, slightly higher than the previous year, investor sentiment has been dampened, leading to a decline in the stock’s value. As of today, the shares are trading at ~$3.5 per share, down 43% YTD and 62% YoY.

I believe that 2U presents a speculative opportunity. My target price model indicates that the stock is undervalued today. In light of this, I am assigning a buy rating for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.