Summary:

- While past performance is no guarantee of future execution, AAPL may still be a safe haven for the next decade’s portfolio growth, akin to JPM’s role during the banking crisis.

- Its margins continue to expand as well, thanks to its strategic outsourcing to Foxconn, which bears the brunt of the low-margin, high-volume, and high-capex manufacturing lines.

- AAPL’s balance sheet is also showing early signs of recovery, with expanding liquidity and moderating long-term debts aided the prudent rate swaps.

- However, we do not recommend long-term investors to add at this peak since it may retest its previous 2022 resistance level of $175, triggering further volatility ahead.

Aslan Alphan

The Premium Investment Thesis

This is why we remain bullish about Apple (NASDAQ:AAPL), since the stock continues to maintain its outperformance against the market-wide destruction thus far, against the FAAMG stocks and the S&P 500 Index, as discussed in our previous article here.

Despite its underwhelming FQ2’23 earnings call (in our opinion), the stock continues to be well supported while recording a moderate gain at the same time, further underscoring its premium investment thesis.

AAPL records revenues of $94.84B (-19% QoQ/ -2.5% YoY) and GAAP EPS of $1.52 (-19.1% QoQ/ inline YoY) in the latest quarter, against the historical cadence in FQ2’22 (-21.5% QoQ/ +8.5% YoY) and (-27.6% QoQ/ +8.5% YoY), respectively.

Then again, we must also highlight that the Cupertino giant has had a tough YoY comparison, due to the massive pulled-forward demand during the hyper-pandemic days. This is on top of the elevated interest rates environment resulting in tightened discretionary and corporate spending.

Therefore, we suppose AAPL’s current performance is more than acceptable after all, since inline top and bottom line numbers are naturally better than declines.

The same cadence is visible in Samsung (OTCPK:SSNLF), with its Mobile eXperience segment reporting an expansion of +21.5% QoQ/ -1.5% YoY in the latest quarter, with Q1s typically being the seasonally strongest quarter, as opposed to Q4s for AAPL. Notably, the South Korean company reports that the premium smartphone market remains resilient, with sustained growth in volume and value.

Thanks to the decelerating smartphone demand by Q1’23, AAPL commands 20.6% of global sales (-2.5 points QoQ/ +2.6 YoY) at 58M units (-17.4% QoQ/ -1.6% YoY). We suppose part of this gain is attributed to SSNLF’s declining share at 21.6% (+2.4 points QoQ/ -1.1 YoY), suggesting the former’s stellar branding and consumer loyalty.

In addition, its balance sheet is showing early signs of improvement, with $55.86B of cash/ short-term investments (+8.8% QoQ/ +8.4% YoY) and moderating long-term debts to $97.04B (-2.4% QoQ/ -6% YoY) by the latest quarter.

Thanks to AAPL’s prudent rate swaps thus far, its annualized interest rate expenses have also declined to $3.72B (-7.27% QoQ/ +34.7% YoY) at the same time, though likely to stay elevated over the next few quarters before the Fed pivots.

Particularly, investors may want to focus on its expanding Services revenue of $20.9B (+0.6% QoQ/ +5.4% YoY), underscoring the iOS’ enduring platform despite the moderation in its Product revenues to $73.92B (-23.3% QoQ/ -4.5% YoY). This is against the previous cadence in FQ2’22 (+1.5% QoQ/+17.2% YoY) and (-25.8% QoQ/ +6.5% YoY) respectively.

Therefore, while AAPL’s FQ2’23 performance may have left some wanting, we remain bullish about its long-term prospects, especially given the consistent expansion in its gross margins to 44.3% (+1.3 points QoQ/ +0.6 YoY). This is naturally thanks to its strategic outsourcing to Foxconn, which bears the brunt of the low-margin, high-volume, and high-capex manufacturing lines.

With the manufacturing partner already moving out parts of its operations beyond China, we suppose the geopolitical headwinds may lift in the intermediate term, with Taiwan Semiconductor Manufacturing Company (NYSE:TSM) also to begin semiconductor production in Arizona by 2024. The geopolitical narrative is therefore stale, in our opinion.

So, Is AAPL Stock A Buy, Sell, or Hold?

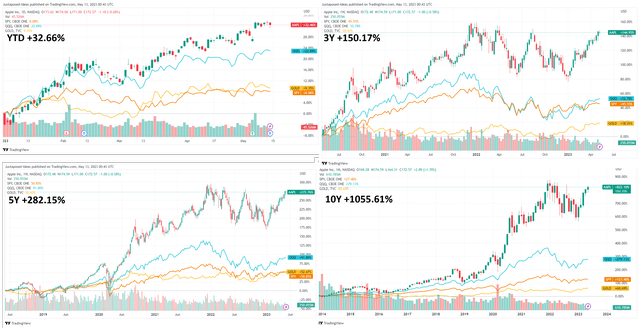

AAPL YTD, 3Y, 5Y, and 10Y Returns Compared to QQQ, SPY, and Gold

Trading View

While past performance may not guarantee future performance, AAPL has delivered exemplary returns indeed, as compared to Invesco QQQ Trust (NASDAQ:QQQ), SPDR S&P 500 Trust ETF (NYSEARCA:SPY), and Gold. (Readers may want to click on the image for improved image quality). Despite the mixed numbers from the recent earnings call, the stock continues to rally by +4.6% by the end of the trading day, boosted by its stockholders’ immense support.

It is for this reason that the stock’s premium remains well justified, in our opinion, further revealed by the peak recessionary fears. Therefore, while there may be other discussions about its elevated NTM P/E valuations of 27.64x, compared to its 1Y mean of 24.25x and 3Y pre-pandemic mean of 15.66x, we will not overly concern ourselves with those metrics as yet.

We suppose AAPL may still be treated with the same high regard as that of JPMorgan (NYSE:JPM) during the recent banking crisis, as a safe haven by many institutional and retail investors alike. In this case, the overwhelming support and market confidence have worked in its favor.

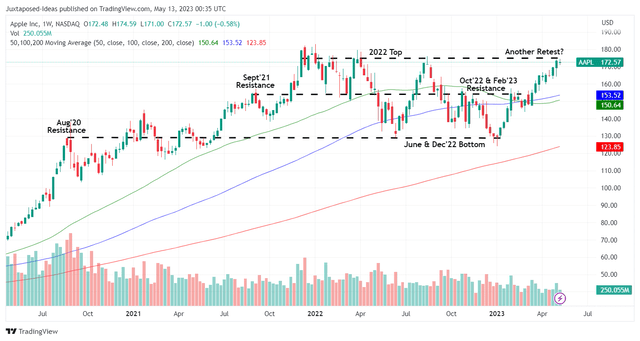

AAPL 3Y Stock Prices

Trading View

So, is AAPL a buy here? No, in our opinion, since the stock is trading way above its 50/ 100/ 200-day moving averages, boosted by the sustained rally of 38.7% since its previous December 2022 bottom. Otherwise, by +30.1% since our previous Buy article on January 12, 2023.

In addition, with the Fed determined to tamp down the rising inflationary pressure, the macroeconomic outlook remains uncertain, with the banking industry still highly volatile at the moment.

Even Warren Buffett from Berkshire Hathaway (NYSE:BRK.B) (NYSE:BRK.A) has expressed his pessimism for the next few quarters, with “the majority of its businesses to report lower earnings this year than last year.” While this may be attributed to the deceleration in demand from the pulled-forward growth over the past few quarters, we suppose the peak recessionary fears also play a part.

Combined with the fact that AAPL will be retesting its previous 2022 resistance level of $175 in the short term, we prefer to prudently rate the stock as a Hold here. Do not chase this rally due to the potential volatility in the short term.

While traders may attempt to time the market, we hold the opinion that the stock has been an exemplary asset that continues to appreciate in value for the past few years, despite the market volatility. As a result, those attempting to realize some quick gains here must also be experienced enough not to miss out on any dips ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.