Summary:

- Berkshire Hathaway Inc. took advantage of low crude oil prices to make a massive acquisition in Chevron Corporation worth $10s of billions.

- The company recently sold $6 billion worth of Chevron stock as that company’s equity has hit all-time highs.

- Chevron Corporation’s share price isn’t justified by its cash flow, and at this time, the company is overvalued.

Mario Tama

Chevron Corporation (NYSE:CVX) is one of the largest crude oil companies with a $300 billion market capitalization. The company saw Berkshire Hathaway Inc. (BRK.A, BRK.B) acquire 167 million shares, worth ~$30 billion at its peak, or roughly 10% of the company’s outstanding shares. That was a sizable position for the company. Last quarter Berkshire trimmed it by $6 billion or >20%.

As we’ll see throughout this article, there’s a reason for that.

Chevron’s Capital Spending

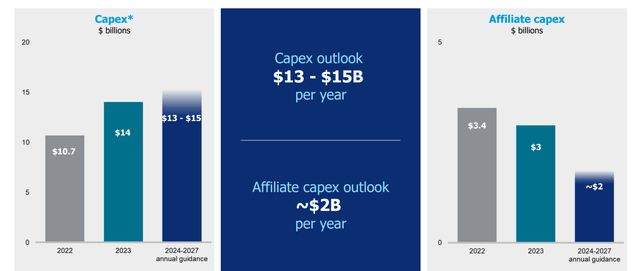

The company is planning to ramp up capital spending substantially YoY to 2023, but remain constant from here.

Specifically, the company is planning to spend roughly $14 billion in capital spending per year. Affiliate capital expenditures are expected to go down, resulting in total capital spending more like $16 billion for the 4-year 2024-2027 time period versus $17 billion in 2023. Still, this capital spending is well above ~$14 billion for 2022.

That capital spending has panned off in some ways for the company. From 2012 to 2022, the company managed to keep reserves constant. It produced 10.3 billion out of 11.3 billion barrels at the start of the decade. It also sold 1.1 billion barrels worth of reserves, but it had 11.3 billion barrels in replacements, finishing the decade just a hair below the start.

We’ll discuss production next, but there’s a takeaway for capital spending that this level of capital spending doesn’t represent rapid growth, but it instead represents constant assets. The company can always produce those assets faster.

Chevron’s Production Growth

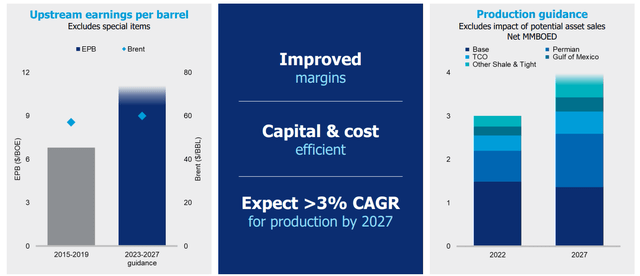

The company is guiding for production growth at a slight increase in Brent crude prices.

The company’s 2022 production was roughly 3 million barrels/day. The company’s guidance in 2027 is to get that production to roughly 3.8 million barrels/day. That’s a lofty goal, the company is targeting ~25% production growth in 5 years, and historically without a new major project coming online, it’s never achieved that.

Still, the company expects Permian Basin production to roughly double, showing lofty growth ambitions in a low-cost basin. That is a benefit of the company’s capital spending, and it’s a sign of the company’s strength, something we’ll give it the benefit of the doubt for, even if reserves for the company remain constant.

Chevron’s Cash Generation

The company’s cash generation is the story at the end of the day.

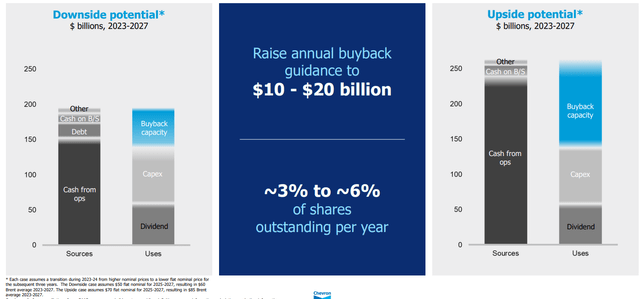

The company has raised its annual buyback guidance to ~$15 billion, highlighting its cash flow. That’s enough to repurchase ~4.5% of its shares on annualized business, which with a 3.8% dividend yield, represents a yield of just over 8%. The downside for the company assumes $60/barrel average Brent, the upside assumes $85/barrel.

It’s worth noting, while the company plans to maintain its 3.8% dividend yield, its buyback capacity is heavily dependent on the market. For reference, current Brent crude prices are ~$75/barrel, so halfway in between the company’s two scenarios. The company’s buyback capacity on the low end is ~$10 billion/year, on the high-end, it’s $20 billion/year.

That means, at current prices, it can return 8% a year. At lower prices, however, those returns become ~6.5%. At higher prices, they become 9.5%. Even in the higher-priced environment, Chevron Corporation struggles to have the cash flow generation to justify its valuation.

Thesis Risk

The largest risk to our thesis is crude oil prices. Chevron has an impressive portfolio of assets and a low-cost basis. At higher oil prices, such as if the expected recession doesn’t manifest, the company’s cash flow could increase substantially. That could enable increased shareholder returns, making Chevron Corporation a strong investment at the current price.

Conclusion

Chevron Corporation is a great company, there’s no denying that fact. There’s a reason why Berkshire Hathaway built up an equity position at one point worth more than $30 billion. However, there’s also a reason why the investment giant has sold billions of dollars’ worth of its stake. Chevron Corporation, as it hits all-time highs, can no longer provide the double-digit shareholder returns we love and chase.

Chevron Corporation is sitting at roughly the midpoint of its targeted pricing guidance. That means the company can generate roughly 8% in annualized shareholder returns. Based on the Brent price range the company has provided, it sees a more accurate yield as being in the 6.5% to 9.5% range. Versus long-term S&P 500 returns, that’s not compelling, making Chevron Corporation a poor investment at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.