Summary:

- OpenAI’s ChatGPT poses a more significant threat to Google Search than Microsoft Bing due to its rapid adoption and new web browsing capabilities.

- Google’s I/O conference showcased improvements in AI technology, suggesting it is not far behind in the AI race and can leverage its competitive moat.

- Despite Google’s progress, investors should remain patient for a more attractive entry point as the current valuation is fairly valued at best.

400tmax

Google (NASDAQ:GOOGL) (NASDAQ:GOOG) strikes back at its Google I/O developers conference, highlighting its recent advances since its faux pas in its earlier February keynote.

Management was caught napping then, as it reacted with a “poorly executed” response to the launch of the OpenAI-powered Microsoft (MSFT) Bing. As such, it led to a momentary selloff in February, as the event created doubts about whether Google is an “AI dinosaur” ripe for disruption.

However, as we highlighted in our previous update, Bing’s share gains against Google have been tepid at best. The Information reported that Microsoft management could be making its next move to bid for the Firefox contract “as the current contract is set to expire this year.”

As such, investors are likely more assured that Google’s AI leadership hasn’t been lost to MSFT’s advances, despite the aggressive moves made by Microsoft CEO Satya Nadella and his team.

However, it’s important to note that Bing’s challenge against Google Search has always been one of Microsoft’s optionalities. Microsoft’s most essential and critical growth drivers are centered in its Azure cloud computing platform, driven by its investments in OpenAI. As such, while Bing has struggled to gain a foothold in search, Microsoft has made noteworthy progress in Azure.

ServiceNow (NOW) is partnering with Microsoft “to introduce new generative artificial intelligence [AI] features for its business applications.” As such, I believe Microsoft poses a far greater threat to Google in cloud computing, as OpenAI’s ChatGPT models have proved to be highly formidable, given its rapid adoption, crossing 100M active users by February in less than three months from its launch in 2022.

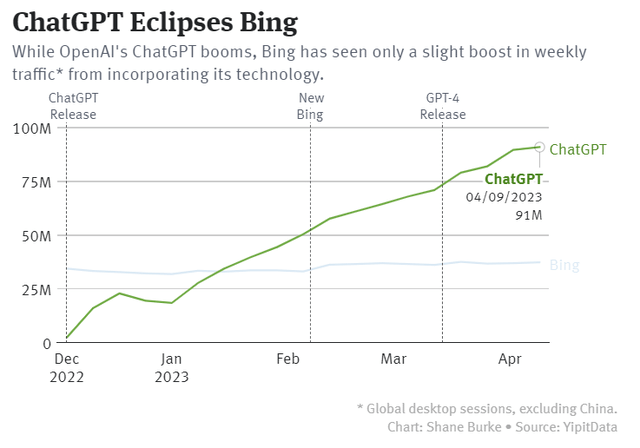

While Microsoft touted Bing’s share “is still small relative to other search engines,” investors should note that OpenAI’s ChatGPT has continued to expand its adoption rapidly.

ChatGPT Vs. Bing weekly traffic by users (The Information, Yipitdata)

As seen above, ChatGPT continues its meteoric rise based on weekly traffic, attracting “more visitors than the 14-year-old Bing does on desktop devices.” Therefore, investors focusing on Bing shouldn’t understate that Microsoft still has a fast-growing optionality up its sleeve, given its reported profit-sharing arrangements with OpenAI.

Hence, I assessed that the “real threat” to Google Search likely isn’t Bing: It’s OpenAI’s ChatGPT and its other AI tools integrated into its models.

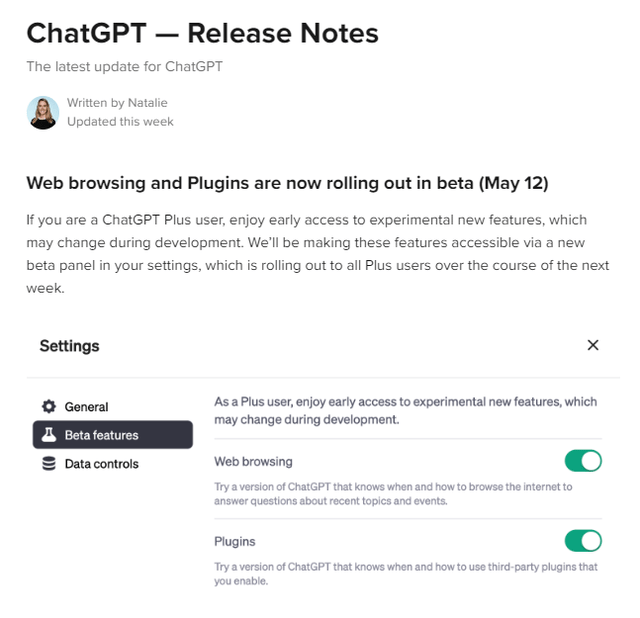

ChatGPT release notes (OpenAI)

The same week Google held its I/O conference, OpenAI updated its release notes, highlighting a significant upgrade to ChatGPT. Accordingly, OpenAI added:

Once the beta panel rolls out to you, you’ll be able to try two new features: Web browsing: Try a new version of ChatGPT that knows when and how to browse the internet to answer questions about recent topics and events. Plugins: Try a new version of ChatGPT that knows when and how to use third-party plugins that you enable. – ChatGPT’s release notes

Wait a minute. Doesn’t that mean ChatGPT can now surf the web and get its users “more accurate” answers they need, helping to resolve some of the most critical challenges it used to face: inaccuracies, outdated information, sourcing, and disinformation, for example?

While the upgrade likely still faces such challenges, users can now click on the links displayed in ChatGPT when they query it, mitigating these issues. If users can use ChatGPT as their search engine (why not), doesn’t that represent a credible threat to Google Search? Given its rapid rise to fame and adoption, I think Google investors can no longer rule that out.

If that’s not all, VentureBeat published an article recently reminding us why OpenAI’s “rolling out of Plugins” is “a big deal.” It reminded us that OpenAI only “announced 11 third-party plugins in March.” However, the release notes in May highlighted that ChatGPT’s users will now have access to “use 70+ third-party plugins.”

That’s a significant increase, indicating that developers are likely jumping on board the rapid adoption of ChatGPT to develop tools to enhance its value to users. Accordingly, the plugins now “include ones for chess play, recipe-finding, live soccer, and nutrition. For those developers who want to create a ChatGPT plugin, there is a waitlist for access.”

I think OpenAI’s ability to disrupt Google Search has been significantly enhanced. It didn’t use to have a web-browsing capability. Coupled with the enhancements of third-party plugins, OpenAI is moving toward building a robust ecosystem with the developer community. The threat is credible to Google, and we could still be in the early stages of its development.

Notwithstanding, Google’s announcements at I/O also highlighted some intriguing progress to improve the experience and value for its users. Moreover, Google still holds a significant user lead that far eclipses that of OpenAI or Microsoft.

Google highlighted that the company has “15 products with over 500 million users. Moreover, “six Google products have over 2 billion users,” accentuating the massive reach that undergirds Google’s wide economic moat.

As such, Stratechery discussed that AI could be less disruptive to Google’s business model than he previously argued. In contrast, AI should be viewed as a “sustaining technology” for Google, given the improvements it has made in I/O.

Moreover, Google Search could also benefit from its revamp, as it seeks to improve the conversational experience using its AI technologies with its users. Forbes argued it could pose a more significant threat to publishers, as “the new search format will include snapshot answers and optional links for further exploration.”

As such, it argued that “users will no longer need to visit publishers’ websites to access the information they seek,” directing users to the more profitable Google Search properties instead of the less profitable Google Network.

Based on estimates provided by Bernstein previously, Google Search has a segment margin of about 55% compared to Google Network’s 10% margin. Therefore, Google Search’s value proposition could be enhanced significantly, helping to drive more profitable revenue to Search. As such, it could mitigate the impact of ChatGPT’s upgrade that aims to disrupt Google Search due to its rapid adoption curve.

Hence, I assessed that Google Bears have been wrong so far about the disruptive impact of Bing and ChatGPT. Google CEO Sundar Pichai and his team have demonstrated their ability to make AI a “sustaining technology” for its business model. While the AI revolution is still early in its development, Google is leveraging its competitive moat and AI leadership to drive its dominance further. That suggests that Google is not far behind the curve but likely leading from the front.

Despite that, I also assessed that the buy point remains unattractive at the current levels, as GOOGL is, at best, fairly valued. Moreover, coupled with the recent momentum surge driven by investors seeking AI plays, the risks of a steeper pullback have increased.

Hence, I encourage investors confident about Google’s ability to navigate the disruptive power of generative AI to remain patient for a more attractive entry point.

Rating: Hold (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, MSFT, NOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!