Summary:

- Should investors wait for a recovery in PayPal’s stock shortly? Today, I’m trying to assess the prospects of this event by looking at the business economics of the company.

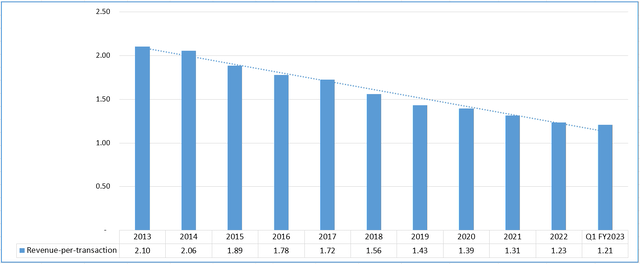

- Although in absolute terms PYPL’s revenue has grown at a CAGR of 15.1% since 2013, the revenue-per-transaction ratio has been falling by ~5.2% annually.

- My revenue forecast for PYPL gives it a 5-year CAGR of only 7.73%, which is low but includes the maturity of the PYPL business cycle.

- In my base case scenario, PYPL stock has a 5-year upside of about 20%, meaning it should grow at a CAGR of only 3.72% annually. This is too low for a buy recommendation.

- PYPL should fall another 20-30% to become attractive for dip buyers.

chameleonseye

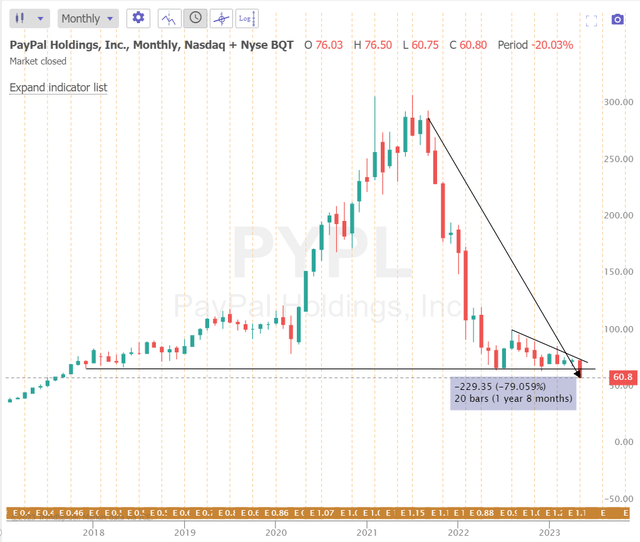

PayPal Holdings, Inc. (NASDAQ:PYPL), a digital payments company with a market capitalization of ~$68 billion, received a mixed reception from the press and investors (potential and current) due to its fiscal 2023 first quarter report, which led to a continuation of the correction that had already begun in mid-2021.

TrendSpider Software, author’s notes

In today’s article, I’ll attempt to assess the prospects for a stock recovery by looking at and forecasting the business economics of the company.

Why PayPal Stock Is In A Free Fall Past Q1?

PYPL stock dropped 12.73% on May 9, 2023, as the company issued soft Q2 guidance. However, its full-year earnings guidance was raised due to stronger-than-expected Q1 earnings, driven by cost-cutting efforts. Q2 adjusted EPS is expected to be $1.15-$1.17, slightly below prior analysts’ estimates. The company raised its FY2023 adjusted EPS guidance to around $4.95.

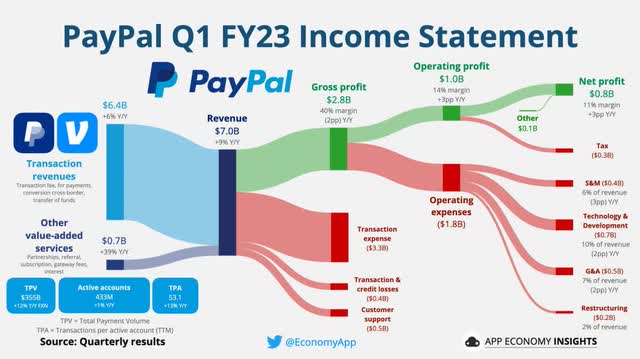

Twitter, shared by @EconomyApp

In Q1, PayPal reported adjusted EPS of $1.17, beating expectations. Q1 revenue reached $7.04 billion, exceeding consensus estimates, while total payment volume [TPV] was $354.5 billion. Venmo, PayPal’s subsidiary, processed $62.7 billion in TPV during the quarter. The total number of active accounts slightly decreased to 433 million [in FY2022 this metric was at 435 million]. Operating expenses for Q1 were $6.04 billion [-1.6% YoY] – the EBIT margin improved by 322 basis points YoY because of the cost-cutting measures, and that looks solid.

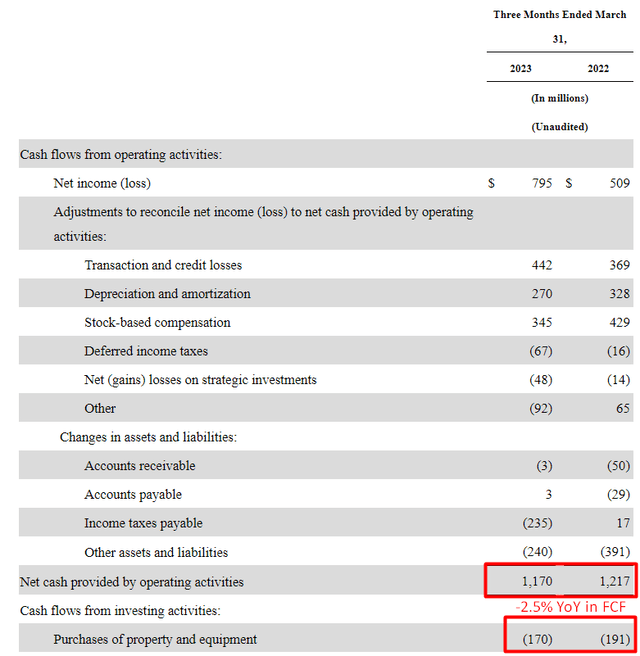

Net cash provided by operating activities was $1.17 billion, and free cash flow was $1.00 billion in Q1 (CFO minus CAPEX), which is 2.5% lower than last year:

PYPL’s Q1 results, author’s notes

During PayPal’s earnings call, management indicated that operating margin expansion in 2H FY2023 will be lower than in the first half. Additionally, the decline in operating expenses will be less in Q3 and Q4 as the company reaches the later stages of its cost-savings program.

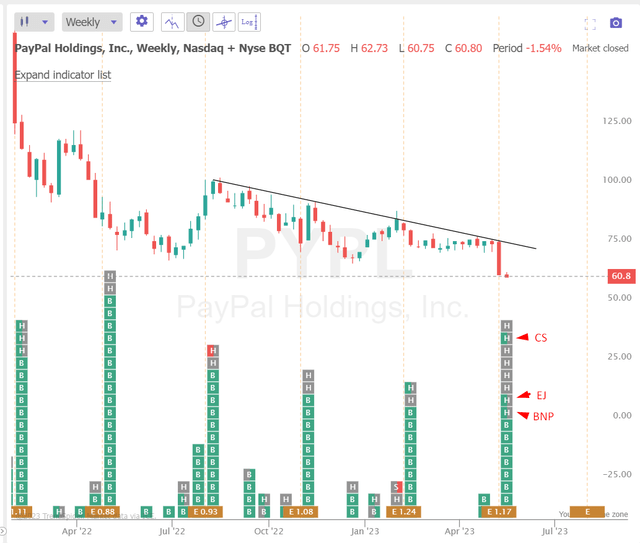

Credit Suisse analyst Timothy Chiodo downgraded PayPal to a Neutral rating from Outperform, despite the stable trends in branded checkout growth seen in Q1 earnings. Chiodo points to specific factors affecting Q1 growth, including invoicing weakness, the discontinuation of PayPal unbranded, and the ending of PayPal Here, which are expected to persist in the near term.

Given the ongoing pressures on transaction margins, PayPal’s discretionary spending focus in an uncertain macroeconomic environment, a pending management transition, and increasing competition, Chiodo finds it challenging to recommend investing in PayPal shares at this time. However, he states that he may reassess his stance if there are indications of significant gross profit growth for the company in 2024 and beyond. However, he noted that PayPal’s unique network and potential for future gross profit growth could change this perspective.

Credit Suisse wasn’t the only bank to lower its forecasts after the company’s report. Edward Jones’ investment boutique and Exane BNP Paribas did the same move:

TrendSpider Software, author’s notes

In my opinion, these rating revisions were the main reason for the stock’s sell-off, as the day of the downgrade fell on the unfortunate May 9 for PYPL. But as practice shows, downgrades usually follow the share price and not the other way around – analysts are often forced to adjust their price targets so that they don’t appear too unrealistic. Perhaps that’s what happened this time – I came across the same report from Credit Suisse, and the history of Chiodo’s coverage clearly shows how that works:

Credit Suisse [May 9, 2023], proprietary source![Credit Suisse [May 9, 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/5/17/49513514-16843083326196704.png)

I don’t think that Chiodo himself expected that his “Gray Sky” scenario would come true just a few days after the publication of his research paper:

Credit Suisse [May 9, 2023], proprietary source, author’s notes![Credit Suisse [May 9, 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/5/17/49513514-16843087516596794.png)

So should investors wait for a recovery to at least the “base case” price in the foreseeable future?

PayPal Stock In 5 Years

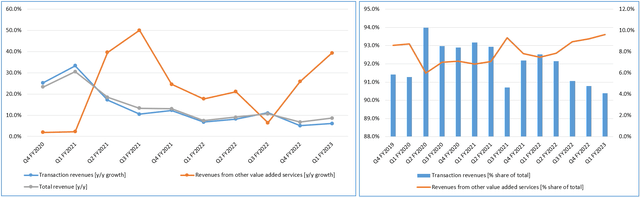

Let’s start from the top – how PayPal makes revenue. It’s essentially payment transactions from customers’ payments on the company’s platform, as well as other value-added services. So PYPL’s revenue streams are classified into 2 categories: Transaction revenues and Revenues from other value-added services.

In terms of unit-economics metrics, the company’s revenue has stagnated, although in absolute terms it has grown at a CAGR of 15.1% since 2013, the revenue-per-transaction ratio has been falling by ~5.2% annually:

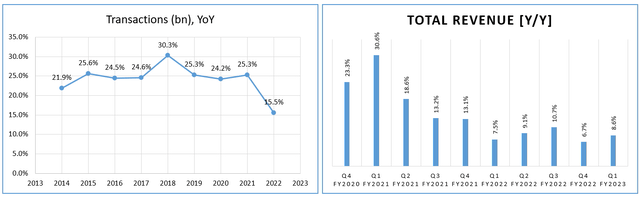

Therefore, total revenue growth slowed to only 7-10% as the number of transactions declined from the low-20s percent to the mid-10s percent:

The >30% growth in the Revenues from other value-added services that you could see in the infographic above doesn’t add any tangible incremental growth or diversification, as the share of this segment in the revenue structure has only grown by 90 basis points since Q1 FY2020 and currently accounts to just 9.6% of consolidate revenue figure:

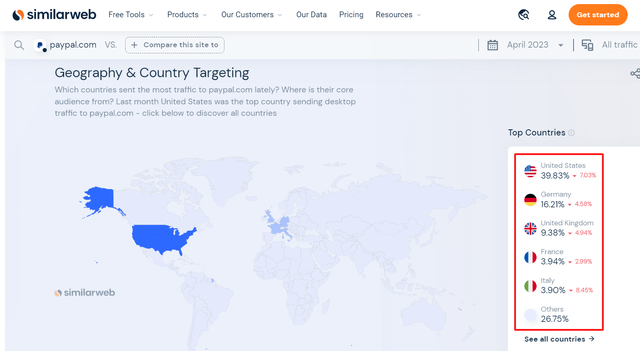

I assume that the emerging competition in the digital payments market is forcing the company to charge less commission on transactions – which explains the decline in revenue per transaction. I don’t think this trend will stop anytime soon, because every year more and more PayPal competitors appear on the fintech market, taking away the market from the company (judging by the dynamics of SimilarWeb):

SimilarWeb, PayPal’s traffic, author’s notes

Therefore, I expect PYPL to be able to grow its user base by only 2% YoY over the next 5 years [which is already better than the decline in Q1]. This low growth will trigger growth in the number of transactions [+12% annually], which will get additional tailwinds from the continued decline in the revenue-per-transaction ratio [-2% annually since 2024]. Here’s what I get as a result:

| Year | Users [M] | Transactions [B] | Sales [$M] | Revenue-per-transaction |

| 2023 | 441.66 | 24.98 | $29.22 | 1.17 * |

| 2024 | 450.49 | 27.97 | $32.07 | 1.15 |

| 2025 | 459.50 | 31.33 | $35.2 | 1.12 |

| 2026 | 468.69 | 35.09 | $38.64 | 1.10 |

| 2027 | 478.07 | 39.3 | $42.41 | 1.08 |

| Assumptions [YoY] | +2% | +12% | -2% |

Source: Author’s work [* – the ratio will decline by 5.2% in FY2023]

So my revenue forecast for PYPL gives it a 5-year CAGR of only 7.73%, which is low but includes the maturity of the PYPL business cycle. In many ways, everything will depend on what margins the company will achieve.

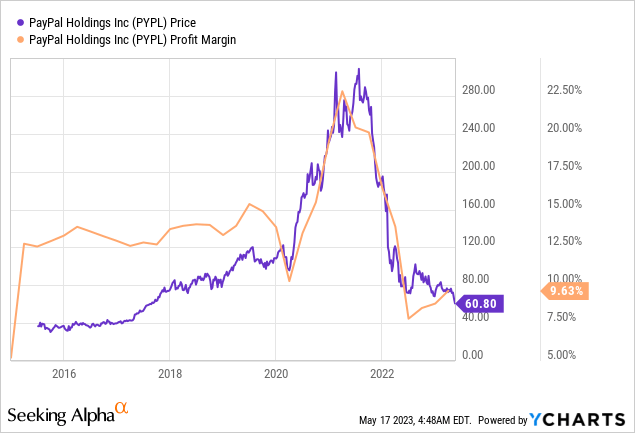

Since the IPO, the company has maintained a fairly comfortable margin range of 12-15%. The exception was the 2020-2022 period when PayPal was able to increase its margin to about 22.5% within a few quarters. Since then, the bottom line margin has fallen to 9.63%.

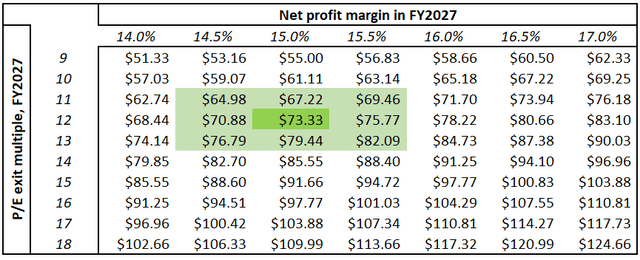

Knowing that we won’t see significant improvements shortly, we can only speculate when PYPL can return to its average margins. However, if we assume that momentum will be positive after 2023 and PYPL still manages to return to its pre-COVID range [say, to 15%] by FY2027, then the company may generate about $5.115 billion in net profits at that margin.

During the earnings call, the CFO Gabrielle Rabinovitch said that PayPal will buy back about $4 billion of its shares in FY2023 – of that amount, 2.6 billion remains after Q1. I think the company will continue to use the buybacks after FY2023 – at about 1.5% per year, which is lower than the 2.36% between 2021 and 2022. The remaining $2.3 billion for buybacks in FY2023 means that at a current share price of $61.1, PYPL’s outstanding shares should be reduced by ~42.55 million shares by the end of FY2023.

| FY2027 forecast figures: | |

| Revenue, [$M] | $42.41 |

| Net profit margin, % | 15% |

| # of sh. [M] | 1,041.07 |

| Implied EPS, $ | $6.11 |

Source: Author’s calculations

At 12x earnings by FY2027, PYPL should trade at $73.3 per share. Here’s how the sensitivity analysis looks like with different inputs for profit margin and P/E ratio:

So What’s The Conclusion?

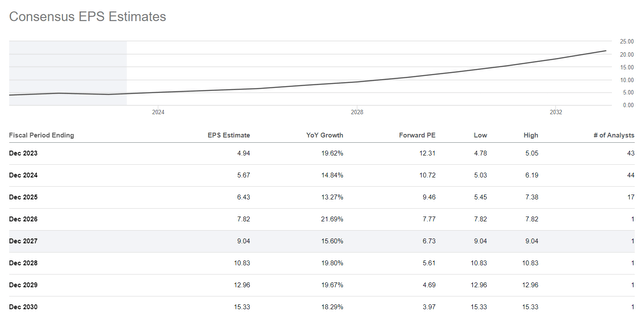

My assumptions and a set of input data may be controversial and disputed. Of course, I’m not trying to hit the bull’s eye – it’s just an attempt to look into the future based on the latest trends in financial facts and the stock market condition as a whole. So I’m definitely wrong – the only question is by what margin? The forecast from 1 Wall Street analyst says that FY2027 earnings per share should be close to $9. Time will tell which of us was right.

Seeking Alpha, PYPL stock, Earnings Estimates

My assumptions and a set of input data may be controversial and disputed. Of course, I’m not trying to hit the bull’s eye – it’s just an attempt to look into the future based on the latest trends in financial facts and the stock market condition as a whole. So I’m definitely wrong – the only question is by what margin? The forecasts from 1 Wall Street analyst say that FY2027 earnings per share should be close to $9. Time will tell which of us was right.

In my base case scenario, PYPL stock has a 5-year upside of about 20%, meaning it should grow at a CAGR of only 3.72% annually. This is too low for a buy recommendation. Most likely, the recent correction has brought PYPL back into the fair valuation range that the stock has been targeting in recent months. If PYPL drops even lower – say to $45-50 per share – it’ll touch a comfortable buying zone. In my opinion, long-term investors should look to this zone for guidance. Now the stock is a Hold.

Thank you for reading! Please, let me know what you think in the comment section below!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to navigate the stock market environment?

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!