Summary:

- Pfizer Inc. has seen its stock get shattered after enjoying COVID tailwinds.

- How much is too much is a personal question at the end of the day.

- For me, a 5-year high yield and 5-year low PE multiple make Pfizer tempting here.

- As a contrarian, I like to invest when the crowd hates the stock of a good company.

JHVEPhoto

Pfizer Inc. (NYSE:PFE) has been on a downtrend, to put it mildly. The stock was on a tear in 2021 and did not fall as much as many popular stocks in 2022. Now, to put the recent downturn more blatantly, as of this writing, the stock is:

- down almost 1% today

- down 2.40% in the last 5 days

- down nearly 11% in the last month

- down 24% in the last 6 months

- down 28.38% YTD

- down 28.50% in the last 1 year

Well, you get the drift. The stock is up a (sarcasm on) “monumental” (sarcasm off) 9% in the last 5 years, excluding dividends. Speaking of dividends, I wrote this article about 3 months ago evaluating if Pfizer’s dividend was at risk due to the then rumored deal to buy Seagen Inc. (SGEN). The stock has lost about 10% since that article, compared to the market going up about 4%. So, mea-culpa on that front. But I still am retaining my buy rating for the reasons mentioned below. Let us get into the details.

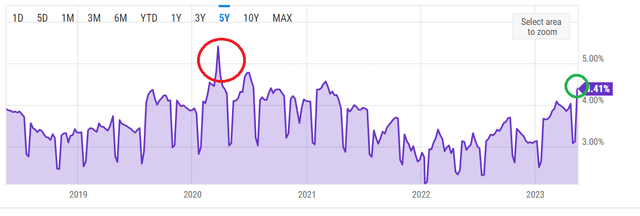

- Being part dividend growth investor, when the stock of a well-known company sells off, my attention immediately goes to the yield, if any. Pfizer does pay a pretty solid dividend, which was increased a tiny bit in December 2022. Due to the never ending sell off, the stock right now yields nearly 4.50%, which is well above the 5-year average of 3.56%. Only once did the stock yield higher than this in the past 5 years and no prize for guessing that it was at the height of COVID fear. That seems ironic in hindsight because Pfizer’s stock gained quite a bit due to pandemic.

- Speaking of pandemic, the COVID highs are well and truly a thing of the past. Why am I stating this as a plus? Because the stock has clearly adjusted for its previous excesses when everyone believed there will be a non-stop demand for boosters and how the pandemic would be the way of life. Being back to reality gives Pfizer and its investors the opportunity to be pragmatic about future expectations without relying on once in a life time events, which while profitable in the short to medium run, pull the rug when least expected.

- This relentless fall in stock price has pushed the stock’s trailing multiple to its 5-year lows. While earnings are expected to be under pressure over the next 5 years, even the forward multiple based on 2023 estimates remains fairly low at 11. Before you think I am relying too much on estimates and those are suspect, Pfizer has beaten EPS estimates 14 out of the last 16 quarters. The stock market is all about expectations vs. reality.

- I like the fact that the company has wisely used most, if not all, of its COVID windfall on acquiring companies. Acquisitions of any size is challenging with cultural, functional, technical, and philosophical differences to deal with, before the expected synergy materializes. And with Pfizer, we are talking acquisitions tens of billions of dollars in size. If you are concerned about Pfizer taking on unmanageable debt to fund acquisitions , you are wise. Many well established companies have bitten off more than they could chew in acquisitions and have ended up hurting investors. Hello, AT&T (T). Although Pfizer’s debt will increase with the reported $31 billion offering, its overall debt has fallen nearly 14% in the last 5 years.

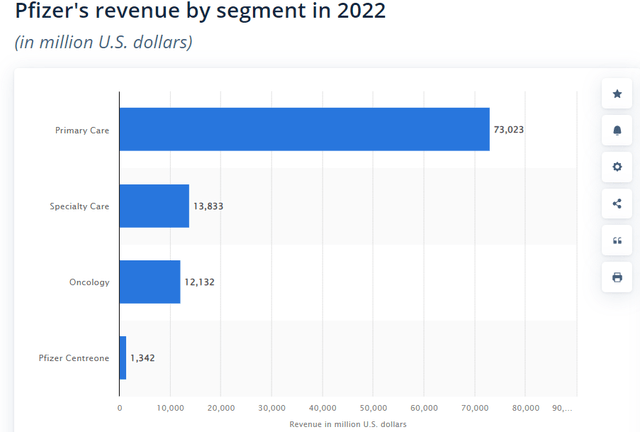

- I won’t pretend to fully understand Pharma pipeline but I do know that Pfizer’s deal to buy Seagen was clearly strategic when it came to filling portfolio gaps. Oncology currently occupies a lowly third spot in the revenue mix and Seagen’s potential has given Pfizer enough confidence to project the new addition could contribute $10 billion revenue by 2030.

- Finally, Pfizer’s median price target of $44.50 is a good 20% away from where the stock is trading right now. For a change, this is not a case of analysts pumping up their targets but more due to Pfizer stock losing its ground to make this an attractive entry point.

To conclude, Pfizer is already part of my portfolio and I am likely to add further, especially if the recent weakness takes the stock close to the 5% yield mark, which is only about 10% from here. I am watching.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE, T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.