Summary:

- AT&T Inc. stock has continued to fall since recently reporting earnings.

- The stock has officially entered “No Man’s Land” at this point. Nonetheless, I see strong support just below this level.

- In the following piece, I explain why I believe AT&T stock may present an excellent buying opportunity for income investors at this juncture.

Brandon Bell

Executive Summary

When to buy and when to sell a stock are the two hardest decisions an investor can make. The primary reason for this is the fact investing in stocks is completely counterintuitive to human nature. In life, most of the time you look to your friends, family, and public opinion in general for confirmation of your beliefs. This trait translates into investing in the form of investors seeking out information that confirms their bias. This is called “confirmation bias.” Oftentimes, investors will see that the crowd is either highly positive or highly negative regarding a certain investment and choose to run with the pack. Yet, in investing, the right move is to go against the herd, more often than not.

Many times, due to the herd mentality, stocks are often sold off or driven higher much further than they should be. Identifying and capitalizing on these “mispricings” is an effective way to increase your chances of success. This is the case with AT&T Inc. (NYSE:T) today, I surmise. Let me explain.

Distinguishing opportunities from traps

Sometimes a stock is being sold off for good reason. It’s important to do your homework and ensure the selloff has created a buying opportunity and not a so-called “value trap.” After doing my due diligence on AT&T, I posit this is an excellent time to buy AT&T’s stock.

My due diligence process explained

When I perform my due diligence regarding buying a stock for my SWAN (sleep well at night) Income portfolio, I first look at the company’s long-term growth story, fundamentals, valuation metrics, and finally the current dividend yield to determine if an opportunity exists. AT&T scores an A on Seeking Alpha’s Quant Valuation grade.

AT&T Seeking Alpha Valuation Quant Grade

T stock is trading at a forward P/E of 6.81, which is substantially below the sector median and its 5 year historical average. It’s also knocking the ball out of the park regarding to its profitability metrics.

AT&T Seeking Alpha Profitability Quant Grade

The stock is trading substantially above the sector median and its 5 year historical averages on all three major profitability metrics. Next, I like to review the most recent earnings announcement to ensure the long-term growth story is still intact.

Long-term Growth Story Intact

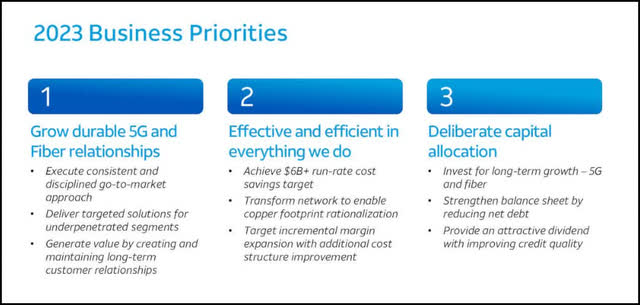

AT&T is executing on its 2023 business priorities extremely well.

AT&T 2023 Business Priorities

During the recent earnings conference call, CEO John Stankey stated:

“As we noted at the end of last year, our fiber subscribers now outnumber non-fiber and DSL subscribers. We now have about 7.5 million AT&T fiber subscribers, with the fiber adoption and margin expansion driving Consumer Wireline revenue and EBITDA growth. We believe that AT&T offers the best wired Internet service available anywhere, that this elevated AT&T fiber experience is providing a strong tailwind.

So overall, across both 5G and fiber, I’m very happy with the high-quality subscriber adds we achieved in the quarter, and these long-term customer relationships provide a great and profitable revenue stream now and into the future. Even in the midst of increased macroeconomic uncertainty, we’re executing more sharply and efficiently after repositioning our operations around our connectivity strengths. We remain on track to achieve our $6 billion plus cost savings run rate target by the end of the year, if not sooner.

As we mentioned before, the benefits from these efforts are expected to increasingly fall to the bottom line. While we’ve largely delivered what we set out to accomplish three years ago, our journey has only raised our confidence that we can continue to evolve and improve. In fact, we believe we can further accelerate cost takeouts as we progress through the year.

Part of this entails transforming our network as we ultimately replace our copper services footprint with best-in-class fiber connectivity, and where it makes sense for customers, replacement products built on our wireless network.”

So, everything sounded great as far as Q1 earnings went, yet the stock posted its worst drop in years after the report.

AT&T Current Chart

The stock dropped 10%, the most in years, after reporting only $1 billion in free cash flow (“FCF”), while the guidance stands at $16 billion for the year. That puts AT&T definitively behind the eight ball, so to speak. Yet, CEO Stankey stuck with the company’s initial guidance. According to a recent Seeking Alpha news article:

“Free cash flow, meanwhile, came in at just $1B while analysts had expected $2.6B, thanks to higher capital expenditures than expected.

But as with last year, AT&T stuck to guidance that it could hit $16B-plus on the measure in 2023 — suggesting it once again is counting on cash flow loaded to the back half of the year.

That is once again due to timing issues, Stankey suggested: “One, it’s the highest quarter of device payments. Recall, Q4 holiday sales is the heaviest volume for devices; we pay for those in Q1. You saw our capital spend is elevated relative to the annual guidance that we gave. And Q1 is the quarter we pay incentive comp … When you factor all those things in, along with our expectations that we will continue to grow EBITDA, we feel really good about delivering $16B or better.”

What’s more, even after the initial drop, T stock has continued lower. I feel we may have reached the point of maximum pessimism.

The next step in my due diligence process is to look at the chart and determine the stock’s current technical status.

Buying at the point of maximum pessimism

I’m sure some of the selling pressure most likely comes from many losing faith in management’s ability to come through on its guidance. While some are most likely related to the fact that there are some major macro headwinds hitting the markets at present as well. A looming recession and the debt deal debacle are definitely not helping. Yet, as one of my favorite investing icons, Sir John Templeton likes to say, “The time to buy is at the point of maximum pessimism.”

Templeton’s full quote is as follows:

“The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

Templeton also stated:

“When people are desperately trying to sell, I buy. When people are desperately trying to buy, I sell. It has worked out very well over the years.”

If we aren’t at the point of maximum pessimism, I posit we are darn close. I have put in a buy limit order at $16 presently just in case we have some further downside. Another big positive is the fact AT&T stock has substantial upside of 27% and a healthy dividend yield of nearly 7% after the massive selloff. Let’s take a deeper dive into it.

27% Upside

I believe AT&T is going to come through on guidance. When they do, I see T stock regaining the $21 price point it was trading at just prior to the last earnings report. If you remember, sentiment on AT&T was extremely bullish just prior. So much so, I paid attention to Templeton’s second mantra, “When people are desperately trying to buy, I sell.” And sold out of my position after a 30% gain in just 3 months. I have found that the quicker the gains come, the quicker they go. This lesson learned held true in this case.

AT&T Chart

I recently bought back in with a small starter position at $17.64. I’ve learned over the years to build new positions slowly. I layer in overtime with several tranches to reduce risk. It’s nearly impossible to calculate the exact top or bottom in a stock. The best way to achieve a satisfactory basis is to save some dry powder for a rainy day. Now let’s wrap this up.

The Wrap-Up

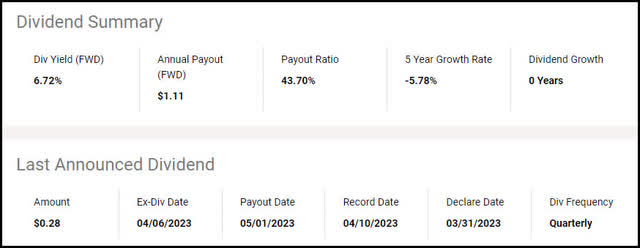

AT&T Inc. stock has been beaten down over the last few months, from $21 to $16.60 presently. This has caused the dividend yield to spike to nearly 7%.

Seeking Alpha Dividend Summary

The 7% yield threshold has historically acted as a backstop for the AT&T share price. Many current shareholders often add at this level to lower their basis and increase their yield on cost. I am in that boat as well.

The second point I’d like to make is the fact the stock has sold off “as if” Stankey had stated that the company was going to miss the $16 billion free cash flow guidance for the year. The fact of the matter is that he did not. This leads me to believe the selloff was unjustified.

In fact, HSBC just recently upgraded AT&T’s stock for the very reasons I have stated in this article. According to another recent Seeking Alpha News article:

“Analyst Adam Fox-Rumley moved his rating on AT&T (T) shares to buy from hold with a per-share price target of $21, noting there is an “opportunity” that has arisen from Thursday’s sell-off.

“At some point this year, subject to FCF generation, the market’s attention should turn to falling CAPEX spend in 2024, a shrinking debt pile and, thereafter, the possibilities for buybacks,” Fox-Rumley wrote in an investor note.

Fox-Rumley added that AT&T (T) has its own headwinds, including the profitability of its business wireline unit and more visibility on its fiber optic internet buildout beyond what has already been laid out, but he agrees with the company’s current strategy.”

So there you have it. These are the reasons I believe AT&T Inc. stock is a fat pitch with home run written all over it. I believe the time to buy or add to a position is now.

Nevertheless, this is not a blanket call that everyone should buy AT&T Inc. stock now. I have no idea what each individual’s suitability and status may be. Please use this information as a starting point for your own due diligence. Those are my thoughts on the matter, I look forward to reading yours!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

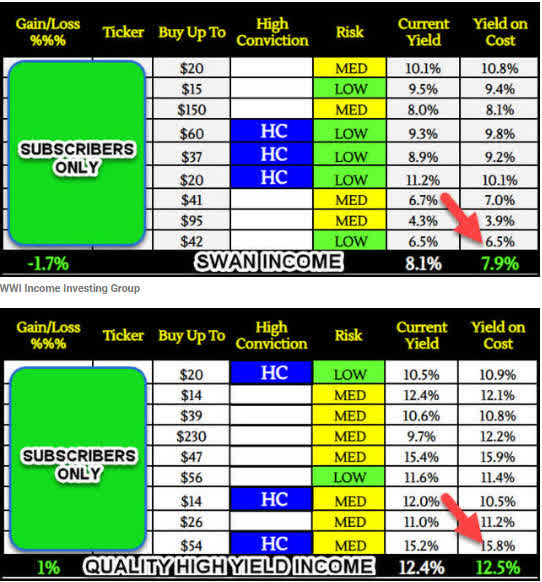

Join the #1 fastest growing new Income Investing Group! Our SWAN and High Yield Income Portfolios are substantially outperforming the market!

We have opened up an addition 50 Charter memberships at the legacy rate! Memberships are going fast with 30 new members already signed up! We have 17 FIVE STAR reviews in the first few months!

~ Quality High Yield Income – Current Yield – 12.5%

~ SWAN Quality Income – Current Yield – 7.9%

~ High Quality Growth

~ Ultra-High Growth

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds are donated to the DAV (Disabled American Veterans).