Summary:

- Elon Musk remains the Tesla, Inc. CEO, dispelling rumors of his departure.

- Optimus robot represents a significant technological breakthrough with potential industry-wide impact.

- Tesla shifts its strategy to include advertising for increased market reach.

- Future initiatives include safety enhancements, battery technology advancements, and the introduction of the Cybertruck.

- As a long-term investor, I see Tesla stock as a buy opportunity.

VCG

Tesla, Inc. (NASDAQ:TSLA) is an innovative electric vehicle company led by CEO Elon Musk. It is known for its cutting-edge technology, sustainable approach, and potential to revolutionize the automotive industry. The recent Tesla shareholders meeting provided valuable insights into the company’s future prospects.

Looking ahead, I am optimistic about Tesla’s prospects. With its strong market position, ongoing safety enhancements, and upcoming projects like the Cybertruck and robotaxi service, Tesla is well-positioned for sustained growth. Considering the company’s valuation metrics, including a relatively low price-to-earnings-to-growth ratio and price-to-sales ratio, I see Tesla stock as an attractive long-term investment opportunity.

Elon Musk’s Continued Role as Tesla CEO

In my view, the decision by Elon Musk to remain the CEO of Tesla carries significant importance for the company. While there are differing opinions on whether Tesla could thrive without him at the helm, I believe his continued presence is crucial, especially given the ambitious projects and product roadmap ahead. With several years’ worth of products already in development, Elon Musk’s leadership and vision will play a pivotal role in driving Tesla’s success.

One area where Elon’s involvement is particularly vital is in the development of artificial intelligence (AI) for Tesla’s commercial applications. During the shareholder meeting, he expressed his commitment to overseeing the company’s AI initiatives, which hold tremendous potential for Tesla’s Full Self-Driving (FSD) technology and the Optimus robot. Given Elon’s expertise and track record in pushing the boundaries of AI, his continued engagement will undoubtedly contribute to solidifying Tesla’s position as a leading player in this field.

Furthermore, the recent announcement of Elon Musk stepping down as CEO of Twitter has implications that could further benefit Tesla. With fewer responsibilities at Twitter, Elon will have more capacity to devote his attention and energy to Tesla’s business. As an investor, I find this development encouraging, as it suggests that Elon will have greater availability to focus on driving Tesla’s growth and innovation.

Additionally, the return of JB Straubel to Tesla’s board, particularly from his role at Redwood Materials battery recycling company, is a positive move. JB Straubel is widely respected in the electric vehicle industry, having been an early employee and co-founder of Tesla. His extensive experience and knowledge in the field will undoubtedly contribute to Tesla’s ongoing efforts to make electric vehicles more sustainable, affordable, and accessible. JB Straubel’s advocacy for sustainability and environmental responsibility aligns well with Tesla’s core values and long-term objectives.

Optimus and the Future

The introduction of Optimus, Tesla’s robot, has the potential to be a game changer. This versatile robot can automate a wide range of tasks, from manufacturing to customer service, and has the potential to address labor shortages and improve productivity. While it is still early to determine the full impact of Optimus, it is evident that this robot represents a significant technological breakthrough.

Peter Lynch in his book “One Up on Wall Street” said “I once visited a mundane little Florida cattle company called Alico, run out of La Belle, a small town at the edge of the Everglades. All I saw there was scrub pine and palmetto brush, a few cows grazing around, and perhaps twenty Alico employees trying unsuccessfully to look busy. It wasn’t very exciting until you figured out that you could have bought Alico for under $20 a share, and ten years later the land alone turned out to be worth more than $200 a share”

Reflecting Peter Lynch’s quote, it raises intriguing thoughts about the future value of Optimus. As technology continues to advance, it is compelling to envision what Optimus might be worth in ten years’ time. The progress already achieved with the robot, such as its ability to individually control its fingers or manipulate objects in confined spaces, demonstrates the potential for significant advancements. Elon Musk’s visionary mindset plays a crucial role in envisioning the integration of artificial intelligence into practical applications. It is remarkable to consider Elon’s suggestion that we could see 10 to 20 billion humanoid robots in the future, potentially one or two robots per person.

While acknowledging the boldness of such projections, it’s important to exercise a healthy level of skepticism. However, the optimistic outlook and ambitious goals underscore the reason why having Elon Musk at the helm of Tesla remains crucial. Elon’s visionary perspective and drive for growth are instrumental in shaping Tesla’s future trajectory.

While acknowledging skepticism, it’s important to remember that technological advancements often surpass initial expectations. The potential impact of Optimus and the integration of artificial intelligence with practical needs are areas where Elon’s critical eye and visionary mindset come into play. Tesla’s continued growth relies on the ability to push boundaries and capitalize on emerging opportunities.

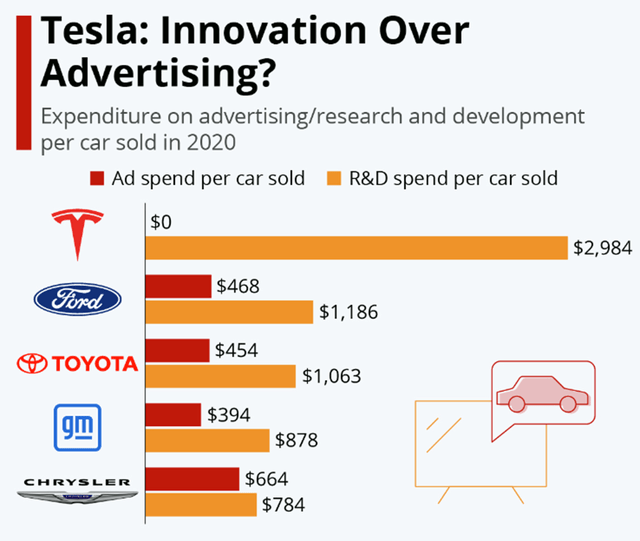

R&D vs Advertising

Tesla’s rise to become one of the most valuable companies globally is even more impressive considering its zero spending on traditional advertising. While many other automakers allocate significant budgets to marketing, Tesla has relied on word-of-mouth and its strong brand reputation. However, recent developments indicate a change in this strategy as Elon Musk announced that Tesla would begin experimenting with advertising.

Tesla’s decision to explore advertising represents a notable shift in its strategy. While the company has achieved remarkable success without traditional advertising, the introduction of advertising could help amplify Tesla’s brand and reach a wider audience. It enables Tesla to communicate its value proposition, such as the affordability of its cars, safety features, and superior technology, to a broader market. By sharing this information through advertising channels, Tesla aims to inform and engage potential customers who may not be familiar with the brand or the benefits it offers.

Tesla: Innovation Over Advertising? (Statista )

Although the specifics of the advertising budget and its impact on the company’s growth and profitability are still unclear, I believe that this move toward advertising is a prudent choice for Tesla. Despite repeatedly lowering the prices of its cars to increase demand and gain market share, Tesla needs to proactively inform the public about these price reductions. Relying solely on word-of-mouth may no longer be sufficient. Advertising will allow Tesla to communicate to potential customers that it’s starting prices are below the average auto price in the US, a goal Elon Musk has long pursued to make Tesla cars affordable to the general public. Additionally, Tesla needs to emphasize the safety features and value it offers to consumers, addressing any hesitations they may have about purchasing a Tesla.

|

Model |

New Price |

Prev Price |

Percent Change |

|

Model 3 RWD |

$ 43,990 |

$ 46,990 |

(6.38%) |

|

Model 3 Performance |

$ 53,990 |

$ 62,990 |

(14.29%) |

|

Model Y Long Range |

$ 52,990 |

$ 65,990 |

(19.70%) |

|

Model Y Performance |

$ 56,990 |

$ 69,990 |

(18.57%) |

|

Model S |

$ 94,990 |

$ 104,990 |

(9.52%) |

|

Model S Plaid |

$ 114,990 |

$ 135,990 |

(15.44%) |

|

Model X |

$ 109,990 |

$ 120,990 |

(9.09%) |

|

Model X Plaid |

$ 119,990 |

$ 138,990 |

(13.67%) |

Tesla’s focus on advertising does not diminish its commitment to research and development (R&D), rather, it is a complementary strategy aimed at increasing market penetration and solidifying Tesla’s market share. In fact, Tesla allocates more R&D spending per car sold compared to traditional automakers like Ford Motor (F), Toyota Motor Corporation (TM), and General Motors Company (GM), often triple the amount.

Tesla’s management has reported a high order intake rate, almost double the rate of production, and expressed the potential to surpass its 2023 delivery targets if production capacity allows.

Elon Musk said: “We currently are seeing orders at almost twice the rate of production. So it’s hard to say that will continue twice the rate of production, but the orders are high. And we’ve actually raised the Model Y price a little bit in response to that.”

This strategy aims to understand Tesla’s price points and prevent competitors from engaging in an unsustainable price war that could lead to bankruptcy.

As the leading manufacturer of electric vehicles worldwide, Tesla possesses a significant competitive advantage in its technological expertise, particularly in the area of full self-driving (FSD) capabilities. However, I am aware that Tesla’s moat in this regard may diminish over time as other companies catch up. Nevertheless, Tesla’s current market position and foresight indicate that competitors cannot win in the price war initiated by Tesla unless they are willing to face potential financial difficulties. Therefore, it is highly likely that Tesla will continue to gain market share, even amid the macroeconomic challenges.

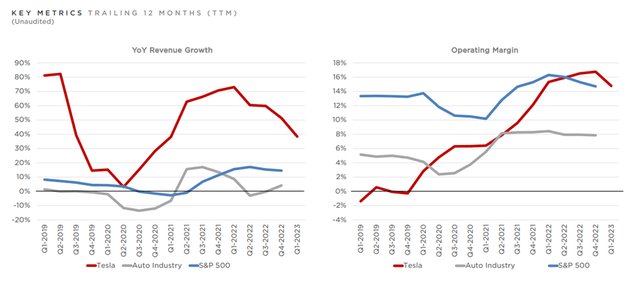

Q1 2023 Financials

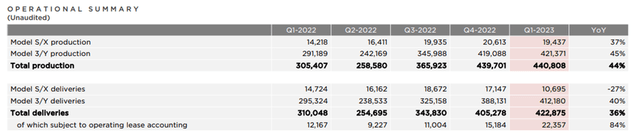

In Q1 2023, Tesla’s financial performance demonstrated solid growth and profitability. Total revenue for Q1 reached $23.3 billion, representing a 24% YoY increase. Notably, the energy generation and storage segment experienced remarkable growth of 148% YoY, while total automotive revenues grew by 18% YoY.

In terms of production and delivery numbers, the company produced 441 million cars, reflecting a YoY growth of 44%. Moreover, Tesla delivered 423 million cars during the same period.

While Tesla’s gross margin experienced a decline of 9.8%, it is important to note that this is part of the company’s strategic approach. Tesla is implementing strategies that may result in lower margins, and as a shareholder, I understand the reasoning behind this decision. Despite the decrease in gross margin, Tesla remained profitable. The company generated $2.5 billion in net income on a GAAP basis in Q1 2023, which represented a 24% decrease compared to the previous year. Tesla’s free cash flow was impacted by higher capital expenditures.

Nevertheless, the company’s balance sheet remains robust, with Tesla holding a negative net debt (net cash position) of £16.8 billion. This indicates the company’s strong financial position and ability to invest in future growth opportunities.

Other Highlights

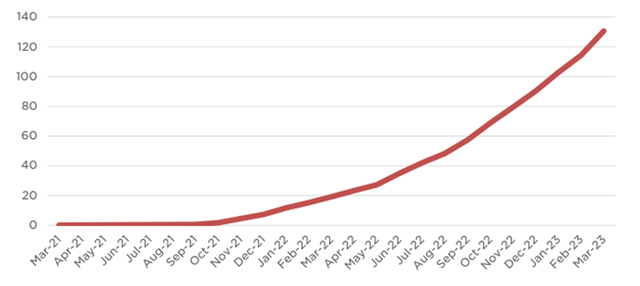

• Full Self-Driving: Tesla’s growing fleet of FSD Beta users has had a significant impact on the total number of FSD Beta miles driven, surpassing 150 million miles to date. This level of data collection is unprecedented in the industry and is crucial for developing scalable autonomy through AI-based approaches. In Q1, Tesla enabled the latest FSD Beta software stack specifically designed for highway driving. While this is a highly speculative area, the potential for increased margins and revenue growth through expanded FSD capabilities is immense. Elon Musk himself has described it as a potential “asset value step change” of historic proportions.

Cumulative miles driven with FSD Beta (millions) (Tesla)

• Safety: Tesla remains committed to improving vehicle safety. The company continuously analyzes accident data and utilizes over-the-air updates to enhance airbag deployment and emergency braking systems. This ongoing commitment to safety sets Tesla apart from other car manufacturers, as it enables existing vehicles to receive the latest safety features without the need to purchase a new model.

• Cybertruck: The highly anticipated Cybertruck is still on track for production to begin later this year at Gigafactory Texas. This innovative electric pickup truck has generated significant interest, and Tesla aims to deliver up to 10,000 units this year. The success of the Cybertruck could further solidify Tesla’s position in the electric vehicle market.

• Robotaxi Service: Tesla has expressed its vision and expectation of launching a robotaxi service, however, specific details are yet to be revealed.

• Energy Storage Segment: The energy storage segment of Tesla’s business is experiencing rapid growth, outpacing the automotive sector. This demonstrates the demand for Tesla’s energy storage solutions, which play a crucial role in the transition to renewable energy sources and grid stability.

• Battery Technology Advancements: Tesla is actively working on developing new battery technologies that could significantly reduce the cost of electric vehicles. This ongoing research and development aim to make electric vehicles more affordable compared to their gasoline-powered counterparts.

Summary and Investment Outlook

Taking all the factors into consideration, I believe that Tesla, Inc. had a strong quarter, and the future looks promising for the company. Despite the challenges of the next macrocycle, Tesla’s position in the market is well ahead of its competitors. The technological advancements and innovative features that Tesla offers provide a significant competitive advantage.

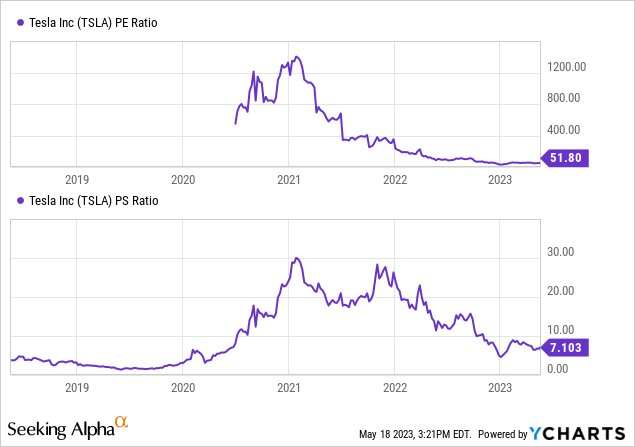

While the stock price may not be considered cheap by traditional valuation metrics, such as price-to-earnings on an absolute basis, Tesla is currently trading at a lower price-to-earnings-to-growth ratio. This ratio reflects investors’ expectations of future earnings growth and indicates a more reasonable valuation. With a projected earnings growth rate of 10%, which I believe is more than reasonable (Seeking Alpha expects the earnings growth rate on CAGR of 18% for the next 5 years), Tesla’s current valuation appears more attractive at 5x the price-to-earnings-to-growth ratio.

Considering the price-to-sales ratio, Tesla is currently trading at 7x, which, although not cheap on an absolute basis, is relatively low compared to historical levels. This suggests that there may be an entry point for investors looking to capitalize on Tesla’s potential and the new features that are yet to come.

As a long-term investor, I see Tesla, Inc. stock as a buy opportunity. The company’s strong market position, continuous technological advancements, and commitment to sustainability make it an appealing investment choice.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.