Summary:

- We suggest data points to an impending macroeconomic storm, as interest rates on auto loans are soaring and banks severely tighten credit.

- Based on inventory and used car sales prices, we believe Tesla’s gross margins could fall even lower in the second quarter than the 19.3% witnessed in Q1.

- Compared to its industry peers BYD Company Limited and Toyota Motor Corporation, which have fundamentally very similar characteristics, TSLA stock is trading at a valuation that is way out of proportion.

- In our view, many investors overlooked earlier signals at the shareholder meeting from CEO Elon Musk about macroeconomic woes.

Justin Sullivan

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) just had its 2023 annual shareholder meeting on Tuesday, and the stock is up about 5% since then. More to the point, Tesla stock is up 42.62% YTD, reflecting positive investor sentiment, perhaps following some statements by CEO Elon Musk that he is open to media advertising and that he has found a new CEO for Twitter.

Still, we think market participants have overlooked some of Elon Musk’s comments about the macroeconomic environment, where we find Tesla highly suspect for a macroeconomic blast. In this article, we explore why a macroeconomic storm is potentially imminent, and why investors may want to be cautious.

An Interest Rate Storm

In one of our previous articles, we warned investors about a potential “interest rate storm” that appeared on the horizon, and now seems to have arrived. Elon Musk also touched on this subject, several times during the annual shareholder meeting:

Interest rates have a very big effect on the affordability of cars. The vast majority of people buy cars based on the monthly payment, so it’s like “how much is the monthly payment?” And it’s not a question of value for money, it’s just do they actually have enough money, can they afford it?

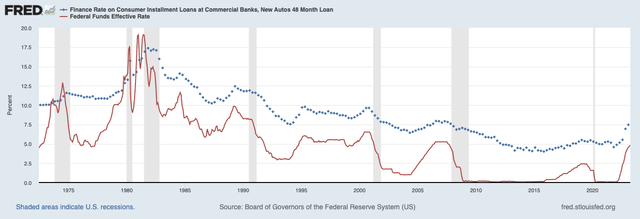

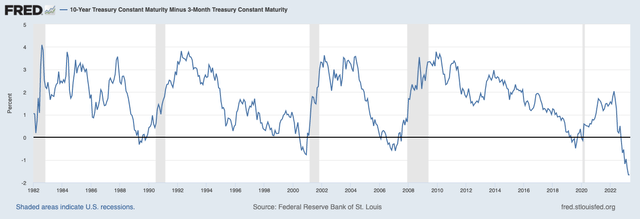

And so, in the article, we looked at where auto loan rates are headed, also as a function of where short-term interest rates are now. Because, over the past 40 years, interest rates have generally been a tailwind as they had fallen to all-time lows. In 2016, for example, the average interest rate on the most common loan (72-month) touched nearly 4%. Currently, however, that figure is more like 7-8%.

Short-term interest rates are now at the same level as they were in 2007, when interest rates on auto loans were around 8%, which we will use in our example.

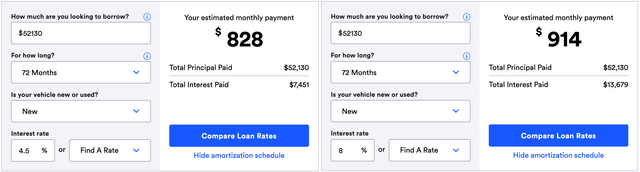

The monthly payment may not have increased that much for, say, a popular Model Y long-range, but it adds up over several years. Consumers will end up spending $6228 more if they finance at 8%, compared to the 4.5% we saw in 2021 and during the previous decade of near-0 rates.

But in terms of affordability, it also plays a big role. As a rule of thumb for affordability, it is common knowledge that car payments should not exceed 15% of monthly take-home pay. With an $828 payment, it becomes affordable at a monthly income of over $5520, and at $914 you would be expected to earn over $6093.

And when sold to the masses, a 10% increase in income needed to afford the same car can cut into demand faster than you might expect. Not only that, but the debt-to-income ratio plays a role in financing a car, along with the bank’s general lending standards.

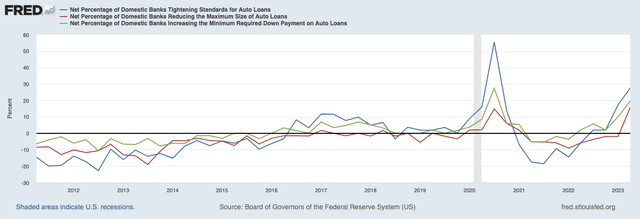

As mortgage rates have also risen, the amount of total monthly debt people owes on a higher-rate financed property, or higher interest charges on credit cards, can also impair people’s ability to finance a car at all. If the debt-to-income ratio is too high, banks are generally unwilling to finance. But perhaps more importantly in the current environment, any undue pressure on banks in general could curtail their willingness to expand their portfolio of auto loans. And with multiple banks like First Republic Bank (OTCPK:FRCB) and SVB Financial Group (OTC:SIVBQ) going bankrupt six ways to Sunday, banks are tightening credit for auto loans significantly. Here’s what Elon Musk had to say about this:

As interest rates increase, and credit tightens, like it’s safe to say that these various banks that have died are probably somewhat distracted from handing out auto loans. If you’re on the way to the cemetery, increasing their auto loan portfolio is not the first thing on their mind.

And when you couple this with data recently released by the Federal Reserve, it does become very clear that banks are tightening their lending standards loan size portfolio for auto loans tremendously, the strictest in recent history, with the exception being 2020.

Demand Is A Concern

Another risk we evaluate is Tesla’s ambiguity when it comes to pricing. In 2021, at a time when cars were in short-supply and trading well above MSRP, Tesla could exert tremendous leverage and continually raise prices.

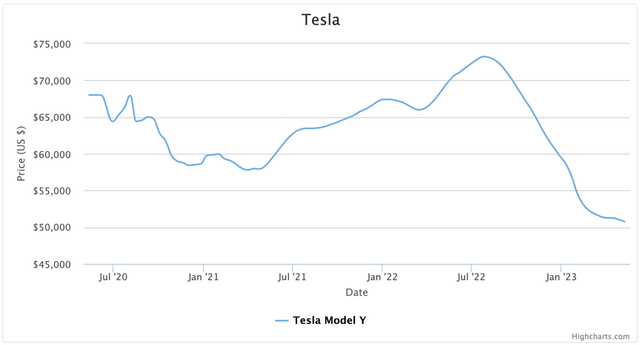

We can also see this in Tesla’s used car price data, which saw a huge increase in 2021 and recently collapsed, along with Tesla’s gross margins. In Q1 2022, Tesla reached record gross margins of 29.1%, and it is right now standing at 19.3% in Q1. Even if we take Model Y, for example, the price decline in Q2 continued, with little improvement in sight.

It is also important to note that Tesla first cut prices sharply in the middle of the first quarter, and so we most likely have not yet seen a spike in margin pressure, as we should see the full effect of the price cuts in the second quarter. And that’s without taking into account further price declines in the coming month. Used car prices for Model Y went from $73,241 at the peak to $50,302 now, which is a huge change of -31.32%.

Elon Musk also seemed rather reluctant to talk about demand during the Q1 call, telling investors mainly that:

I think the overall thing we can say is that orders are in excess of production. (Q1 Earnings Call.)

Which is perhaps a bit of a cop-out, as orders are likely to be in excess of production if Tesla merely keeps cutting prices. It also seems that Elon is fully prepared to cut prices, which may affect margins in order to still meet volume targets and monetize the fleet with FSD Beta later on, which we think is a risky strategy to say the least:

We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin. However, we expect our vehicles, over time, will be able to generate significant profit through autonomy. So we do believe we’re like laying the groundwork here, and then it’s better to ship a large number of cars at a lower margin, and subsequently, harvest that margin in the future as we perfect autonomy.

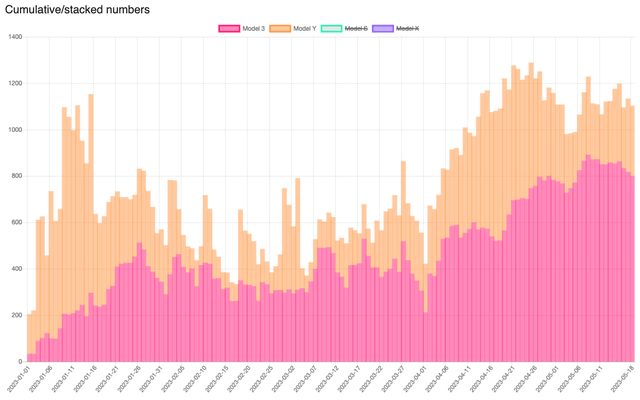

If we actually start looking at the inventory for hints of future potential price cuts, the stock on some models seems to be high in certain regions. Especially in Europe, where the Model Y is especially in high inventory, and the Model 3 which has also seen inventory growth in the United States.

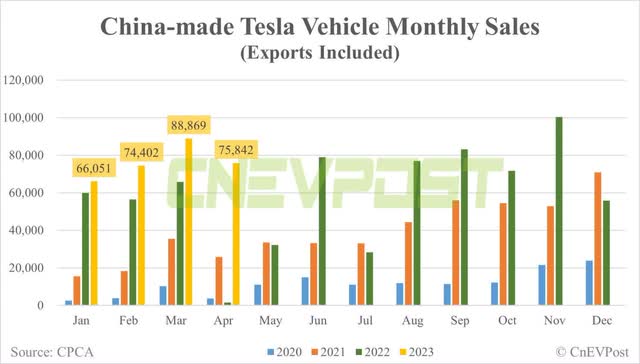

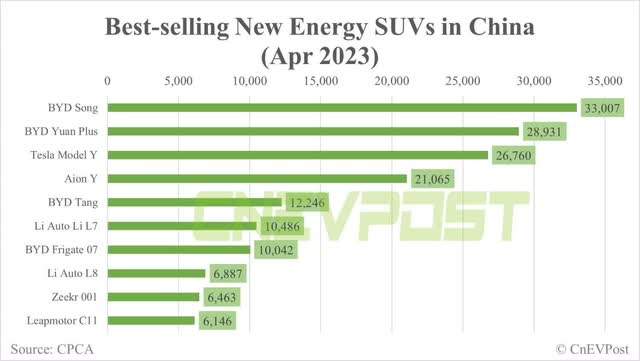

In China, deliveries and production do seem to be going according to plan and are arguably in line with expectations, although they lag a bit behind BYD in the month of April.

Tesla cut prices in China mainly late last year/first quarter of this year, and has kept prices strong since then, which means we expect less impact in terms of margins for China for the second quarter unless prices get cut again. For example, the standard Model Y currently sells in China for just RMB 263,900, or $37,592.

Overall, Tesla is not the only one with big ambitions to capture the EV car market in China, as BYD has set a goal of selling 3.6 million EVs and PHEVs by 2023.

The Macro Storm

And so, in terms of what the next 12 months look like, we think there are immense macroeconomic risks ahead for Tesla. Elon Musk believes that, too, as he has hinted on Twitter and in a recent interview with CNBC, in which he indicated that the Fed is operating with “too much latency.”

This is evidenced by the spread between 10-year and 3-month interest rates, which is now over -166 bp, more than in 2008 and the most since the 1980s. This essentially screams that there are short- to medium-term economic problems ahead.

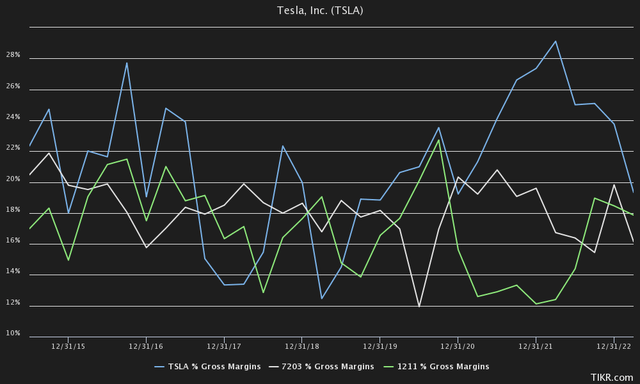

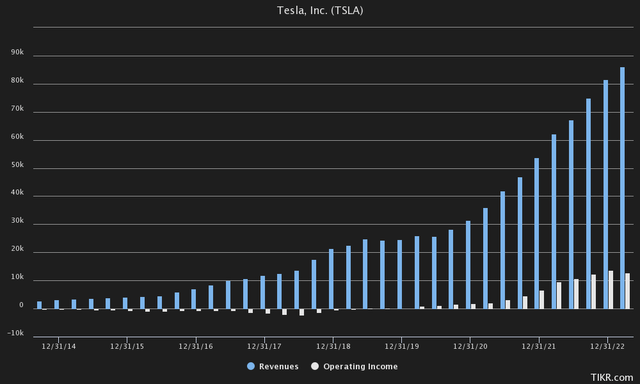

Tesla is expected by Elon Musk himself and Wall Street to achieve $100.27 billion in revenue for fiscal year 2023. Tesla’s gross margins have historically been relatively close to those of Toyota Motor Corporation (TM) & BYD Company Limited (OTCPK:BYDDF) until 2021, when Tesla’s gross margins varied widely.

However, these gross margins have currently returned to average, and one may wonder if this was just temporary pricing power rather than permanent. We believe this may be due to extremely favorable macroeconomic conditions combined with little competition on the EV front and less supply chain disruption due to Tesla’s high vertical integration.

Regardless, we stand by our conclusion that we think gross margins in Q2 and probably in FY2023 will be lower than Q1 figures, because prices were not significantly reduced until midway through Q1 and smaller reductions occurred in Q2.

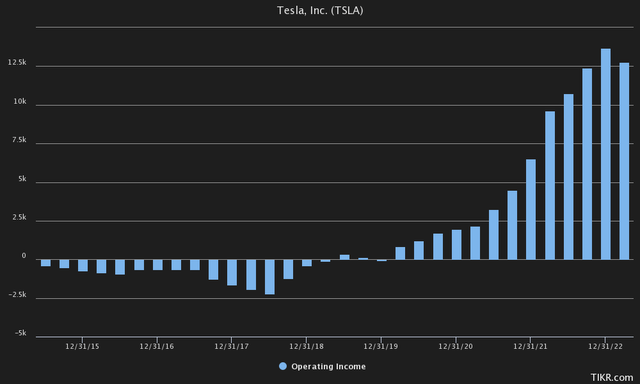

Keeping with Q1 margins, and taking into account a gross margin of about 19%, we think Tesla will bring in $19 billion in gross revenue. Operating expenses, despite the scale-up, have remained flat at about $1.85 billion per quarter, and we think that will continue. In other words, we think operating income for fiscal year 2023 is expected to be about $11.60 billion. This would be in line with the 12-month operating income trend, which has recently remained flat.

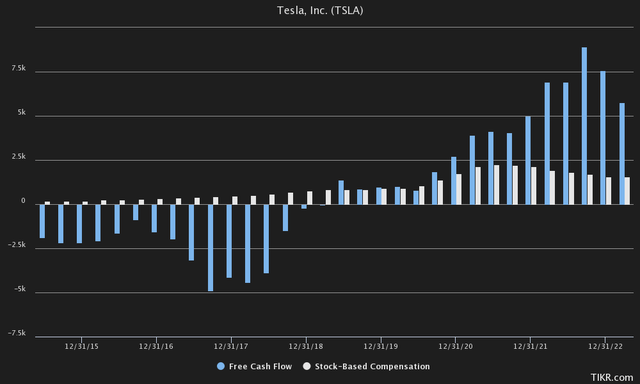

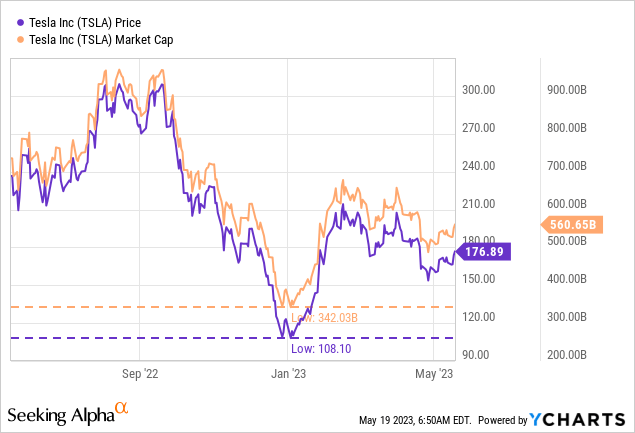

This trend, perhaps worryingly, is also evident based on free cash flow. Over the past 12 months, free cash flow was $5.78 billion (CFO-CapEx). However, if we were to measure actual profitability and take into account stock-based compensation, we would be left with about $4.22 billion on a TTM basis. This contrasts with the $560.65BN market capitalization, so downside risk protection is questionable at 132x Adjusted FCF (TTM).

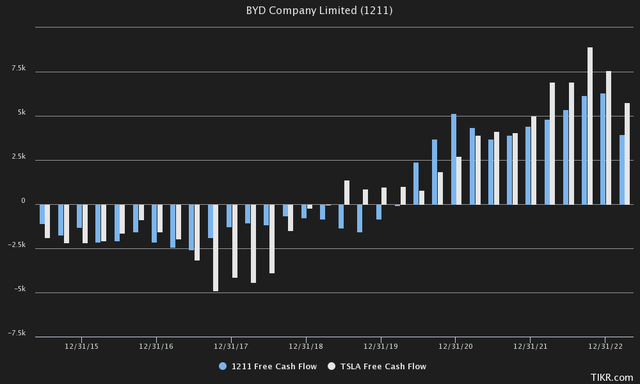

Tesla’s Chinese counterpart, BYD for example, also got hit in terms of Free Cash Flow (“FCF”) recently, but still brought in $3.93BN worth of FCF despite headwinds on a TTM basis. Unlike Tesla, however, it is currently valued at $101.19BN or 25.75x TTM Free Cash Flow. At BYD’s valuation, Tesla would be trading at a $148.83BN market cap, not even adjusting for stock-based compensation.

Even if we try to make the valuation work from an EBIT perspective, we don’t see how Tesla would now trade well below intrinsic value. As we said earlier, we think operating income comes out to $11.60 billion for FY2023.

From a top-line perspective, as we also indicated earlier, it is expected to come out somewhere at $100BN, or a 23% increase for 2023. Wall Street Estimates expect 29.21% growth for 2024, and revenue growth in the years after that will also slow to low double digits. If we give Tesla the benefit of the doubt, at a PEG ratio of 1, or a ratio of 30x Operating Income at 30% growth, we would arrive at a market cap of $348BN.

That would be closer to the bottom from early this year, around $110. At the current $560.65BN market cap and a P/FCF multiple of 20x, we expect Tesla to have to put in 28.03BN of FCF on an annualized basis, which is a far cry from its current $5.78BN of TTM FCF.

The main problem, we currently have with Tesla is that it seems the company is increasing the number of cars at the expense of margin. To what extent this is due to macroeconomic pressures, competition, or market saturation in general may be a bit too early to guess. It seems to us that a next-generation platform is indeed needed at a lower MSRP to sell both volume and margin, but there is currently renewed speculation about what the margins will be.

Even if we were to ignore the $5.78BN of FCF on a TTM basis, and take the highest FCF generated by Tesla on a TTM basis, which was $8.91BN last year at a 30x P/FCF multiple, we would only end up with $267.3BN or $84.32 per share.

The Ace Of Spades

Finally, just because we think bottom-line performance is unlikely to be driven by hardware sales does not mean Elon Musk cannot have a couple of aces up his sleeves.

Tesla FSD could potentially unlock an immense amount of value if their fleet could be deployed as a robotaxi fleet. Tesla’s FSD is getting close to perfection, although “close enough” is not nearly enough when it comes to self-driving. And it remains to be seen when/if they would actually be allowed to deploy their FSD full scale, only using cameras as Elon Musk himself would like. Needless to say, it won’t be there tomorrow, or maybe even in the next few years. Other competitors such as Waymo of Alphabet Inc. (GOOG, GOOGL) and Cruise of General Motors (GM), are already active, although they use other equipment such as Radar/ Lidar, sensors and pre-mapped locations.

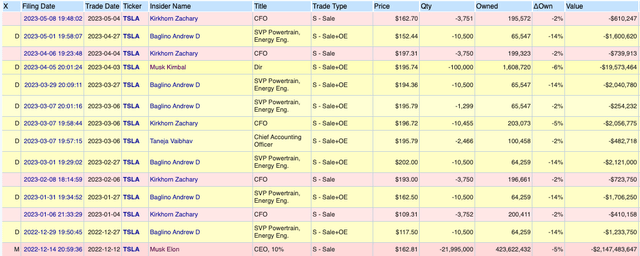

There are also opportunities such as using this data collected through FSD and applying their AI with their Optimus robot, which could create an incredible future mass-market product, although it won’t be there tomorrow, either. The same goes for the application of their AI expertise for generative AI and other software products. We think it’s too much speculation for now. Insiders have not been shy about selling lately, either: Elon’s brother Kimbal exercised options and also sold $19.5M worth of shares.

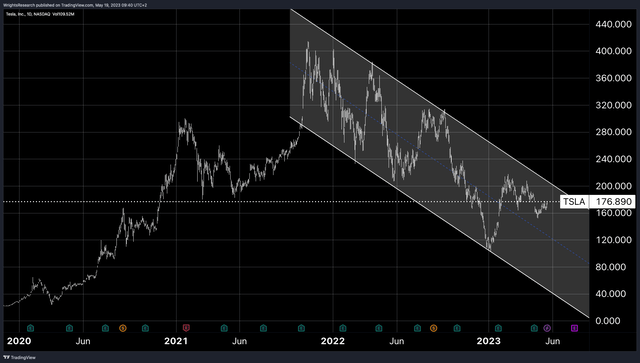

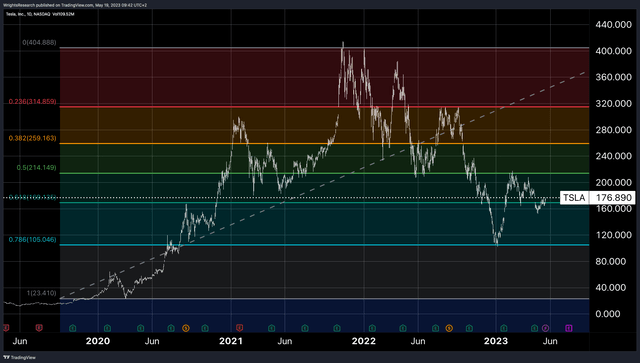

Technically, everything also seems to point in the direction of downward movement. We currently see Tesla trading in a downward channel, heading towards the previous lows from earlier this year around $100.

Tradingview, Wright’s Research

Also on a Fibonacci retracement, it appears that the stock hit the lower limit of the trading range earlier this year at about $105, and rebounded strongly from this support level and was rejected at the upper limit of the 50% level at $214. Our technical analysis in line with the fundamentals and macroeconomic view leads us to believe that Tesla is likely headed for its 2023 lows, and could perhaps be considered a buy at such levels.

Tradingview, Wright’s Research

The Bottom Line

While Tesla offers very bright future prospects in automation, AI and robotics, given the fundamental and macroeconomic outlook, it remains too speculative for us to touch.

Margins have plummeted, prices have been cut, and banks are tightening credit en masse. Therefore, we think Tesla is heading into the perfect storm in the second quarter. Until Tesla, Inc. again shows margin improvements while increasing sales, or trades at lower multiples closer to its industry peers, we keep our “hold” rating, as we think Tesla’s fair value/ intrinsic value is closer to its previous lows at $100.

Other companies such as BYD, which is extremely similar in terms of free cash flow and growth rates, are trading at less than 1/5 of Tesla’s current market capitalization. The next 12 months will be very difficult for Tesla, Inc., and Elon Musk has not been shy about announcing this to shareholders. Yet the stock is up more than 42% YTD, which does not reflect this sentiment. As Elon Musk said at the annual shareholder meeting:

This is going to be a challenging 12 months, I sort of want to be realistic about it that Tesla is not immune to the global economic environment. I expect things to be just at a macroeconomic level difficult for at least the next 12 months. Like, Tesla will get through it, and we’ll do well and I think we’ll see a lot of companies go bankrupt. I want to make sure this is not just the “good news parade.”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.