Summary:

- Lucid dip buyers returned to defend the slide in its stock, even though the company posted a weak Q1 and issued disappointing guidance.

- Therefore, sellers have been unable to force a steeper decline in LCID. However, investors must be careful when considering buying the dips here.

- Lucid’s dwindling liquidity balance suggests additional funding could be necessary if its execution remains poor. Also, macro and competitive headwinds are not entirely in its control.

- With revised production guidance of just 10K, downgraded from a 12K midpoint previously, investors must be frustrated that the company keeps underperforming.

- Avoiding LCID at the current levels could save investors from more pain later.

hapabapa

Lucid Group (NASDAQ:LCID) investors appear unfazed by the company’s weak Q1 earnings release in early May, as LCID remains in a consolidation range. As such, short-sellers who reloaded their bets at the end of April have not made much progress in forcing a lower low in LCID’s price action, as dip buyers held the defense line robustly.

Furthermore, management issued disappointing production guidance, pointing to just 10K in its revised full-year outlook, down from the 12K midpoint guidance at the end of 2022.

However, Lucid produced just 2,314 vehicles in Q1. Therefore, I think it’s a prudent move by management to reduce their projections to avoid further disappointment for investors. Notably, an investor on the call aptly pointed out to management, highlighting, “When will [investors] see under-promising and over-delivering? It has been the complete opposite so far.”

As such, I believe Lucid has likely lowered its near-term optimism, as management attributed its poor performance to macroeconomic headwinds worsened by the elevated interest rates.

However, time is running out for Lucid, as management stressed that it estimates sufficient liquidity of $4.1B through “at least the second quarter of 2024.” However, the cash burn in Q1 was much worse than expected, leading analysts to pencil in worse negative free cash flow or FCF estimates for FY23.

Accordingly, Lucid posted $3.4B in cash and equivalents in Q1, down $1B from FQ4. As such, Lucid is burning through more cash than the annualized $3B metric that analysts projected previously. As such, the revised estimates lifted Lucid’s cash burn to $4.3B for FY23, $1.3B more than previous projections.

Therefore, Lucid investors would likely need to bank on the support of the company’s cornerstone investor; Saudi Arabia PIF, for additional funding if its execution in H2 remains subpar.

Management is placing the weight of its execution in the second half as it prepares to ramp production for Lucid Air Pure while “expanding globally and planning to launch the Gravity SUV in 2024.”

As such, I assessed that investors buying the dips now must be confident of its growth inflection in H2. Management accentuated that “Q3 production and delivery numbers will depend on the ramp-up of Pure. CFO Sherry House also reminded investors that the company expects Q4 to be “the largest quarter” of the year.

I assessed that Lucid’s guidance suggests that investors should not expect a blockbuster Q2, as macro headwinds continue to be challenging. In addition, I discussed in a recent Rivian (RIVN) article, highlighting why Tesla’s backlog and inventory levels have underperformed.

Meanwhile, even BYD (OTCPK:BYDDF) resorted to more price cuts recently, likely responding to the effects of Tesla’s (TSLA) dynamic pricing strategies to defend its turf and gain share. Therefore, I expect EV upstarts like Lucid to continue struggling, as the company still needs to convince investors to buy expensive cars.

Lucid has likely reacted to Tesla’s significant price cuts as its ASP for Q1 fell to $106K, down from $133K in Q4. However, Lucid doesn’t have the volume or margins to engage in a debilitating price war with Tesla, further crimping its ability to execute well in the second half.

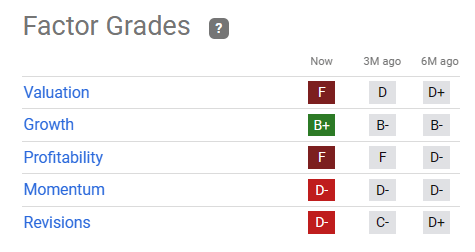

LCID quant factor ratings (Seeking Alpha)

Seeking Alpha Quant rated LCID’s valuation with an “F” grade, the worst possible. In addition, I noted that analysts downgraded their expectations for the company. Still, sellers couldn’t push a steeper decline in LCID over the past four weeks since its horrid deliveries card.

Hence, buyers sustaining LCID at the current levels are likely anticipating that Lucid could execute well in the second half.

However, I urge investors to consider Lucid’s ability to compete carefully. Macro headwinds affecting Lucid’s ability to ramp production are likely not in the company’s control. Moreover, competitive challenges and macro issues are some of the worst combos a fledgling EV maker could face, despite trying to achieve a production slate of just 10K for 2023.

With competition intensifying with the legacy OEMs, Lucid’s dwindling liquidity balance, and an expensive car that has yet to gain sustainable traction with consumers, Lucid has its work cut out for it.

For me, I wouldn’t even touch it with a ten-foot pole at the current levels.

Rating: Hold (Reiterated). See additional disclosure below for important notes accompanying the thesis presented.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!