Summary:

- PYPL’s execution has been stellar thus far, especially given the diversification toward Braintree.

- The payment API connects most digital wallet players, including Apple Pay and Samsung Pay, to e-commerce platforms, allowing Braintree to be one of the backbones of digital payments.

- As more adopts digital wallets, the fintech may further grow its unbranded Total Payment Volume [TPV] and consequently its top and bottom line in the long term.

- Therefore, investors must not be taken in by the myopia surrounding the lower FQ2’23 guidance and Credit Suisse analyst downgrade since PYPL continues to guide exemplary FY2023 numbers.

- Combined with the guided expansion in operating margins, PYPL is only temporarily battered by the negative market sentiments and peak recessionary fears.

Motortion/iStock via Getty Images

The PYPL Investment Thesis Looks Even More Attractive At These Depressed Levels

PYPL 1Y Stock Price

As a fellow investor in PayPal Holdings (NASDAQ:PYPL), it pains us to see the stock sink as low as it has at the time of writing. For now, it has already drastically plunged to its September 2017 lows, creating a new bottom never seen in the past six years.

And all of the carnage is only caused by two unreasonable factors.

First, PYPL guides a softer FQ2’23 adj EPS of $1.16 at the midpoint against the consensus estimate of $1.17, inline QoQ and only missing by a mere -$0.01, despite the impressive expansion by +24.7% YoY.

We must also remind investors that the fintech has raised its FY2023 guidance to adj. EPS of $4.95, against the consensus estimate of $4.89, implying an excellent growth of +19.8% YoY. Clearly, its stellar performance has been temporarily overshadowed by the peak recessionary fears, suggesting that the pessimism has been overdone.

Secondly, the PYPL stock is downgraded by Timothy Chiodo, an analyst from Credit Suisse (NYSE:CS). While we will not delve into much detail, with the recent banking meltdown resulting in the latter’s sale to UBS Group (NYSE:UBS) for a mere $3.25B against the Enterprise Value of $31.96B as of May 16, 2023, we prefer taking the analyst’s opinion with a healthy grain of salt.

We agree that PYPL may face intense competition ahead in the fintech market, with many Big Tech companies offering alternative payment platforms, such as Apple Pay (NASDAQ:AAPL), Samsung Pay (OTCPK:SSNLF), Google Pay (NASDAQ:GOOG) (NASDAQ:GOOGL), and Amazon Pay (NASDAQ:AMZN).

This is on top of those offered by legacy players such as Visa (NYSE:V) and Mastercard (NYSE:MA), as with up-and-coming fintech such as Block (NYSE:SQ) and SoFi (NASDAQ:SOFI). The big US banks are not to be left out as well, with JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC), and Bank of America (NYSE:BAC) reportedly releasing a joint digital wallet venture by the end of 2023.

Nonetheless, we suppose this is why PYPL has diversified its payment platform to include Braintree (acquired in 2013), a point that has been previously discussed in our article here.

Most importantly, PYPL went one step ahead of the game by powering most of the payment methods discussed above, aside from those offered by SQ, SOFI, and Amazon Pay, through the Braintree API, as a service provider in select regions, with more global expansion already underway. That is a strategic plan indeed, since the fintech may emerge as one of the backbones for most digital wallets and e-commerce payment platforms ahead.

This cadence demonstrates how PYPL seeks to evolve beyond its early mover advantage in the currently crowded digital wallet space, in our view. In a way, the more consumers and Big Tech companies adopt digital wallets, the more the fintech may grow its unbranded Total Payment Volume [TPV] and consequently, its top and bottom lines in the long term. Impressive plan indeed.

For now, Braintree is already gaining immense traction, with the unbranded TPV growth accelerating by +30% YoY FXN to an unspecified sum by the latest quarter, likely increasing from the $400B reported for FY2022 (+33% YoY). Its total transaction revenue also grew to $6.4B, expanding by +6% YoY, “driven primarily by its unbranded processing volume.”

While transaction expenses have also grown, attributed to the unbranded TPVs, PYPL investors need not fret yet, since its transaction margins remain highly profitable at 47.1% in FQ1’23 (-3.8 YoY). Combined with the consistent optimization in its operating expenses to $1.66B (-10.7% QoQ/ -17.4% YoY) at the same time, the fintech reports an expanding GAAP operating margin of 14.2% (-2 points QoQ/ +3.5 YoY).

Therefore, we believe the acceleration in the unbranded TPVs remains a net positive for the fintech, especially due to the exemplary Free Cash Flow [FCF] generation of $1B (inline QoQ and YoY) in the latest quarter.

Combined with the stellar guidance of expanding operating margin by “at least 100 basis points in 2023,” speculatively to 14.8%, the carnage in PYPL’s stock prices continues to puzzle us, likely attributed to the myopia surrounding its digital wallet segment.

Then again, as a result of these depressed levels, PYPL looks extremely attractive for a company that continues to expand its top and bottom line growth, despite the uncertain macroeconomic outlook.

In addition, despite the downgrade by Chiodo, market analysts continue to project an excellent top and adj. bottom line CAGR of 8.7% and 15.8% through 2025, against those reported at 15.7%/ 10% during the hyper-pandemic period.

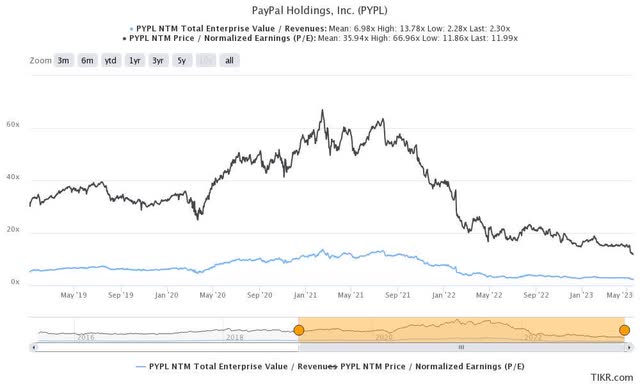

PYPL 5Y EV/Revenue and P/E Valuations

Despite these optimistic projections, the PYPL stock remains undervalued compared to its historical cadence as well, trading at an EV/NTM Revenue of 2.30x and NTM P/E of 11.99x, lower than its 5Y mean of 6.78x and 35.57x, respectively, and 1Y mean of 3.17x and 17.95x, respectively.

Therefore, we continue to rate the PYPL stock as a Buy here, allowing long-term investors to dollar cost average at a highly attractive level. We remain optimistic about its eventual recovery, similar to the one we have seen with Meta Platforms, Inc. (NASDAQ:META) at +162.9% since its bottom in November 2022.

Do not miss this dip!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, AAPL, GOOG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.