Summary:

- During the first quarter of 2023, UnitedHealth Group generated an impressive $16.3 billion in operating cash flow, which was a significant improvement from the end of 2022.

- In the first quarter of 2023, Optum generated over $54 billion in revenue for UNH, representing a 25% YoY increase from 1Q 2022.

- With free cash flow of $15.5 billion, UNH is well-positioned to pursue further investment activities in the future, while also increasing its payout ratio from its current level of 28.75%.

- On average, UNH generated an operating margin of 8.86% during the last five years. This is a promising indication that UNH has created value for its shareholders in recent years.

FreshSplash

Introduction

UnitedHealth Group (NYSE:UNH) is a leading healthcare company that operates through two complementary business platforms: Optum and UnitedHealthcare. Optum leverages technology and data analysis to drive better health outcomes, which has become increasingly important in the wake of the pandemic and quarantine measures. Optum is comprised of three segments – Optum Health, Optum Insights, and Optum Rx – that work together to improve the overall health system. The other segment of UNH is UnitedHealthcare, which offers a range of health benefits. After conducting a thorough analysis of UNH’s business and financial structures, I have concluded that the stock’s strong performance warrants a buy rating.

UNH business and financial outlook

UNH utilizes complex data analysis across its various segments, leveraging technology to make more accurate predictions and provide individuals with the necessary guidance and tools to address health challenges. Optum, in particular, combines clinical expertise with data and technology to serve a wide range of healthcare markets, including care recipients and healthcare providers. In the first quarter of 2023, Optum generated over $54 billion in revenue for UNH, representing a 25% YoY increase from 1Q 2022. Optum Rx, responsible for providing pharmacy care services through a network of over 67,000 retail pharmacies, generated the highest portion of Optum’s revenue at $27.4 billion. However, I am most optimistic about the growth and profitability potential of Optum Insights. In 1Q 2023, this segment’s revenue increased by approximately 40% YoY compared to the same period in 2022. This growth highlights the critical role of technology and data analysis in the healthcare industry. By connecting healthcare systems with advanced analytics and platforms, Optum Insights can help hospital systems, public entities, life sciences companies and other participants in the healthcare industry improve their performance while reducing costs. As with other software and technology companies, delivering Optum Insight’s software and information products requires extended periods of time; however, this segment’s contribution to UNH’s profits is expected to increase significantly in the future.

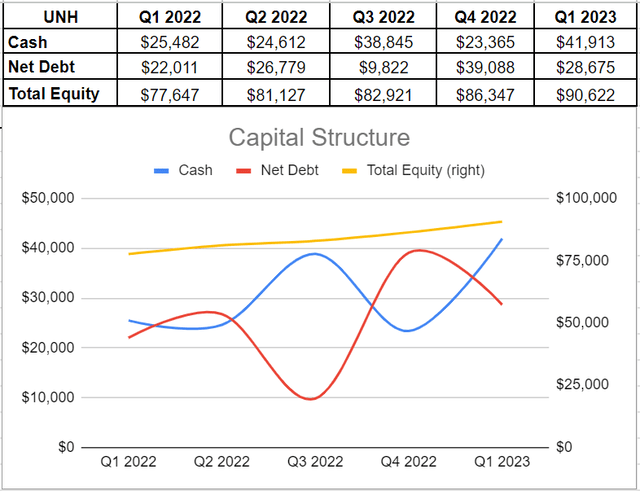

Overall, UNH’s capital structure indicates strong performance over the past year. Although there was a decline in cash balance to $23.3 billion in the last quarter of 2022 from $38.8 billion in 3Q 2022, the company was able to increase its cash balance back up to around $42 billion in 1Q 2023, thanks to higher cash generation. Additionally, UNH reduced its debt levels by 13% in the first quarter compared to the end of 2022, resulting in a 26% decrease in net debt levels to $28.6 billion. While this level is still higher than most previous quarters, UNH’s net debt level is below the company’s cash and total equity levels. In fact, UNH’s total equity increased significantly throughout 2022 and reached over $90 billion in 1Q 2023 (see Figure 1).

Figure 1 – UNH’s capital structure (in millions)

Author

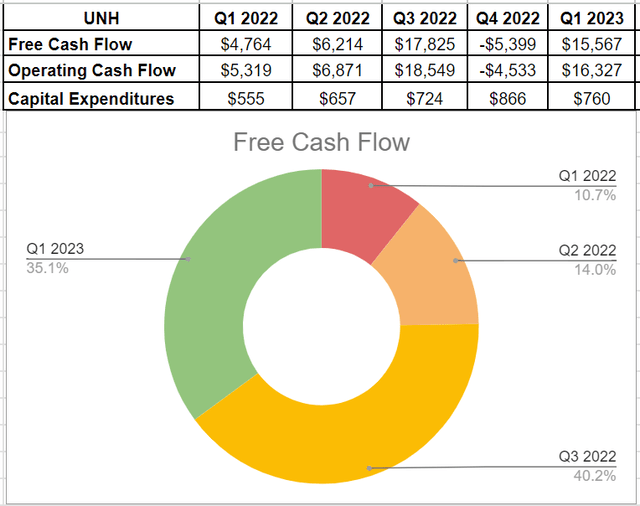

During the first quarter of 2023, UNH generated an impressive $16.3 billion in operating cash flow, which was a significant improvement from the end of 2022 and the first quarter of 2022, where they had $(4.5) billion and $5.3 billion, respectively. It’s important to note that the company’s low cash levels at the end of 2022 were due to their investment of approximately $21.5 billion on acquisitions during that year. In 1Q 2023, the operating cash flow coupled with $760 million in capital expenditures resulted in over $15.5 billion of free cash flow. Over the last five consecutive quarters, UNH has consistently generated high levels of free cash flow, with 1Q 2023 being no exception, except for 3Q 2022 when they generated $17.8 billion. Out of this FCF, over $3.5 billion was allocated towards shareholders’ returns – $1.5 billion for dividend payments and $2 billion for share buybacks. With such a healthy amount of free cash flow available, UNH is well-positioned to pursue further investment activities and share buybacks in the future while also increasing its payout ratio from its current level of 28.75% (see Figure 2).

Figure 2 – UNH’s free cash flow (in millions)

Author

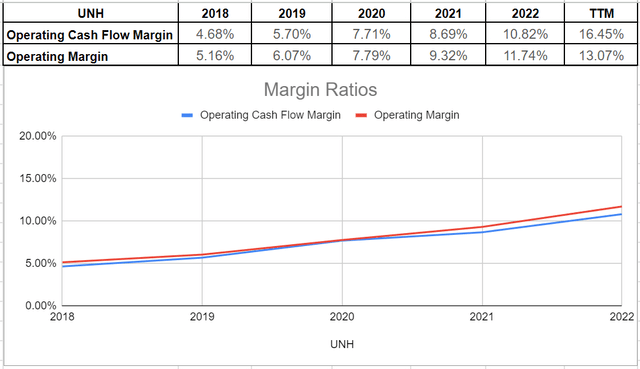

After a thorough analysis of UNH’s robust cash and capital structures, it is not surprising to observe an upward trend in the company’s margin ratios. Since 2018, UNH has had an average operating cash flow margin of 9%, which has since increased to a TTM amount of 16.4%, the highest level seen in consecutive years. This profitability ratio indicates that UNH has been highly successful in converting its revenue into cash. Furthermore, the company’s operating margin reached its five-year peak at 11.7% in 2022 and surged to over 13% in TTM. On average, UNH generated an operating margin of 8.86% during the last five years, meaning that approximately 9% of revenue remained after deducting all expenses. This is a promising indication that UNH has created value for its shareholders in recent years and faces fewer financial risks as a result (see Figure 3).

Figure 3 – UNH’s margin ratios

Author

Risk

UNH, like any other businesses, is facing industry and business-related risks that must be carefully considered. One of the most critical risks is related to the technology and data analysis segment of the company, which plays a vital role in generating potential profits. If UNH fails to maintain data integrity or upgrade and expand its information systems efficiency, it may experience failures in the healthcare industry, resulting in lost customers and difficulties in determining medical estimations. This risk can have a significant adverse impact on UNH’s profitability and operations since the volume of healthcare data records is expanding rapidly, requiring rapid and innovative technologies and services to remain efficient. Additionally, UNH is always at risk of cyber-attacks or other data security incidents that could result in losing personal information or data security breaches. Such incidents could lead to revenue loss and increased costs for the company. Another risk associated with UNH’s operations is its reliance on sustained relationships with healthcare payers, hospitals, pharmacies, and other service providers. Failure to continue contracting or engaging in activities that lead to higher costs may adversely affect the company’s operations and cash generation. Therefore, it is essential for UnitedHealth Group to carefully manage these relationships while also seeking new partnerships to mitigate this risk.

Conclusion

UnitedHealth Group has shown consistent financial improvement in recent years, with investments in technology and data analysis through its Optum segments providing further optimism for the company’s future. The company’s increasing margin ratios demonstrate its ability to convert revenue into profit and manage potential financial risks. Additionally, UnitedHealth Group’s significant free cash flow, following a $3.5 billion payment to shareholders in Q1 2023, suggests potential for an increase in their current 28.75% payout ratio. Overall, considering these factors, I believe a buy rating is appropriate for UNH stock.

Please share your thoughts on this assessment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.