Summary:

- Roku investors have failed to sustain recent earnings optimism as sellers returned to haunt ROKU’s holders.

- Roku’s market leadership has not translated into sustainable economics. With the streaming competition heating up, Roku will find it increasingly tougher to remain profitable.

- ROKU is also at a critical juncture. If buyers fail to turn up and support the current levels, investors will likely need to be prepared for more pain.

Justin Sullivan

Roku, Inc. (NASDAQ:ROKU) investors continue to endure a steep slide in ROKU since its early April highs, as the optimism over its recovery fizzled out. Dip buyers returned in early May after Roku posted pretty decent results for its first-quarter earnings. However, the buyers could not maintain their momentum as selling pressure intensified.

I noted ROKU’s price action suggests the stock is at a critical moment. Buyers must return in force to bolster buying sentiments and force a bear trap or false downside breakdown, or holders will likely need to brace for more pain ahead.

Why are investors still so bearish on ROKU since Netflix (NFLX) stock bottomed out in July 2022, which we highlighted? NFLX has outperformed ROKU significantly since its highly pessimistic May to July 2022 levels. Does it make sense?

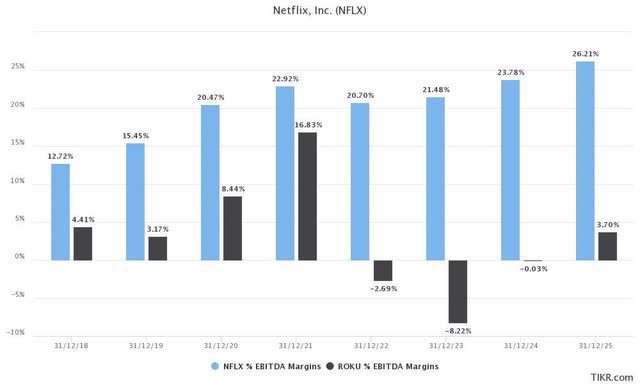

Netflix and Roku adjusted EBITDA margins consensus estimates (TIKR)

As seen above, Netflix has proved its competitive edge as the global streaming (SVOD) leader, with robust adjusted EBITDA margins in FY22, even though competition intensified. Therefore, I assessed that Netflix had proved the sustainability of its business model against its arch-rivals, including Disney (DIS), Warner Bros. Discovery (WBD), Comcast (CMCSA), and Paramount (PARA). Therefore, the legacy players face significant challenges trying to unseat Netflix’s leadership while posting mounting streaming losses.

As for Roku, while it rode the pandemic-driven wave as the streaming OS leader, it couldn’t sustain its profitability growth. As seen above, revised Wall Street estimates expect Roku’s adjusted EBITDA losses to bottom out this year, in line with management’s guidance.

Accordingly, Roku expects to achieve adjusted EBITDA profitability in 2024. However, investors shouldn’t forget that Roku was profitable previously. But, as competition intensified and macro headwinds on ad spending worsened, Roku’s business model was put to the test but performed poorly.

Therefore, I concur with Morningstar’s assessment of Roku as a no-moat business (subscription needed), even though some bulls could argue that it at least has a narrow moat, given its network effect.

Roku’s strategy of focusing on monetization is predicated on its active accounts growth, which increased by 17% YoY and above FQ4’22’s 70M accounts. However, despite its so-called market leadership, Roku’s profitability is mediocre at best. So investors need to ask themselves, which dominant market leader doesn’t have leading profitability metrics through the up and down cycle?

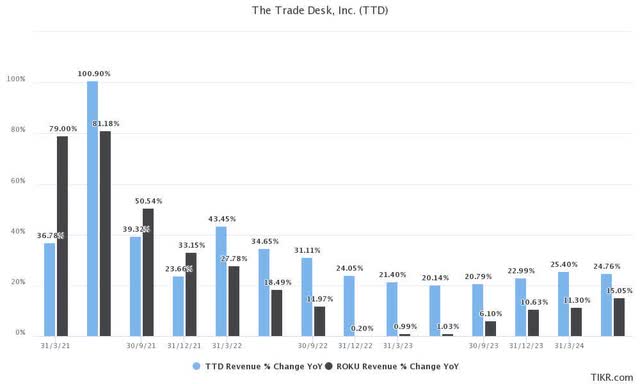

The Trade Desk and Roku revenue growth consensus estimates (TIKR)

Moreover, while Roku has failed to sustain its top-line growth through the cycle, The Trade Desk’s (TTD) leadership as the independent demand-side platform or DSP provided its worth.

As seen above, TTD’s value proposition in the programmatic space has helped it achieve robust revenue growth through the ad market downcycle much better than Roku.

Roku’s reliance on the scatter market has suffered, while it’s questionable how effective OneView has helped the company in the DSP space. Therefore, it’s assuring to hear that the company is working with third-party DSPs to generate incremental demand and broaden its reach further. Therefore, Roku’s leadership in the streaming OS space has failed to translate into sustainable economics compared to Netflix in the SVOD space and TTD as the independent DSP leader.

With Netflix expected to gain more ground as it expands its AVOD offering, it’s important to note that the streaming leader is competing against its peers from a position of strength.

In addition, with Disney expected to merge Hulu with Disney+, it’s expected to improve the appeal of Hulu, as it’s still ahead of Roku in terms of ad revenue and also led the upfront streaming spend in a recent survey. As such, I think Roku’s competitive dynamics will likely intensify. With Roku’s unprofitable platform, despite its market leadership, I assessed that it could struggle to cope with the rapidly changing market dynamics in the AVOD space.

Also, with four “D” variant grades in Seeking Alpha Quant rating, I see significant challenges in expecting Roku buyers to return confidently in the near term to stanch the recent slide.

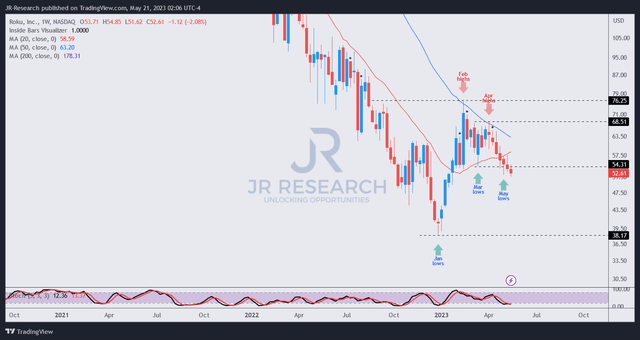

ROKU price chart (weekly) (TradingView)

ROKU dip buyers have not defended the recent re-test of its March lows, even though they could still return in the following weeks.

I assessed that ROKU is at a critical juncture and remains in a downtrend, resisted by the $70 level. Hence, speculative investors might find an opportunity for a mean-reversion set-up to that level if a bullish reversal price action follows subsequently.

However, failing which, ROKU holders likely need to anticipate more pain as buyers fail to hold, with the gap between $38 and $54 as the next possible drop zone. Where would ROKU drop to within the zone? If you cannot stomach volatility, it’s better not to try and avoid it for now.

Rating: Hold (Reiterated). See additional disclosure below for important notes accompanying the thesis presented.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!