Summary:

- 18 months ago, it was fairly obvious PayPal stock was a sell. Now that the price has dropped significantly, the stock is getting more interesting.

- Analysts have proven unreliable in their earnings predictions over the past two years and are likely to be wrong again over the next 24 months.

- A potential coming recession may also put pressure on PayPal’s earnings. Investors will have to decide for themselves what basic assumptions to make regarding earnings.

- This article shares the factors I’m considering, and why I’m continuing to be patient before buying the stock.

chameleonseye

Introduction

The format of his article is going to deviate a little bit from my typical valuation format where I explain my valuation process and the price I would be willing to buy or sell a stock. I’ve already written a few articles that explain this process for PayPal (NASDAQ:PYPL) stock, and I will link to those if there are readers who wish to dig deeper into how I arrive at my buy prices. With some well-established businesses that have a long public history, about 80% of the valuation process (if it is a good process) is essentially a math problem, particularly if the process is historically based as mine usually is. Essentially, I look at what the business has been able to do in the past, and then extrapolate that out into the future, making small adjustments if needed.

But with other stocks that have a shorter history, like PayPal, the biggest determinant of making a roughly accurate medium-term return estimate are the assumptions one starts with at the outset. In my previous articles, I’ve tended to give PayPal the benefit of the doubt in terms of extending its relatively short earnings history into the future. Part of that choice was because PayPal has actually been around for a long time as part of eBay (EBAY) before being spun off. But another part of that choice was that I knew I was publishing mostly bearish videos and articles on PayPal, and when I know I’m going to be pretty bearish ahead of time, I typically try to give the stock and the business the benefit of the doubt in terms of what they might be able to accomplish with their future earnings. In contrast, when I get ready to buy a stock, I reverse that to some extent and try to consider more bearish assumptions in case there is something I’ve been missing so I have a margin of safety. This article will try to frame what I think are the most important issues for investors to think about while deciding whether to buy PayPal stock or not in the near future.

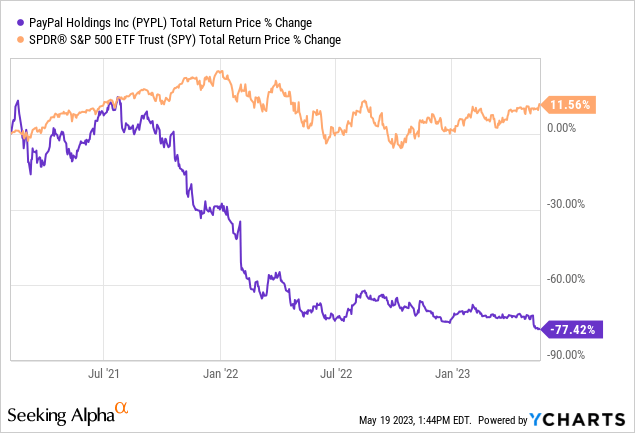

I always like to start my articles by reviewing any relevant previous coverage I’ve shared on a stock. I do this because usually I write what are essentially valuation articles and I don’t often spend time telling stories, so I try to let my previous articles speak for themselves (even if I’ve been wrong). On February 6th, 2021 I performed a valuation analysis of PayPal stock for my YouTube channel titled “It’s Time To Take Profits In PayPal”. In that video, I explained why PayPal stock was extremely overvalued and why investors should take profits in it. Here is how the stock has performed since:

Since then, I’ve followed up with three Seeking Alpha articles on PayPal, all with neutral or hold ratings. The titles basically tell the story. In December 2021 I wrote “PayPal’s Recent Decline Will Happen To Nearly All Overvalued Tech Stocks”, then in May 2022 “Is PayPal Worth Investing In? Maybe, But Here Is Why I Haven’t Bought, Yet”, and finally in December 2022 “After Rerating, PayPal Stock Is Nearing My Buy Price“. I linked to the last one in case anyone wants to see the valuation process. The basic story here is that PayPal stock was extremely overvalued in early 2021 even using optimistic assumptions, and as time went on the stock price fell and it got closer and closer to my buy price. Here is part of my conclusion from the last article.

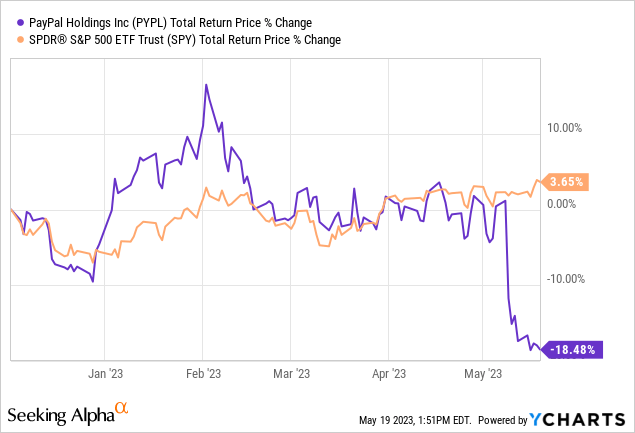

Right now using Seeking Alpha’s quant metrics, PayPal has a “C” grade for momentum. I would like this to be a “B-” or higher while the price is also below my $69.70 buy price before I would buy. So, we have two factors that need to be met. The price needs to be below my buy price and the momentum needs to be positive as well.

Here is how the stock has performed since my last article.

I’ve received several comments on that article the past few weeks asking where I stood on the stock now that the price is in my previous buy range, and whether I had bought, yet. To answer that, I haven’t bought it yet. Mostly because the momentum for the stock has been poor. Currently, it is “D+” in Seeking Alpha’s momentum quant ratings. Using those quant ratings did a pretty good job of keeping me from buying too soon since the price is now about $61 per share. I don’t usually use a momentum factor with an S&P 500 stock. In fact, often I buy against the momentum when the price is falling, but because PayPal had yet to experience a real recession as a standalone business, I didn’t have any good historical recession data for it. As a way to help balance that lack of data, I decided to use momentum as an additional factor in this particular case.

There are some macro factors that have made me slow to buy PayPal stock as well. Mainly, the fact that we haven’t had a recession in the US, yet, and the Fed has significantly hiked interest rates over the past year, so the odds are high that a recession is probably coming. This could put continued pressure on PayPal’s earnings regardless of how they execute at the individual business level. That doesn’t mean I haven’t been buying any stocks because of recession fears. It just means I have taken my time with a stock like PayPal for which I have no recession data.

There are some good things that come from being able to wait. The main one is I get to see more earnings data come in and have more time to think about their business and what an investor might expect from it over the next 5 to 10 years. It also gives me more time to think about and examine risks before buying. One of the reasons PayPal has been kind of a battleground stock lately in terms of narratives is that it could look like a really good, or a really bad, investment at today’s price going forward depending on one’s assumptions. In this article, I’m going to share what I think are the most important considerations even though I’m still not entirely sure I will eventually buy the stock when momentum eventually turns positive.

How Cyclical Will Earnings Be In A Recession?

As a standalone company, we don’t have data for PayPal’s earnings performance during a “real” recession as we experienced in 2008/9. Additionally, PayPal has grown and changed a lot since then, which was before the wide adoption of smartphones. I am a big proponent of looking at what a business’s earnings actually did during previous recessions to judge how cyclical those earnings are rather than relying on their sector classification or guessing.

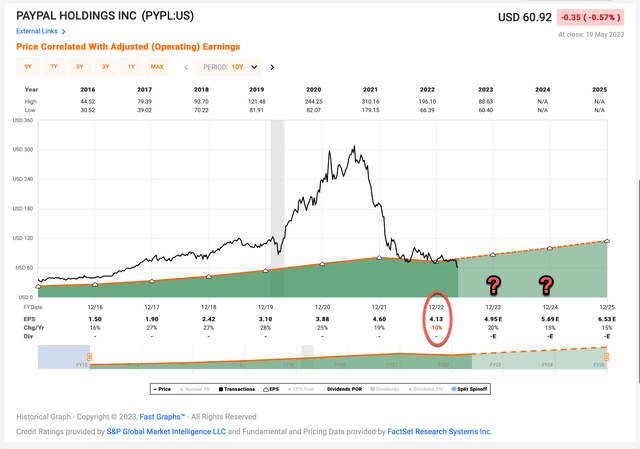

PayPal had a good secular growth earnings pattern through the 2020 pandemic. One can easily see on the FAST Graph how ridiculously overvalued it was in early 2021 when I first warned about it. Analysts are basically estimating EPS growth at 15%+, so with a P/E around 13, we have a PEG ratio under 1, and the valuation looks attractive. It’s no wonder there have been 41 “Buy” or “Strong Buy” articles written this calendar year on the stock, and only 2 “Sell”, or “Strong Sell” articles.

That said, I think the first thing investors should do is ignore analysts’ earnings expectations for 2023 and 2024. When I wrote my first SA PayPal article in December 2021, analysts thought 2022’s earnings would be $5.25 and they ended up being $4.13. They thought 2023’s earnings would be $6.68 and those have been lowered to $4.95. So, this is a situation where investors need to assume we don’t know what earnings will be in the next couple of years. This makes it difficult to have a base from which to estimate the value of the stock.

The base earnings are really important for valuing a business. A business that grows earnings 10% a year and starts with $5 per share of earnings is very different than a business with the same earnings growth rate of 10%, but that starts with $10 per share in earnings. So, if we are trying to estimate how much a business will cumulatively earn per share over the next 10 years (which is how I value stocks like PayPal) knowing the starting point is really important. We already know PayPal has shown some earnings weakness last year, my first main concern is what those earnings do in a recession.

My base case now is that a US recession is very likely during the next 12 months. I think it’s reasonable to assume that will hurt PayPal’s earnings, potentially a lot. I don’t have the historical data to say for sure, and depending on what one considers PayPal’s peers to be to use as a proxy, many of those don’t have data from 2008/9 either, and those that do have mixed levels of earnings cyclicality. (Some very cyclical, some less so.) This level of uncertainty has caused me to be slow to buy PayPal stock before a recession, and it’s why I’ve been watching the momentum score closely as a signal of what the market thinks. In short, I trust the traders and buy-side regarding PayPal’s likely earnings trajectory over the next year or two more than I do the sell-side analysts who have mostly been wrong. I would want to see that momentum score at “B-” or better and hold it for a week or two as a potential signal the earnings bottom might be close to being in.

Earnings Growth & Apple

If at some point it looks like the stock price and earnings might have bottomed in the next 6-12 months, the next question we need to ask is what sort of earnings growth rate we think PayPal can do long-term, over the next decade or so. When I first covered PayPal and started tracking it in my Investing Group, The Cyclical Investor’s Club, I assumed, based on its short history, that it could grow earnings by 20% per year. They had been able to do better than that since 2015. But since then, we have seen their earnings growth weakness, experiencing a -10% decline last year. I first lowered my earnings growth expectation to 15%, and now I am using a 10% earnings growth rate longer term after earnings eventually bottom. It’s really anyone’s guess what it will actually be, but 10% seems doable once they get through the next recession.

The consideration investors really need to think about is what the competition is going to look like. Even after losing nearly 80% of its peak value, PayPal is still a $68 billion dollar business. This isn’t a niche business which has huge growth potential. In order to grow, even at 10% long-term, it is going to have to do a lot of things right. Personally, I think the biggest near-to-medium-term issue is going to be the credit quality and income level of the typical PayPal user given that Apple is entering several of their businesses. I don’t necessarily think this is going to kill PayPal, as some of the bears do, but it could limit them to mostly lower-income and less-well-do-consumers.

A lot of this comes from anecdotal observations on my part, but I think it’s fairly well-established that Apple generally has a wealthier consumer base than other smartphone users. I have been bearish on Apple stock for several years now (after having owned it for nearly 7 years before that) but even I have been impressed at how long they have been able to at least maintain their pandemic boom earnings. At least so far, a lot of this has to do with the fact that Apple users are less economically sensitive than other groups. The way I’ve started thinking about it is Apple is really going after the typical JP Morgan Chase credit card user. Higher-income, higher credit quality people who use their credit cards to accumulate airline miles and things like that while paying them off every month. PayPal is more like Capital One. There is still money to be made from those not near the top quintile of income and wealth, because they are a much bigger group even if individually they don’t have as much money or credit. Apple’s payment process is the easiest I’ve ever experienced. I buy a lot of things with my Apple watch, for example. I don’t even need to carry a wallet or smartphone to the store anymore. It seems to me that over time, most people who can afford it will use Apple to pay for most items. I have PayPal and almost never use it. I know people who do, but none of them are Apple users.

Here is the big reason I bring this all up: I think PayPal’s user base is likely to be more economically sensitive, and therefore PayPal’s earnings are likely to be more deeply cyclical during a recession. This means, assuming we have a recession, PayPal’s earnings are likely to fall much deeper than analysts currently expect. This means generally higher risk for the stock because that 13 P/E which looks really attractive right now, will not look as attractive if 2023 or 2024’s earnings come in significantly lower.

Even though I think there are big question marks regarding PayPal’s potential earnings decline during a recession, and the earnings growth rate after that, I like for my articles to be actionable to readers as possible, so I’m including a table where investors can pick what sort of trough earnings and future earnings growth they think is reasonable, and what sort of buy price those assumptions would correlate to. The trough EPS may occur in 2023 or 2024. I consider roughly $5.00 per share and 15% earnings growth to be the current consensus, and most optimistic.

| Trough EPS | 10-Year Earnings Growth Estimate | Buy Price |

| $5.00 | 15% | $85.00 |

| $5.00 | 10% | $64.00 |

| $5.00 | 5% | $48.00 |

| $4.00 | 15% | $68.00 |

| $4.00 | 10% | $51.00 |

| $4.00 | 5% | $39.00 |

| $3.00 | 15% | $51.00 |

| $3.00 | 10% | $38.00 |

| $3.00 | 5% | $25.00 |

Alright, we can see that if investors think that analysts are correct, then PayPal is a good buy here under $85 per share, and even if an investor thought earnings growth would be 10% instead of 15%, the stock would be a good value today. This explains why so many authors are so bullish on the stock. But if PayPal’s earnings turn out to be more cyclical (which is how I’m leaning) and if we have a recession (which is also how I’m leaning) then EPS could fall either this year or next, and in that case, if we assume 10% earnings growth rate after that, which is probably a decent guess (I don’t think anyone really knows), then we would be looking at a buy price somewhere between $38 and $51 per share. I think if we have a recession, that’s probably a decent range to think about building a position, but the more earnings data we get during the recession will tell us more, so being patient here makes sense to me. If you are more optimistic, then feel free to pick your own expectations from the table above and use it as a valuation guide.

Conclusion

I’ve been a lot more speculative in this article than I typically am. But there are a lot of important unknowns still with PayPal’s near-future earnings. And while this market has shown stocks can rally very hard for very little reason, I don’t see a rush to buy the stock, yet. We are at a point in the economic cycle where the Fed is fighting the economy, and I expect, one way or another, for the Fed to win. PayPal’s stock has indeed fallen a lot off its highs, but those highs were completely unjustified. Earnings ultimately fell -10% last year, so it’s not unreasonable to have a 12 or 13 P/E ratio right now. It’s honestly not clear that earnings have stopped falling, yet. And even a brief reprieve this year will still have to battle the effects of the Fed tightening in 2024.

I’m not saying it’s impossible for both the economy and PayPal to thread the needle here, and for PayPal’s earnings to bottom. If earnings have really bottomed and PayPal can grow earnings at 10% or better going forward then the stock is a buy. And that could happen. But even if it does, I don’t see it happening so quickly as to cause real urgency to buy the stock, yet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $30/month, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.