Summary:

- American Tower is a great business with growth drivers such as rising mobile data consumption and 5G deployment.

- It’s demonstrating respectable growth and has a solid track record of growing the dividend, including expected growth this year.

- Recent pullback in price presents an opportunity for investors to get potential share price appreciation and a decent starting yield.

Tsener/iStock via Getty Images

I recently read a reader comment that resonated with me. They said that value investing works because it doesn’t seem to work for stretches of time. In other words, the market isn’t going to respond just because you buy a stock, and it can actually be to your advantage to reinvest dividends at discounted prices.

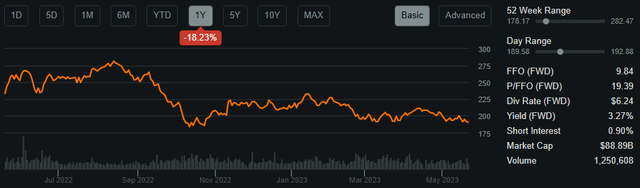

It’s important, however, to distinguish between value stocks and value traps, and that includes REITs (VNQ), many of which are trading at discounted valuations. This brings me to American Tower (NYSE:AMT), which as shown below, is down 18% over the past 12 months, and is now again trading near the bottom of its 52-week range.

I last covered AMT back in March, and the stock continues to trade weakly, having declined by 3% in price since then. In this article, I highlight AMT’s recent business developments and why now remains a great time to pick up this long-term wealth compounder.

Why AMT?

American Tower happens to be one of the largest REITs on the market today and owns and operates a moat-worthy collection of assets. This includes 226K communications sites that are leased to the top telcos Verizon (VZ), AT&T (T), and T-Mobile (TMUS). Through acquisitions, not least of which includes CoreSite in 2021, AMT also owns a network of highly interconnected U.S. data center facilities.

AMT also differs from peers Crown Castle (CCI) and SBA Communications (SBAC) due to its global focus. This makes it less dependent on U.S. telco spend while also giving it the ability to capture growing global demand for wireless data. This includes an established foothold in Latin America, India, Europe, and Africa.

American Tower is still in the early stages of the 5G rollout and saw robust organic (same-tower) sales growth of 5.6% YoY during the first quarter. This was the best growth in 3 years and after lapping the Sprint related churn. Growth came from new leases as well as lower churn and management expects $220 million in growth this year from colocations and amendments, a record for its U.S. business.

While there is always talk of the U.S. wireless network being a mature one, reality shows that’s simply not the case. This is reflected by industry estimates that mobile data consumption, which will require higher spend and lower latency, will grow at a compound growth rate above 20% over the next 5 years.

This supports a continued growth runway for AMT, as management expects its customers’ networks will need to provide at least 2x the network capacity over the next 3-4 years, and around 3x by the year 2030.

Risks to AMT include new technologies, such as satellite-enabled networks. AMT has a small investment in AST SpaceMobile (ASTS), and this appears to be just a nominal investment at this point in order for AMT to stay engaged on new developments in this “space”. However, management doesn’t believe it represents a true threat to the ground network and sees collaboration opportunities down the line, as noted during last week’s Telco Industry conference:

We don’t believe it [ASTS] is certainly a competitor to typical terrestrial networks, but there’s other carriers that are invested or affiliated that it’s interesting to kind of get their understanding of how they’re viewing the technology and their network needs.

We also believe there could be an opportunity to support their offering through our infrastructure on the ground as well. So we certainly, as part of our innovation and platform extension program, seek to find opportunities to better position ourselves to monetize on those type of events.

And I think for us, there’s certainly a lot of infrastructure in a 5G world that we acknowledge is important, but it doesn’t make economic sense for us. And mobile edge could certainly fall into that category, but we feel certainly with CoreSite, we have a much better seat at the table.

Meanwhile, AMT maintains a BBB- investment grade credit rating, and has a safe amount of leverage, with a net debt to EBITDA of 5.2x. Management has plans to deleverage towards a ratio in the 3x to 5x range, and has reduced its floating rate debt balance to just over 20% of total debt, thereby helping to mitigate the effect of higher interest rates.

Importantly for dividend investors, AMT currently yields a respectable 3.3% and has grown its dividend annually for 10 consecutive years. The dividend is also well covered by a 65% payout ratio, based on management’s full year AFFO per share guidance of $9.53. While I wouldn’t expect AMT to maintain its 5-year 17% dividend CAGR this year, management still plans to raise the dividend by a meaningful 10% this year.

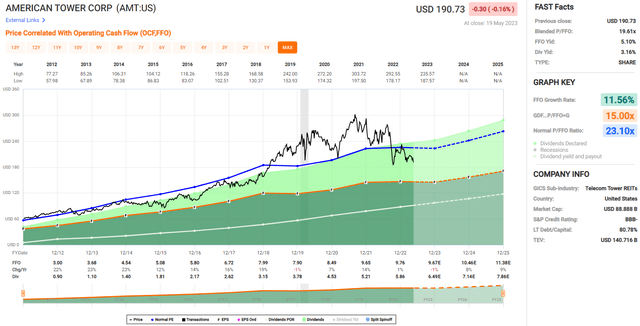

Lastly, AMT appears to be solidly in value territory at its current price of $190.73 with a forward P/FFO of 19.4, sitting well below its normal P/FFO of 23.1. Sell side analysts who follow the company expect 8% to 11% annual FFO/share growth in the 2024 – 2026 timeframe. They also have a consensus Buy rating with an average price target of $243.71, implying a potential 28% upside based on share price appreciation alone.

Investor Takeaway

American Tower is likely as a solid business as you can get with growth drivers, including rising mobile data consumption and 5G deployment. The company also has a strong balance sheet and now yields a respectable 3.3%. Plus, management expects to raise the dividend by 10% this year, continuing its 10-year growth streak. Lastly, the recent pullback in price presents a great opportunity for total returns investors to get potentially strong long-term capital appreciation while getting paid a solid yield to boot.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!