Summary:

- PayPal’s cross-border payment outlook remains uncertain.

- Competitors continue to outperform.

- The stock is not likely a buy for the long term.

FilippoBacci

Article Overview: PayPal Outlook As Competition Remains Fierce

I had previously written that PayPal (NASDAQ:PYPL) is facing a crisis stemming from management’s poor execution and has a business that may not be as competitive as the market outlook suggests. PayPal has been struggling with growth prospects after the market had initially predicted that the company could grow around 13% in the near future

Since then growth has continued to slow down as PayPal continues to face increasing competition. Meanwhile, competitors such as Payoneer and Wise continue to gain market share, and their rate of growth is much better than that of PayPal. PayPal’s focus has mostly been on commercial transactions and has let payments take a backseat it remains to be seen how whether this strategy will work going into 2023 as a number of competitors continue to build their own commercial-focused product strategies.

January 2023 Article: PayPal Is An Uncompetitive Dinosaur And Poorly Managed

Competitors Continue To See Strong Growth

Payoneer recently reported its first quarter growth in 2023, where growth came in 40%, YoY, significantly above the global payments average. Meanwhile, Wise formerly known as Transfer Wise, also continued to grow at a brisk pace as it posted its previous interim results, during which revenue grew by 60%., significantly above that of PayPal, whose own growth has slowed significantly in recently. While I focused on payments and freelancing previously, this time I am going to focus on the commercial market and the competition currently PayPal is facing within this segment.

PayPal’s Outlook in 2023

PayPal has focused on commercial transactions, and considering it has not made any real changes to the fee structure, we can assume the current trajectory of the business will continue. Competition in the commercial space continues to increase globally and that too in an environment where global commerce is facing headwinds stemming from high inflation, rising interest rates, and slowing economies. PayPal is equally at risk from the effects of these headwinds, due to the nature of the financial services it offers, that are directly correlated to cross-border commerce, and economic activity in general.

PayPal currently has a slew of competition, in the global payments space, not only from traditional finance but also from the ever-increasing payment companies, some of which I mentioned earlier.

Wise is one such company, that has taken a much more competitive trajectory. Although PayPal does have some advantages, such as its availability in almost all countries. Meanwhile, Wise is available only in about 80 countries, but again what matters is the customer quality and potential of those countries, not merely how many countries a service is available in, as many countries don’t have a large cross-border commerce economy.

PayPal has a few other advantages over Wise, for example, it currently offers credit to its business account customers; Wise does not, and PayPal also offers the ability to pay later to merchants. This is especially important for those looking to have an invoice schedule, where they can receive goods earlier and pay later, a feature that is especially important for small businesses that rely on these facilities in order to ensure that their business runs smoothly.

On the other hand, PayPal’s services still remain cumbersome, with merchants quite often unable to pay directly to bank accounts, unless they use the Xoom services, which itself created a whole new level of bureaucracy. This quite often turns away customers and could affect growth in the future.

Furthermore, PayPal has limited options in terms of currency. Wise has more currencies that it deals in, and in which merchants can hold their payments. These are just examples where Wise has a competitive advantage. Wise offers its customers 50+ currencies, but PayPal only offers 25. While PayPal might be available in more countries, Wise likely has a better payment quality structure. These features are far more important for cross-border merchants, and Wise might be the winner in the long term unless PayPal changes its strategy.

But again the biggest factor remains PayPal’s fee structure, the ability to transact, not only locally but internationally cheaply is what will drive cross-border payment and commerce in the 21st century. PayPal’s 4% markup, on its exchange rate, a rate which significantly eats into profit margins, and turns customers away. On the other hand wise offers mid-market exchange rates, and that too with no markup. Adding to the cumbersome transfers is the fact that Wise fees while variable are significantly lower than that of PayPal which offers 5% on transfer amount

PayPal’s issue is that it has a great foothold in the United States, where it offers far better fee structure and commercial access, but beyond the United States internationally it is failing behind its competitors. The inability to offer a competitive fee structure, provide better payment transfer facilities, and offer exchange rates that are competitive, means that competitors, who do offer these services will be preferred.

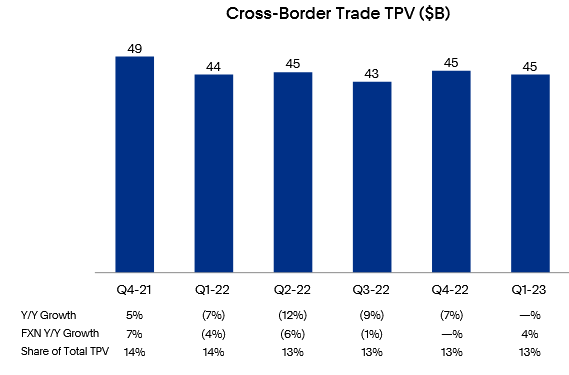

Payment Volume (Investor Presentation)

PayPal’s Increasingly Dependent on Venmo

The current valuation still remains relatively high, with a P/E of 30x, and analysts projecting a forward P/E of 13x, which isn’t expensive, considering one-off impairments led to the current decline. But even at those levels, the upside remains limited. PayPal is currently overly reliant on Venmo to lead growth, and international has all but dried up, which is telling of the company’s future.

Investors clearly are betting that PayPal will continue to struggle in the future, and the risk of the business slowing down is currently driving sentiment in the market. PayPal’s P2P total payment volume increased by 2%, during the quarter, meanwhile, Venmo’s TPV grew by 9%, to $62 billion. Venmo is increasingly becoming a larger portion of total payment volume, where Venmo’s own growth rate is 9%.

Should this continue, revenue growth will increasingly depend on Venmo, where profitability is likely to be lower than PayPal’s other services, and this could affect profit margins in the future. The P2P payment market remains fierce, and Venmo is reliant on US users primarily, which in itself is a problem. Globally Venmo’s presence remains relatively non-existent for now, and major markets already have their own local P2P payment apps, which makes expansion harder. While Venmo will see some benefit from the payment integration with PayPal later this year, the overall accretive effects will be limited.

It is clear PayPal’s future is unclear, and this means that investors are unlikely to invest in the stock until PayPal can show a better long-term strategy. The global commerce and payments markets facing a plethora of risks, and what is already a slow rate of growth is likely to slow further as cross-border commerce likely slows, which means PayPal’s valuation will reflect single-digit growth for now. It remains to be seen where growth will go once the economy steadies out.

Investors should carefully scrutinize the long-term prospects for PayPal, despite it appearing like relatively cheap stock on a forward basis. For now, there is no case to take a significant position.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.