Summary:

- PayPal is about to face serious competition at an infrastructure level it can’t compete with.

- PayPal may prove sticky with current users, but FedNow makes PayPal’s user acquisition value proposition unclear.

- PayPal is a third party instant settlement network that will suffer from reduced network effects.

- The company is overvalued in light of this, and we think the shares have 25%+ further downside potential.

hapabapa

A little over a year ago, when PayPal (NASDAQ:PYPL) had just dipped below the $100/share price point, we wrote an article titled “PayPal: A Dream Entry Point In A Long-Term Compounder“. Broadly speaking, the thesis of the article was that PayPal was a well-run business with thick margins, and that the company was unfairly priced as a result of rising interest rates and a tougher macro environment. We argued that investors should stick with the company through the pain and begin accumulating shares while they were still cheap.

The difference, however, between a momentary deal and a value trap is sometimes difficult to discern. Typically, a deal is what happens when a strong company with a moat is affected by factors outside of its control, which is what we initially thought was happening. However, given the recent earnings report and developments in the broader financial system, we think the company’s moat is quickly evaporating.

FedNow is a seismic shift in U.S. payments infrastructure and stands to hurt PayPal’s go-to-market strategy. It’s likely the company will likely see reduced network effects as a result. In turn, customer acquisition will become more difficult, payment volume will decrease, and PayPal’s pitch to merchants (“a PayPal button on your site will increase conversion”), won’t be as compelling.

We rate the stock a sell, given that we expect further multiple compression as the company goes ex-growth.

PayPal’s Business

It’s important to understand PayPal’s history and business model to get a better idea of why the introduction of FedNow is such a big deal.

When PayPal started back in the day, it was the de-facto payments layer for the internet. It made it easier to pay your friends and buy things online, and in return the company charged a transaction fee for its services (PayPal still operates on this transaction volume business model).

As a result of this first-mover advantage, the company built up a strong network effect. Want to send money to your friend? Better get a PayPal account. Want to pay for something online without getting scammed? Pay through PayPal.

However, over time, the equation has changed. Buying online from merchants has gotten much safer as technology has improved and increased competition from the likes of Stripe, Amazon, Apple, Shopify and others has lessened consumers’ need for any specific payment type.

Most merchants now accept multiple ways to pay (Shopify)

The PayPal button still enjoys increased conversion during checkout as a result of the company’s existing userbase, but “Checkout with PayPal” is no longer a material user acquisition channel.

Growth Challenges

This leaves P2P payments.

While the relative volume of P2P payments is small at just over a quarter of all PayPal’s transaction volume, the market need it fills is much, much more important. In the U.S., the easiest way to pay someone with instant settlement is via Venmo or PayPal.

Zelle and Cash App have tried to horn in on this market as the banks and other companies have realized the opportunity, but user adoption has been relatively weak. Zelle’s user experience is poor, and if Venmo works fine, then why bother setting up Cash App?

FedNow is set to change all that. Unlike Zelle, FedNow is set to enable instant settlement at the base level, between banks. This entirely removes the need for PayPal or Venmo in P2P situations.

The UK has an analogous financial solution called “Fast Payments”, which is integrated at the bank transfer level. As a result, an app similar to Venmo simply doesn’t exist there. There’s no need for a third-party instant settlement layer.

Settling up with a friend after dinner or drinks? You just send money instantly to their bank account.

In short, we are worried that this is what will happen to PayPal. The company will continue to exist and print cash; but not as a result of growth, rather, inertia.

Again, with FedNow, there will no longer be a need for a third-party P2P instant-settlement transaction network.

Ex-Growth

These fears are already manifesting in the numbers, currently as a result of competition from other brands:

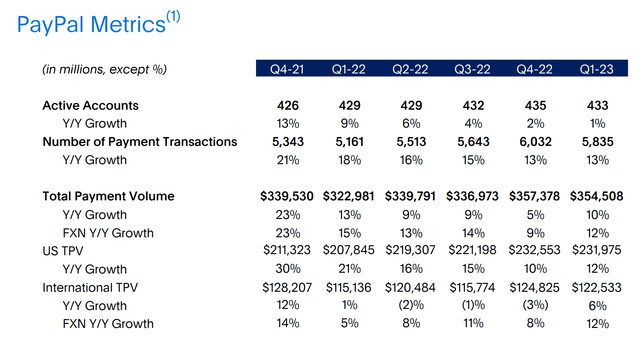

Over the last year and a half, PayPal has seen essentially zero Active Accounts growth – including the first ever QoQ decline in active accounts. This has resulted in flatlining TPV growth.

If this is the state of growth without FedNow, then it’s easy to see how things could worsen significantly with its introduction. As more and more TPV moves through FedNow, it could cannibalize PayPal’s revenues.

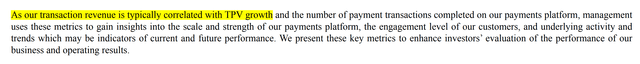

Given that PayPal’s transaction revenue is linearly correlated with TPV growth;

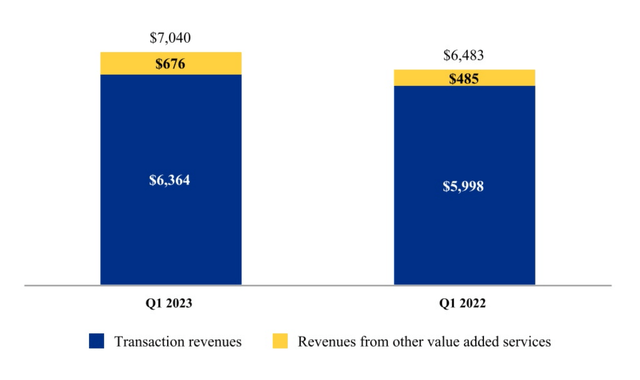

and that almost all of PayPal’s revenue is from Transaction Revenue;

It’s easy to see how the company could be in for a world of hurt given the increased competition.

We’ll just have to wait and see how the company manages this challenge.

Valuation

This all brings us to valuation, and what PayPal might be worth in light of the changes underway in the industry.

Right now, the stock is trading at ~26x GAAP income. For a company that has been as historically strong as PayPal, this ‘looks’ cheap.

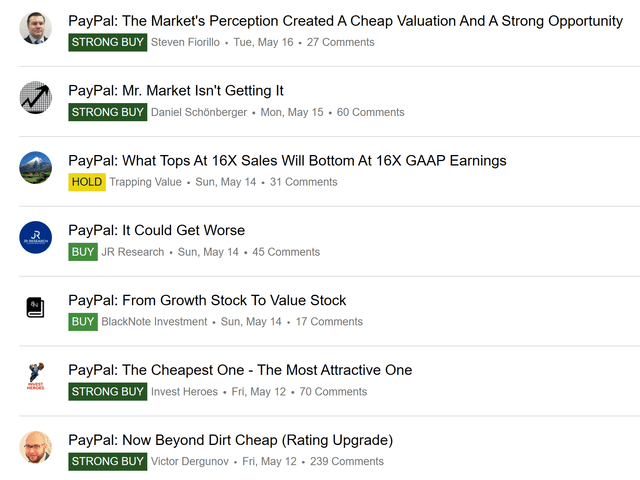

In fact, the many articles coming out here on SeekingAlpha in defense of PayPal have said something to that effect. Of the 22 articles published since the company reported earnings on May 8th, 21 of them advocate buying or holding the stock, many of which reference valuation as a key selling point:

We take a different view. If the top line is actually set to begin declining as a result of FedNow and the fact that consumers no longer “need” a PayPal / Venmo account, then the selloff and subsequent valuation seems justified.

In fact, we think there is further room to fall.

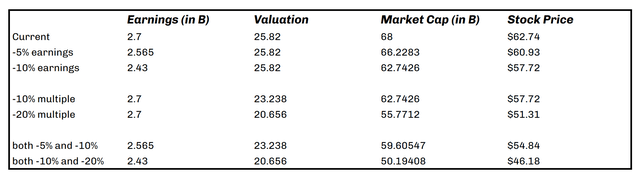

Going ex-growth is a huge development that requires re-thinking almost all assumptions in valuation models made up to this point. Here’s a table where you can see some of our assumptions begin to affect the stock price further:

The downside here is somewhat limited as we don’t think PayPal’s earnings or multiple will continue to drop considerably in the short term. However, the stock still has reasonable downside of more than 25% in the last-line scenario above, which we consider a base-case.

The Short

We rate the stock a “sell”, and think there is a case to be made for risk tolerant investors to short the stock at current prices. Thankfully, shares are easy to borrow at almost all brokers, which makes the cost of shorting negligible and a non-factor.

The trade also has layered in the probability of an upcoming catalyst: the launch of FedNow. The program was announced on March 15th, but the actual launch is set for early July. As the market begins to realize the potential issues this could cause PayPal, we expect a further decline the stock price.

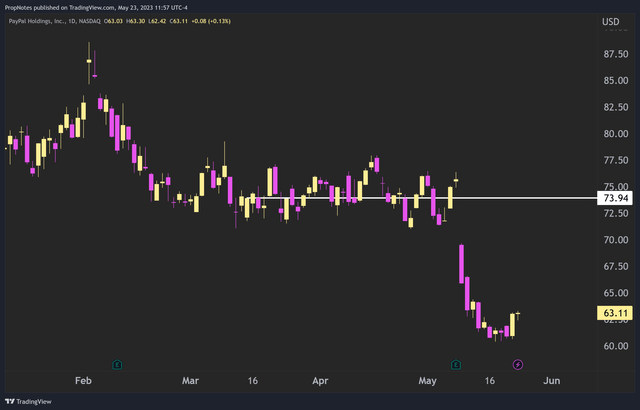

A reasonable spot to control risk would be to the price of the stock during the FedNow’s announcement. While we think there is material downside left, if PayPal heads north of that announcement high around $74, before heading lower, then we’ve likely missed something, and the thesis is invalidated. That ‘stop’ price is 17% higher than the current price.

Announcement Price (TradingView)

A great place to begin taking profit would be at our “base case” price ~$46, which we mentioned prior.

Risks

There are some risks to our thesis. The main one is that PayPal’s P2P payment products and wallets could prove stickier with consumers than expected, which would be a boon for PayPal’s bottom line. The less TPV that gets siphoned away, the better.

However, it’s still unclear how PayPal will manage the growth question. While current users may continue to use PayPal products, the lack of any clear value proposition for new users will be a long term headwind for the company. We don’t think PayPal’s purchase of Honey as a user acquisition tool is going to be enough.

Summary

Here’s the bottom line: PayPal is struggling to grow. It’s no longer a necessary payment layer for merchants given the robust competition in the space, and it’s about to face serious headwinds in the important P2P market. We struggle to see how PayPal will hang onto market share and TPV. Given than TPV accounts for the lion’s share of PayPal’s revenues, we think flatlining growth could turn into TPV declines, and the stock isn’t fully priced for that. We rate PayPal a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.