Summary:

- Chevron has agreed to acquire PDC Energy in a multibillion-dollar transaction, with the implied value of the deal at $6.3 billion for PDC Energy’s equity and an enterprise value of $7.6 billion.

- The acquisition is expected to bring $100 million in annual operating synergies and $400 million per year in capital expenditure efficiencies, adding about $1 billion in incremental free cash flow.

- The deal is expected to be completed by the end of the year, and while it may present some transaction-related risks, it could be an attractive opportunity for long-term investors.

jewhyte

May 22, 2023 proved to be a monumental day for investors in the oil and gas space. This is especially true for those focused on the exploration and production market. After news broke that industry giant Chevron (NYSE:CVX) had entered into an agreement to acquire smaller rival PDC Energy (NASDAQ:PDCE) in a multibillion-dollar transaction, shares of the latter popped higher. Based on my knowledge of both firms, as well as the terms discussed by both parties, it seems to me as though Chevron is making out like a bandit on this transaction. Even ignoring potential synergies from the deal, the industry leader is snatching up an enterprise that is currently generating significant positive cash flow. Although I do believe that investors in PDC Energy are ending up with the short end of the stick in this deal, the immediate upside is definitely nice to see, and both companies make for attractive prospects for value investors at this time.

A big deal in the oil patch

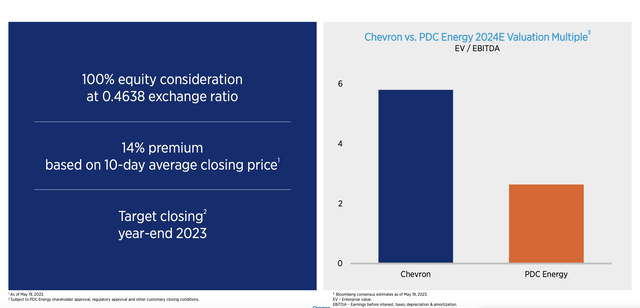

As I mentioned already, Chevron agreed to acquire PDC Energy in what is essentially A multibillion-dollar transaction. The implied value of the deal, using prices from immediately before the deal became public knowledge, comes out to a purchase of $6.3 billion for the equity in PDC Energy. When you add on net debt to the picture, you end up with an enterprise value of $7.6 billion. Ultimately, the price at which the transaction is completed can vary. This is because it is all stock in nature, which means that, as shares of Chevron fluctuate, the effective price of the buyout will also fluctuate.

In exchange for each share of PDC Energy that an investor holds, Chevron will give 0.4638 of a share of itself. This represents a premium of 14% over the 10-day average price at which shares of PDC Energy we’re trading for immediately prior to the deal being announced. Given how much larger Chevron is, investors who own stock in PDC Energy will collectively only get about 2.1% of the combined company. Based on the issuance of about 41 million shares of Chevron stock that will be needed to see the deal through.

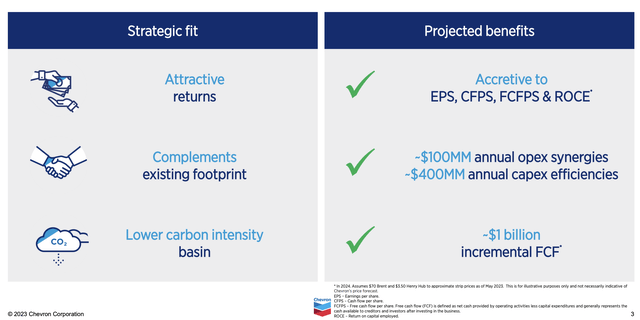

The management team at Chevron paints this transaction as being highly profitable for shareholders. I would agree with that assessment. For starters, they believe that they can achieve $100 million in annual operating synergies from the transaction. They are also forecasting about $400 million per year in capital expenditure efficiencies. All of this, combined with the overall health of PDC Energy, is forecasted to add about $1 billion in incremental free cash flow to the company each year if we assume that Brent crude prices will average around $70 per barrel and natural gas prices will average $3.50 per Mcf.

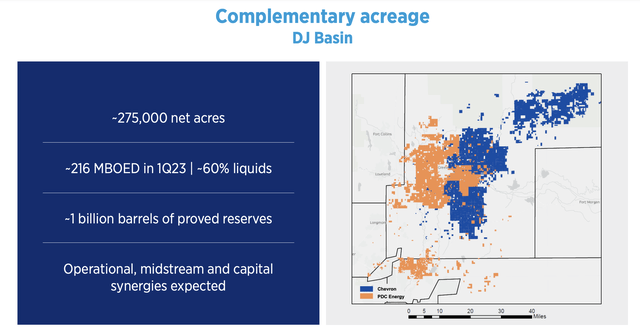

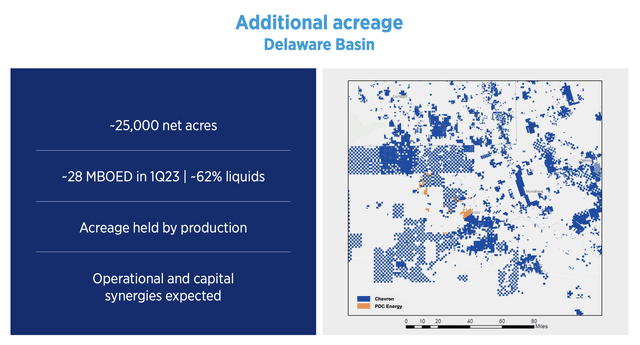

Almost certainly, the synergies forecasted by management will come from the fact that many of the assets owned by both parties overlap considerably. As you can see in the image above, PDC Energy has around 275,000 net acres of land at their disposal throughout the DJ Basin. All combined, these assets produced 216,000 boe (barrels of oil equivalent per day) in the first quarter of 2023, 60% of which was in the form of liquids like oil and NGLs. Chevron itself has a vast network of midstream assets that will likely make at least some of these synergies achievable. Outside of this acreage exists about 25,000 additional acres located in the Delaware Basin that also has some overlap with Chevron’s footprint. But this is fairly minor by comparison.

I have absolutely no doubt that this transaction will prove to be very accretive to the profitability of Chevron. However, the picture that they paint is a bit skewed. Consider, for instance, the image below. Although specific numbers are not provided on the chart, Chevron uses the EV to EBITDA multiple of both parties, based on estimates for EBITDA for the 2024 fiscal year, to illustrate just how cheap it is picking up PDC Energy. The fact that we can’t see the numbers that Chevron is using is a bit frustrating. But using actual historical data, I calculated that PDC Energy is being bought out at an EV to EBITDA multiple of about 2.83 based on financial performance from the 2022 fiscal year. Admittedly, 2022 was a particularly good year for oil and gas exploration and production companies. But even if we use results from 2021, the multiple is still quite attractive at 4.77.

In my Marketplace Service here on Seeking Alpha, I cover 36 oil and gas exploration and production companies on a regular basis, providing cash flow deep dives and sensitivity analysis into each firm. Many of the companies that I cover trade at EV to EBITDA multiples of between 3.0 and 6.0, with some of the highest quality players coming in more expensive than that, while some of the lowest quality (and some decent-quality ones that are misunderstood) trade at levels that are lower. I would argue, then, that this is a rather low price to pay for such a high-quality operator as PDC Energy. In addition to this, it’s worth noting that the EV to EBITDA comparison with Chevron doesn’t make a great deal of sense. After all, Chevron is nowhere near a pureplay in this market.

Using data from last year, only 37.3% of its revenue (before intersegment eliminations) came from upstream operations. And the midstream and downstream assets that the company has, some of which focus on things like chemical production, renewable fuels production, crude refining, and more, should trade at levels that are higher than what the exploration and production companies out there trade for. This is because, unlike the exploration and production companies that have a history of extreme volatility from a cash flow perspective, the other segments in the energy market tend to experience greater stability and safety.

Takeaway

If all goes according to plan, the transaction between Chevron and PDC Energy should be completed before this year is over. Of course, anything can happen between now and then. This could include regulatory issues or something else entirely. For those who are bullish on the energy market and who believe that Chevron is an attractive long-term prospect, I would say that I am in the same boat. But one interesting way, for those who don’t mind taking some transaction-related risk, to buy Chevron on the cheap would be to purchase shares of PDC Energy. Based on the terms of the agreement, buying PDC Energy is like picking up Chevron at a 1.3% discount. Though it is worth noting that about two-thirds of this discount will be made up for by the fact that Chevron does pay a higher yield at this time. So the additional upside relative to the risk assumed in this case may not make the most sense, unless investors anticipate a higher bid coming in. But even that seems unlikely given the market’s pricing activity. So for those who want the greater stability and a high-quality company at the same time, just picking up shares of Chevron might be the best way to go.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!