Summary:

- Nike has the strongest brand of any of its competitors and young people are crazy about certain Nike shoes.

- I believe problems such as de-stocking are only temporary, and the really important, high-demand items have not been affected or discounted.

- People are exaggerating the problems and only seeing the negative and not focusing on Nike’s long-term prospects in my view.

stockelements/iStock Editorial via Getty Images

Thesis

I think Nike’s (NYSE:NKE) falling share price is an excellent buying opportunity because the problems appear to be temporary and the business is still high quality. A lot of people who are selling the stock are thinking short-term, in my opinion, and not seeing the big competitive advantages that Nike has. In the long run, Nike should do well.

Analysis

A lot of people who watch and invest in Nike know that they have a very strong brand, but I think they still underestimate it because they are probably not the target audience for their special edition shoes of the Dunks and Jordan product lines.

For example, in March they released the Air Force 1 Low Tiffany, which had a retail price of $400 and sold out within minutes. Now you have to pay over $1000 for a pair on StockX.

Another example is the Jordan 1 Retro Low Travis Scott Olive, which was released at the end of April for $150, but now costs almost $1500 for the popular sizes on StockX. This is almost 10 times the retail price.

And Nike releases really hyped sneakers on an almost weekly basis, with sneakerheads paying premium prices just to get their hands on a pair. Collaborations with companies like Tiffany or Louis Vuitton are sold at prices that no other shoe brand can charge. That really shows us that they have pricing power. And even without the luxury brands, they have some special editions that are almost as expensive. And even a standard model like the white Air Force 1 Low is so popular that in some European countries it is impossible to get your hands on it, as it is always sold out and you have to be lucky to score a drop on Nike’s website.

Some sneakers are so popular that people are robbed at gunpoint just for wearing them. I mean, that should show you what a strong brand Nike has when people are willing to commit a crime and potentially go to jail just to get the shoes. So the demand for Nike shoes is undiminished, and that should show everyone what a great competitive advantage their brand has.

And if you look at their list of sponsored athletes, they have Antetokounmpo, Lebron and Jokic for basketball and Neymar, Mbappe, Ronaldo for soccer and many more, which is clearly the best-in-class rooster when compared to adidas (OTCQX:ADDYY), Under Armour (UAA) or PUMA (OTCPK:PMMAF). And with Wembanyama likely to have already signed with Nike, they could have the biggest sporting star of the future under contract.

Adidas, which had been very successful with its Yeezy brand but had to end the partnership, lost out on millions in sales and Nike’s dominance of the sneaker market was further strengthened.

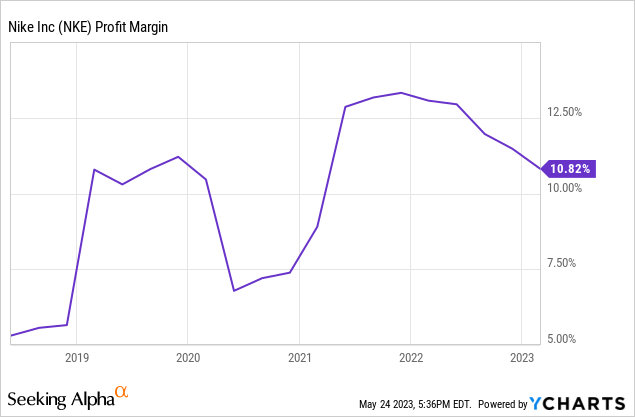

Nike is having temporary problems where they have had to reduce inventory and therefore sell some things at a discount, but they still have a strong 10% profit margin and have only lost a few percentage points which they are likely to regain once inflation and supply chain problems are under control. These are not problems of demand; margins have fallen because of the general economic difficulties.

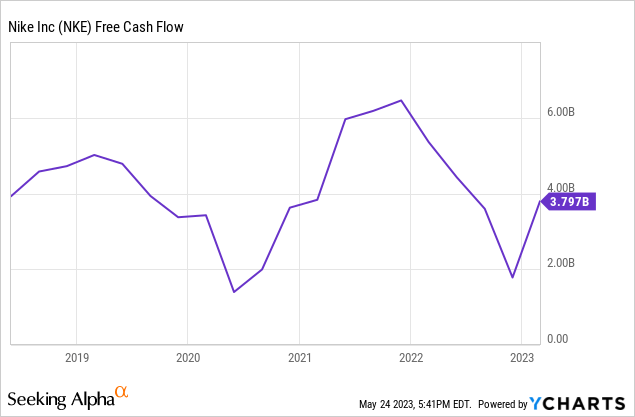

Nike still generates $3.79bn in free cash flow, which it will distribute to shareholders in the form of dividends and share buybacks. The dividend growth rate since 1989 has been 17.91% per annum and the historical CAGR of shares outstanding is -1.91%, both of which are very beneficial to shareholders.

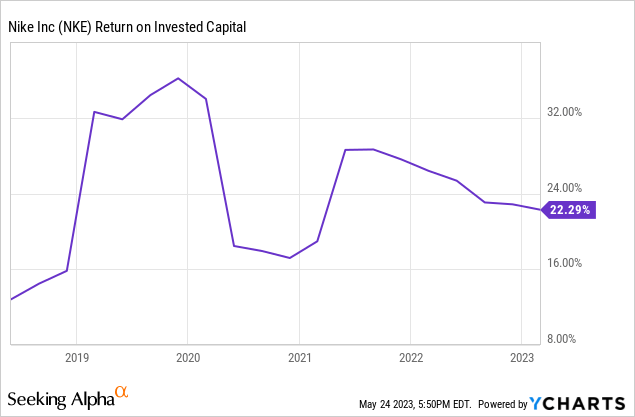

ROIC is also over 20%, despite some tough times, which also clearly shows that Nike has a competitive advantage. I mean, China was closed for a long time because of COVID, and despite losing sales there for a while, Nike is still producing excellent figures. Once growth picks up in China, the numbers will improve even more. In China, however, Li-Ning and Anta have the potential to become the top brands in the sports brand market.

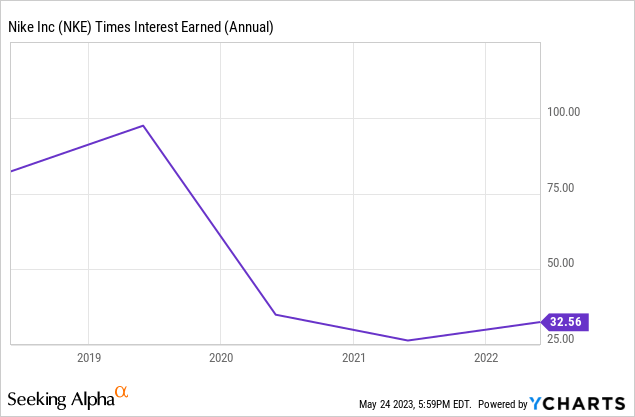

Nike’s balance sheet is incredibly strong, with 32 times interest coverage, compared to the S&P 500 average of around 10 times. Free cash flow will also continue to be generated at a high level, so there is no reason why it should not be returned to shareholders.

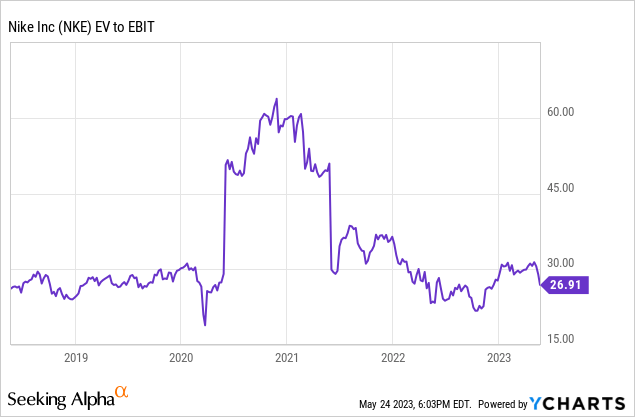

And the valuation, if you look at EV / EBIT, is also roughly in line with Nike’s long-term multiple. But if we take into account that earnings are temporarily depressed, we could argue that the multiple is lower on a normalized basis and therefore much better than it looks. In my view, any entry point at $100 or below will reward shareholders in the long term and is likely to produce market-beating results.

Conclusion

Nike has $10.8bn in cash and ST investments, will probably generate $4bn+ in FCF, and has a huge competitive advantage due to its brand and the demand it has been able to build. In addition, they increase their dividends every year while reducing the number of shares outstanding, and grow their revenues and net profits. Getting such a company at a favorable price because of temporary problems should be an investor’s dream.

But as is always the case when share prices fall, people talk about the bad things and get caught up in the negative sentiment, rather than taking the opportunity to buy good companies at a better price. This was the case with Meta (META) and Netflix (NFLX) in the recent past, and the people who bought the companies when they fell might have been laughed at during that time, but now that they have risen again many investors are probably saying ‘I wish I had bought them then’.

Of course, Nike shares can fall further, but for me, every drop is a good opportunity because I believe in Nike’s long-term prospects and its competitive advantage.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.