Summary:

- Investors have latched to the negative elements facing PayPal Holdings, Inc.

- There’s competition, slow growth, and operating margin compression.

- However, those are now well known and in the PayPal Holdings share price already.

- Looking ahead to 2024, PayPal Holdings stock is priced at 10x EPS.

- Investors won’t get a bargain when the PayPal Holdings, Inc. outlook improves.

chameleonseye

Investment Thesis

PayPal Holdings, Inc. (NASDAQ:PYPL) has plenty of problems. Let’s just put this front and center so that we shape the thesis around this. There’s the CEO transition afoot, margin compression for H2 2024 relative to prior expectations, combined with a weak backdrop in e-commerce.

Furthermore, the share price performance is just awful, with PayPal’s shares trading at a 5-year low.

So, why should investors even consider PayPal? Yes, the stock is cheap.

But I do not believe that just because something is cheap that it’s undervalued. But when a stock is cheap and is still growing at mid-teens CAGR, that’s when I believe something positive can happen.

Top 3 Bearish Arguments Facing PayPal

The bearish arguments facing PayPal Holdings, Inc. are threefold.

There are concerns over PayPal’s slowing revenue growth rates, that we’ll soon discuss. Also, there are worries about the hyper-competitive space that digital payments have become.

And on top of those, the impact that a slowing e-commerce sector will have on PayPal’s medium-term prospects.

Essentially, there’s a lot of uncertainty facing the company. And did I mention that PayPal’s guidance from earlier this month downwards revised their operating margins relative to prior expectations?

To sum up it, investors have many reasons to be put off by PayPal.

No Longer a Growth Company

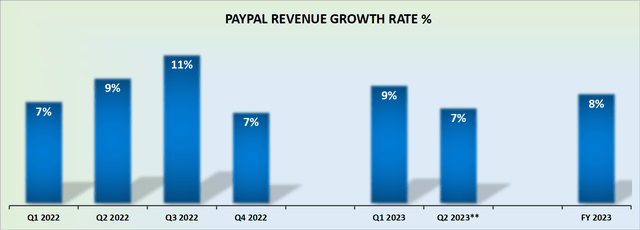

Next, as you can see above, PayPal’s revenue growth rates don’t appear to be that exciting. Investors are now bracing themselves for around 10% CAGR from PayPal.

For a business that could previously, up until a few years ago, be counted on as a 20% CAGR compounder, the fact that 2023 is set to be another year of lackluster growth has investors and analysts disenchanted with this business.

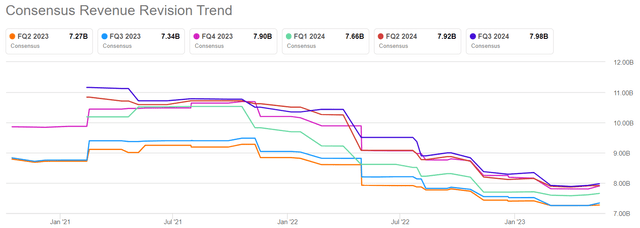

Clearly, as you can see above, for months on end, analysts have been downwards revising PayPal’s revenue consensus estimates. The level of negativity here is practically palpable.

Not All Bad News, Profitability is Improving

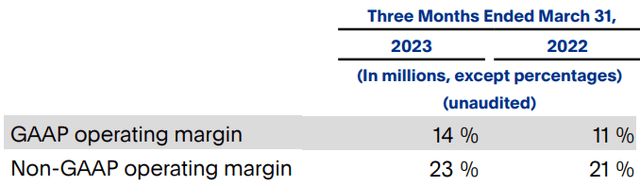

And yet, the reason why I struggle to be as bearish on PayPal as many investors are that I can clearly see that its underlying profitability is making remarkable progress.

Not only was there a 200 basis points expansion on its non-GAAP profitability in Q1, but also, recall, the guidance for the remainder of this year points to more than 20% CAGR to nearly $5 of non-GAAP EPS this year.

Yes, I know that Q1 was particularly strong. And yes, I know that PayPal downwards revised its operating margin outlook for the second half of 2023. And, yes, I know that PayPal has for several years overpromised and under-delivered.

That being said, given that we are already halfway through 2023, it makes sense to start to think about next year.

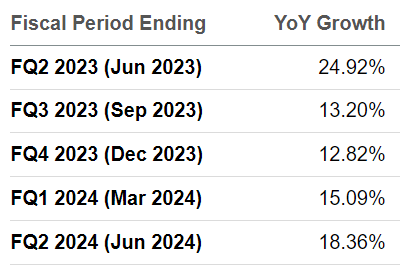

If we assume that PayPal’s profitability slows down and its EPS only grows by 18% y/y compared with the 21% y/y EPS growth expected for this year, this would mean that PayPal’s 2024 non-GAAP EPS could reach nearly $6 of non-GAAP EPS.

And to provide evidence that my assumptions are not outlandish, consider analysts’ consensus estimates:

SA Premium

Analysts are also expecting around the mid-teens EPS growth rates into the first half of 2024.

The Bottom Line

To sum it up, PayPal Holdings, Inc. prospects are showing no signs of improving any time soon. I do not believe that investors looking at the stock today have anything to be particularly cheerful to say about PayPal.

As I alluded to already, PayPal’s share price is at a 5-year low. That means that there are very few shareholders that are looking at their PayPal shares and have a positive return to show for it.

Accordingly, what happens in this environment, is that investors are capitulating. Investors simply want to exit their position and call it a day. To forget the pain associated with investing PayPal.

But for new investors looking at this stock from this point, to them I declare, yes, PayPal Holdings, Inc. has a lot of headwinds to navigate. But paying 10x next year’s EPS is really quite attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.