Summary:

- Abercrombie & Fitch brand’s sales surpassed Hollister, accounting for 52% of the company’s total sales, indicating the early success of the brand’s transformation.

- Abercrombie & Fitch has entered the growing athleisure market with its YPB active brand, leveraging its reputation for comfort and targeting non-denim products.

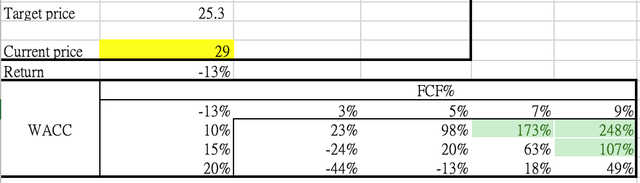

- The DCF model indicates that the stock price falls within a reasonable range if we use management’s FY 2023 guidance as model assumptions.

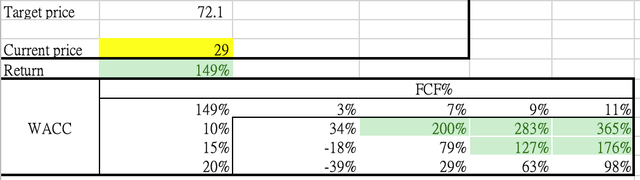

- If we use management’s FY 2025 guidance as model assumptions, I believe there is a potential for a 149% increase in the stock price.

- We consider it a short-term opportunity rather than a long-term investment.

FreshSplash/E+ via Getty Images

Recap

The story of Abercrombie & Fitch Co. (NYSE:ANF) serves as a poignant reminder that the path of entrepreneurship often diverges from the original plan. If David T. Abercrombie, the founder, were alive today, he would be astounded by the brand’s transformation. What began as a high-end sporting goods store catering to elite outdoorsmen has evolved into a luxury clothing brand favored by affluent teenagers.

In 2012, ANF reached its peak. The company experienced a significant shift when controversial CEO Mike Jeffries stepped down in 2014. The recent Netflix documentary, “White Hot: The Rise and Fall of Abercrombie & Fitch,” delves into the controversies that surrounded the iconic fashion brand of the 1990s. Fran Horowitz, the former president and CMO of ANF, took the helm in 2017, bringing with her a fresh strategy to revive the company.

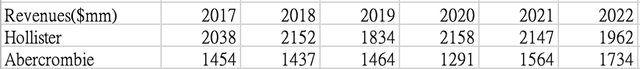

Under Horowitz’s leadership, ANF witnessed a slight increase in revenues, from $3.4 billion in 2017 to $3.7 billion in 2022. Operating income also rose from $72 million to $92 million. Although the company’s outward appearance may not have changed significantly, the performance of its two iconic brands, Abercrombie & Fitch (“Abercrombie”) and Hollister, showed contrasting results. Abercrombie’s sales soared from $1.4 billion to $1.7 billion, surpassing Hollister’s revenues for the first time in Q1 2023. As a result, ANF’s stock surged by 30% following the earnings release.

Valuation Assumptions Reflect Management’s Projection

A quick examination using the DCF model revealed that the stock is now trading at a level that is consistent with the outcome if the management’s FY2023 prediction is included as a model assumption input. (Sales: $3.7 billion, 5-6% operating margin) We also use the following assumption:

- WACC: 20%

- Terminal growth rate: 3%

- Net debt:149 million (Q12023 data)

- Shares outstanding: 51 million (Q12023 data)

Sensitivity analysis (2023 projection) (LEL Investment)

As a result of this finding, we reran the model with management’s FY 2025 prediction as the model input. The revised analysis indicated a remarkable upside potential of 149% from the current stock price. Hence, the stock is likely to reprice as a result when management provides more data points or the company continues to meet the guidance goal.

Sensitivity analysis(2025 projection) (LEL Investment)

Management’s FY2025 projection encompasses ambitious targets, including a revenue increase from $3.7 billion to $5 billion, representing a CAGR of 16% over the next two years. Additionally, the projection entails enhancing the operating margin from its current level of 5% to 8%.

We assess the viability of the plan’s breakdown by opportunity for margin expansion and growth driver as follows:

Abercrombie Returned to Growth

Hollister and Abercrombie, two distinct brands under Abercrombie & Fitch Co., have strategically targeted different consumer groups. Hollister caters to the teenage demographic, while Abercrombie focuses on millennials. In the first quarter, Abercrombie & Fitch’s sales surpassed those of Hollister and accounted for 52% of the company’s total sales, indicating the early success of the brand’s transformation.

Revenue by brands (ANF)

Contrary to reports of consumer weakness from other retailers, ANF anticipated an acceleration in sales for the second quarter. Management expected the growth trend of Abercrombie to continue, while Hollister is projected to demonstrate sequential progress.

According to the management, the women’s business had played a pivotal role in the company’s turnaround, with double-digit increases for 11 consecutive quarters. The men’s business has also exhibited growth. One factor contributing to Abercrombie’s success has been the expansion of its product range beyond jeans and t-shirts, encompassing dresses and clothing for various occasions. YPB, the active brand introduced by the company, celebrated its first anniversary and has expanded into the men’s segment, offering non-denim products. Leveraging Abercrombie’s reputation for soft and comfortable materials, YPB aims to capitalize on the trend of shifting from denim to non-denim and the preference for comfortable workwear, influenced by the work-from-home culture.

The company’s shift toward more comfortable and casual clothing aligns with the increasing consumer demand for practicality and comfort, as observed in the successes of brands like Hoka and Lululemon. According to Grand View Research, the athleisure market is expected to reach $662.5 billion by 2030, presenting Abercrombie with an opportunity for growth if it continues to innovate and introduce new products in this space.

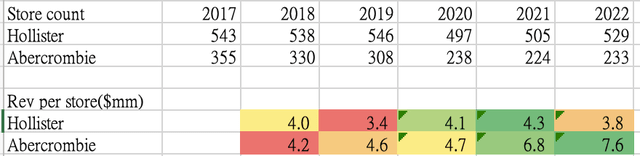

Under the new CEO’s strategy, the company has closed old-format stores while increasing the presence of new-format stores and introducing new brands. This initiative led to a decrease in the store count from 355 to 233. However, it also significantly improved the average revenue per store, nearly doubling from $4.2 million per store to $7.6 million in 2022. This shift reflects the company’s efforts to optimize store performance and adapt to changing consumer preferences.

Store count and Rev per store (ANF)

Overall, Abercrombie has transformed its approach from exclusively targeting a particular consumer group to attracting customers from diverse backgrounds and catering to different occasions, including office wear. However, this broadening of the customer base comes with the risk of losing differentiation. This worrying trend nevertheless vanished in 2021, when the brand’s growth resumed.

Margin Expansion

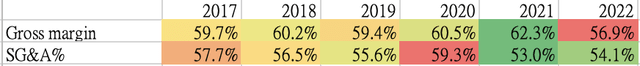

Since 2017, ANF has lowered its SG&A expense percentage by 300 basis points. However, with a current SG&A expense ratio of 54%, which is higher than the industry average, there is still room for expense reduction.

Margin and expense % of revenues (ANF)

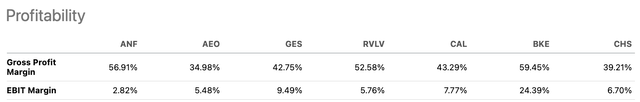

Margins (Seeking Alpha)

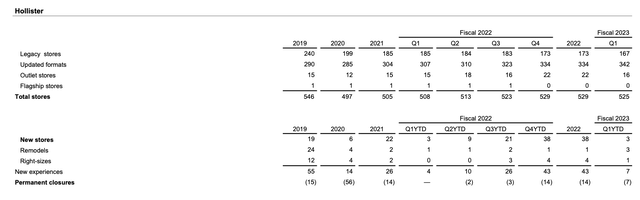

We are particularly interested in the cost-cutting initiatives being implemented at Hollister, although it appears that the company is still in the testing phase. The new store formats have increased in number, with 342 locations, while legacy stores have been reduced to 167. While they aim to leverage the success of the Abercrombie brand, progress seems limited.

We think one of the reasons is that Hollister primarily targets teenagers, whereas Abercrombie focuses on millennials. Therefore, certain factors contributing to Abercrombie’s success, such as the work-from-home trend, may not be as applicable to the teen demographic.

Hollister store count (ANF)

Through its marketing expenditures, we can assess its performance in another way. According to Banknotes, the company invested heavily in social media and celebrity collaboration. ANF launched its IGTV series, In the Living Room. The brand also teamed up with soccer star Megan Rapinoe on a seven-part interview series. These initiatives aimed to gain more influence among audiences.

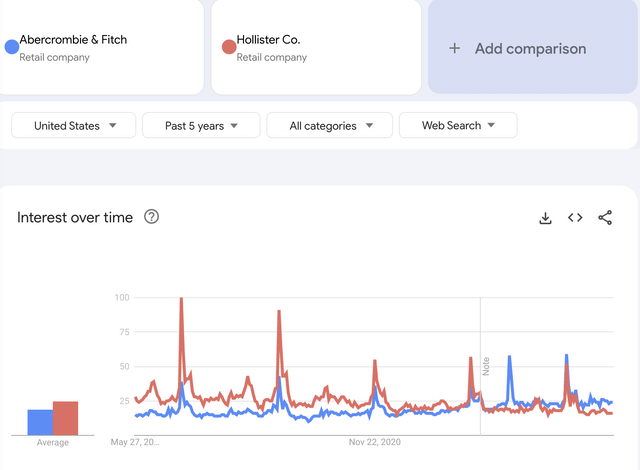

Google search trends showed Abercrombie interests were increasing and outweighing Hollister in recent years.

Google search (Google trend)

While we believe there is potential for margin expansion, the progress at Hollister appears to be slow and impeding overall performance. Spending on marketing is a hit-or-miss situation. We remained cautious on this margin improvement target.

Historical Valuation Multiple

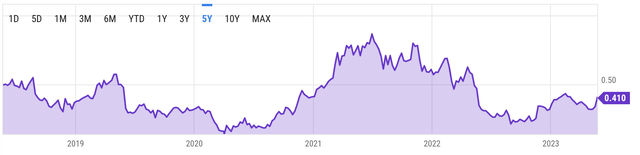

From a valuation perspective, ANF’s stock historically traded within a range of 0.5x to 0.3x the P/S ratio before the pandemic. However, the company’s Abercrombie brand has gained significant momentum since 2021, leading to a higher P/S ratio of 0.6x to 0.8x.

Historical P/S ratio (YChart)

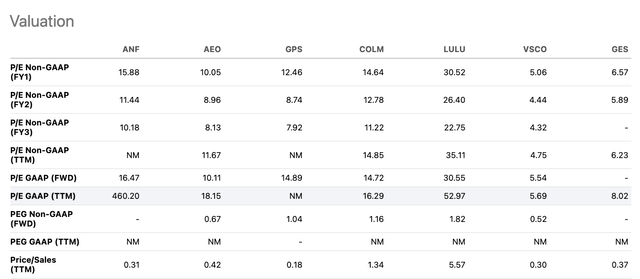

Compared to peers like LULU, a couple of stocks, including Abercrombie’s stock, are currently trading at a stressed multiple of a P/S ratio below 1x. We think the market perceives these as relatively weak fundamentals. If ANF successfully leverages the momentum of the Abercrombie brand and achieves its sales and margin targets, there is potential for the stock to undergo valuation multiple expansion.

Valuation multiple (Seeking Alpha)

Summary

Since the stock trades at a low P/S ratio, the downside risk of the stock appears limited based on our valuation multiples and the DCF model analysis. While Abercrombie presents an appealing proposition in the growing athleisure market, caution is advised regarding its margin expansion initiatives and potential challenges from the Hollister brand. As such, we consider ANF’s stock a short-term opportunity rather than a long-term investment, given its attractive risk and reward profile. We have assigned a “Neutral” rating to the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.