Summary:

- In this article, I discuss four important aspects related to the current environment of rising interest rates and how it affects home improvement retailers The Home Depot, Inc. and Lowe’s Companies, Inc.

- I explain the impact of interest rates on the valuation of the stocks of The Home Depot and Lowe’s Companies.

- I address the impact of interest rates on the unemployment rate and the housing market and show where I see Home Depot and Lowe’s in this context.

- I also take a close look at their debt servicing ability under a range of stress scenarios – after all, both companies have significant debt on their balance sheets.

- Finally, I reveal which of the two stocks I think is the better buy in this difficult environment.

KanawatTH

Introduction

Home improvement giants The Home Depot, Inc. (NYSE:HD) and Lowe’s Companies, Inc. (NYSE:LOW) reported their first quarter results on May 16 and May 23, respectively. Both reported a decline in comparable sales (4.5% and 4.3%, respectively) and issued rather weak guidance. Analysts revised their revenue expectations (and earnings per share expectations) downward accordingly, which can best be seen in the revenue revision trend graphs found on Seeking Alpha:

Figure 1: The Home Depot, Inc. [HD]: Revenue revision trend (retrieved from Seeking Alpha’s Premium service website for HD stock) Figure 2: Lowe’s Companies, Inc. [LOW]: Revenue revision trend (retrieved from Seeking Alpha’s Premium service website for LOW stock)![The Home Depot, Inc. [HD]: Revenue revision trend](https://static.seekingalpha.com/uploads/2023/5/26/49694823-16851069600553312.png)

![Lowe's Companies, Inc. [LOW]: Revenue revision trend](https://static.seekingalpha.com/uploads/2023/5/26/49694823-16851069763966625.png)

In my recent article, published after the release of the annual results, when analysts’ expectations were still a bit rosier, I discussed my positive long-term view of both stocks. However, as my regular readers know, I am always long-term oriented and therefore actually expected softer guidance. After all, the pandemic was a huge tailwind for both companies, so from that perspective alone, some sort of “mean reversion” was to be expected.

With the Federal Reserve raising interest rates at an unprecedented pace (it looks like it’s not done yet and inflation is still relatively high), it’s important to take a look at how interest rates have affected and continue to affect stocks like HD or LOW. Since there are several ways to look at this topic, I have divided the articles into four sections, each covering a single aspect. However, the sections should not be viewed as completely separable from each other, as some of the impacts discussed are interrelated.

Let’s start with the most obvious impact of interest rates – valuation:

1) The Impact Of Interest Rates On The Valuation Of Home Depot And Lowe’s Stock

In 2020 and 2021, stocks knew only one direction – up and to the right – due to aggressive quantitative easing and stimulus checks. The return to more reasonable valuations began as inflation heated up and the Federal Reserve started raising interest rates in early 2022. Growth stocks got hammered, while value stocks did not fall as dramatically.

Because growth stocks have relatively low current earnings and high expected earnings growth, they are much more sensitive to interest rate changes than stocks of companies that generate strong current cash flows (e.g., tobacco, pharmaceutical, food and beverage companies).

HD and LOW have very strong current earnings and cash flows, but at the same time they had significant growth priced into them at the end of 2021. As of today (May 26, 2023), HD and LOW are 30% and 22% below their all-time highs, respectively. While it can be argued that “the damage has already been done,” i.e., investors have already priced in higher interest rates, it is still interesting to look at the interest rate sensitivity of the two stocks.

The 30-year Treasury is a good indicator of the long-term “risk-free” rate and currently yields 4.0%. Since equity is always more expensive than debt (shareholders have only residual claims and no contractual right to a coupon payment), equity investors demand a risk premium on the prevailing risk-free rate.

The use of a static risk premium for equities is, of course, a crude approximation, since it implies that the risks of the underlying company are not affected by changes in interest rates. However, it is sufficient to explain the issue at hand. When interest rates rise, shareholders’ expected compensation adjusts accordingly, all else being equal.

Figure 3 shows the results of a discounted cash flow sensitivity analysis for the valuation of HD and LOW stock. The risk-free rate ranges from 2.5% to 4.5%, and the equity risk premium is fixed at 4.0%. It is easy to see how sensitive even stocks with high current cash flows, such as HD and LOW, are. For example, an increase in the risk-free rate of just 200 basis points results in a 25% to 45% decline in fair value based on implied terminal growth rates of 0% and 4%, respectively.

In summary, this example illustrates the interest rate sensitivity of HD and LOW. In principle, stocks can be considered as investments with a very long duration. Those who are not familiar with the concept of duration should take a look at this article where I explain the concept in detail. As will be discussed later, it is unlikely that the Federal Reserve will continue to aggressively raise interest rates, so I do not expect much further downside associated with a rise in the risk-free rate. Nevertheless, LOW stock is more conservatively valued (i.e., lower implied growth) in direct comparison and when viewed in isolation, making it less susceptible to such valuation adjustments.

Figure 3: The Home Depot, Inc. [HD] vs. Lowe’s Companies, Inc. [LOW]: Discounted cash flow analyses showing the interest rate sensitivity of HD and LOW stock (own work, based on the two companies’ 2020 to 2022 10-Ks, the 2023 Q1 results, and own calculations)![The Home Depot, Inc. [HD] vs. Lowe's Companies, Inc. [LOW]: Discounted cash flow analyses showing the interest rate sensitivity of HD and LOW stock](https://static.seekingalpha.com/uploads/2023/5/26/49694823-16851071040882316.png)

2) The Impact Of Interest Rates On The Unemployment Rate

As the two largest home improvement retailers in the U.S., shares of The Home Depot and Lowe’s Companies are naturally very sensitive to the unemployment rate. Of course, this statistic should not be viewed in isolation, but all other things being equal, a weakened labor force – taken as a whole – has less disposable income and thus less money to spend on elected home improvement projects. Mandatory repairs are unlikely to be foregone, but it is reasonable to draw an inverse relationship between home improvement revenues and the unemployment rate.

In very simplistic terms, when the Fed raises interest rates, borrowing costs for businesses rise and economic growth slows. Profitability falls, and businesses have to cut spending and lay off employees. Already from this perspective, the unemployment rate cannot be a leading indicator of a recession, and this is confirmed when we look at recessions in the U.S. since the 1940s (Figure 4). The unemployment rate rises during a recession and usually starts to fall at the end of a recession.

Figure 4: U.S. Bureau of Labor Statistics, Unemployment Rate [UNRATE] (retrieved from FRED, Federal Reserve Bank of St. Louis; stlouisfed.org, May 26, 2023)![U.S. Bureau of Labor Statistics, Unemployment Rate [UNRATE]](https://static.seekingalpha.com/uploads/2023/5/26/49694823-16851071428523285.png)

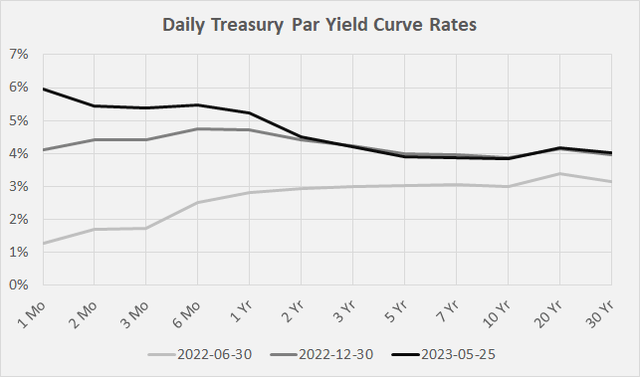

As an aside, an inverted yield curve is the most reliable leading indicator of an impending recession, and research shows that it might even be able to cause one. The correlation between the occurrence of a recession and a previous yield curve inversion is shown in Figure 5. Figure 6 compares daily Treasury par yield curve rates from about a year ago with the rates at the end of September 2022 and the most recent data. An inversion of the yield curve can be bad for homebuyers with adjustable-rate mortgages (more on this later).

Figure 5: Federal Reserve Bank of St. Louis, 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity [T10Y2Y] (retrieved from FRED, Federal Reserve Bank of St. Louis; stlouisfed.org, May 26, 2023) Figure 6: Daily Treasury par yield curve rates (own work, based on data retrieved from treasury.gov)![Federal Reserve Bank of St. Louis, 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity [T10Y2Y]](https://static.seekingalpha.com/uploads/2023/5/26/49694823-16851071869522212.png)

Returning to the impact of interest rates on the labor market, it is becoming clear that the oft-cited robustness of the U.S. labor market should not be taken as a reassuring signal. Granted, the unemployment rate remains extremely low and shows no signs of rising yet. However, if one takes into account recent statements made by many company managements, the number of layoffs is increasing, and it is to be expected that the unemployment rate will rise at some point.

In addition, it should not be forgotten that some companies are still benefiting from pandemic-related loan moratoriums and/or various subsidies. In addition, a certain percentage of companies are only able to survive and retain employees because of the monetary policies that have prevailed since the Great Financial Crisis and the related malinvestments. I discuss this important aspect and the possible consequences of a concerted demise of such so-called “zombie companies” in great detail in another article.

As a counter-argument, however, it can also be argued that in the face of rising interest rates and a weaker labor market, people are less and less able to afford to buy a new house and are instead considering buying a used property to renovate. It is difficult to impossible to weigh the two factors, but the – in my opinion incorrect – assumption that a weakening housing market will lead to an outright and severe decline in profits at home improvement companies is one reason why I remain optimistic about my investments in HD and LOW.

3) The Impact Of Interest Rates On The Housing Market

As I mentioned earlier, the labor force as a whole has less disposable income when interest rates rise and the unemployment rate increases. Persistently high inflation has the same effect at the individual level. However, as the Federal Reserve raises interest rates to contain inflation, consumers are also squeezed by rising mortgage rates. Of course, those who financed their homes at a fixed rate are much better off than those who chose an adjustable rate mortgage loan.

Basically, it is very reassuring that the percentage of adjustable rate mortgages in the United States is extremely low. In comparison, and according to the same article, the percentage of fixed-rate mortgages in Belgium and Denmark is also quite high (77% and 46%, respectively), while in Poland and Portugal almost all mortgages have a variable rate (100% and 89%, respectively).

Although the high share of fixed-rate mortgages results in a high resilience of existing mortgages, resulting in little to no unhedged interest rate risk and thus stable disposable income for borrowers (all else being equal), prospective homeowners are less and less able to borrow. In the current environment, the average interest rate on 30-year fixed rate mortgages has risen sharply from just 2.6% in January 2021 (the lowest level since the 1970s) to 7.0% in November 2022. Since then, the interest rate has fallen somewhat, but is still quite high at 6.6%.

As a result, housing starts began to decline in early 2022 (Figure 7), as did the median price of homes sold (Figure 8). The well-known S&P/Case-Shiller U.S. National Home Price Index also signals a weakening housing market. Those interested in a deeper dive into the current state of the housing market should take a look at the most recent presentation of the National Association of Realtors.

Figure 7: U.S. Census Bureau and U.S. Department of Housing and Urban Development, New Privately-Owned Housing Units Started: Total Units [HOUST] (retrieved from FRED, Federal Reserve Bank of St. Louis; stlouisfed.org, May 26, 2023) Figure 8: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price of Houses Sold for the United States [MSPUS] (retrieved from FRED, Federal Reserve Bank of St. Louis; stlouisfed.org, May 26, 2023)![U.S. Census Bureau and U.S. Department of Housing and Urban Development, New Privately-Owned Housing Units Started: Total Units [HOUST]](https://static.seekingalpha.com/uploads/2023/5/26/49694823-1685107278793436.png)

![U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price of Houses Sold for the United States [MSPUS]](https://static.seekingalpha.com/uploads/2023/5/26/49694823-16851073206488411.png)

However, I don’t think these are necessarily negative signals for home improvement retailers like HD and LOW. Considering that the median price of homes sold is still very high and has risen extremely sharply since the pandemic (CAGR of about 16%), people are likely to increasingly choose to renovate rather than buy a new property. Even though the steep rise in home prices since 2020 suggests that there is still a lot of downside potential ahead, I would argue that housing market stability is an important goal of the Federal Reserve. Although interest rates are likely to rise another 25 or 50 basis points, it is difficult to envision a much higher federal funds rate because of the expected negative impact on the housing market and thus on the banking system (decline in collateral valuations).

Against this backdrop, I expect real estate prices to decline somewhat in the near term, but to remain expensive by historical standards. As a result, I think HD and LOW will benefit from the expected continued high demand for used real estate.

4) The Impact Of Interest Rates On HD’s And LOW’s Debt Servicing Capacity

As I have detailed in my previous articles, both HD and LOW are heavily indebted, in part due to large share buybacks. However, it is important to understand that while the debt is high in absolute terms, it is very manageable due to the companies’ strong free cash flows.

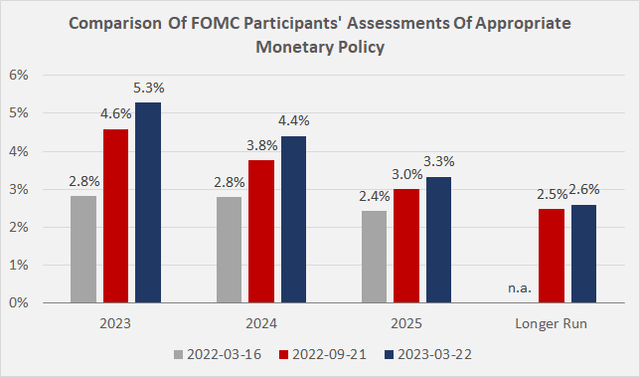

Nevertheless, as the Federal Reserve continues to raise interest rates and rates are likely to remain high for longer (Figure 9), it is important to assess the potential impact on HD and LOW’s debt servicing ability. Finally, cash flow will decline in a recession, so we should ensure that our companies have sufficient headroom to weather such an environment.

Figure 9: Comparison of FOMC participants’ assessments of appropriate monetary policy; note that the “Longer Run” value for the March 2022 data is missing because the FOMC published expectations for 2022 to 2024 and “Longer Run” at that time; therefore, I used the “Longer Run” value published at that time in the 2025 category (own work, based on projection materials retrieved from federalreserve.gov, which have been recalculated to yield weighted-average mean expectations)

The maturity profiles for The Home Depot’s and Lowe’s Companies’ long-term debt are shown in Figure 10 and Figure 11, respectively, including the weighted-average interest rate for each five-year period. At first glance, it looks like both companies have excessively large debt maturing through 2027 – about $9 billion and $7 billion, respectively. However, using data for 2020 through 2022, HD and LOW generated free cash flow of about $21.5 billion and $18.5 billion, respectively, over the last three years, adjusted for stock-based compensation, normalized with respect to working capital movements and, most importantly, after dividends. This means that both companies could comfortably pay off the outstanding bonds as they mature.

Figure 10: The Home Depot, Inc. [HD]: Long-term debt maturities as of year-end 2022 (own work, based on the company’s 2022 10-K) Figure 11: Lowe’s Companies, Inc. [LOW]: Long-term debt maturities as of year-end 2022 (own work, based on the company’s 2022 10-K)![The Home Depot, Inc. [HD]: Long-term debt maturities as of year-end 2022](https://static.seekingalpha.com/uploads/2023/5/26/49694823-1685107398804359.png)

![Lowe's Companies, Inc. [LOW]: Long-term debt maturities as of year-end 2022](https://static.seekingalpha.com/uploads/2023/5/26/49694823-16851074071138353.png)

In the event of a severe recession or prolonged stagflationary environment, cash flows will of course decline quite significantly. Therefore, we should assume that both companies will have to refinance their debt (and they will likely refinance it even if we avoid a deep recession). Assuming that interest rates remain high for longer, I have calculated relatively simple stress scenarios to estimate the impact on HD’s and LOW’s debt servicing ability. Currently, HD’s debt is slightly cheaper than LOW’s (Figure 12), which also makes sense from a credit rating perspective (A2 and Baa1, both with a stable outlook, respectively). The scenario analysis assumes that both companies will have to refinance debt maturing in the next ten years at premiums of 50 to 200 basis points. As expected, the weighted-average interest rate rises for both HD and LOW, but I would argue that the increase is still manageable even in the worst (and probably unrealistic) scenario.

Figure 12: The Home Depot, Inc. [HD] vs. Lowe’s Companies, Inc. [LOW]: Interest rate sensitivity analysis – weighted-average interest rates (own work, based on the companies’ 2022 10-Ks and own calculations)![The Home Depot, Inc. [HD] vs. Lowe's Companies, Inc. [LOW]: Interest rate sensitivity analysis - weighted-average interest rates](https://static.seekingalpha.com/uploads/2023/5/26/49694823-16851074458100736.png)

Putting the interest payments of the two companies under the above scenario in relation to free cash flow, the interest coverage ratio can be calculated (Figure 13). Again, HD looks better than LOW in this regard, but I would argue that both companies are acceptably financed. An interest coverage ratio of six times free cash flow before interest in the most conservative scenario is still no cause for concern.

Figure 13: The Home Depot, Inc. [HD] vs. Lowe’s Companies, Inc. [LOW]: Interest rate sensitivity analyses – interest coverage ratio (own work, based on the companies’ 2022 10-Ks and own calculations)![The Home Depot, Inc. [HD] vs. Lowe's Companies, Inc. [LOW]: Interest rate sensitivity analyses - interest coverage ratio](https://static.seekingalpha.com/uploads/2023/5/26/49694823-16851074814313366.png)

Finally, assuming that HD and LOW’s free cash flow declines in a recession or long-term stagflationary environment, it is reassuring to know that HD and LOW will most likely still be able to pay their dividends. Assuming the +200 basis point stress scenario mentioned above, HD’s free cash flow could decline by 35% before its dividend would no longer be fully covered. And while one might assume that LOW’s headroom is more limited due to its already more expensive debt, the opposite is true. The company’s cash flow could decline by more than 50% before the dividend would be in jeopardy. This is due to LOW’s much lower dividend payout ratio, which is currently around 28% of the three-year average normalized free cash flow (52% for HD).

Key Takeaways – And Is HD Or LOW Stock The Better Buy In This Environment?

Rising inflation and the resulting rapid increase in interest rates have severely impacted the overall stock market since early 2022 and continue to contribute to a choppy environment.

Looking at the impact purely from a discount rate perspective, most of the damage has already been done, and I don’t expect valuations of The Home Depot, Inc. and Lowe’s Companies, Inc. stocks to fall much further in this context, all else being equal. However, the post-pandemic period is a prime example of why investors should always consider the concept of duration in their due diligence.

The U.S. labor market is still very strong, but I would not take that as a positive signal. The unemployment rate usually rises during a recession, and considering that the yield curve has recently inverted (the most reliable leading indicator of a recession), it is reasonable to expect earnings from the two home improvement giants to suffer in the near term. However, with rising interest rates and a weaker labor market, people are likely to increasingly focus on used properties, and the associated demand for renovations should support HD’s and LOW’s earnings.

Housing valuations remain very high, but the market is showing signs of weakness. The Federal Reserve knows all too well that a continuation of its current course will have serious implications for the housing market at some point and, by extension, the banking sector. I think there will still be some setbacks, but I expect the housing market to remain quite robust – assuming there is no deep and prolonged recession, of course. Continued high housing valuations should support sales of used properties in need of renovation, and thus HD and LOW.

Finally, the debt servicing ability of both companies is likely to weaken somewhat as they refinance their debt in this environment. However, as I have shown, this is not a problem, and although both companies have high debt in absolute terms, it is very manageable even under pretty conservative scenarios. In my opinion, it is very reassuring to know that both companies can easily maintain (and continue to increase) their dividends even if they have to refinance their upcoming debt at a 200 basis point premium. Most reassuring is the fact that LOW’s cash flow could decline by more than 50% before its dividend would be at risk, while HD’s room to maneuver is more limited (35% tolerable decline) despite its comparatively lower weighted-average interest rate. This is due to LOW’s much lower dividend payout ratio, which is currently around 28% of its three-year average normalized free cash flow (52% for HD).

All in all, I remain positive on the prospects of both companies, which I outlined in my last article. While both companies are very well positioned in this difficult environment, I still believe that LOW stock is the better buy at current levels, as it has higher potential for margin expansion, a lower payout ratio and, most importantly, a more favorable valuation. LOW stock is currently trading at a free cash flow yield of over 7% (5% for HD). The FAST Graphs charts in Figure 14 and Figure 15 nicely confirm this – in my opinion largely unjustified – valuation gap.

Figure 14: The Home Depot, Inc. [HD]: FAST Graphs chart based on adjusted operating earnings per share (retrieved from fastgraphs.com, May 26, 2023) Figure 15: Lowe’s Companies, Inc. [LOW]: FAST Graphs chart based on adjusted operating earnings per share (retrieved from fastgraphs.com, May 26, 2023)![The Home Depot, Inc. [HD]: FAST Graphs chart based on adjusted operating earnings per share](https://static.seekingalpha.com/uploads/2023/5/26/49694823-16851075201733756.png)

![Lowe's Companies, Inc. [LOW]: FAST Graphs chart based on adjusted operating earnings per share](https://static.seekingalpha.com/uploads/2023/5/26/49694823-1685107554809302.png)

As always, please consider this article only as a first step in your own due diligence. Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there is anything I should improve or expand on in future articles, drop me a line as well.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LOW, HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice and I am in no way qualified to do so. I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any form of investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.