Summary:

- Pfizer’s revenue for the first three months of 2023 was $18.28 billion, down 24.7% from the previous quarter and 28.8% from the first quarter of 2022.

- At the end of March 2023, Pfizer’s total debt was about $36.17 billion, down substantially from 2021 despite several acquisitions.

- In the first quarter of 2023, Oxbryta sales reached $71 million, reflecting a 28.6% increase from the previous year.

- Despite the expected beginning of a period of turbulence in the stock market in the coming months, we continue our analytical coverage of Pfizer with an “outperform” rating for the next 12 months.

- Pfizer’s gross margin stood at 73.5% in Q1 2023, reaching its highest since the start of the COVID-19 pandemic, thanks to recent price increases for some of the company’s blockbusters, lower raw material costs, and improved drug supply chains.

tommaso79/iStock via Getty Images

On May 2, 2023, Pfizer (NYSE:PFE) released its financial results for the first quarter of 2023, which not only beat analysts’ expectations but were able to demonstrate that demand for Paxlovid, an antiviral drug for the treatment of COVID-19, remains solid and sales of many of the targeted cancer medicines remain upward momentum.

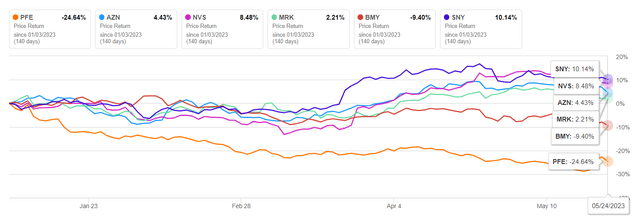

Since the beginning of 2023, Pfizer’s share price has shown a decline of 24.64%, reaching our predicted price level of $37 per share as indicated in the previous article “Pfizer Vs. AstraZeneca: Which Is Better For Long-Term Investors?” and then reversed.

Author’s elaboration, based on Seeking Alpha

Despite increased competition in the neuroscience and rare disease treatment markets from main competitors such as Roche Holding (OTCQX:RHHBY) (OTCPK:RHHVF), AstraZeneca (AZN), and Johnson & Johnson (JNJ), as well as the upcoming US presidential election in November 2024, which could put additional pressure on the pharmaceutical industry due to the expected rhetoric from many politicians putting prescription drug price cuts at the center of their campaign, Pfizer is still one of the best dividend stocks for long-term investors.

We continue our analytics coverage of Pfizer with an “outperform” rating for the next 12 months.

Pfizer’s Financial Position

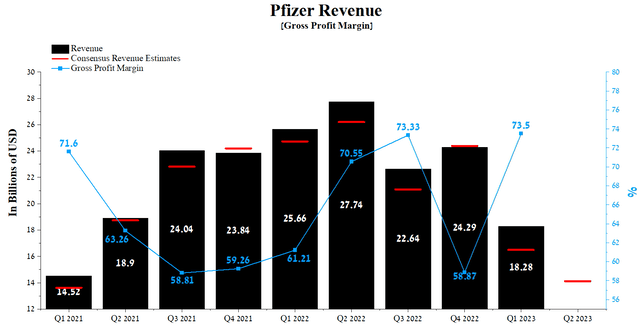

Pfizer’s revenue for the first three months of 2023 was $18.28 billion, down 24.7% from the previous quarter and 28.8% from the first quarter of 2022. Since 2021, when the Pfizer-BioNTech COVID-19 vaccine hit the market, the company’s actual revenue has beaten analysts’ consensus estimates seven times out of nine. In recent months, Pfizer has continued to actively expand its portfolio of product candidates and rejuvenate its drug portfolio to offset the impact of the future loss of exclusivity of some of the company’s blockbusters and also invest its COVID-19 money in increasing the share of the company’s products in the fast-growing pharmaceutical market.

Author’s elaboration, based on Seeking Alpha

In recent months, Mr. Market has stepped up its oversight of Pfizer’s business development, continuing to evaluate the effectiveness of business strategies implemented by Albert Bourla to improve the company’s financial position in the post-COVID-19 period. In the first quarter of 2023, Pfizer’s management surprised Wall Street by beating consensus estimates by $1.79 billion despite a $10.1 billion drop in Comirnaty sales and a drop in demand for Xeljanz due to label changes.

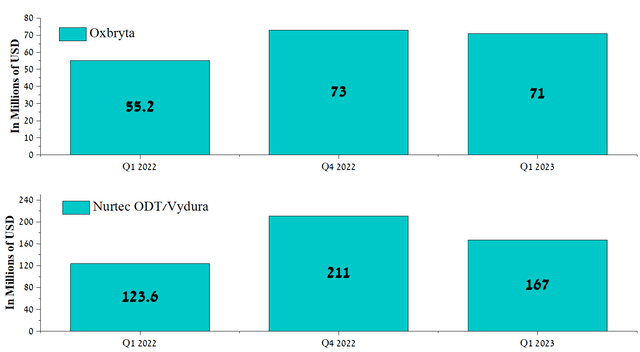

In 2022, Pfizer completed the acquisition of Global Blood Therapeutics and Biohaven Pharmaceuticals, which adds Nurtec ODT/Vydura and Oxbryta to the company’s product portfolio.

Author’s elaboration, based on quarterly securities reports

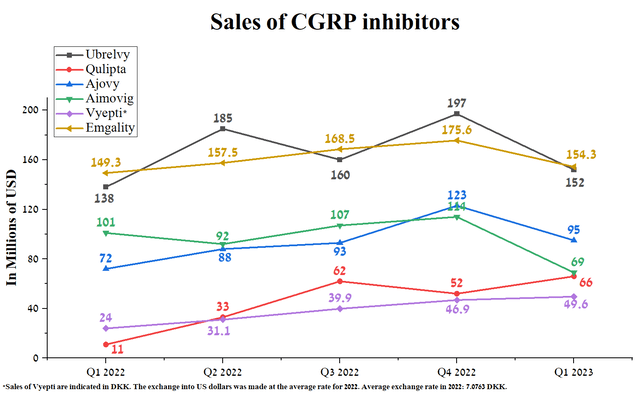

In the first quarter of 2023, Oxbryta sales reached $71 million, reflecting a 28.6% increase from the previous year. At the same time, Nurtec ODT/Vydura’s sales grew by 35.1% compared to Q1 2022. However, a worrisome moment that surprised us was the lack of a clear QoQ growth trend for Nurtec ODT/Vydura, and this may be due to increased competition from such CGRP inhibitors as AbbVie’s Ubrelvy and Qulipta (ABBV), Teva’s Ajovy (TEVA), Amgen’s Aimovig (AMGN), Lundbeck’s Vyepti, and Eli Lilly’s Emgality (LLY).

Author’s elaboration, based on quarterly securities reports

On the other hand, we continue to believe sales will improve in the coming quarters due to Nurtec ODT/Vydura’s competitive advantages in efficiency, the oral route of administration, and Pfizer’s colossal marketing capabilities that will improve patient access to the medicine.

Pfizer’s gross margin stood at 73.5% in Q1 2023, reaching its highest since the start of the COVID-19 pandemic, thanks to recent price increases for some of the company’s blockbusters, lower raw material costs, and improved drug supply chains. Moreover, this financial ratio is higher than that of major competitors such as Sanofi (SNY), Roche Holding, and Takeda Pharmaceutical (TAK), another factor attracting investors looking for dividend stocks from the healthcare sector.

We predict that Pfizer’s gross margin will reach 66.5% by 2023 and increase to 70.5% by 2024, thanks to lower inflation, pending FDA approval of a vaccine to prevent RSV in infants, and synergies from the completion of the acquisition of Seagen, which has rich pipeline product candidates are in pivotal clinical trials.

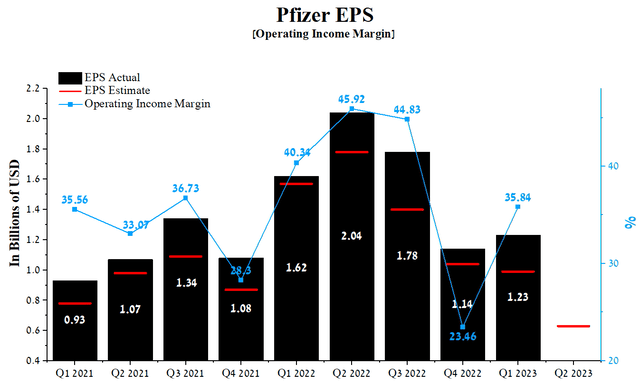

Pfizer’s Q1 2023 margin operating income was 35.84%, up significantly quarter-on-quarter and approaching its median of 36.01% between January 1, 2021, and the end of March 2023. The company’s earnings per share (EPS) for the first three months of 2023 was $1.23, up 7.9% quarter-on-quarter, and just as importantly, it has continued to beat analyst consensus estimates in recent years.

But at the same time, Pfizer’s Q2 EPS is expected to be $0.44-0.85, which is 37.4% less than the consensus for Q1 2023. Pfizer’s Non-GAAP P/E (TTM) is 6.11x, which is 65.71% less than the average for the sector and 49.14% less than the average over the past five years, which is one of the factors, indicating that the company is underestimated by Wall Street in the current period of declining inflation and recovering economic growth in China and India.

Author’s elaboration, based on Seeking Alpha

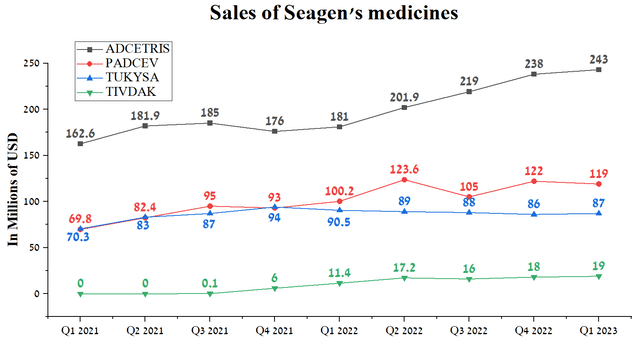

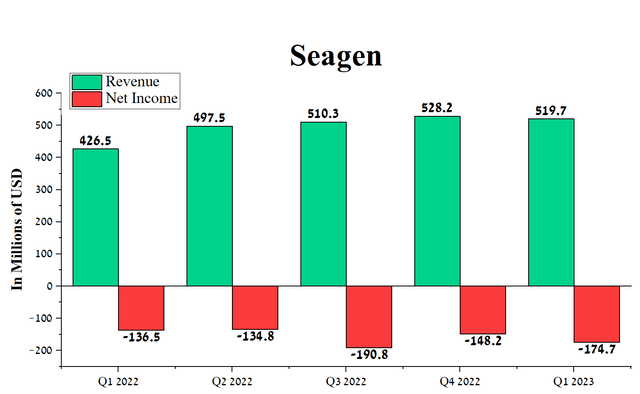

We expect the acquisition of Seagen to negatively impact Pfizer’s net income in the medium term, as even with growing sales of its medicines, it remains a loss-making company.

Author’s elaboration, based on quarterly securities reports

Thus, Seagen’s total revenue amounted to $519.7 million, an increase of 21.9% compared to the previous year, but at the same time, its net loss increased by $38.2 million.

Author’s elaboration, based on Seeking Alpha

Given the need to service increased debt after the Seagen acquisition and high R&D spending, we do not expect Albert Bourla to resort to using the company’s share buyback program in the coming months, which of course, could make the company’s shares more vulnerable to short sellers who believe that in the post-COVID-19 era, the company does not have products that can return it to the Olympus of the industry.

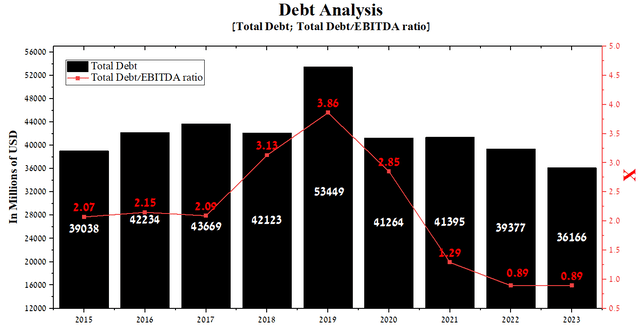

At the end of March 2023, Pfizer’s total debt was about $36.17 billion, down substantially from 2021 despite several acquisitions. At the same time, even considering the decrease in EBITDA in recent quarters, the total debt/EBITDA ratio is below 1x, indicating that the company maintains financial flexibility in developing experimental drugs and further entering into partnership agreements.

Author’s elaboration, based on Seeking Alpha

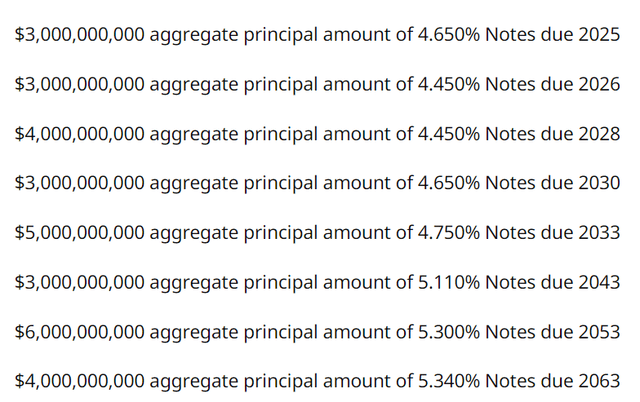

Pfizer will finance the $43 billion acquisition of Seagen with the company’s cash, which stood at about $19.97 billion at the end of March, and through the placement of senior notes totaling $31 billion. On May 16, 2023, the company announced additional terms and pricing of a debt offering.

Thanks to Pfizer’s balanced borrowing policy, we don’t expect it to have problems redeeming its senior notes. Moreover, given the significant decline in inflation in most countries over the past year, we expect the beginning of the reduction of interest rates of central banks as early as 2023. At the same time, the company’s management may resort to debt refinancing in the event of unforeseen circumstances or to reduce debt servicing costs.

Conclusion

On May 2, 2023, Pfizer released its financial results for the first quarter of 2023, which not only beat analysts’ expectations but were able to demonstrate that demand for Paxlovid, an antiviral medicine for the treatment of COVID-19, remains high, contrary to the expectations of many market participants. At the same time, Mr. Market has stepped up its oversight of Pfizer’s business development, continuing to evaluate the effectiveness of business strategies implemented by Albert Bourla, which are aimed at improving the company’s financial position in the post-COVID-19 era.

The company continues to delight investors with positive news from both the FDA advisory committee, which voted to approve the company’s vaccine candidate for preventing RSV in infants, and continued to publish positive results from various clinical trials evaluating the effectiveness of the company’s experimental drugs for treating type 2 diabetes and multiple types of cancer.

That said, despite the news that the FTC is seeking to block Amgen’s acquisition of Horizon Therapeutics, we believe the upcoming court battle between them will have little impact on Pfizer’s acquisition of Seagen. On the other hand, we are concerned about the continued increase in Seagen’s net loss, despite optimistic expectations for its revenue growth rate and an extensive portfolio of product candidates that could significantly help Pfizer’s return to the top of the pharmaceutical industry. The company’s increased debt following a $31bn bond sale could increase short selling power on Pfizer shares, as Albert Bourla is unlikely to resort to a share buyback program in the current environment.

Despite the expected beginning of a period of turbulence in the stock market in the coming months, we continue our analytical coverage of Pfizer with an “outperform” rating for the next 12 months.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TAK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.