Summary:

- Nvidia Corporation is getting closer to our $1 trillion valuation target we established last year.

- Having given Nvidia a buy rating at $160 last year, and being up more than 136.81% since, we maintain a more cautious stance on the company.

- Despite sharply increased multiples, we maintain our “hold” rating, based on positive outlook combined with recent AI developments.

- Based on our updated growth projections, we outline at what price we consider Nvidia Corporation stock to be a “Buy” and “Strong Buy” again.

Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

Nvidia Corporation (NASDAQ:NVDA) reported its Q1 FY2024 earnings earlier this week, after which it gained more than $200BN in market cap and nearly joined the trillion-dollar club, reaching a market cap of $986.76BN at one point in the pre-market session.

This comes after we wrote a piece last June titled “Nvidia Is On Track To Join The Trillion Dollar Club,” in which we gave Nvidia a buy rating and outlined our trillion-dollar valuation for the company. Since our last buy rating in November at $160 with AI cited as the reason to buy the company and before the advent of ChatGPT, the stock has risen a whopping 136.81%. And while we didn’t expect the stock to get so close to the trillion-dollar club so quickly, we were positively surprised by management’s recent guidance, and have adjusted our valuation model to reflect some new critical data.

This article discusses where we see Nvidia going long term, why we maintain our hold rating for the stock, and at what level we would become buyers of the stock again.

Seeking Alpha, Wright’s Research

Party Like It’s 1999

Nvidia’s earnings call was interesting, to say the least. As most investors know by now, Nvidia raised its expectations for Q2 earnings from $7.2 billion to an immense $11 billion+, which was a slap in the face to bears who went short the stock based on its high P/E ratio, or thinking that Nvidia’s scenario is similar to the hype during dot-com.

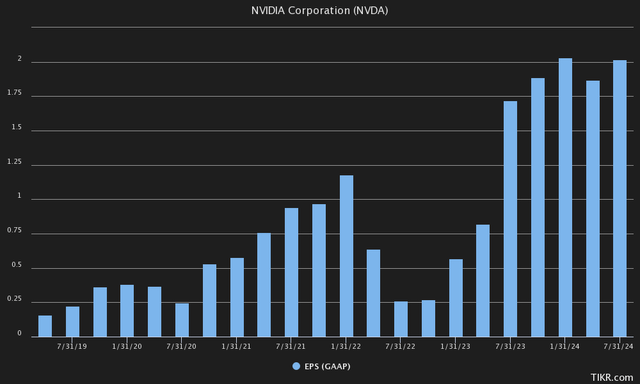

And rightfully so, as Nvidia is currently trading at a price-to-earnings ratio of 114x if we take Q1 numbers on an annualized basis. But it is also important to separate fact from fiction, and also recognize management’s expectations for Q2. In short, they expect $11BN in revenue, with GAAP gross margins of about 68.6%, or $7.55BN in gross profit. They also expect $2.71BN in GAAP operating expenses, leaving us with $4.84BN in operating income. After adjusting for other income and deducting taxes, Nvidia is expected to be left with $4.24BN in earnings.

In other words, according to our calculations and analyst expectations, they are aiming for a GAAP EPS in Q2 of $1.72. This means that, at an annualized Q2 EPS ($6.88), Nvidia is rather trading at 55x earnings. So still a very stretched multiple, but perhaps justifiable when growth is taken into account.

Speaking of partying like it’s 1999, Nvidia’s management wasn’t shy about mentioning artificial intelligence, or AI, in its earnings call, either. They mentioned AI a whopping 107 times during the 68-minute-long earnings call. That’s one AI mention every 38 seconds. Impressive.

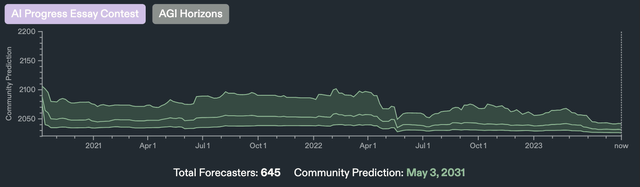

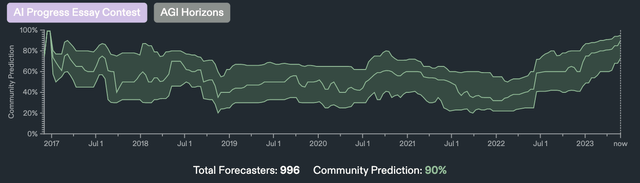

After this huge beat, almost all analysts on the Street raised their price targets north of $500, which is still quite a stretch if you would ask us, but we’ll get to our valuation model in a moment. Before we get to that, we want to highlight some of the key metrics we have considered in our previous models when it comes to expected growth in the AI space. In the past, we have primarily used Metaculus to gauge whether people were overly optimistic or pessimistic about future AI growth. Metaculus is a prediction platform that uses a unique method to collect predictions about future events, mainly by rewarding predictors through a point system where they get points if they are right, or more right than the community. Metaculus has an amazing track record of historical predictions, far exceeding the baseline.

One of the forecasts we follow closely is the timeline of when “a first general AI system will be conceived, tested, and publicly announced.” Since our initial buy rating last year, we have noticed that this timeline shifted from an average target of the year 2050 in 2020 to the year 2038 from last year’s prediction. However, recent polls show that this timeline has moved even closer, now standing at May 2031.

Some of the reasons for this recent progress include GPT-4, which has scored exceptionally high on the Multi-task language understanding benchmark. In another poll forecasting when AIs will be able to program programs that AIs can program, the timeline has also shrunk from 2037 in 2020 to 2026 now. Finally, in the poll forecasting whether there will be parity between humans and machines before 2040, the consensus now stands at a whopping 90%.

If there is one thing we can derive from all these predictions, it is that AI seems to continually surprise humans on the upside in terms of advances made in space.

Our Updated Valuation Model

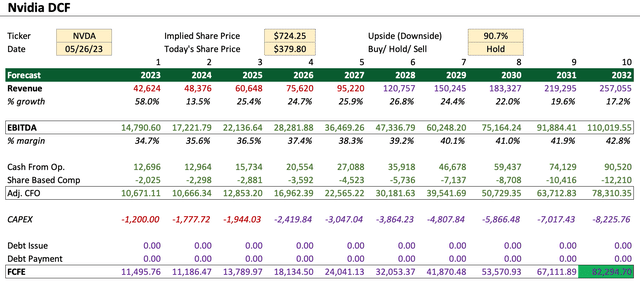

To take into account both the very positive guidance from management, which we did not anticipate, and the positive developments in the AI space, we have mainly taken into account a higher growth rate in the coming years.

Keep in mind that our current valuation model is quite optimistic. We think Nvidia has the ability to generate $120BN in revenue by 2028, versus annual revenue of $44BN as of the second quarter. While this may seem excessive at first glance, though Nvidia has quadrupled its revenue between 2019 and now. After 2028, we forecast slower but still high double-digit growth by the end of this 10-year cycle, as mentioned in the earnings call.

And so I think you’re starting — you’re seeing the beginning of call it a 10-year transition to basically recycle or reclaim the world’s data centers and build it out as accelerated computing.

We overlaid this revenue growth and compared it to other historically disruptive technologies, such as Apple’s revenue growth when they launched the iPhone in 2007. Apple was able to grow revenue in a manner similar to our forecast for Nvidia, with a CAGR of 18.94% between 2007 and now, compared to our CAGR growth of 19.68% for Nvidia. We don’t think many forecasters expected Apple to also grow its revenue from $24.58BN in 2007 to $394.32BN in 2022, similar to perhaps Nvidia today.

Like Apple and its iPhone, we see Nvidia essentially as a provider of the tools to increase efficiency and/or provide entertainment value by selling hardware with unique software. For Apple, it is the iPhone/Mac combined with IOS. For Nvidia, it’s their GPU with CUDA attached. And in terms of the long-term potential of productivity growth and entertainment value, we think Nvidia could be on par with Apple in the future.

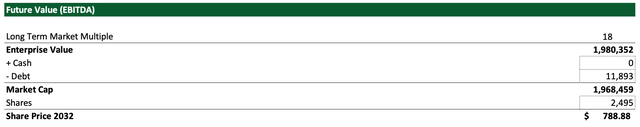

Thus, our best-case valuation model expects EBITDA margins to remain more or less flat throughout the period, ending the forecast at roughly the same margins as in the second quarter of this year, while revenues increase exponentially. At an EV/EBITDA multiple of 18x, we think that with an optimistic outlook, a market valuation of $1.98T or $788 per share by 2032 could be within reach.

To put our forecasts in context once again, the GPU market is expected to grow at a CAGR of 33.3% between now and 2030. If we extend this to 2032, the market is expected to reach $791.79 billion, which according to our valuation model means they would own a 32.37% market share. This scenario strongly reminds us of Amazon AWS, which currently has a 35% market share in the cloud computing market, currently valued at $545.8 billion.

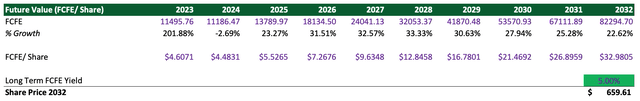

Like Amazon.com, Inc. (AMZN), which gained its competitive advantage by scaling AWS for more than a decade, Nvidia has also built its competitive edge in the GPU space with their CUDA software, while other players focused on CPUs and tried to push the limits of Moore’s law. But back to valuation: on an FCFE basis, we believe that in an optimal scenario, Nvidia has the potential to generate $32.98 in FCFE per share by 2032. At an FCFE yield of 5%, we arrive at a price target of $659.61.

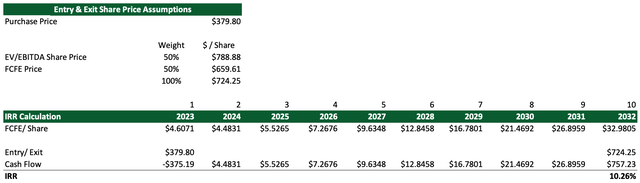

In other words, assuming both valuations at a 50% weighting, in our bull case, we expect Nvidia to trade north of $724.25. But even in our highly optimistic scenario, the IRR at Nvidia’s current share price is expected to be only 10.26%. In other words, we think Nvidia can generate an average historical return comparable to that of broad benchmarks.

However, we do not believe this would be an attractive risk-return proposition, as investors are taking huge risks, taking into account the fact that revenues are sure to grow at a CAGR of nearly 20% over the next decade, while margins remain robust and Nvidia maintains its leadership position. To put it briefly, at these prices, it would be better to just buy the benchmark, and eliminate company risks completely.

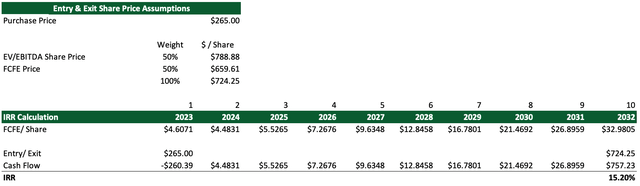

On the other hand, we would start to consider it an attractive buying opportunity if it yielded at least 500 bp of Alpha above benchmarks, given the huge risk being taken on. At a price of $265 per share and an IRR of 15.20%, we think the stock is starting to become a more attractive risk-reward opportunity again with our bull case. At $190 and an IRR of about 20%, we would consider the stock a Strong Buy, but only given our assumptions about AI are still holding up.

We would actually still be slightly bearish at the current price level compared to our previous “hold” rating that we gave around the $300 level, and we would scale back a position significantly if the stock crossed above the current price level of $380. We wouldn’t be so much of a buyer either at current prices, as downside risks are still abundant.

Some Major Risks

In terms of risks, we think the market is getting ahead of itself and has not yet priced in some of the key risks. First, regarding the most obvious risk: it remains to be seen whether Nvidia can live up to its revenue growth potential while maintaining its dominant position in the face of future fierce competition.

Even if we take Nvidia’s projections for the second quarter for granted, and expect earnings per share to remain more or less flat for the rest of the year, the company is still trading at 55x earnings. If Nvidia fails to grow earnings per share beyond the $6.88 target that we predict in the short term, based on second-quarter expectations, the stock could easily fall more than 50%, bringing the price-to-earnings ratio back to a fairly normal ratio of about 20x earnings. At earnings per share of $6.88 and a multiple of 20x, Nvidia would only be trading at $137.6. Nvidia has a lot of expectations to live up to, and if it fails to do so, the stock could fall as fast as it has risen this year in our view.

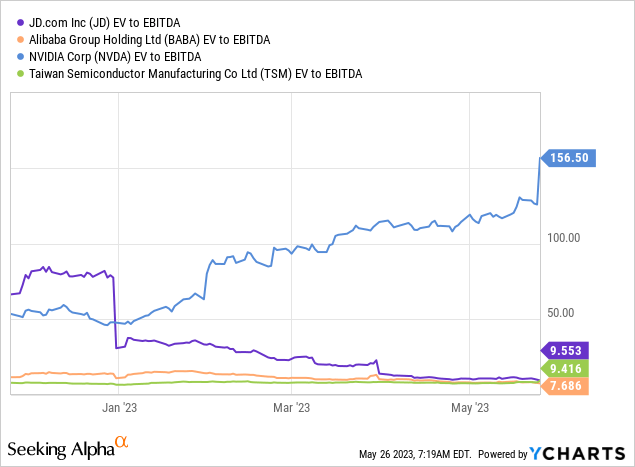

It is also important to note that other risks, such as geopolitical risks, are arguably overlooked when it comes to Nvidia. While the company is the one developing the GPUs, it is important to note that it is still dependent on companies such as Taiwan Semiconductor Manufacturing Company Limited (TSM) and Samsung Electronics Co., Ltd. (OTCPK:SSNLF) to produce their chips. Rising tensions between the U.S. and China, or a possible conflict over Taiwan, would also hurt Nvidia. While other Chinese stocks are suffering and trading at single-digit ratios due to geopolitical concerns, such as Alibaba Group Holding Limited (BABA), JD.com (JD), and Taiwan Semi itself, Nvidia is surging, meaning investors are perhaps overlooking these risks.

And while we think Nvidia is fully priced at current levels, other companies can certainly still offer an attractive risk/reward profile to gain exposure to AI, such as Taiwan Semi, ASML Holding N.V. (ASML), Adobe Inc. (ADBE) for the potential of generative AI content and others. Finally, looking at insider trading at Nvidia is also consistent with our findings that Nvidia is fully priced in, as certain investors have been dumping millions of dollars of shares on the open market this year and last year.

The Bottom Line

We believe Nvidia Corporation is currently fully priced in, as the market may be ahead of itself and taking much of the future revenue growth for granted. Before this write-up on Nvidia, we actually analyzed Nike and assessed the fair value of that company. Funnily enough, by the time we finished our valuation of Nike, Inc. (NKE), Nvidia had gained $200BN in market value in after-hours trading alone, or more than Nike’s current market cap, which is $165BN.

On the one hand, it is hard to justify that one quarter’s positive results combined with excellent advice are worth more than the entire market capitalization of Nike, a 59-year-old, rigid company. Its rise in market cap in after-hours trading even came close to the market capitalization of 131-year-old The Coca-Cola Company (KO), considered one of the most solid companies at $261 billion. On the other hand, some may justify its 55x forward EPS multiple as Nvidia may continue its stellar growth when it comes to laying the groundwork for AI.

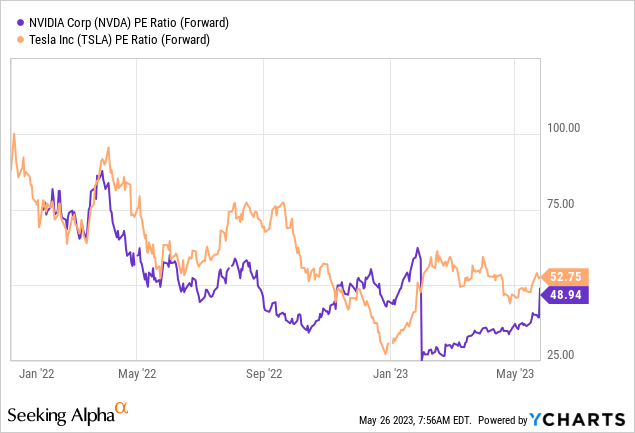

As it stands, we maintain our “Hold” rating on Nvidia Corporation stock and would cut the stock if it rises even further in the short term. We also would not go short, as positive surprises to the upside have surprised bears in the past, and could continue to do so. Using Tesla, Inc. (TSLA) as an example in 2018, it is not always the best idea to short a stock based solely on an elevated short-term valuation, as upside surprises can deliver a fatal blow in the long-run as the company evolves.

It is difficult to say where Nvidia Corporation will be even in a few years and is arguably far too speculative at current levels. However, we would be inclined to buy Nvidia Corporation below $265, as we believe that from those levels, the rewards start to outweigh the risks. At the end of the day, opinions on Nvidia Corporation will vary widely based on people’s projections and expectations of where artificial intelligence is headed.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JD, BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.