Summary:

- The Coca-Cola Company has been the go-to example for recession resilience and business stability.

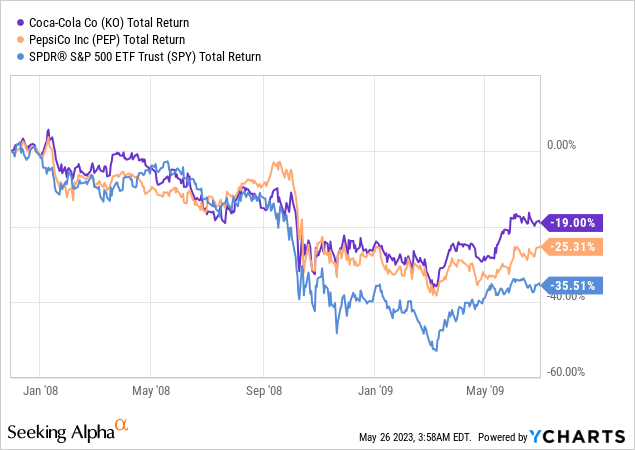

- In recessions, Coca-Cola traditionally has done better than the general market and its main competitor – PepsiCo.

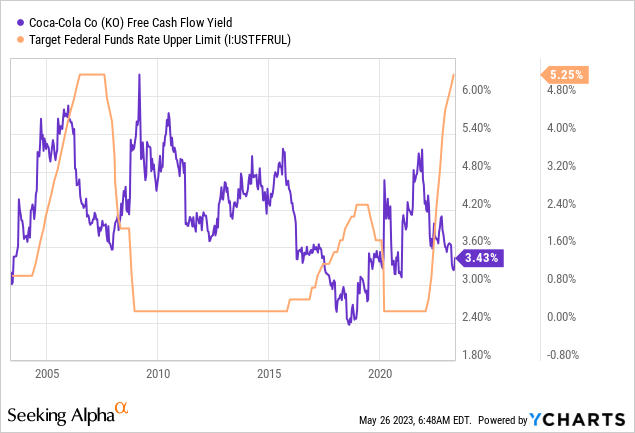

- However, looking at the current market value, Coca-Cola is trading well above its 20-year average EV/EBITDA multiple, and its cash flow yield is much lower than the Fed’s funds.

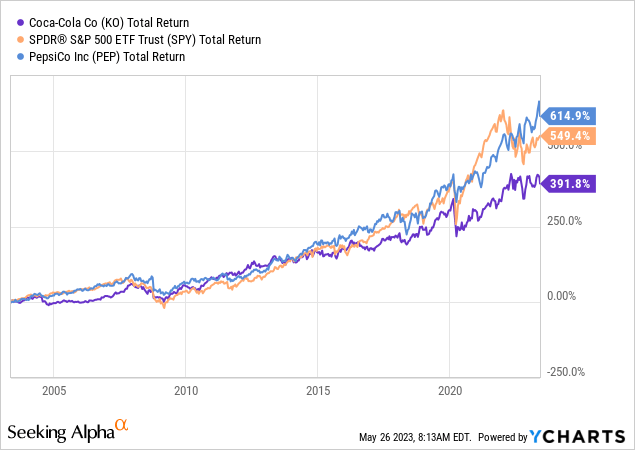

- In longer time frames, The Coca-Cola Company has been underperforming both the market and its biggest competitor – PepsiCo.

Zoltan Tarlacz/iStock Editorial via Getty Images

When thinking about recession resilience, one of the first company that comes to mind for many investors is The Coca-Cola Company (NYSE:KO). The beverages produced by the company have been proving themselves for multiple decades and now billions of people are drinking them.

However, there’s a difference between a great business and a great investment. Sure, those who invested heavily in KO decades ago, like Warren Buffett, enjoyed marvelous returns and the dividends received from the company have repaid their initial investment long-ago. However, from today’s standpoint, The Coca-Cola Company looks to be quite expensive, and the upside is limited.

The positive side of things is that The Coca-Cola Company stock could do better than the market in a recession, as demonstrated by historical data. Still, I don’t see much benefits of adding KO to one’s portfolio at today’s share price.

Coca-Cola – the epitome of business stability

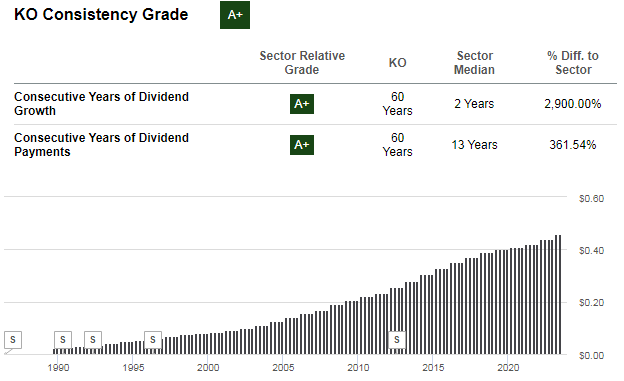

The Coca-Cola Company’s business has been well covered here, so I’m not going to go into its details. Still, I want to highlight one simple fact, which demonstrates the stability and resilience of the business – dividends. KO is a behemoth dividend aristocrat, with 60 years of annual increases of the distributions to shareholders. During those 60 years, the world economy has gone through multiple ups and downs as well as tectonic shifts like the elimination of the gold standard, the 1973 oil shock, the end of the Cold War and so on. Still, KO has been increasing its dividends each and every year, uninterrupted by those events.

Coca-Cola’s dividend statistics (Seeking Alpha)

This in and of itself explains why many investors come up with KO when thinking about recession resilience. Looking at historical data from the bursting of the housing bubble and the stock market meltdown in 2007-2009, it appears that indeed Coca-Cola has done much better than the general market, represented by the SPDR® S&P 500 ETF Trust (SPY) and the main competitor in the beverage industry – PepsiCo, Inc. (PEP).

However, a great business doesn’t translate into a great investment automatically. There’s little sense in investing in great businesses at grossly overvalued prices. Instead, ideally one should wait for market weaknesses in order to enter into such positions, just like Warren Buffett did in 1988.

Valuation

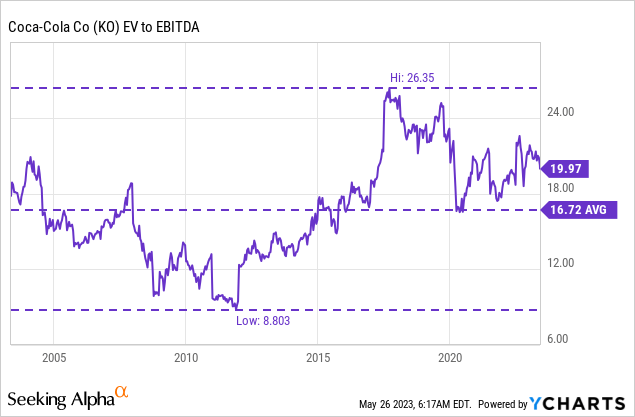

The Coca-Cola Company is in a class of its own, so some premium to the beverage industry is probably more than justified. For that reason, I’ll look at KO’s valuation through its own historical EV/EBITDA multiple for a long 20-year period.

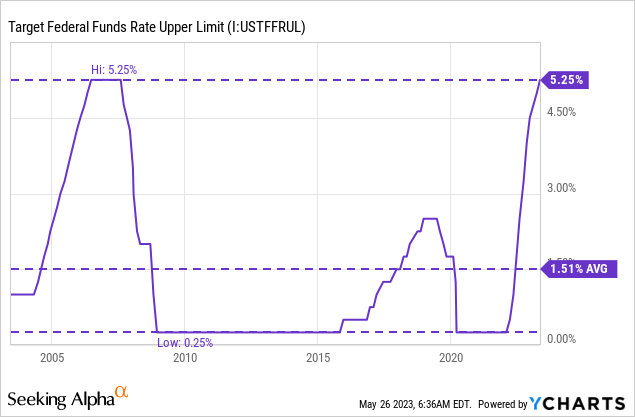

It turns out that KO is trading well above its 20-year EV/EBITDA average. Note that this happens when the Fed’s funds rate us well above its 20-year average as well. However, it doesn’t make sense to have multiple expansion in times of rising cost of capital. Quite the contrary – when capital is expensive, multiples should contract.

Looking to KO through its cash flow yield in comparison to the FED’s funds rate, it turns out that in the moment investing in money-market securities should be yielding substantially more than Coca-Cola’s cash flow yield.

Indeed, some may think that this is an apples-to-oranges comparison, and there’s a valid argument that could be made in that direction. After all, KO could be viewed as a long-term investment, while money-market securities are short-term. While this is true, it is also the reason why one should consider what could be an attractive entry point. In my opinion, today’s higher-than-average historical EV/EBITDA multiple in conjunction with higher interest rates environment don’t result in an attractive entry point in KO, rather the opposite.

Historical performance

Looking at the historical performance over a long 20-year period, The Coca-Cola Company stock has considerably underperformed both the broad market, represented by SPY, and its main peer – PepsiCo. Given the expanded multiples that KO is trading at, I expect this to continue further.

Conclusion

The Coca-Cola Company has a business model that has proven its resilience through many different downturns and challenges. The company is truly the behemoth dividend aristocrat, with 60 consecutive years of dividend growth.

However, I believe this is one of the examples where a great business is not equal to a great investment. The current EV/EBITDA multiple of The Coca-Cola Company is considerably above its historical average, especially if we consider the rising interest rates environment. For that reason, I believe that The Coca-Cola Company’s upside is rather limited and investors may want to wait for more attractive entry points.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.