Summary:

- The stock price has gone nowhere in the last decade just like its sales figures.

- The company is plagued with negative sentiment, which I believe is duly warranted.

- Financials show a company that’s losing its edge.

- I give it a hold rating for now until the management sorts itself out.

jetcityimage

Investment Thesis

The poor decade-long performance of 3M Company (NYSE:MMM) led to only a 20% total return for loyal, long-term investors. I wanted to look at the company’s financials and see how it is performing and what needs to be changed for the company to turn around and reward its shareholders in the long run.

Right now, the company has yet to prove that it can turn the ship around and the management needs to do a much better job. Therefore, I give it a hold rating for now.

Outlook

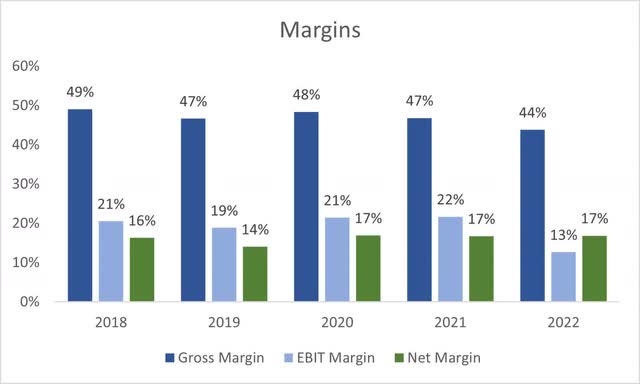

It is not looking very good for the company right now. The guidance is very poor, with no indication that anything has changed for the better in the last three years. The restructuring that was announced in 2020, which was supposed to help the company to be better streamlined in its operations didn’t do much good. Just looking at the company’s financials, which I will touch on in more depth later on in the article, margins have been deteriorating since the end of ’20. In their latest transcript, the management was very serious about the next wave of efficiency measures by announcing further job cuts at the management level throughout the whole company, simplifying their chain support structure, and many other efficiency measures that sound great on paper, however, I’m slightly skeptical because of how the company has performed in the past.

To me, the management seems like a total mess right now. Operations have been plagued with litigations and the most recent scandal of Mike Vale, who in the latest transcript above was appointed as Group President, Chief Business Officer, and Country Officer, was subsequently fired about three weeks later for inappropriate conduct. This can be seen as a positive of course, but also, what is going on at the top of the ivory tower?

Sales numbers have gone nowhere in the last decade and the company is guiding around -6% to -2% for the full year ’23. That is abysmal. I could see the demand for their many products to pick up in the future, with China opening up, and the world pretty much returning to normal, however, if the company did nothing spectacular in the last decade, I’m not comfortable giving good growth assumptions for now, until I see some improvement over the next few quarters.

Financials

The below graphs will present the company’s yearly performance. I will provide some numbers from the recent quarter for some extra color if needed. So, let’s see how the internals look.

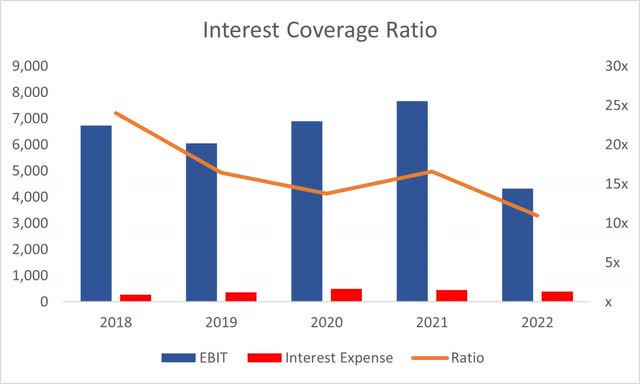

The company at the end of Q1 ’23 had around $4B in cash and marketable securities against $13B in debt. It’s a slightly better position they are in than at the end of FY22. Many investors would shy away from companies that have a lot of leverage but I don’t think debt is a problem as long as it is working well for the company, and it can manage the annual interest expenses and is slowly paying it down.

3M generates a lot of cashflow. EBIT at the end of FY22 was $4.3B while interest expenses were 395m. The company’s interest coverage ratio is very healthy, so debt is not an issue in my opinion.

The current ratio of the company is also quite acceptable, standing at around 1.5 by the end of FY22 and around 1.4 at the end of Q1 23, slightly lower, but the company has no short-term liquidity issues as it can cover short-term obligations comfortably.

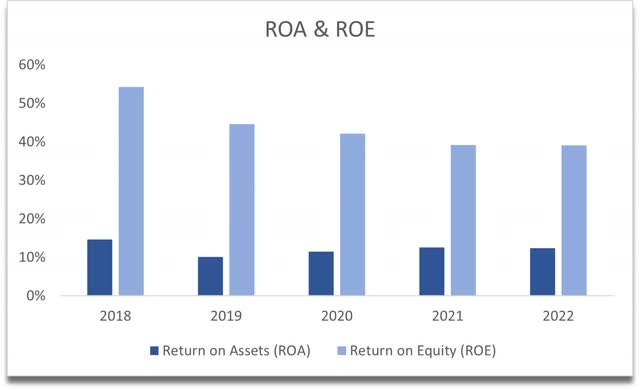

Looking at the company’s efficiency and profitability, we can see that ROA and ROE are quite good, however, these have been trending down recently, which if not fixed with all those promises of streamlining operations and job cuts, may continue to go down in the future, meaning the company is not creating value with shareholder’s capital and its assets.

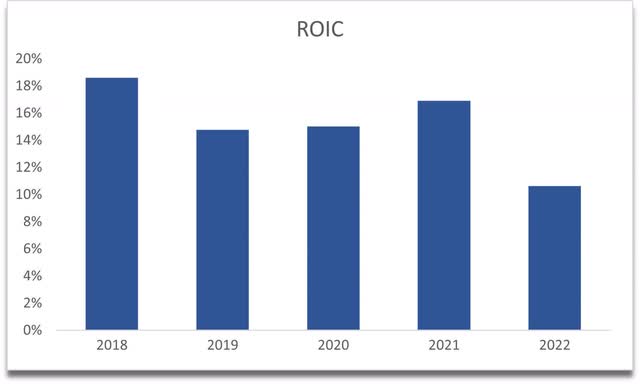

Another useful measure to me is ROIC. The company has a decent ROIC, however, the same story can be seen above. Return on invested capital has been trending downwards, which means the company is losing its competitive advantage and its moat is deteriorating.

Overall, the balance sheet is a mixed bag. I wouldn’t want to invest in a company based on these downtrends, as I would like to see a few extra years in the future to see if it manages to turn around and become as good or even better than before. Right now, these figures tell me to be patient.

The company’s margins, as I mentioned, have been deteriorating over time as well, and if all of the cost-cutting measures aren’t successful, then I could see further pain here.

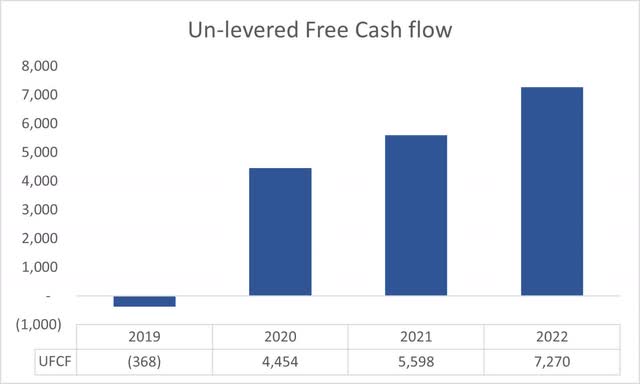

On a positive note, the company is generating a very strong unlevered free cash flow.

Valuation

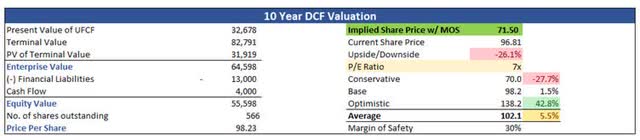

I couldn’t even go with around 2% growth in the next decade, just because of the negative sentiment and the management’s bleak guidance for ’23. In the last decade, revenue went from around $31B to $34B, which is around 1% a year. That is not good. For the base case, I decided to grow revenue by the company’s historical growth of 1%, for the conservative case, I went with -1% for the decade, while for the optimistic, I went with a whopping 4.8% just to be really optimistic.

In terms of margins, I assumed that the company’s cost-cutting initiatives will work, but not as effectively as the management thinks. For the base case, I went with a 200bps improvement in gross and operating margins over the next decade. For the conservative case I went with no improvements, while for the optimistic case, gross margins are 75bps higher than the base case, and 50bps higher on the operating margins.

I will also add a 30% margin of safety to the intrinsic value calculation. I usually add 25%, but I’m not the biggest fan of the company’s financials currently.

With that said, the company’s intrinsic value is $71.50, implying a 26% downside from the current valuation.

Closing Comments

I see the potential the company has, which is being squandered by the management’s actions or lack thereof. The company is generating a lot of cash, but the inefficiencies and the confusion at the top are what’s giving investors a negative sentiment. If the management isn’t going to succeed in turning the ship around in the next year or two, then it will see its value deteriorating further. At least for now, it yields around a 6% dividend, which is good, but with an 82% payout ratio, I wouldn’t rely on it.

Further economic headwinds will lead to more volatility in the stock market. Even if it does come down to the intrinsic value I’ve calculated, I wouldn’t jump into it if the financials keep deteriorating further.

I believe it can turn itself around. I wouldn’t sell if I already owned the stock, just because the dividend is pretty nice and the company has the potential to turn around and hopefully will within the next couple of years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.