Summary:

- AT&T shares plunged 5% on May 25th, contributing to a 15.3% drop in share value so far this year.

- The stock’s decline may be due to concerns about the economy and competition from DISH Network’s potential deal with Amazon.

- The author believes AT&T is undervalued and has increased its stake in the company, citing robust financials and growth potential.

jetcityimage

May 25th was not a good day to own shares of telecommunications conglomerate AT&T (NYSE:T). A combination of factors that really consisted of general market sentiment and some industry specific news, sent shares of the company plunging. For the day, the stock closed down 5%. But this is just one more bad day in a string of bad days so far this year that have left the stock down significantly. At this point, I can understand why some investors might consider exiting their position in the firm. But I took this opportunity to increase my stake in it rather substantially. When you dig into the numbers, especially after seeing the stock fall like it has, it’s difficult to be anything other than incredibly bullish. And further the T stock drops from this point, the more likely I am to allocate additional capital toward it.

A tough day

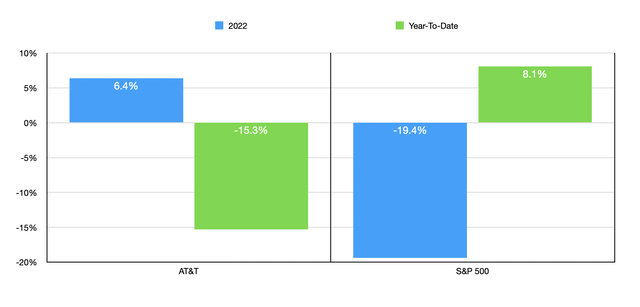

As I mentioned already, shares of AT&T plunged 5% on May 25th. However, this is not all the pain that the stock has seen recently. So far this year as a whole, shares are down about 15.3%, and that’s with a reduction in basis resulting from distributions that investors in the company have received. Over the same window of time, the S&P 500 is up about 8.1%. This massive disparity is interesting to see since it is a reversal of what we saw last year. In 2022, the S&P 500 was down 19.4%. Over that same window of time, inclusive of distributions, AT&T achieved upside for investors of 6.4%.

Part of the downside that the company experienced was almost certainly caused by continued worries about the state of the economy. Lofty inflation, combined with high interest rates and concerns of a potential recession, do not necessarily translate to robust financial results for most companies. But the bigger problem was almost certainly the report that DISH Network (DISH) is working on a deal with ecommerce giant Amazon (AMZN) whereby DISH Network would be able to market its wireless services through Amazon in an attempt to grow its network substantially. In terms of overall coverage, DISH Network is a very marginal player. And with a market capitalization of only $3.6 billion, the company is essentially a rounding error compared to the other providers out there.

To put this in perspective, by market capitalization, AT&T is the next smallest of the four major companies in this market. And it has a market capitalization right now of $108.3 billion. It is worth noting that, in response to this report, AT&T was not the only company to suffer. Its shares were down the most. However, both Verizon (VZ) and T-Mobile (TMUS) also took a hit, with shares dipping around 3% each.

While it is always possible that some smaller competitor can grow to challenge the larger firms in a market, I don’t believe that this is a significant threat for any of the three big players. As an example, consider recent statements by John Stankey, the CEO of AT&T. At a conference for shareholders on May 22nd, Stankey informed investors that the company remains on track with its network expansion commitments. By the end of this year, the company expects to deploy mid band spectrum to 200 million people. It also anticipates granting access to fiber to over 30 million customers and business locations by the end of 2025. Even ignoring things like broadband and other offerings, and focusing only on its mobile activities, the company boasted 85.4 million postpaid subscribers at the end of the most recent quarter, with 70 million of those being postpaid phone subscribers. The Mobility unit of the company as a whole generated $20.6 billion of revenue and $6.3 billion of operating income in the most recent fiscal quarter alone. That means that, with the profits from a single quarter alone, the company could nearly purchase DISH Network two times over.

During the conference, Stankey reiterated the company’s guidance that calls for $16 billion or more of free cash flow this year. Overall EBITDA for 2023 should be at least 3% higher than it was during 2022. And this comes in spite of his statement that, in the second quarter of this year, wireless results are likely to experience weaker postpaid net additions because of temporary factors such as competitor rate plan launches, industry normalization following the COVID-19 pandemic, and a one-time reduction of 75,000 customers from a government contract that the company elected not to pursue because it didn’t make sense financially.

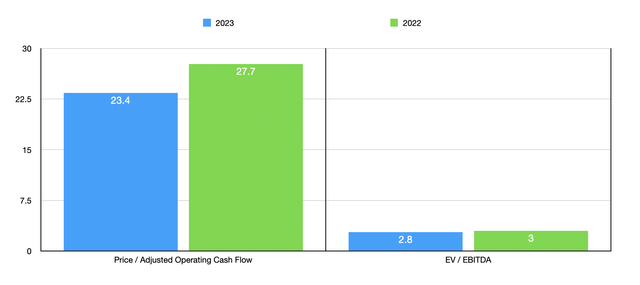

Assuming that this guidance comes to fruition, I believe that adjusted operating cash flow for the company this year will be around $38.4 billion, while EBITDA attributable to the enterprise should be about $42.7 billion. After seeing the stock drop so far, this implies some rather attractive forward multiples that shares are trading at. As an example, the price to adjusted operating cash flow multiple of the business should be about 2.8. That’s down from the 3 reading we would get if we use data from 2022. Over that same window of time, the EV to EBITDA multiple should drop from 6.2 to 6.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| AT&T | 2.8 | 6.0 |

| Verizon | 3.8 | 6.1 |

| T-Mobile | 10.0 | 11.1 |

| Rogers Communications (RCI) | 7.3 | 10.6 |

Relative to similar companies, AT&T is most certainly the cheapest prospect. As part of my analysis of the firm, I compared it to three similar enterprises. These can be seen in the table above. Using both the price to operating cash flow approach and the EV to EBITDA approach, I discovered that AT&T still remains the cheapest of the group. In the table below, you can see what kind of upside shares of the company might warrant if we assume that it should trade at levels more or less in line with what its rivals are trading at. On the one hand, we have what upside the company would experience if it were to trade at a level that matches the cheapest of its rivals. On a price to operating cash flow basis, this upside would be 35.7%. Though when it comes to the EV to EBITDA approach, that upside becomes a much more modest 3.2%. The other scenario saw me average out the trading multiples of these other firms. In this case, you end up with upside of between 128% and 151.2%. I don’t know if I would hold on to the stock for long enough to get that kind of upside. But I do think it’s safe to say that shares are significantly undervalued.

| Valuation Approach | Price / Operating Cash Flow | EV / EBITDA |

| Low | 35.7% | 3.2% |

| Average | 151.2% | 128.0% |

Takeaway

From all that I can see, the general picture for AT&T remains robust. There is no indication as of yet that the company will be severely negatively-affected by changes in the market. Upside potential definitely looks to be on the table, particularly now that the stock has fallen as much as it has. As shares plunged for the day, I drastically increased my own position in the business. It now accounts for over 19% of my portfolio. Unfortunately, most of this increase, totaling over 34%, came from my decision to sell off my stake in Ingles Markets (IMKTA). Don’t get me wrong. I believe that Ingles Markets is still a great prospect that has some significant upside potential to it. But it’s just not as good in my opinion as AT&T.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!