Summary:

- Today, we revisit small biopharma Zynerba Pharmaceuticals for the first time in just over a year.

- The company plans to launch a key trial before the end of the year targeting Fragile X Syndrome and has seen some more positive analyst commentary recently.

- We peek back in on Zynerba Pharmaceuticals in the paragraphs below.

We are going to peek back in on small biopharma Zynerba Pharmaceuticals (NASDAQ:ZYNE) since we posted an article on it to begin 2020. At the time, we recommended the shares were no more than a small ‘watch item’ and preferably only through establishing a holding via covered call orders.

The world has obviously changed a lot over the past year. Has the situation changed for Zynerba? I have gotten a few questions on this small cap name in recent months from followers here on Seeking Alpha, so we will examine that question in the paragraphs that follow.

Company Overview:

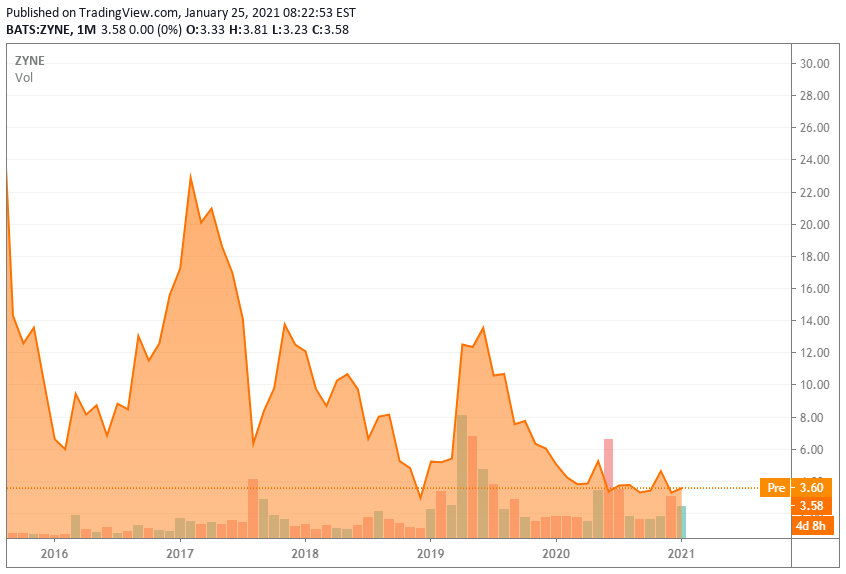

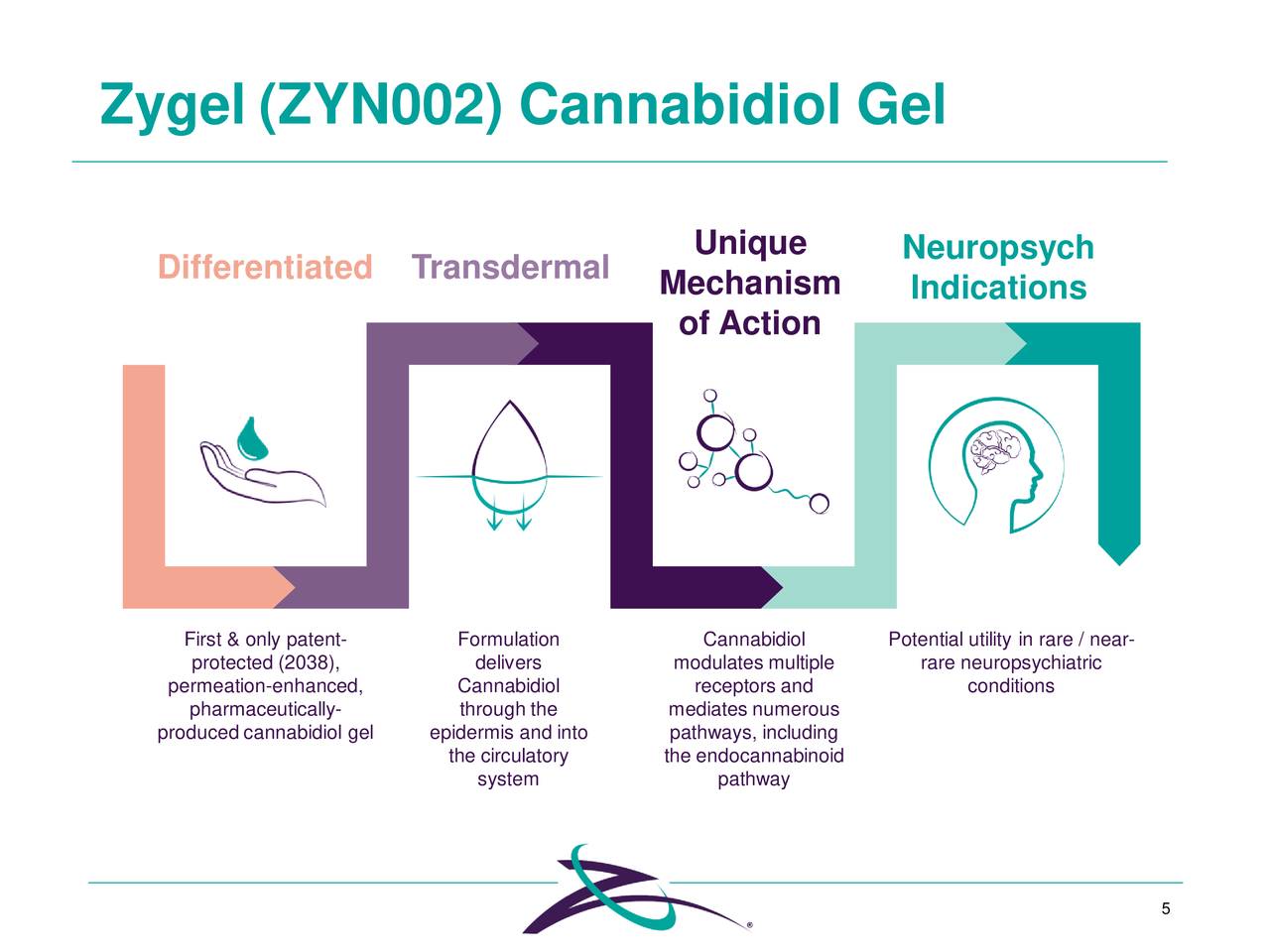

Zynerba is a small ‘Tier 4‘ developmental concern based just outside of Philadelphia. The company’s current developmental efforts are centered around Zygel, the first and only pharmaceutically-produced CBD formulated permeation-enhanced gel for transdermal delivery through the skin and into the circulatory system. The stock trades just north of $3.50 a share and the company has not rewarded longtime shareholders to this point (see above). The current market cap of the company is approximately $100 million.

Recent Developments:

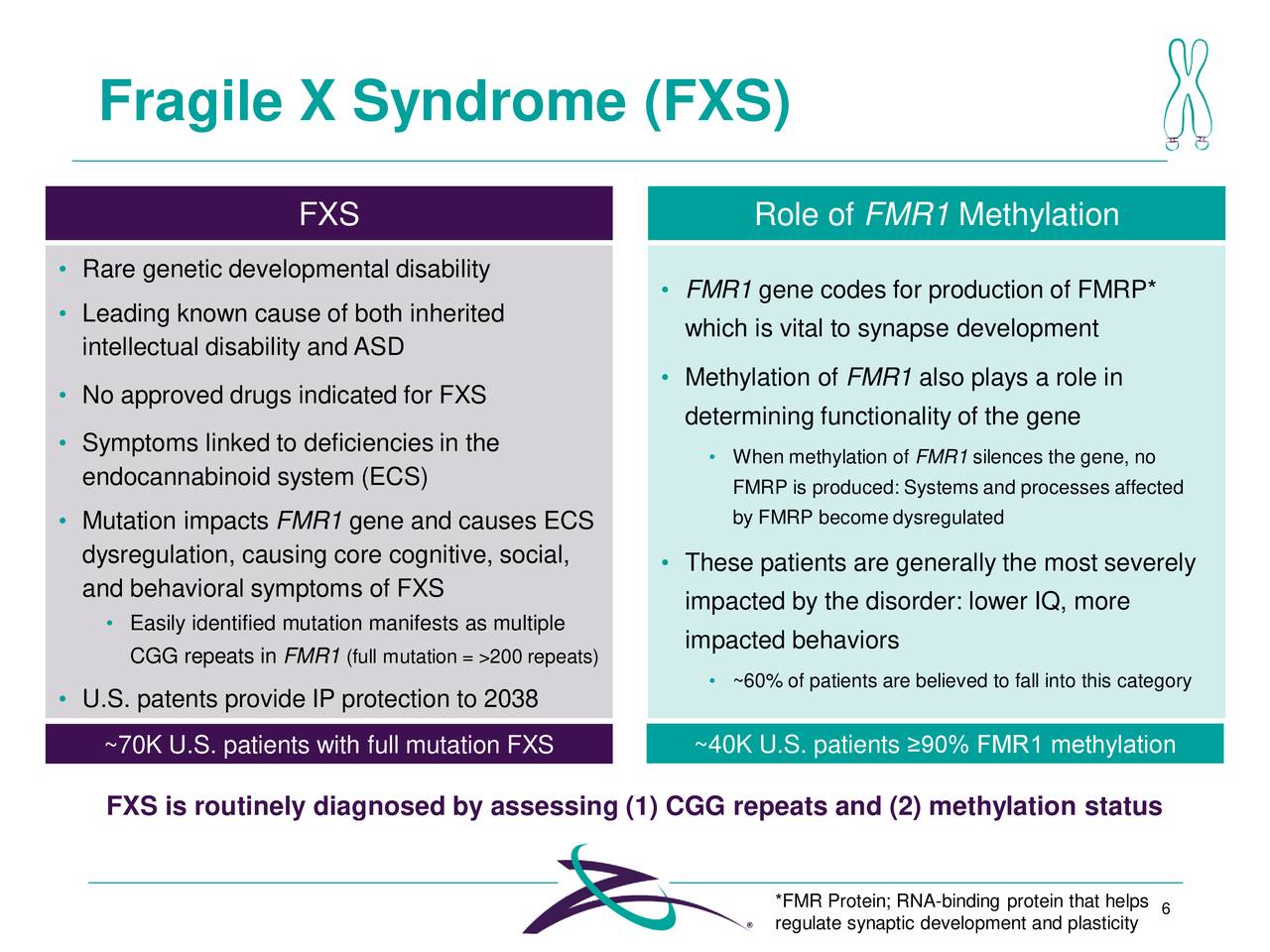

Zynerba is targeting several indications with Zygel. The company suffered a significant setback in early summer as on June 30th it reported unsuccessful results from Phase 2/3 trial evaluating Zygel in children and adolescents with FXS. The company met with the FDA late in 2020 and is currently designing a new pivotal trial that will be a ‘double-blind, placebo-controlled trial in patients with FXS who have a highly methylated FMR1 gene to confirm the positive results observed in this population of responders in the CONNECT-FX trial‘. The company plans to meet again with the government agency before the first half of this year around the design of this new study and plans to launch this key trial before the end of 2021.

Source: Company Presentation

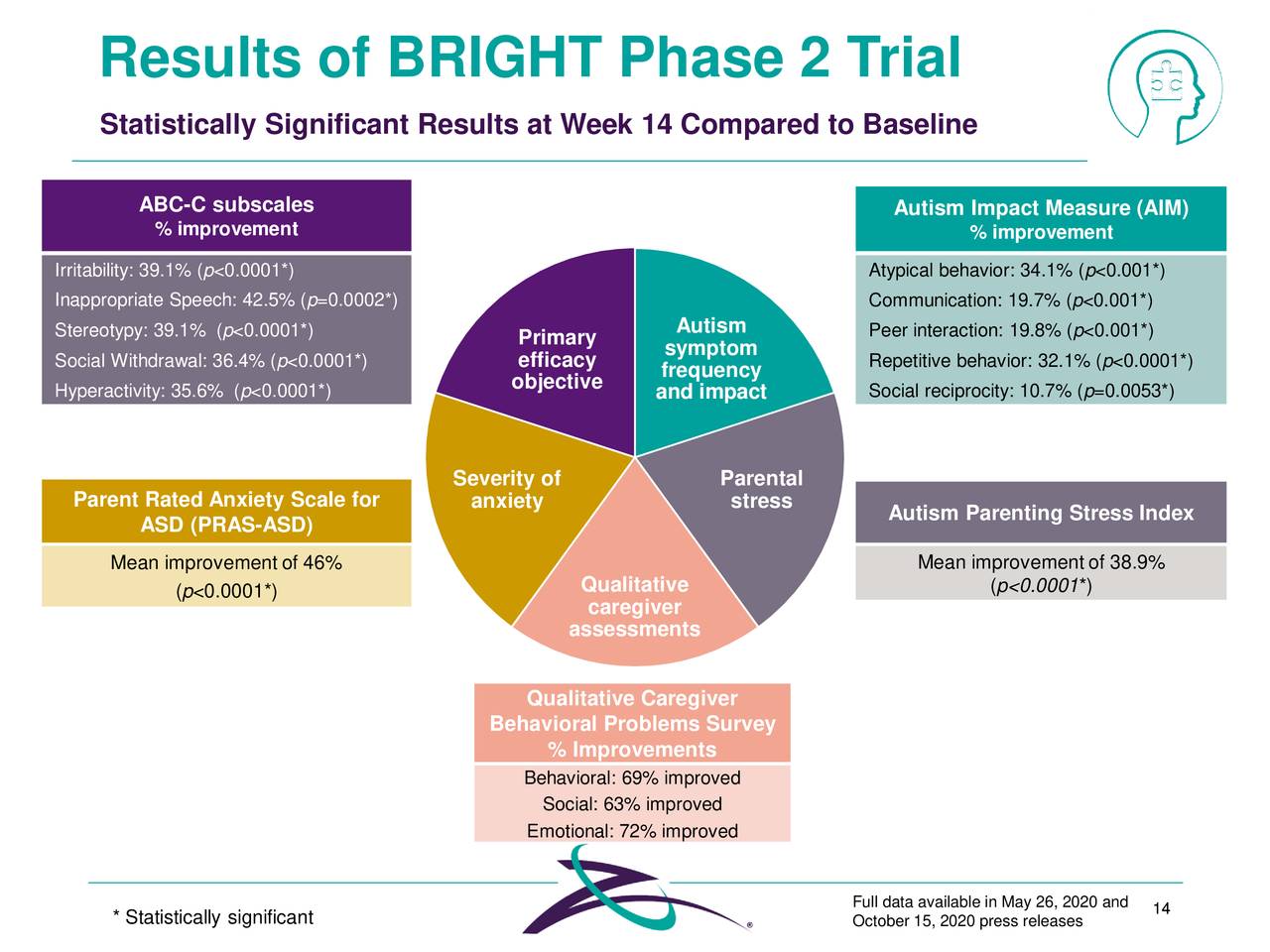

In mid-October, Zygel did produce some positive data targeting Autism in a Phase 2 trial. A month earlier, Zygel garnered Orphan Drug status from the FDA targeting DiGeorge Syndrome. The company plans to meet with the FDA regarding its recent study on autism to discuss a regulatory path forward sometime in the first half of this year.

Source: Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community was dormant on Zynerba from the time of its disappointing trial results in late June to Mid-December. Since then Canaccord Genuity ($9 price target), Ladenberg Thalmann ($8 price target) and H.C. Wainwright ($9 price target) have all reissued Buy ratings on ZYNE while Needham reiterated its Hold rating. Insiders have not sold a share of ZYNE since August of 2016. Of course, the last insider purchase of the shares was in August of 2018.

The company has nearly $65 million in cash and marketable securities on the balance sheet at the end of the third quarter. The company states this is sufficient to fund all operation activities until 2023.

Source: Company Presentation

Verdict:

The company has some positives going for it. It has several ‘shots on goal’ and is advancing its pipeline on multiple fronts. It is also well funded at the moment and has some recent analyst support. On the down side, the June trial results for Fragile X had undermined investor faith that the company will be successful eventually targeting this indication even as it is planning a key trail to tackle this rare disease. There are some mild milestones on the horizon (like, meetings with the FDA).

However, there is no big compelling reason to invest in ZYNE at the moment. And if I were to do so I would do so via covered call orders. Utilizing the August $5 call strikes you should be able to garner 70 to 75 cents a share for the option premiums, which would provide approximately 20% of downside protection through the duration of the position while still allowing considerable potential upside. Other than that, I think the best course of action is to pass on any investment recommendation on the stock right now and plan to revisit Zynerba again in a year when its key Fragile X trial is hopefully well underway.

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum.

Analyst’s Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ZYNE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author’s note: I present and update my best small-cap Busted IPO stock ideas only to subscribers of my exclusive marketplace, The Busted IPO Forum. Our model portfolio has crushed the return of the Russell 2000 since its launch in the summer of 2017. To join the Busted IPO Forum community, just click on the logo below.