Summary:

- The Boston Beer Company reported Q1 earnings that missed expectations.

- The company is attempting to deal with declining shipments including weakness in the seltzer category.

- A lack of growth and poor brand dynamics may likely keep shares volatile.

Justin Sullivan

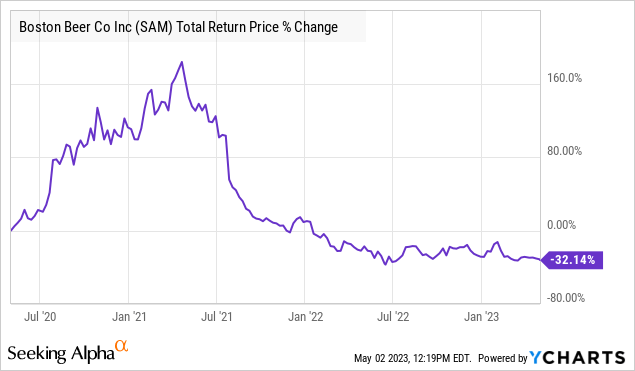

It’s been a tough last few years for The Boston Beer Company, Inc. (NYSE:SAM), still dealing with an apparent post-pandemic hangover. From record profitability back in 2020, the challenge has been slowing beer and seltzer sales against rights costs hitting earnings.

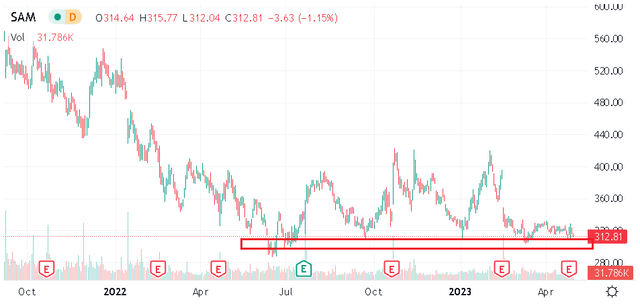

Indeed, shares of SAM are down more than 70% from their all-time high following a string of disappointing results. The company’s latest quarterly report continued that poor streak by missing estimates, working to keep shares near a 52-week low.

While management is projecting some optimism regarding improving conditions going forward, we’re skeptical of any near-term turnaround. In our view, weak growth and a sense that shares remain overvalued should keep shares volatile with risks tilted to the downside.

SAM Q1 Earnings Recap

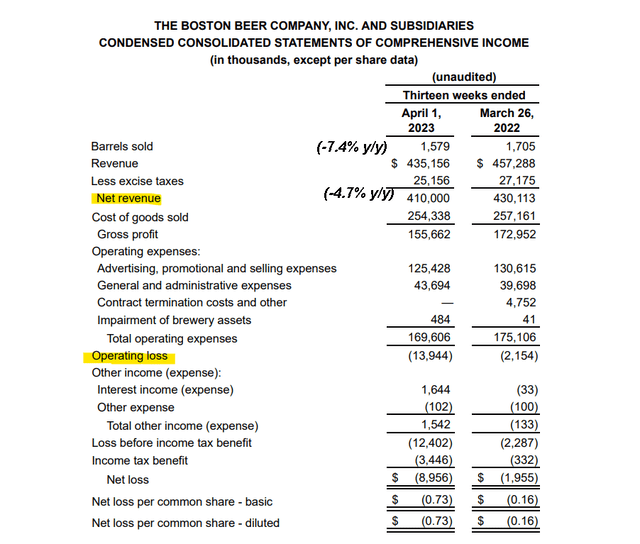

Boston Beer Company reported a Q1 EPS loss of -$0.73, which came in $0.41 below expectations. Revenue of $410 million, was down by -4.7% year-over-year and was also under the consensus.

The story this quarter was a decrease in the gross margin to 38.0%, from 40.2% in the year prior. This reflected higher brewery processing costs along with an inventory charge based on an effort to rebrand “Truly Vodka Seltzer” to “Truly Vodka Soda”.

The bigger picture was the top-line weakness where shipment volumes in terms of barrels sold at 1.6 million, declined by -7.4% across key brands like “Samuel Adams”, “Angry Orchard”, and “Truly”. These trends were partially offset by higher pricing and moderate shipment gains in “Twisted Tea”.

Even as total expenses ticked lower, aided by a cutback in advertising and promotional activities, the result was a sharply wider operating loss at -$13.9 million compared to -$2.2 million in Q1 2022.

The plan for the company is to focus on stabilizing margins while making adjustments operationally to deal with the softer volumes. Long term, management believes that its portfolio of brands diversified into “beyond beer” categories will exceed market growth rates over time. These were points discussed during the earnings conference call:

We are implementing the operational plans to adjust to a lower volume environment. This includes simplifying our business to reduce needless complexity and improve margins, as well as adjusting our cost structure to be more closely in sync with our volume expectations. These operational plans are on track and should begin to impact our margins positively in the second half of the year.

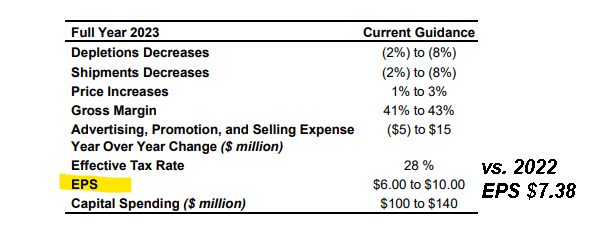

In terms of guidance, Boston Beer sees shipment volumes for 2023 down between -2% and -8% compared to last year. The company believes the gross margin can get a lift to around 42% for the full year, representing an improvement compared to the result in Q1. Management is targeting EPS between $6.00 and $10.00 for the year, which compares to $7.38 in 2022 or $18.22 in 2020 as a reference point.

source: company IR

What’s Next For SAM?

The first point here is that we see the company’s fundamentals as stable. A strong balance sheet position with over $120 million in net cash means Boston Beer Co has the financial flexibility to make necessary strategy changes and whether near-term headwinds. At the same time, we’re skeptical that any of the announced efforts can begin to move the needle in terms of top-line growth.

Data suggests that the “hard seltzer” category that includes Truly continues to struggle with the boom of consumption observed during the pandemic looking more and more like just a temporary fad. If anything, that reassessment of the market potential explains much of the stock price decline over the period.

Getting sales to stop declining is one thing, but shareholders will need to see evidence of a return to growth, which we don’t see happening. The Truly brand makeover may not be enough in our opinion.

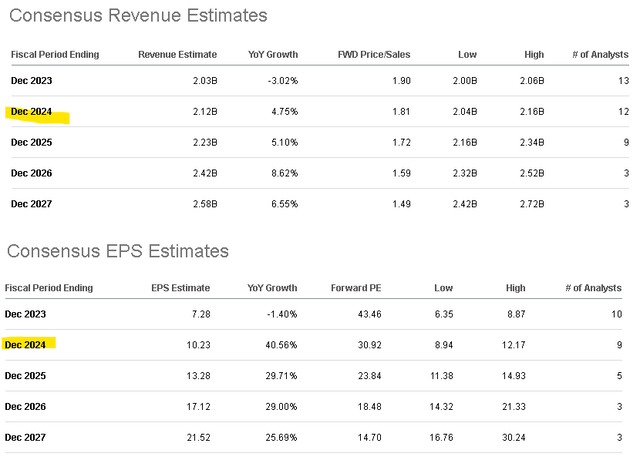

According to consensus estimates, the market sees revenues declining by -3% this year and EPS of $7.28, which is consistent with management guidance. We believe there is some downside to those figures in the context of the latest trends and broader macro environment.

Into 2024, the consensus is for a rebound at the top line by 5% while EPS rebounds sharply towards $10.23 with some momentum follow-through in 2025 and beyond. The way we see it playing out is that a few more quarters this year of weaker-than-expected results would lead to revisions lower to forward estimates.

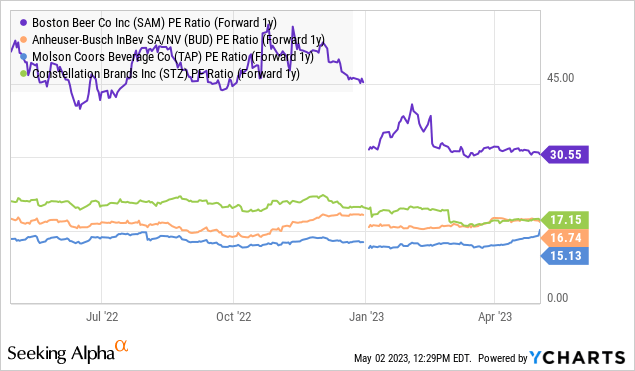

When we look at SAM, the other dynamic here is that the stock simply appears overvalued relative to peers across several valuation metrics. Even looking at the 2024 EPS estimate implying a 1-year forward P/E of 31x on the stock, SAM trades at a wide premium relative to names like Anheuser-Busch InBev SA/NV (BUD), Molson Coors Beverage (TAP), or Constellation Brands Inc (STZ) averaging closer to 17x.

Historically, the ability of SAM to capture market share in specialty categories and its higher growth could justify these spreads which is no longer the case. Our interpretation is that the stock needs to sell off further to converge closer to fair value.

Final Thoughts

Even with SAM already losing more than half its value over the past two years, we believe there is more downside. This is a case of a major company that made some critical strategy mistakes in recent years, and the efforts to repair the brand still have a long ways to go.

We rate SAM as a sell with a price target of $250 representing a 35x multiple on the consensus EPS estimate for 2023, or 25x based on the current 2024 EPS estimate. The bearish case for the stock is that sales continue to disappoint, while margins remain pressured as Boston Beer company is forced to turn more aggressive with marketing and promotions.

On the upside, investors will want to see stronger top-line momentum as evidence of brand recovery with an improvement in shipments. Monitoring points over the next few quarters include the gross margin and cash flow trends.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.