Summary:

- Boston Beer Co. is a seller of top brands such as Samuel Adams, Truly Hard Seltzer, Twisted Tea, Angry Orchard, and more.

- The company saw high growth these past few years due to the rise in popularity of the Hard Seltzer category. But in 2021 sales of this category have steeply declined.

- At a forward P/E of 40x and with a now lower growth expectation, Boston Beer Co. is overvalued yet again.

Neilson Barnard

Introduction

One of the main players in the sale of alcohol, Boston Beer Co. (NYSE:SAM), has seen considerable stock price declines over the past year. The company owns key brands in the High-End beer space, such as the Samuel Adams and Dogfish Head but also owns Truly Hard Seltzer, Angry Orchard, and Twisted Tea in the Hard Seltzer, Cider, and Iced Tea space. Even with these top brands, most of the high growth over the past few years has come from the accelerating Hard Seltzer market, which has now seen growth dwindle due to oversaturation. With this, Boston Beer Co. has seen double-digit growth in profits turn to nothing, as the company takes impairments/charges to readjust the Truly brand’s expectations. While I think the business will continue to grow in the high single digits to low teens range, the high 20%+ growth is probably gone. Therefore even after the stock price has dropped from $900 to $330, I am not a buyer at 40x forward earnings.

Financial History and Current Headwinds

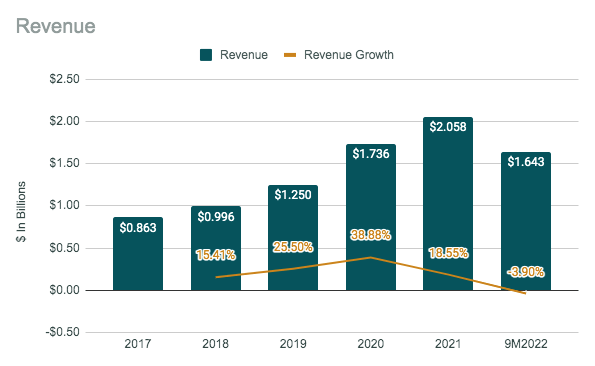

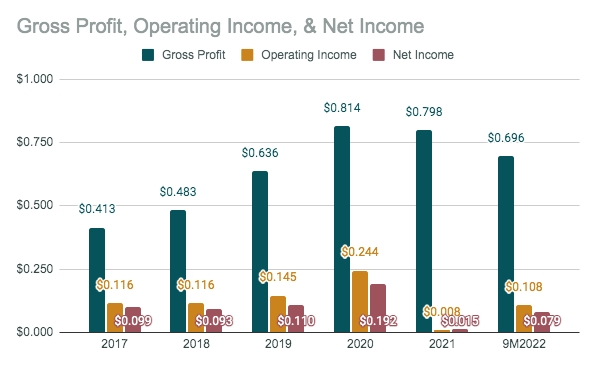

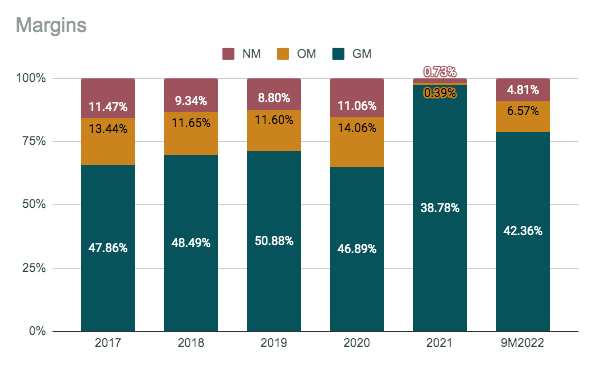

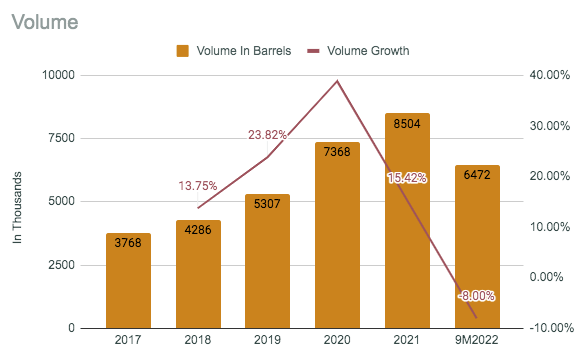

Boston Beer Co. Revenue (SEC.gov) Boston Beer Co. Gross Profit, Operating Income, & Net Income (SEC.gov) Boston Beer Co. Margins (SEC.gov) Boston Beer Co. Volume (SEC.gov)

Boston Beer Co. had seen a strong growth story until 2021 when the Hard Seltzer market became oversaturated. From 2017 to 2020, the company saw revenue growth of 19.09% per year and operating and net income growth rates of 20.43% and 18.01%. Overall, very consistent and high growth was led by the growing High-End beer category and the rapidly growing Hard Seltzer segment. In total, volume from 2017 to 2020 grew by 95.5%. In 2021, the industry saw an oversaturation of the rapidly growing Hard Seltzer market. It seems that there are now over 100 brands in each store selling Hard Seltzer or substitutes like packaged cocktails. Hard Seltzer growth for the company declined from growing 158% to just 13% in 2021, a crazy decline that changes the whole future growth potential for the business. While 2021 revenue and volumes weren’t drastically affected, the Hard Seltzer decline can be seen in the impairments/charges Boston Beer Co. has taken for the revised growth in the category. These charges tanked operating and net income, which was down by 2950% and 92.19% each. Margins for 2021 shrank to lower than a percent. Overall, Boston Beer Co. saw just $1.17 per share in earnings and seems to have lost a major growth engine.

This Year So Far

Now, with nine months of 2022 in the books, Boston Beer Co. has seen somewhat reverse results from the Hard Seltzer situation. Volumes and revenue so far this year are down by single digits. This is while operating and net income is up 33% and 18.6%, and margins have regained some ground. This year the business has seen more impairment and charges relating to Hard Seltzer brands, but they haven’t cut into profits quite as badly as in 2021. Altogether, what I expect from the company is somewhat flat to low growth results into the foreseeable future. The Hard Seltzer market hasn’t disappeared, but rather is just encumbered with brands. Luckily Truly Hard Seltzer is a top brand in the category. Therefore, the readjusted valuation in these brands should be a temporary charge-off and not a consistent event. Boston Beer Co. is also still a leader in the High-End Beer category, which has grown double digits in the past. The company currently has an 11% market share of High End and should still see growth here too. With that, when the company stops taking an impairment and other charges from Hard Seltzer, we should see more normal profits and operations, but at a much lower growth rate.

Balance Sheet

Boston Beer Co. does have a pristine balance sheet to withhold during a moderate downturn. The business has a current and quick ratio of 1.69x and 1.07x, showing ample liquidity. The debt load is also extremely low, with a debt-to-equity of just 0.42x. This balance sheet is great and can withstand a serious drought in business if that were to somehow happen in my opinion.

Valuation

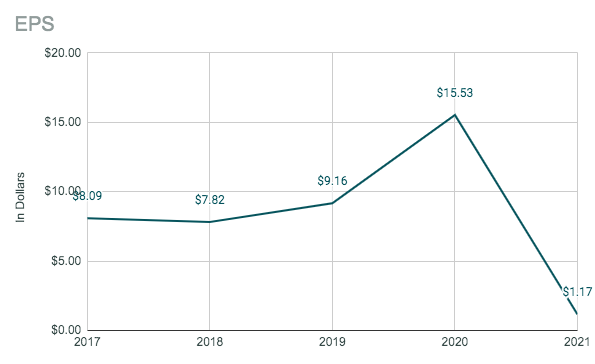

Boston Beer Co. EPS (SEC.gov)

I think Boston Beer Co. is a great business, but I have never purchased the company because of an arguably sky high valuation. But since the revisions on Hard Seltzer growth, the stock has seen a price decrease of over 60% since the midpoint of 2021. The stock was trading at over $900 and is now at close to $330. So is it now a better value? Well, the estimated EPS for this fiscal year is $8.10, making for a forward P/E of 40.7x. This is very high for the new growth outlook of the company. I would consider paying at 40x if there was still 20% growth in the business, but I think growth will be by high-teens at the very best. This gives me a PEG of 2.7x at the least, which is just too high for this business. Therefore, even despite the large drop in share price, the new growth outlook is making me stay away from this company yet again.

Conclusion

Overall, Boston Beer Co. will be fine and should still see growth after these charges are through. The High-End beer market is still expanding, and the business has some top-tier brands in High End, Hard Seltzer, Ice Tea, and Cider. I would expect the high single to low teens for a long-term growth rate. But at 40x forward earnings, and this new revised growth rate, you are paying a huge premium for the business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.