Summary:

- PepsiCo’s dominant position in the snack market, strong brand portfolio, and successful strategy of appealing to a wide range of consumers make it an attractive investment.

- The company’s focus on sustainability, steady free cash flow generation, and commitment to dividend growth offer long-term prospects for investors.

- While the current valuation may not be ideal, buying opportunities may arise in the future, and PepsiCo is expected to outperform its peers and the market.

Fotoatelie

Introduction

Is Pepsi OK?

While I favor a cold glass of Coca-Cola (KO) over the Pepsi alternative, I prefer the company behind Pepsi over almost every single consumer staple stock on the market. PepsiCo (NASDAQ:PEP) accounts for 3.9% of my dividend portfolio. It currently is the only consumer staple stock and a company I have added to frequently and aggressively over the past three years.

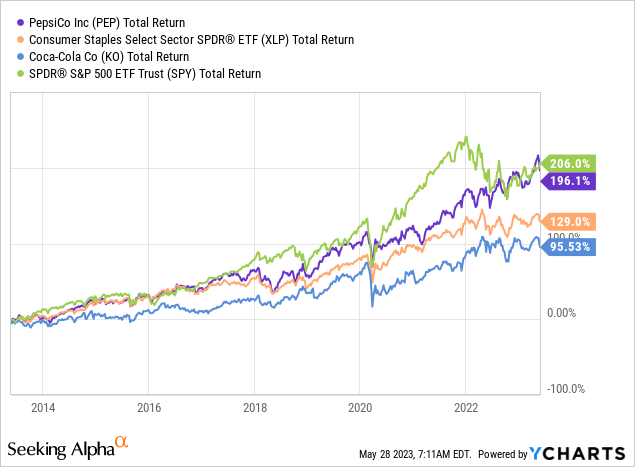

Over the past ten years, PEP shares have returned almost 200%. If it weren’t for the current correction, PEP shares would have outperformed the S&P 500.

In this article, I will assess the attractiveness of the company’s current 2.8% yield and explain why PEP stock remains the cornerstone of defensive exposure in my portfolio.

Buying Top-Tier Consumer Exposure

I’m not a big fan of consumer stocks. I own just one consumer staple (PepsiCo) and one consumer discretionary, which is Home Depot (HD).

The reason I avoid consumer stocks is that I’m not in the business of predicting consumer trends, and competition is often fierce. That’s why I pick companies with relatively large moats and businesses that appeal to most people, regardless of race, age, sexual orientation, and whatnot.

PepsiCo is for people who like snacks. That’s a straightforward way of putting it. Unless PepsiCo makes a marketing blunder like Bud Light, I’m fairly sure the company will be fine.

PepsiCo is a leading player in convenient foods, particularly savory snacks, and it holds the second position globally in the beverage sector. PepsiCo has a significant market share in North America, with $49 billion in the United States alone, while the international segment accounts for 39% of its business, amounting to around $34 billion.

The company has been making strides in expanding its footprint in developing and emerging markets, which currently represent 31% of its business. Its food segment accounts for 58% of its total revenue.

While PepsiCo does have competition, it dominates the snack aisles in many nations. It owns go-to brands that come with strong pricing power, as generic brands often aren’t that good.

PepsiCo’s strategy is straightforward and simple, yet highly successful. In 2012, the decision was made to focus on all consumers, to deeply penetrate snack aisles, capturing a wide range of potential customers. This is what the New York Times wrote back then:

Now, though, Frito-Lay, a unit of PepsiCo, is building a “company within a company” to pursue what might be called a 1 percent-99 percent strategy: creating high-end snacks as well as those that appeal to what it diplomatically calls “value” customers.

[…] Frito-Lay has until now largely left the premium end of the market to niche competitors like Pop Chips, Pretzel Crisps and Pirate’s Booty and ceded the bottom to grocery store brands.

“These traditionally have been niche markets dominated by small players and regional brands,” said Harry Balzer, the chief food industry analyst at the NPD Group, a research firm. “That leaves a lot of room for a mass player like Frito-Lay to come in and gain market share.”

I’m quoting a newspaper from more than ten years ago. However, the strategy has worked perfectly.

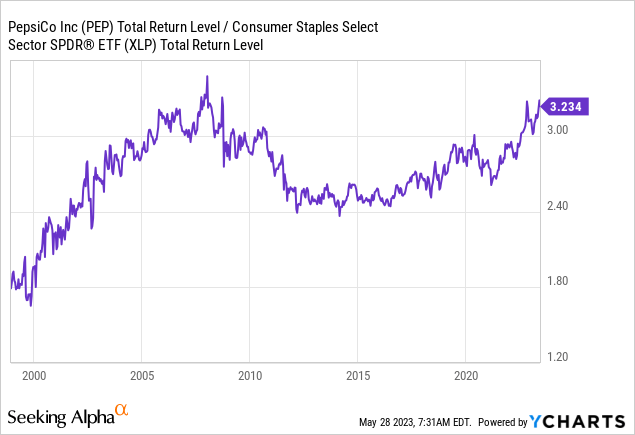

While other factors cannot be ruled out, 2012 is when the relative performance of PepsiCo shares versus the SPDR Consumer Staples ETF (XLP) bottomed. Since then, PEP has consistently outperformed its peers. PEP has a 10% weighting in the XLP ETF.

Now, the company is updating – or streamlining – its strategy, as outlined in this year’s CAGNY Conference.

PepsiCo outlined its efforts to accelerate performance and transform the company to ensure long-term sustainability, which is what it’s all about.

The company implemented a strategy called winning with pep+ (PepsiCo Positive), which focuses on growth and serves as the guiding principle for its operations.

Over the years, PepsiCo has made key decisions to enhance its performance, including increasing advertising and marketing investments by 24% and significantly expanding net capital investment.

These investments have yielded positive results, with the company achieving an average growth of 9.4% in net revenue and 8% in earnings per share in 2022.

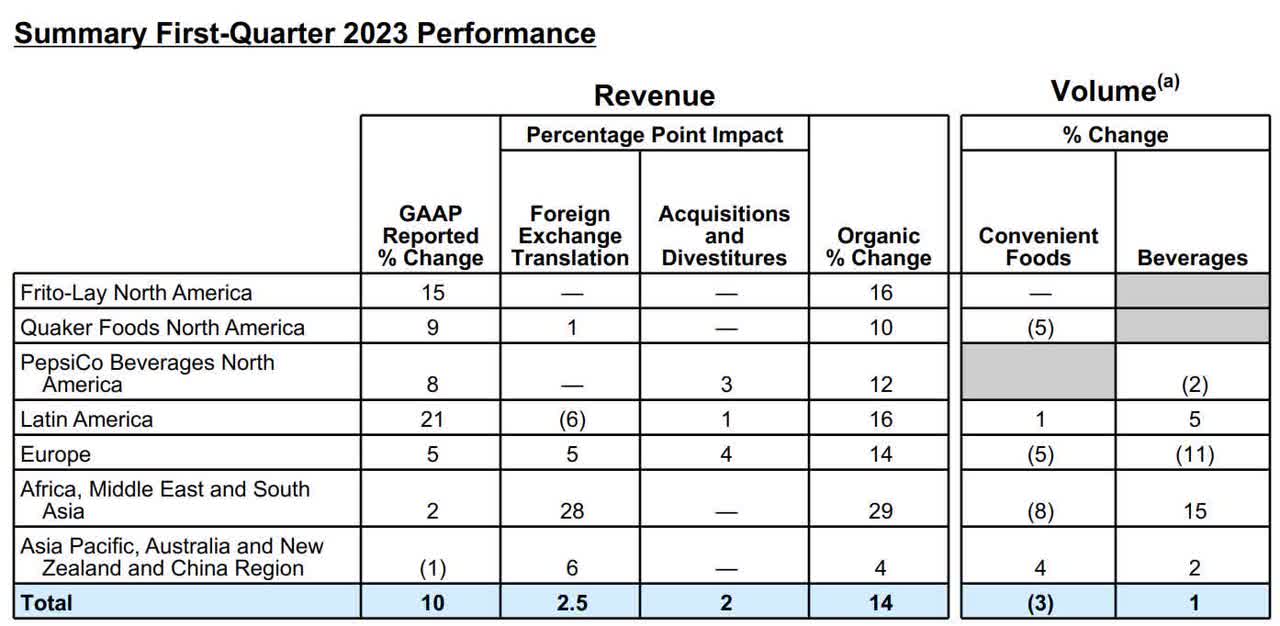

1Q23 numbers also confirmed this. While volumes were weak (3% contraction in foods), the company had significant pricing power leading to 13% organic revenue growth.

Additionally, PepsiCo focuses on offering positive choices to consumers, like zero-sugar options in beverages and healthier snack alternatives. The company has successfully extended its brands into new spaces, premiumizing products like coffee and colas and exploring new substrates and cooking methods.

PepsiCo also leverages packaging innovations to provide consumers with new occasions and personalized experiences.

But wait. There is more.

PepsiCo has been investing in e-commerce to ensure its products are readily available to consumers. The company has also embraced direct-to-consumer initiatives, allowing consumers to personalize their purchases and order products directly. Also, this supports margins, as it cuts out the middleman.

This includes expanding its presence in the away-from-home sector, creating solutions for retailers, and exploring opportunities in unattended retail.

What Does This Mean For The PEP Shareholder?

There’s good news. Very good news.

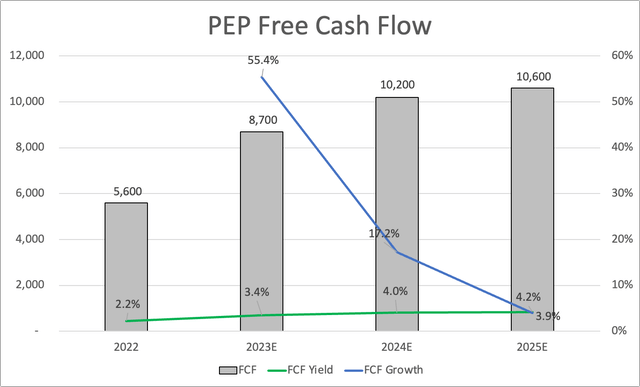

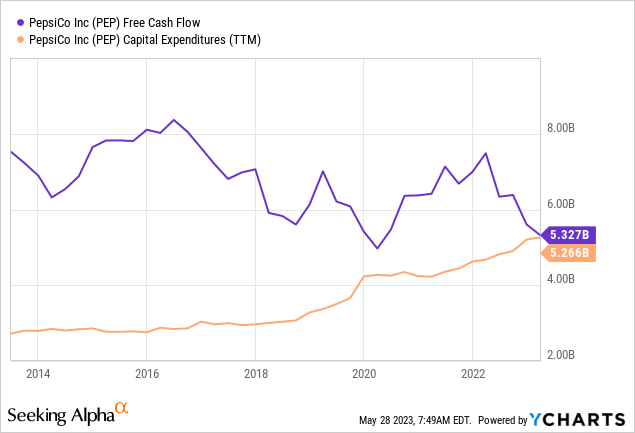

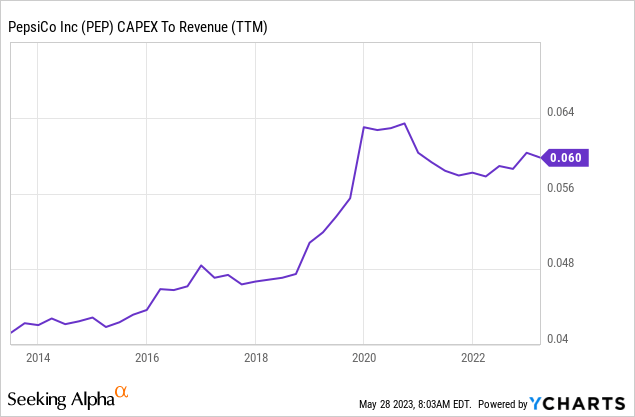

Over the past few years, free cash flow has been unchanged. This was partially caused by rising capital expenditures needed to take the PepsiCo business to the next level.

Now, this is paying dividends – literally.

This year, the company is expected to generate $8.7 billion in free cash flow, followed by more upside to $10.6 billion in 2025.

This paves the way for a 4.2% free cash flow yield, which supports the company’s 2.8% dividend yield and future dividend growth.

Based on this context, PepsiCo’s capital deployment strategy focuses on capturing growth opportunities and delivering value to its shareholders, which is somewhat obvious.

The company’s top priority is investing in its business to drive growth, which includes investing in capacity, digitalization, optimization, and creating new advantages for its operations. This covers investments in manufacturing capacity, warehousing, supply chain improvements, and leveraging IT for both productivity gains and growth opportunities.

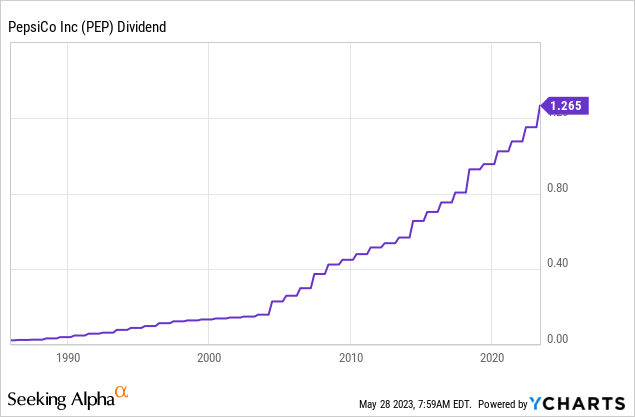

Dividends are another key area of focus for PepsiCo. The company is committed to providing its investors with increasing dividends each year.

This commitment is confirmed by 51 consecutive annual dividend hikes, making the company a dividend king.

- Over the past five years, the company has hiked its dividend by 7.4% per year (on average).

- It maintains a 66% payout ratio.

- On May 2, the company announced a 10% dividend hike.

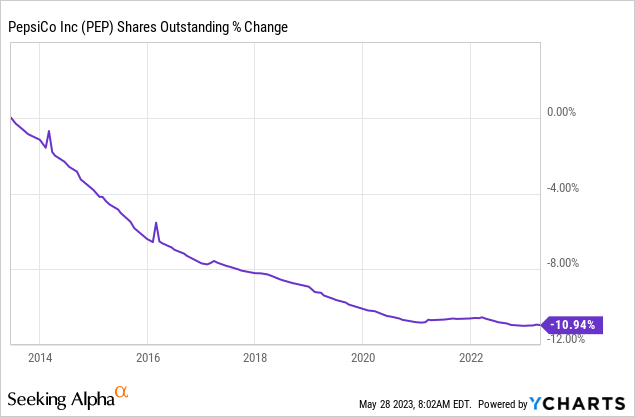

Additionally, share repurchases are used to indirectly distribute cash depending on the available capital after priority investments and portfolio decisions have been made. Share repurchases are part of the company’s overall strategy to maintain sustainable business performance and enhance shareholder value.

Over the past ten years, PEP has repurchased 11% of its shares.

PepsiCo expects its capital expenditure levels to remain between 5.5% and 6% in the coming years. Investments will primarily focus on growth, including capacity expansion, supply chain improvements, and IT advancements. As the benefits of these investments are realized, especially in IT, capital expenditure levels are expected to decrease in the future, which could fuel future free cash flow even more.

In other words, the mix of its success with consumers, its ability to use pricing, and accelerated investments provide strong long-term tailwinds, especially because they are expected to come with a significant increase in free cash flow.

Note that while the company has $33.4 billion in net debt, it’s just 2.0x 2023E EBITDA. This is healthy. The company has an A+ credit rating. There is no need to prioritize balance sheet health, which is beneficial for shareholders.

Valuation

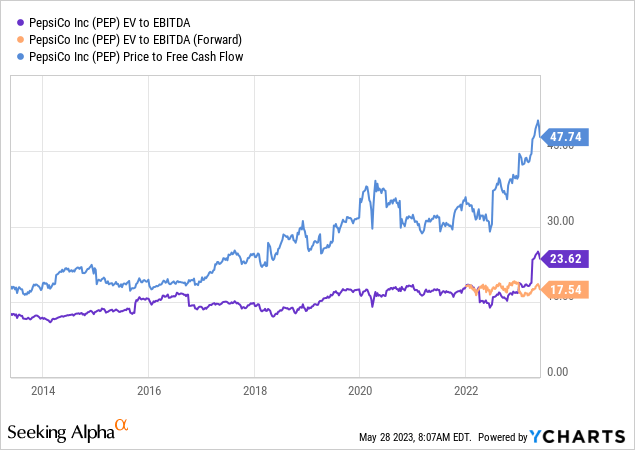

The PEP valuation is fair. It’s not overpriced and not undervalued. The stock is trading at 24x 2024 free cash flow. It’s trading at 48x LTM free cash flow. It’s trading at 17.5x NTM EBITDA.

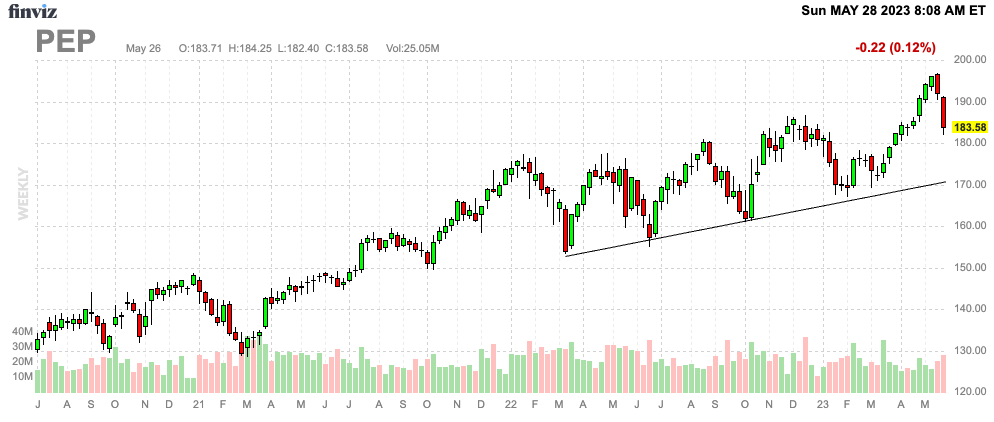

The current consensus price target is $200. I agree with that. However, I’m not buying shares at current levels. While waiting for the downside comes with risks, I would be a buyer close to $170.

FINVIZ

On a longer-term basis, I expect PEP to outperform its peers and the market.

Takeaway

I believe that PepsiCo is an exceptional company and a valuable addition to my dividend portfolio. Over the past decade, PepsiCo’s shares have performed impressively, and its consistent outperformance of the S&P 500 demonstrates its strength.

As an investor, I am cautious about consumer stocks due to unpredictable trends and intense competition. However, PepsiCo’s dominant position in the snack market, along with its well-known and high-quality brands, provides it with a significant advantage.

The company’s straightforward strategy of appealing to all consumers and expanding into new markets has proven successful.

PepsiCo’s recent efforts to enhance its performance and focus on sustainability further solidify its position as a compelling investment.

With steady free cash flow generation, a commitment to dividend growth, and strategic capital deployment, PepsiCo offers attractive prospects for long-term investors.

While the current valuation may not be ideal, I anticipate that buying opportunities may arise in the future, and I remain optimistic about the company’s prospects for outperformance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP, HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.