Summary:

- Cisco Systems, Inc. is losing market share in traditional space as it works towards a new future.

- Recent earnings show enough promise to stick with the transformation efforts.

- For the time being, I consider Cisco’s stock a technology utility.

- That means, your buying price is more critical than with fast growers and staples.

Alexander Koerner/Getty Images News

Cisco Systems, Inc. (NASDAQ:CSCO) recently reported its Q3 earnings report as Seeking Alpha has covered here. I reviewed Cisco Systems a while ago providing 5 reasons to be optimistic about the stock, with one key reason being the company’s on-going efforts to transform itself into product and subscription based instead of service oriented. With the company’s recent earnings report, it is time to check this narrative. Let’s categorize the Good, Bad, and Ugly from Cisco’s recent earnings.

Good

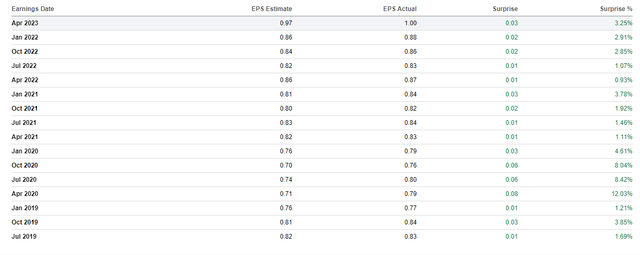

- Cisco beat on both EPS and revenue as it continued its tradition of beating EPS estimates every quarter at least stretching back to July 2019 as shown below. Looking at the consistency and tiny margin of these beats, one would think we are dealing with a utility company here. And that is exactly how one should view Cisco at this moment. A utility technology company that is attempting a turnaround as described below.

CSCO EPS History (Seekingalpha.com)

- In addition to the small, double-beat, Cisco also raised EPS estimate for Q4 as it guided to at least $1.05/share when the consensus was for $1.03. The company also raised its full-year guidance to an average of $3.81 per share. That means at $50, the stock is trading at a very reasonable forward multiple of 13.

- Cisco has dividend its market opportunities into three buckets: Cloud, Software (Product), and Security. The Software (Product) is at the core of the company’s attempts to build its recurring revenue stream and this is gaining stream with an 18% YoY growth in Q3. As a reminder, Q2 showed 10% growth YoY. As I’ve written in a couple of my previous reviews of Cisco, Software Product revenue (typically SaaS these days) have higher margins and stickiness. As an example, Cisco’s GAAP based Product gross-margin has been going up sequentially the last 3 quarters, going up from 59.20% to 60.20% to 62.70% in the most recent quarter. I also like the fact that Cisco reported $32 billion in Remaining Performance Obligations (“RPO”). RPO is the sum of deferred revenue and backlogs from existing contracts that are not officially in the recognized revenue yet.

“First, we are pleased with continued success in our movement toward more subscriptions and recurring revenue. In Q3, we delivered 18% growth in software revenues. We also have $32 billion in Remaining Performance Obligations (RPO), and we expect to see this momentum accelerate.”

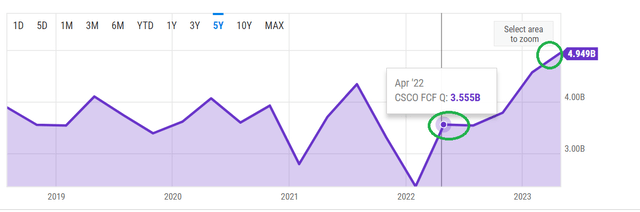

- Cisco’s Free Cash Flow (“FCF”) jumped up an impressive ~40% YoY, going up from $3.555 billion in Q3 2022 to $4.949 billion in Q3 2024. At the expense of stating the obvious, the more cash a business is able to generate from its regular operations, the better. Especially for a company that is looked up as a potential dividend champion.

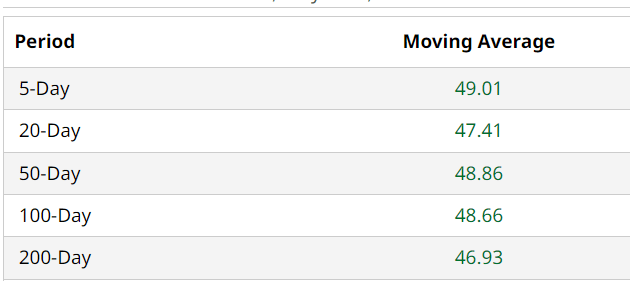

- Finally, on the good side, Cisco’s stock has moved past all the commonly tracked moving averages as shown below and this usually means the stock has momentum in its favor. However, please be mindful of the fact that the stock’s Relative Strength Index (“RSI”) is above 75 already and further upward momentum will push the stock into extremely overbought territory. And we are talking about an extremely range bound stock here.

CSCO Moving Avgs (Barchart.com)

Bad & Ugly

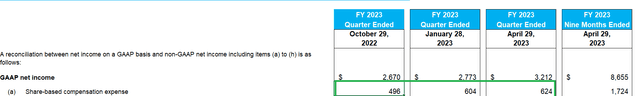

- Operating expenses went up 17% YoY to reach $5.3 billion. In particular, expenses related to employee stock-based compensation expense is trending up, going up 25% over the last 3 quarters. This is not the Cisco of 1990s that we are talking about but this is still an area to be monitored.

CSCO Expense (investor.cisco.com)

- While Cisco’s transformation efforts into being a product-led and recurring revenue based company is off to a promising start, it is not without side-effects. Whether by design or defect, Cisco is slowly but surely losing its leadership position in what has been its bread and butter for long: networking. This was highlighted in this Seeking Alpha news item as well and is backed up by the fact that some well-known networking clients are leaving Cisco for its competitors.

- While I fully acknowledge these are still early days in Cisco’s transformation, the fact that the product margin is barely into the 60s is concerning. A typical SaaS margin is close to 75% and anything below 70% raises red-flags over sustainability and scalability. Again, early days but a metric I will be paying close attention to.

Conclusion

Having personally been involved in turnaround and product cannibalization efforts at a much smaller scale, I am excited whenever I see a company attempting to transform itself instead of stagnating and resting on its laurels, however long past they maybe. Cisco’s transformation effort is literally at the center on its investor relations page, explaining the market opportunities along with its strategy to serve its purpose. Cisco has the deep pockets needed to fund the initially expensive transformation into being product led. For example, in the initial days of such transformation, a company spends money on market research, build vs. buy decisions, and in many cases, eventual acquisition of smaller companies that will lead towards the bigger goal.

But investors are likely to face a long wait before the company’s shows the numbers to back its efforts and the market in turn starts getting excited. In short, unless Cisco has a “Nadella effect”, it is likely to chug along its path and the stock’s returns are likely to mirror that of a utility company in the short to medium run: reasonable dividend that is well-covered, with modest expectations of capital appreciation, bound by a tight trading range. So, be mindful of your entry points.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.