Summary:

- PFE’s historical stock performance remains mediocre compared to its pharmaceutical peers, even after adjusting for dividends.

- Combined with its decelerating COVID-19 portfolio and $22B worth of annualized patent cliff from 2025 onwards, we are not surprised by the pessimism embedded in the stock.

- Perhaps this is why PFE has aggressively pursued multiple acquisitions, with the latest incurring $31B of debt and likely $1.5B of annual interest expenses, if not more.

- Combined with the uncertain macroeconomic outlook, anyone looking to add here must be highly convinced of the eventual success of its multiple pipelines.

valiantsin suprunovich/iStock via Getty Images

PFE Remains An Income Investment Thesis – Though Mediocre At Best

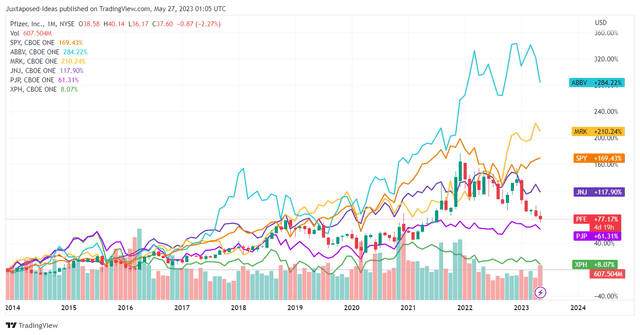

PFE 10Y Stock Returns (Adjusted For Dividends)

TradingView

This is why Pfizer (NYSE:PFE) may have been termed by others as dead money walking. The stock has only generated a 10Y return of +77.17% at the time of writing, compared to its pharmaceutical peers, such as AbbVie (NYSE:ABBV) at +284.22%, Merck (NYSE: MRK) at +210.24%, and Johnson & Johnson (NYSE:JNJ) at +117.90%.

Then again, the former has outperformed the wider pharmaceutical market, compared to Invesco Dynamic Pharmaceuticals ETF (PJP) at +61.31% and SPDR S&P Pharmaceuticals ETF (NYSEARCA:XPH) at +8.07% for the past ten years.

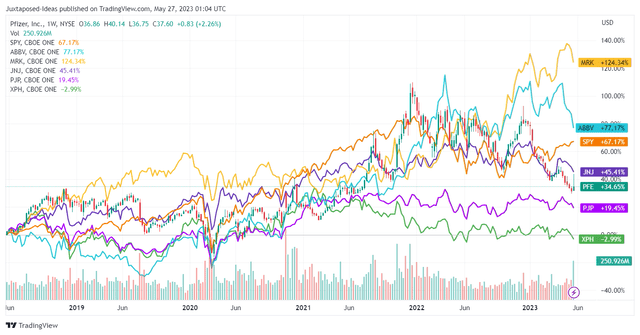

PFE 5Y Stock Returns (Adjusted For Dividends)

TradingView

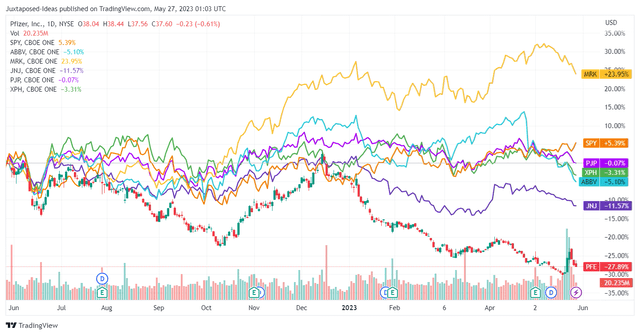

PFE 1Y Stock Returns (Adjusted For Dividends)

TradingView

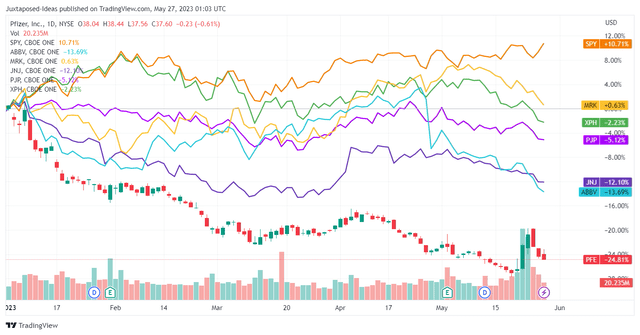

PFE YTD Stock Returns (Adjusted For Dividends)

TradingView

While past performance may not be an indication of forward results, the PFE stock’s returns have been underwhelming, in our view, even if we are to cherry-pick between the past five years, one year, or even YTD.

Naturally, the same cannot be said for those who have cashed out PFE at the December 2021 top for an 8Y return of ~125%, or even at the December 2022 top for a 9Y return of ~100%. Now, why has the market turned bearish on the stock?

This is mostly attributed to PFE facing three major headwinds, in our opinion.

Firstly, the pharmaceutical company’s success in the COVID-19 pandemic has unfortunately become a double-edged sword. It previously enjoyed immense pandemic-related sales of $36.1B in FY2021 and $56.7B in FY2022 (+57% YoY).

Nonetheless, this cadence has obviously stalled by FQ1’23, with Comirnaty and Paxlovid only contributing revenues of $7.1B (-46% QoQ/-51.7% YoY). Combined with its FY2023 guidance of $21.5B for COVID-19-related revenues (-62% YoY), it is unsurprising that there has been massive pessimism embedded in PFE’s stock prices.

Secondly, the windfall has naturally triggered a massive improvement in PFE’s profitability, approximately at gross profits of $1.21B in FQ1’23 (-75.5% YoY), $13.77B in FY2022 (-14% YoY), and $16.03B in FY2021, based on its gross profit split with BioNTech (NASDAQ:BNTX). This number does not include any profit contribution from the former’s Paxlovid as well, an unspecified sum thus far.

As a result, it is undeniable that PFE’s balance sheet has improved tremendously as a direct result of its COVID-19 pipeline, from $12.24B in FQ4’20, to a peak of $31.07B in FQ4’21 (+153.8% YoY) and moderating to the current $19.97B in FQ1’23 (-16.4% YoY).

However, here is where things are taking a rather pessimistic turn. Instead of further deleveraging its elevated long-term debts of $31.97B in FQ1’23 (-3.7% QoQ/ -10.6% YoY), the pharmaceutical company has been going on aggressive acquisition/ investment sprees thus far, as discussed in my previous article here, while adding Seagen (NASDAQ:SGEN) as its latest conquest.

Most importantly, SGEN will come with a hefty price tag of $43B, forcing PFE to raise $31B of debt to finance the all-cash deal. With the funding expected to come with an eye-watering yield to maturity of 4.75%, against the historical 1.75% in 2021, 2.11% to 2.67% in 2020, and 3.57% in 2019, we may see the latter’s profitability impacted indeed.

For now, PFE pays an annualized interest expense of $1.27B (+1.5% QoQ/ -1.2% YoY), with the sum likely to double once the deal closes, bringing its total sum to approximately $2.7B, if not more. While the pharmaceutical company still boasts an annualized EBITDA of $32.08B by FQ1’23 (+11.3% QoQ/ -30.4% YoY), we believe the sum may normalize nearer to $24B, due to the decelerating demand for COVID-19 products thus far.

In addition, SGEN only reported combined sales of $2.05B (+23.4% YoY) over the last twelve months from its four approved cancer therapies, valuing the deal at a pricey Price/ Sales of 20.9x, compared to PFE’s current valuation of 3.12x. The company is not profitable too, with PFE only projecting approximately $10B of sales contribution by 2030, implying the deal’s overvaluation.

Thirdly, PFE is facing a massive patent cliff between FY2025 and FY2030, potentially impacting its annual top line by $22B, as discussed in my previous article here. This alone explained why the management has been overly aggressive in its M&A activities in order to beef up its pipeline, bankrolled by the COVID-19 windfall.

While we understand the urgency, it remains to be seen if SGEN’s offerings are worth the hefty price tag at a time of elevated interest and peak recessionary environment. Furthermore, many of these pipelines are still in clinical trial stages with the US FDA approval remaining uncertain, implying the highly speculative nature of these M&A activities.

On the other hand, assuming a successful outcome, PFE would have made good use of the recent windfall, suggesting the overly sold stock prices. As a result, we are of the opinion that it currently looks quite attractive at these depressed levels, with the current portfolio still growing by +5% YoY (excluding Comirnaty and Paxlovid).

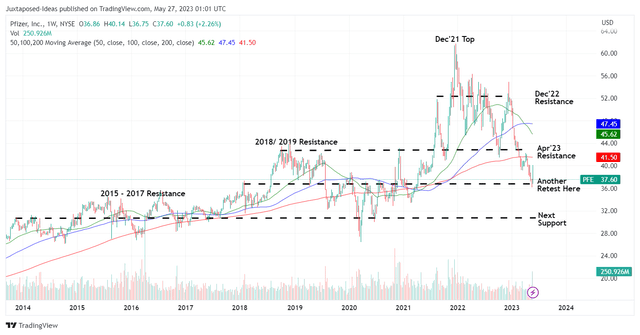

PFE 10Y Stock Prices

TradingView

Therefore, we are cautiously rating the PFE stock as a Buy here, assuming that the exercise consequently reduces long-term investors’ dollar cost averages. Then again, we must also highlight that the stock has historically underperformed as a growth stock, only saved by its forward dividend yield of 4.34% against the 4Y average of 3.68% and sector median of 1.33%.

Even then, based on the stock’s mediocre performance thus far, we suppose there are better income stocks out there worth considering, since the payouts may not be sufficient to cover the losses in stock prices. Investors adding PFE here must calibrate their expectations accordingly, in our view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.