Summary:

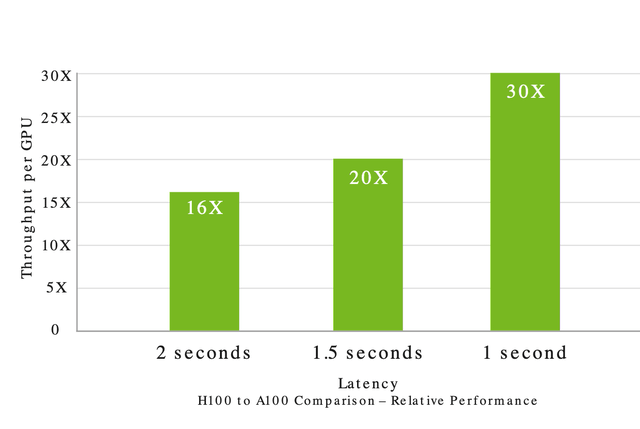

- Nvidia’s latest H100 GPUs are the building blocks of the AI Cloud industry and offer 30 times faster inferencing than its prior A100 chip.

- Nvidia’s management has provided jaw-dropping guidance with a record $11 billion in revenue for Q2, and FY24, with an incredible 64% YoY growth rate.

- The company’s gaming segment revenue is down by 38% year over year, but I believe this is a short-term cyclical pullback.

- I have revised my valuation model and forecasts for Nvidia, increasing my expected growth rate from 16% to 50%, due to the tailwinds in the AI industry.

Justin Sullivan

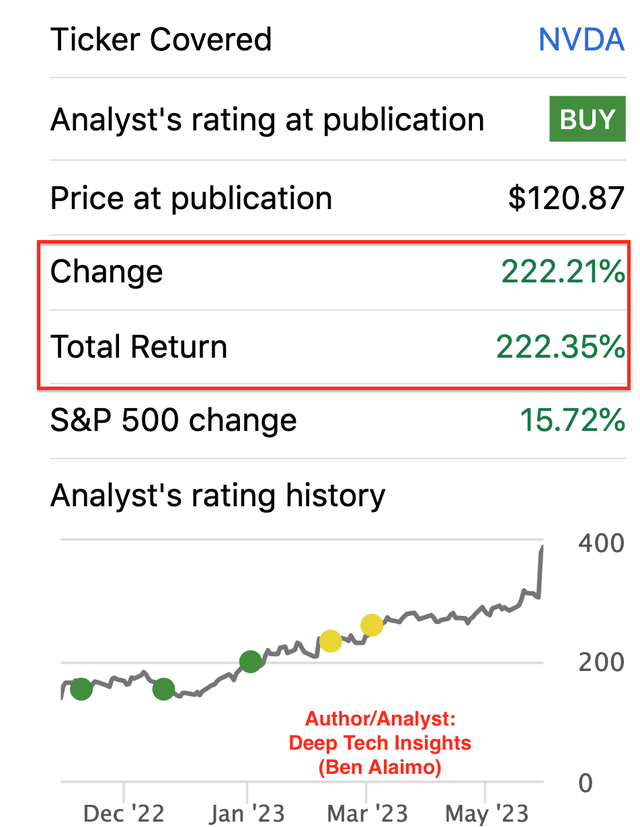

Nvidia (NASDAQ:NVDA) is the leading designer of high-performance GPUs, and stock I have covered multiple times. Since my post in September 2022, titled “Short Term Pain, Long Term Gain”, the stock price is up over 222%. In addition, since my post in December 2022, titled “Backbone of the Artificial Intelligence Industry” the stock is up over 142%. The main reasons for these standout gains have been exuberance in the AI industry and the jaw-dropping guidance announced in the latest earnings report, which was 55% higher than analysts expected. In this post, I am going to revise my valuation forecasts for the stock and discover if we have a case of “Irrational Exuberance” like we saw in the Internet bubble of 1999 or rational exuberance with real fundamentals at play. In this case, I have actually quantified part of this exuberance or market “froth” as at least 10%, based on my valuation model with revised (much higher growth rates), let’s dive into the full details in this post.

Recovering Financials

Nvidia reported solid and recovering financials for the first quarter of FY24. Its revenue was $7.19 billion, which beat analyst forecasts by $669 million. This may seem incredible, but nobody seems to be mentioning that Nvidia’s revenue is still down 13% year over year. Therefore, this is a great start, but the company is still in recovery mode in my eyes. Its operating income was $2.313 billion, which is still down 28% year over year, despite an EPS beat by $0.21 with $0.82 reported.

Gaming Recovery

Its Gaming segment reported $2.24 billion in Q1 FY24, which was down an eye-watering 38% year over year. In my previous posts, I discussed this was mainly due to the pullback in the gaming industry, which is cyclical by nature after a major boom in 2020, during lockdown.

In the meantime, the company has launched its latest GeForce RTX GPUs, which sold out upon release despite the high price. Therefore, it is clear there is a thirst in the market for the highest quality GPUs. I also believe the consumer GPU growth will continue to be accelerated by the forecasted growth in the creator economy and specifically video editing. As someone who runs a large YouTube Channel (Motivation 2 Invest) and podcast, I first became exposed to Nvidia GPUs when I found out I needed them to do professional video editing. Therefore, that is an extra tailwind I believe will continue to help the gaming segment recover and eventually grow.

Nvidia has also enhanced its partnership with Microsoft, accelerating the number of Xbox games offered on its GeForce Now service to over 1600. Nvidia’s state of the art “Ray Tracing” could also become a key element in games, as it enhanced the realistic look of shadows. The first game to adopt it is the iconic Cyberpunk 2077 which acts as a great lighthouse gaming franchise for others to follow.

Data Center and AI Tailwinds

Nvidia’s Data Center segment has grown to become its largest business, generating 59.6% of total revenue in Q1 FY24. Its growth has been solid with $4.284 billion reported, up 14% year over year. This segment is expected to drive a record $11 billion total revenue forecast for Q2 FY24, which would represent an incredible growth rate of 64% year over year.

As I have mentioned in prior posts, Nvidia’s latest H100 Tensor Core GPU has demonstrated up to 4 times faster training of transformer AI models and up to 30 times greater performance for AI inference. Therefore, the phrase “best in class” comes to mind, which is why I previously called Nvidia the “backbone of the AI Industry”.

The company essentially provides the building blocks to the major cloud “Hyperscalers”. Google Cloud has been the first cloud provider to offer the latest L4 Tensor Core GPU. But the company has also expanded its offering with services based upon the H100 GPU. This includes Microsoft Azure’s preview of an H100 virtual machine and Oracle Cloud’s GPU instances. Meta has also deployed its H100-powered Grand Teton AI supercomputer. There has been some criticism by analysts (including myself) that Amazon Web Services may get left behind, it has developed its own ML chip called “Trainium”. However, it was greatest to see AWS has announced EC2 “UltraClusters” which can scale up to 20,000 interconnected H100 GPUs.

Keep in mind, Nvidia also provides other essential “building blocks” for the AI cloud. This includes the networking connector (Quantum 400 InfiniBand), which strings the H100 GPUs together. This basically makes the company the Cisco of the AI age.

Nvidia has also announced its AI platform and AI foundations service. This is a major positive as company leaders are scrambling to adopt AI, and are looking for a company to guide them to do this. In my opinion, the key competitive advantage for businesses will not be the simple adoption of general AI models, but the tailoring or “fine-tuning”, to their unique data set and use case, which Nvidia foundations helps with. Nvidia has even integrated its Enterprise software directly into Microsoft Azure’s Machine learning environment. In addition to scoring a partnership with ServiceNow, which has relationships with over 1000 enterprises and thus should make a “land and expand” approach seamless.

Automotive and Visualization Segments

Nvidia also has a thriving automotive business, which reported a blistering 114% year-over-year increase in revenue to $296 million. The key driver has been its Nvidia DRIVE platform, which has been integrated into many major auto manufacturers, from Mercedes to Volvo. More recently (May 29th) Nvidia scored a partnership with MediaTek to integrate “AI cabin solutions” for vehicles.

Nvidia’s Visualization segment is still recovering with revenue of $295 million down 53% year over year, but up 31% sequentially. I am not too worried about this segment, as I believe its growth will recover thanks to the industry forecasts related to the “Metaverse”. Nvidia has recently announced its “Omniverse Cloud” will be directly integrated into Microsoft Azure to help businesses leverage digital twins. Many electronics manufacturers are planning to adopt this and Nvidia’s “Metropolis for Factories” to help reduce defects.

Valuation and Forecasts

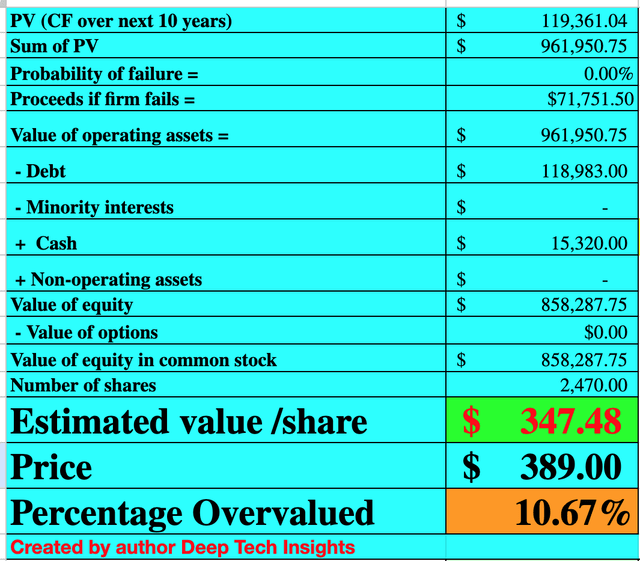

In order to value Nvidia, I will plug its latest financial data into my discounted cash flow model, and update my forecasts based on the latest information. Previously, I forecast a 16% revenue growth rate for the next four quarters which now seems to be ultra-conservative after the recent guidance for Q2 FY24 which would expect a 64% growth rate YoY, with record revenue of $11 billion. Therefore, if I extrapolate this optimism out while still being realistic given the company reported a 13% YoY decline in revenue in Q1 FY24. I get a figure of 50% revenue growth for “next year”, which is over three times my prior expected rate. Then in years 2 to 5, I have forecast 42% revenue growth per year, up from my prior expected rate of 31% per year. I expect the primary growth to have been driven by the large-scale purchasing of H100 chips, its networking equipment, and AI software solutions from Nvidia. In years 2 to 5, I expect a rebound in gaming, visualization, and continued growth in the automotive segment.

Nvidia stock valuation 1 (created by author Deep Tech Insights)

In terms of long-term margins (year 8), I have revised up my prior estimate from 41% to 42% as I believe the business will benefit from greater economies of scale and upsells/cross-sells related to its AI equipment and solutions. For example, earlier I mentioned factories are adopting both generative AI solutions and those related to the Omniverse. I also believe Nvidia has developed its brand power, and companies will pay a premium for best-in-class chips if needed. For extra information, Nvidia has a solid balance sheet to continue to invest to stay ahead, with $15.3 billion in cash and marketable securities. The business does have a fairly high debt of $11.9 billion, but the vast majority, $9.7 billion, is long-term debt and thus manageable.

Nvidia stock valuation 2 (created by author Ben at Deep Tech Insights)

Given these factors I get a fair value of $347 per share, the stock is trading at ~$389 per share, and thus it is close to 11% overvalued.

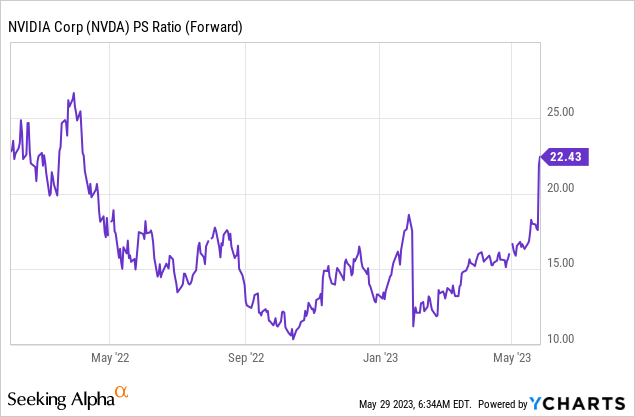

Its forward price to sales (P/S) ratio is 22, which is 45% higher than its 5-year average.

Final Thoughts

Nvidia is a tremendous company that has gradually developed multiple engines of growth, from gaming and data center GPUs, to automotive and software applications. I liked Nvidia prior to the “AI exuberance” but now I like the company even more. Unlike other disruptive technologies such as “Blockchain”, AI has many real-world use cases in which consumers and companies are already finding value in. Yes, there is excitement in the industry and I believe it’s best to quantify the “froth” in the market, which according to my calculations is at least 10% (hence the overvaluation). However, this is not as much as most people (including myself) would have initially expected, given the huge surge in stock price. But keep in mind, the Nvidia thesis has changed because it is now priced for perfection and the market is expecting strong growth from the company. Given my investment style is more of a contrarian, I prefer to buy when others are selling (such as Nvidia in September 2022), and thus I will likely be trimming part of my position. Although, this is just a personal preference, as I believe the company is fantastic, has plenty of runway ahead for growth and my overall position is a “hold”. Nvidia is still the backbone of the industry, and it is poised to become one of the largest companies in the world, (my terminal value is a $1.6 trillion market cap) in year 10.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.