Summary:

- Exxon reported record earnings in Q1 2023, likely marking the peak profitability in the ‘2020-2022 oil party.’

- In 2023, the price environment is slowly but surely becoming less supportive for the oil major, starting to prompt lower earnings estimates.

- The WTI benchmark is down ∼40% from 2022 peak, and early signs of a recession keep the benchmark range-bound between $65-$75 dollars.

- Needless to say, speculation of falling oil prices is anchored on recession expectations that are driven by several factors.

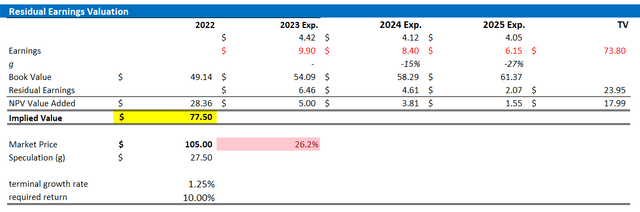

- I estimate Exxon Mobil’s EPS for 2023, 2024 and 2025 at $9.9, $8.4 and $6.15, and calculate a fair implied target price of $77.5/ share.

Liudmila Chernetska/iStock via Getty Images

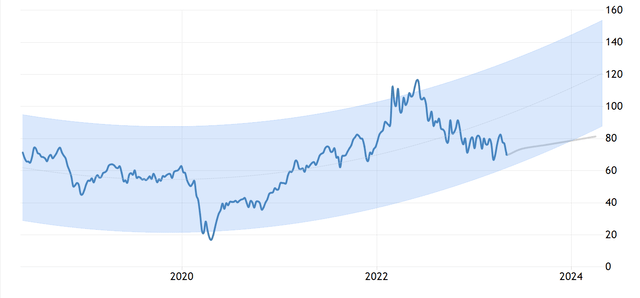

On the backdrop of high energy prices, Exxon Mobil (NYSE:XOM) has enjoyed an exceptionally strong FY 2022, accumulating close to $71.6 billion in operating earnings, up almost 270% versus FY 2021. In 2023, however, the price environment is slowly but surely becoming less supportive for the US oil major: The WTI benchmark is down ∼40% from 2022 peak, and early signs of a recession keep the benchmark range-bound between $65-$75 dollars, despite support from OPEC to prop up prices.

With that frame of reference, Exxon Mobil’s record Q1 performance looks like having been the highlight of the most recent ‘oil party’, and analysts now model that the company’s earnings power has topped for the ‘2020-2023 cycle’. Personally, I now estimate Exxon Mobil’s EPS for 2023, 2024 and 2025 at $9.9, $8.4, and $6.15 respectively; and I now calculate a fair implied target price of $77.5/ share. I’m downgrading to underperform/ sell.

For reference, Exxon Mobil stock has delivered a weak performance in 2023 so far, clearly underperforming the market: YTD, XOM stock is down about 1%, versus a gain of close to 10% for the S&P 500 (SP500).

Exxon Mobil’s Q1 Results Disappoint

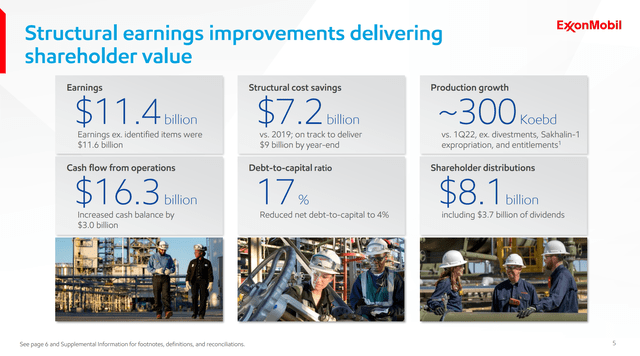

Exxon Mobil reported record Q1 2023 earnings, despite missing analyst expectations on top line by close to $3.5 billion. During the period from January to the end of March, the oil major generated an impressive $11.6 billion of income, compared to $8.8 billion in the previous year (up about 32% YoY), primarily due to stronger downstream earnings. Cash from operations was recorded at $16.3 billion, prompting management to distribute $8.1 billion to shareholders — $3.7 billion through dividend payments and $4.4 billion through share repurchases.

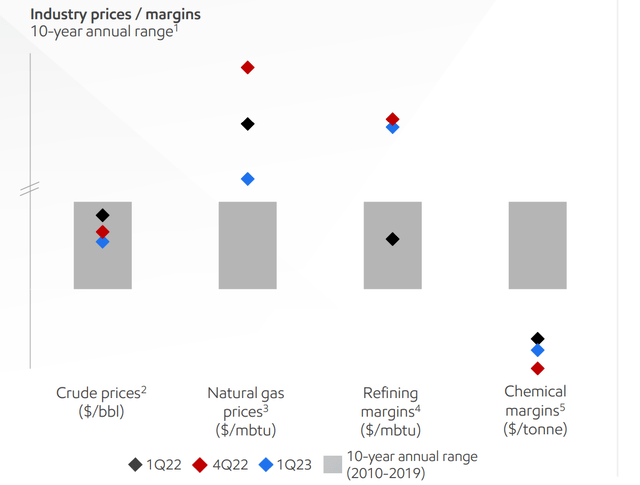

Overall, Exxon benefited from favorable energy prices and robust refining margins. However, it is worth pointing out that pricing support is coming down as compared to Q1 2022 and Q4 2022.

Lower prices suggest that a combination of volume and cost saving push was the main anchor of the Q1 performance. In fact, Exxon Mobil experienced a notable increase in production, reaching 3,831 thousand barrels of oil equivalent per day, compared to 3,675 mboe/d the previous year. This growth is primarily attributed to the expansion in the Permian and Guyana regions, contributing almost 300 mboe/d to the overall increase.

While higher volumes are positive for Exxon, they are negative for the industry as a whole — especially as other oil producers (see Chevron (CVX) Q1 and Occidental Petroleum (OXY) Q1) also push more volume to offset the negative earnings impact from price declines, potentially leading to a downward spiral in oil prices through 2023 and early 2024.

Oil Price Likely A Headwind – Recession Looming

Exxon Mobil’s exceptional 2022 and early Q1 2023 profitability was aided by sky-high energy prices. This environment, however, is changing — fast. Investors should consider that the WTI benchmark is down ∼40% for the trailing twelve months, and will likely remain rangebound at levels of $65-$75 dollars.

Pointing to the oil market, I would like to highlight the bearish positioning of hedge funds and other non-commercial players, whose oil ‘long’ positions are at their lowest levels since at least 2011 across various major oil contracts (see COT report). Needless to say, speculation of falling oil prices are anchored on recession expectations that are driven by several factors. Firstly, there are concerns regarding the Federal Reserve’s decision to increase interest rates, which is anticipated to provoke an economic contraction. Additionally, China’s recovery from the Covid-19 pandemic has been lackluster, falling short of expectations. Furthermore, there is the looming threat of a potential US default if politicians fail to raise the debt ceiling. This possibility adds an additional layer of uncertainty and contributes to the bearish sentiment in the market. Moreover, there is apprehension surrounding the ability of OPEC+ to fully implement pledged output cuts, not to talk about additional cuts.

With that frame of reference, analyst consensus estimates that Exxon’s earnings power for the ‘2020-2023 oil cycle’ might have peaked, seeing Exxon’s FY 2023 earnings at about $9.7. Notably, estimates for FY 2023 are already ~10% lower versus the beginning of the year — and trending down.

Valuation – TP of $77.5

Reflecting on a less favorable outlook for oil prices vs. 2021/ 2022, I adjust my EPS expectations for the US oil major through 2025. I now estimate that XOM’s EPS in 2023 will likely fall to somewhere between $9.7 and $10.1, in line with analyst consensus. In addition, I lower my EPS expectations for 2024 and 2025, to $8.4 and $6.15 respectively, which would imply a very reasonable FY 2025 ROTB of approximately 15%.

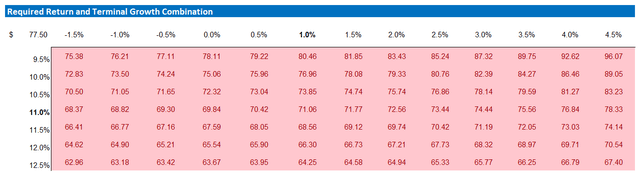

I continue to anchor on a 1.25% terminal growth rate (about 50% of estimated nominal GDP growth), and I raise my cost of equity estimate by 100 basis points, to 10% (reflecting higher risk premia for equity investments due to recession risk and higher yields across asset classes).

Given the EPS updates as highlighted below, I now calculate a fair implied share price for XOM equal to $77.5, seeing close to 25% downside.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Below is also the updated sensitivity table.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Conclusion

Exxon reported record earnings in Q1 2023, likely marking the peak profitability in the ‘2020-2023 oil cycle’. Now, the price environment is slowly but surely becoming less supportive for the US oil major, starting to prompt earnings revisions downwards. The WTI benchmark is down ∼40% from 2022 peak, and early signs of a recession keep the benchmark range-bound between $65-$75 dollars.

Reflecting on Exxon Mobil’s depreciating earnings power versus 2022, as well as normalizing energy prices on the backdrop of a slowing economy, I estimate Exxon Mobil’s EPS for 2023, 2024 and 2025 at $9.9, $8.4 and $6.15; and I calculate a fair implied target price equal to $77.5/ share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.